Abstract

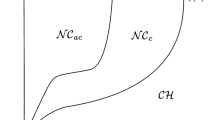

In this paper, we study the optimal dividend problem assuming that the underlying reserve process follows the Sparre Andersen model. In this model, there is no constant restriction on the dividend rates, i.e., the optimization problem is of singular type. In this case, the value function is no longer bounded and the associated Hamilton–Jacobi–Bellman equation is a variational inequality involving a first-order integro-differential operator and a gradient constraint. We prove the regularity properties for the value function by constructing strategies and show that the value function is a constrained viscosity solution of the associated Hamilton–Jacobi–Bellman equation. In addition, we prove that the value function is the upper semicontinuous envelope of the supremum for a class of subsolutions.

Similar content being viewed by others

References

De Finetti, B., Su un’impostazione alternativa della teoria collettiva del rischio. In: Transactions of the XVth International Congress of Actuaries, vol. 2, pp. 433–443. New York (1957)

Asmussen, S., Taksar, M.: Controlled diffusion models for optimal dividend pay-out. Insur. Math. Econ. 20(1), 1–15 (1997)

Guo, X., Liu, J., Zhou, X.Y.: A constrained non-linear regular-singular stochastic control problem, with applications. Stoch. Process. Appl. 109(2), 167–187 (2004)

Azcue, P., Muler, N.: Optimal reinsurance and dividend distribution policies in the Cramér–Lundberg model. Math. Finance 15(2), 261–308 (2005)

Belhaj, M.: Optimal dividend payments when cash reserves follow a jump-diffusion process. Math. Finance 20(2), 313–325 (2010)

Gerber, H.U., Shiu, S.W.: On optimal dividend strategies in the compound Poisson model. North Am. Actuar. J. 10(2), 76–93 (2006)

Andersen, E.S.: On the collective theory of risk in case of contagion between claims. Bull. Inst. Math. Appl. 12(2), 275–279 (1957)

Li, S.M., Garrido, J.: On a class of renewal risk models with a constant dividend barrier. Insur. Math. Econ. 35(3), 691–701 (2004)

Albrecher, H., Mármol, M., Claramunt, M.M.: On the distribution of dividend payments in a Sparre Andersen model with generalized Erlang(n) interclaim times. Insur. Math. Econ. 37(2), 324–334 (2005)

Albrecher, H., Hartinger, J.: On the non-optimality of horizontal barrier strategies in the Sparre Andersen model. HERMES Int. J. Comput. Math. Appl. 7, 1–14 (2006)

Albrecher, H., Thonhauser, S.: Optimality results for dividend problems in insurance. RACSAM-Revista de la Real Academia de Ciencias Exactas, Fisicas y Naturales. Serie A. Matematicas 103(2), 295–320 (2009)

Azcue, P., Muler, N.: Optimal investment policy and dividend payment strategy in an insurance company. Ann. Appl. Probab. 20(4), 1253–1302 (2010)

Benth, F.E., Karlsen, K.H., Reikvam, K.: Optimal portfolio selection with consumption and nonlinear integro-differential equations with gradient constraint: a viscosity solution approach. Finance Stoch. 5(3), 275–303 (2001)

Seydel, R.C.: Existence and uniqueness of viscosity solutions for QVI associated with impulse control of jump-diffusions. Stoch. Process. Appl 119(10), 3719–3748 (2009)

Crandall, M.G., Lions, P.L.: Viscosity solutions of Hamilton–Jacobi equations. Trans. Am. Math. Soc. 277(1), 1–42 (1983)

Crandall, M.G., Ishii, H., Lions, P.L.: User’s guide to viscosity solutions of second order partial differential equations. Bull. Am. Math. Soc. 27(1), 1–67 (1992)

Lions, P.L.: Optimal control of diffusion processes and Hamilton–Jacobi–Bellman equations part 2: viscosity solutions and uniqueness. Commun. Partial Differ. Equ. 8(11), 1229–1276 (1983)

Lions, P.L.: Optimal control of diffusion processes and Hamilton–Jacobi–Bellman equations. I. The dynamic programming principle and applications. Commun. Partial Differ. Equ. 8(10), 1101–1174 (1983)

