Abstract

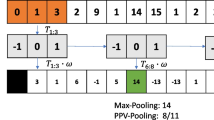

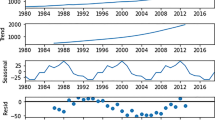

The global economy relies heavily on the worldwide crude oil market. This work presents a crude oil price prediction technique using a time-varying trend. It works by decomposing crude oil price trends over time to characterize changes using a variable time window and determine the price trend in terms of time series. Seasonal Auto Regressive Integrated Moving Average (SARIMA) methodology has been developed in order to predict crude oil price fluctuations over time. The proposed SARIMA model predicts the prices using the weighted average method and accuracy estimation methodology with the feedback error analysis method. Various SARIMA models are evaluated, and best fit relative quality orders have been selected based on the Akaike information criterion. The prediction results of the proposed SARIMA approach are analyzed with performance error metrics and Kurtosis values. Further, the results of the SARIMA model were compared with the existing algorithms. The proposed SARIMA produces higher prediction accuracy with a very much reduced mean absolute error of 30 to 59% compared to the existing approaches.

Similar content being viewed by others

References

Aamir M, Shabri A, Ishaq M (2018) Improving forecasting accuracy of crude oil prices using decomposition ensemble model with reconstruction of IMFs based on ARIMA model. Mal J Fund Appl Sci 14(4):471–483

Aamir M, Shabri A, Ishaq M (2018) Crude oil price forecasting by CEEMDAN based hybrid model of ARIMA and Kalman filter. J Teknol 80(4). https://doi.org/10.11113/jt.v80.10852

Abdollahi H, Ebrahimi SB (2020) A new hybrid model for forecasting Brent crude oil price. Energy 200:117520

Alvarez-Ramirez J, Alvarez J, Solis R (2010) Crude oil market efficiency and modeling: insights from the multiscaling autocorrelation pattern. Energy Econ 32(5):993–1000

Analysis and application of seasonal ARIMA model in Energy Demand Forecasting: A case study of small scale agricultural load. (n.d.) In: 2019 IEEE 62nd International Midwest Symposium on Circuits and Systems (MWSCAS). IEEE. pp. 521–524

Azevedo VG, Campos LM (2016) Combination of forecasts for the price of crude oil on the spot market. Int J Prod Res 54(17):5219–5235

Bristone M, Prasad R, Abubakar AA (2020) CPPCNDL: crude oil price prediction using complex network and deep learning algorithms. Petroleum 6(4):353–361

Chai J, Xing LM, Zhou XY, Zhang ZG, Li JX (2018) Forecasting the WTI crude oil price by a hybrid-refined method. Energy Econ 71:114–127

Chen Y, He K, Tso GK (2017) Forecasting crude oil prices: a deep learning based model. Procedia Comput Sci 122:300–307

Cheng F, Li T, Wei YM, Fan T (2019) The VEC-NAR model for short-term forecasting of oil prices. Energy Econ 78:656–667

Dridi N, Hadzagic M (2018) Akaike and Bayesian information criteria for hidden Markov models. IEEE Signal Process Lett 26(2):302–306

Güleryüz D, Özden E (2020) The prediction of Brent crude oil trend using LSTM and Facebook prophet. Avrupa Bilim ve Teknoloji Dergisi 20:1–9

Hamdi Y, Reem A (2019) A novel trend based SAX reduction technique for time series. Expert Syst Appl 130:113–123

Herrera GP, Constantino M, Tabak BM, Pistori H, Su JJ, Naranpanawa A (2019) Long-term forecast of energy commodities price using machine learning. Energy 179:214–221

Kaggle Repository (n.d.) https://www.kaggle.com/datasets/mabusalah/brent-oil-prices retrieved from U.S. Energy Information Administration: Europe Brent Spot Price, Date: 20-Dec-2020

Lei T, Chen F, Liu H, Sun H, Kang Y, Li D, Li Y, Hou T (2017) ADMET evaluation in drug discovery. Part 17: development of quantitative and qualitative prediction models for chemical-induced respiratory toxicity. Mol Pharm 14:2407–2421

Li P, Zhang JS (2018) A new hybrid method for China’s energy supply security forecasting based on Arima and xgboost. Energies 11(7):1687

Li X, Shang W, Wang S (2019) Text-based crude oil price forecasting: a deep learning approach. Int J Forecast 35(4):1548–1560

Li T, Hua M, Wu XU (2020) A hybrid CNN-LSTM model for forecasting particulate matter (PM2. 5). IEEE Access 8:26933–26940

Luo, H., Liu, Y., Chen, T., Xu, C., Wen, Y. (2016). Derivation of 3-D surface deformation from an integration of InSAR and GNSS measurements based on Akaike’s Bayesian Information Criterion. Geophys J Int, 204(1), 292–310.

