Abstract

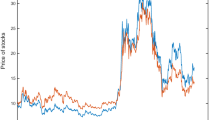

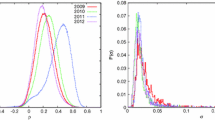

This paper is concerned with an optimal strategy for simultaneously trading of a pair of stocks. The idea of pairs trading is to monitor their price movements and compare their relative strength over time. A pairs trade is triggered by their prices divergence and consists of a pair of positions to short the strong stock and to long the weak one. Such a strategy bets on the reversal of their price strengths. From the viewpoint of technical tractability, typical pairs-trading models usually assume a difference of the stock prices satisfies a mean-reversion equation. In this paper, we consider the optimal pairs-trading problem by allowing the stock prices to follow general geometric Brownian motions. The objective is to trade the pairs over time to maximize an overall return with a fixed commission cost for each transaction. The optimal policy is characterized by threshold curves obtained by solving the associated HJB equations. Numerical examples are included to demonstrate the dependence of our trading rules on various parameters and to illustrate how to implement the results in practice.

Similar content being viewed by others

References

Gatev, E., Goetzmann, W.N., Rouwenhorst, K.G.: Pairs trading: performance of a relative-value arbitrage rule. Revi. Financ. Stud. 19, 797–827 (2006)

Vidyamurthy, G.: Pairs Trading: Quantitative Methods and Analysis. Wiley, Hoboken (2004)

Song, Q.S., Zhang, Q.: An optimal pairs-trading rule. Automatica 49, 3007–3014 (2013)

McDonald, R., Siegel, D.: The value of waiting to invest. Q. J. Econ. 101, 707–727 (1986)

Hu, Y., Øksendal, B.: Optimal time to invest when the price processes are geometric Brownian motions. Financ. Stoch. 2, 295–310 (1998)

Davis, M.H.A., Norman, A.R.: Portfolio selection with transaction costs. Math. Oper. Res. 15, 676–713 (1990)

Shreve, S.E., Soner, H.M.: Optimal investment and consumption with transaction costs. Ann. Appl. Probab. 4, 609–692 (1994)

Zhang, Q.: Stock trading: an optimal selling rule. SIAM J. Control Optim. 40, 64–87 (2001)

Guo, X., Zhang, Q.: Optimal selling rules in a regime switching model. IEEE Trans. Autom. Control 50, 1450–1455 (2005)

Dai, M., Zhang, Q., Zhu, Q.: Trend following trading under a regime switching model. SIAM J. Financ. Math. 1, 780–810 (2010)

Iwarere, S., Barmish, B.R.: A confidence interval triggering method for stock trading via feedback control. In: Proceedings of American Control Conference, Baltimore, MD, (2010)

Merhi, A., Zervos, M.: A model for reversible investment capacity expansion. SIAM J. Control Optim. 46, 839–876 (2007)

Løkka, A., Zervos, M: Long-term optimal investment strategies in the presence of adjustment costs. SIAM J. Control Optim. 51, 996–1034 (2013)

Zhang, H., Zhang, Q.: Trading a mean-reverting asset: buy low and sell high. Automatica 44, 1511–1518 (2008)

Øksendal, B.: Stochastic Differential Equations, 6th edn. Springer-Verlag, New York (2003)

Acknowledgements

We thank the anonymous referee and the editors for their valuable comments and suggestions, which led to much improvements of this paper. This research is supported in part by the Simons Foundation (235179) to (Qing Zhang).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tie, J., Zhang, H. & Zhang, Q. An Optimal Strategy for Pairs Trading Under Geometric Brownian Motions. J Optim Theory Appl 179, 654–675 (2018). https://doi.org/10.1007/s10957-017-1065-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-017-1065-8