Soner, H.M.: Optimal control with state-space constraint. II. SIAM J. Control Optim. 24(6), 1110–1122 (1986)

Fleming, W.H., Soner, H.M.: Controlled Markov Processes and Viscosity Solutions. Stochastic Modelling and Applied Probability, vol. 25, 2nd edn. Springer, New York (2006)

Yong, J., Zhou, X.Y.: Stochastic Controls: Hamiltonian Systems and HJB Equations, vol. 43. Springer, New York (1999)

Bai, L.H., Ma, J., Xing, X.J.: Optimal dividend and investment problems under Sparre Andersen model. Ann. Appl. Probab. 27(6), 3588–3632 (2017)

Rolski, T., Schmidli, H., Schmidt, V., Teugels, J.L.: Stochastic Processes for Insurance and Finance, vol. 505. Wiley, New York (2009)

Protter, P.: Stochastic integration and differential equations (2nd ed.). In: Stochastic Modelling and Applied Probability, vol. 21. Springer-Verlag, Berlin (2004)

Scheer, N., Schmidli, H.: Optimal dividend strategies in a Cramér–Lundberg model with capital injections and administration costs. Eur. Actuar. J. 1(1), 57–92 (2011)

Pham, H.: Continuous-Time Stochastic Control and Optimization with Financial Applications. Springer, Berlin (2009)

Awatif, S.: Equqtions d’Hamilton–Jacobi du premier ordre avec termes intégro-différentiels: Partie 1: Unicité Des solutions de viscosité. Commun. Partial Differ. Equ. 16(6–7), 1057–1074 (1991)

Czarna, I., Palmowski, Z.: Dividend problem with Parisian delay for a spectrally negative Lévy risk process. J. Optim. Theory Appl. 161(1), 239–256 (2014)

Marciniak, E., Palmowski, Z.: On the optimal dividend problem for insurance risk models with surplus-dependent premiums. J. Optim. Theory Appl. 168(2), 723–742 (2016)

Pérez, J.L., Yamazaki, K., Yu, X.: On the bail-out optimal dividend problem. J. Optim. Theory Appl. 179(2), 553–568 (2018)

Zhu, J., Yang, H.: Optimal capital injection and dividend distribution for growth restricted diffusion models with bankruptcy. Insur. Math. Econ. 70, 259–271 (2016)

Zhu, J., Chen, F.: Dividend optimization for regime-switching general diffusions. Insur. Math. Econ. 53(2), 439–456 (2013)

Zhao, Y., Wang, R., Yao, D., Chen, P.: Optimal dividends and capital injections in the dual model with a random time horizon. J. Optim. Theory Appl. 167(1), 272–295 (2015)

Wei, J., Yang, H., Wang, R.: Classical and impulse control for the optimization of dividend and proportional reinsurance policies with regime switching. J. Optim.Theory Appl. 147(2), 358–377 (2010)

Choulli, T., Taksar, M., Zhou, X.Y.: A diffusion model for optimal dividend distribution for a company with constraints on risk control. SIAM J. Control Optim. 41(6), 1946–1979 (2003)

Mou, C.: Perron’s method for nonlocal fully nonlinear equations. Anal. PDE 10(5), 1227–1254 (2017)

Caffarelli, L.A., Ros-Oton, X., Serra, J.: Obstacle problems for integro-differential operators: regularity of solutions and free boundaries. Invent. Math. 208(3), 1155–1211 (2017)

Acknowledgements

Here, we want to express our thanks to Jacques Rioux for his dedication to the improvement in this paper. This research is supported by Chinese NSF Grants No. 11471171, No. 11911530091 and No. 11931018.

Author information

Authors and Affiliations

Corresponding author

Additional information

Kok Lay Teo.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tian, L., Bai, L. & Guo, J. Optimal Singular Dividend Problem Under the Sparre Andersen Model. J Optim Theory Appl 184, 603–626 (2020). https://doi.org/10.1007/s10957-019-01600-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-019-01600-0

Keywords

- Singular control

- Optimal dividend

- Hamilton–Jacobi–Bellman equation

- Constrained viscosity solution

- Viscosity supersolution

- Viscosity subsolution