Luo C, Tan CH, Zheng YJ (2019) Long-term prediction of time series based on stepwise linear division algorithm and time-variant zonary fuzzy information granules. Int J Approx Reason 108:38–61

Mello CE, Carvalho AST, Lyra A, Pedreira CE (2019) Time series classification via divergence measures between probability density functions. Pattern Recogn Lett 125:42–48

Noureen S, Atique S, Roy V, Bayne S (2019, August) Analysis and application of seasonal ARIMA model in Energy Demand Forecasting: A case study of small scale agriculturalload. In: 2019 IEEE 62nd International Midwest Symposium on Circuits and Systems(MWSCAS) (pp. 521–524). IEEE. Noureen, S., Atique, S., Roy, V., & Bayne, S. (2019, August)

Prasannavenkatesan T (2020) FUCEM: futuristic cooperation evaluation model using Markov process for evaluating node reliability and link stability in mobile ad hoc network. Wirel Netw 26(6):4173–4188

Prasannavenkatesan T, Menakadevi T (2021) Mobility speed prediction using ARIMA and RNN for random walk mobility model in mobile ad hoc networks. Concurrency Computat Pract Exper:e6625. https://doi.org/10.1002/cpe.6625

Rahmayanti IA, Andreas C, Ulyah SM (2020) Does US-China trade war affect the Brent crude oil price? An ARIMAX forecasting approach. InAIP Conference Proceedings 2021 Feb 26 (Vol. 2329, No. 1, p. 060010). AIP Publishing LLC.Zhao LT, Wang SG, Zhang ZG. Oil price forecasting using a time-varying approach. Energies 13(6):1403

Safari A, Davallou M (2018) Oil price forecasting using a hybrid model. Energy 148:49–58

Shen F, Chao J, Zhao J (2015) Forecasting exchange rate using deep belief networks and conjugate gradient method. Neurocomputing 167:243–253

Sulasikin A, Nugraha Y, Kanggrawan JI, Suherman AL (2021, August) MonthlyRainfall prediction using the Facebook prophet model for flood mitigation in Central Jakarta. In: 2021 international conference on ICT for smart society (ICISS). IEEE. pp. 1-5

Tang L, Dai W, Yu L, Wang S (2015) A novel CEEMD-based EELM ensemble learning paradigm for crude oil price forecasting. Int J Inf Technol Decis Mak 14(01):141–169

Theerthagiri P (2021) Forecasting hyponatremia in hospitalized patients using multilayer perceptron and multivariate linear regression techniques. Concurr Comput Pract Exp 33:e6248

Theerthagiri P (2021) Prognostic analysis of hyponatremia for diseased patients using multilayer perceptron classification technique. EAI Endorsed Trans Pervasive Health Technol 7(26):e5

Theerthagiri P (2021) Probable forecasting of epidemic COVID-19 in using COCUDE model. EAI Endorsed Trans Pervasive Health Technol 7(26):e3

Theerthagiri P, Thangavelu M (2019) Futuristic speed prediction using auto-regression and neural networks for mobile ad hoc networks. Int J Commun Syst 32(9):e3951

Torres-Barrán A, Alonso Á, Dorronsoro JR (2017) Regression tree ensembles for wind energy and solar radiation prediction. Neurocomputing

Wang M, Zhao L, Du R, Wang C, Chen L, Tian L, Stanley HE (2018) A novel hybrid method of forecasting crude oil prices using complex network science and artificial intelligence algorithms. Appl Energy 220:480–495

Wu J, Miu F, Li T (2020) Daily crude oil price forecasting based on improved CEEMDAN, SCA, and RVFL: a case study in WTI oil market. Energies 13(7):1852

Yang J, Li L, Shi Y, Xie X (2018) An ARIMA model with adaptive orders forpredicting blood glucose concentrations and hypoglycemia. IEEE J Biomed Health Inform 23(3):1251–1260

Yuan C, Liu S, Fang Z (2016) Comparison of China’s primary energy consumption forecasting by using ARIMA (the autoregressive integrated moving average) model and G.M. (1, 1) model. Energy 100:384–390

Zhang D, Gong Y (2020) The comparison of LightGBM and XGBoost coupling factor analysis and prediagnosis of acute liver failure. IEEE Access 8:220990–221003

Zhang Q, Wang B-D, He B, Peng Y, Ren M-L (2011) Singular spectrum analysis and ARIMA hybrid model for annual runoff forecasting. Water Resour Manag 25(11):2683–2703

Zhao LT, Wang Y, Guo SQ, Zeng GR (2018) A novel method based on numerical fitting for oil price trend forecasting. Appl Energy 220:154–163

Zhao LT, Wang ZJ, Wang SP, He LY (2021) Predicting oil prices: an analysis of oil Price volatility cycle and financial markets. Emerg Mark Financ Trade 57(4):1068–1087

Zou Y, Yu L, Tso GK, He K (2020) Risk forecasting in the crude oil market: a multiscale convolutional neural network approach. Phys A: Stat Mech Appl 541:123360

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Theerthagiri, P., Ruby, A.U. Seasonal learning based ARIMA algorithm for prediction of Brent oil Price trends. Multimed Tools Appl 82, 24485–24504 (2023). https://doi.org/10.1007/s11042-023-14819-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11042-023-14819-x