Abstract

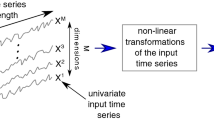

The foreign exchange market plays an important role in the financial field. Accurately predicting the exchange rate appears to be difficult on account of the characteristics of time variability and randomness. This study proposes an Adaboost-based reinforcement ensemble learning framework, which combines two-stage feature extraction with deep learning models to perform multivariate exchange rate prediction. Considering the impact of data information hidden in other financial markets on the foreign exchange market, multiple exogenous variables are introduced as input factors of the proposed model. Auto-encoder and Self-organizing map, as the main two-stage feature extraction models, have their advantages in simplifying model input and clustering similar feature data respectively. Feature extraction paves the way for the subsequent establishment of deep recurrent neural network (DRNN) for prediction, which improves the robustness of the model while improving the prediction accuracy. Finally, the Adaboost algorithm is utilized to integrate the DRNN prediction results. The empirical results reveal that the proposed model has higher accuracy in exchange rate prediction. The prediction effect of the model is significantly better than comparable models and it is a promising way of forecasting exchange rates.

Similar content being viewed by others

References

Baffour AA, Feng JC, Taylorb EK (2019) A hybrid artificial neural network-GJR modeling approach to forecasting currency exchange rate volatility. Neurocomputing 365:285–301

Musyoki D, Pokhariyal GP, Pundo M (2012) The impact of real exchange rate volatility on economic growth: kenyan evidence. Bus Econ Horiz 7:59–75

Huang SC, Chuang PJ, Wu CF (2010) Chaos-based support vector regressions for exchange rate forecasting. Expert Syst Appl 37(12):8590–8598

Rout M, Majhi B, Majhi R, Panda G (2014) Forecasting of currency exchange rates using an adaptive ARMA model with differential evolution based training. J King Saud Univ Sci 26:7–18

Cai N, Cai ZW, Fang Y, Xu QH (2015) Forecasting major Asian exchange rates using a new semiparametric STAR model. Empir Econ 48(1):407–426

Caraiani P (2020) Forecasting financial networks. Comput Econ 55:983–997

Chortareas G, Jiang Y, Nankervis JC (2011) Forecasting exchange rate volatility using high-frequency data: Is the euro different? Int J Forecast 27(4):1089–1107

Marchese M, Kyriakou I, Tamvakis M, Iorio FD (2020) Forecasting crude oil and refined products volatilities and correlations: new evidence from fractionally integrated multivariate GARCH models. Energy Econ 88:104757

Smallwood AD (2019) Analyzing exchange rate uncertainty and bilateral export growth in China: a multivariate GARCH-based approach. Econ Model 82:332–344

Moosa IA, Vaz JJ (2016) Cointegration, error correction and exchange rate forecasting. J Int Financ Mark Inst Money 44:21–34

Joseph DNL (2001) Model specification and forecasting foreign exchange rates with vector autoregressions. J Forecast 20(7):451–484

Santos AAP, Costa NCAD, Coelho LDS (2007) Computational intelligence approaches and linear models in case studies of forecasting exchange rates. Expert Syst Appl 33(4):816–823

Korol T (2014) A fuzzy logic model for forecasting exchange rates. Knowl-Based Syst 67:49–60

Yu L, Lai KK, Wang S (2008) Multistage RBF neural network ensemble learning for exchange rates forecasting. Neurocomputing 71(16–18):3295–3302

Fu SB, Li YW, Sun SL, Li HT (2019) Evolutionary support vector machine for RMB exchange rate forecasting. Phys A 521:692–704

Lin CS, Chiu SH, Lin TY (2012) Empirical mode decomposition–based least squares support vector regression forforeign exchange rate forecasting. Econ Model 29:2583–2590

Zhu BZ, Ye SX, Wang P, Chevallier J, Wei YM (2021) Forecasting carbon price using a multi-objective least squares support vector machine with mixture kernels. J Forecast. https://doi.org/10.1002/for.2784

Ni H, Yin HJ (2009) Exchange rate prediction using hybrid neural networks and trading indicators. Neurocomputing 72:2815–2823

Sezer OB, Gudelek MU, Ozbayoglu AM (2020) Financial time series forecasting with deep learning: a systematic literature review: 2005–2019. Appl Soft Comput 90:106181

Liu C, Hou WY, Liu DY (2017) Foreign exchange rates forecasting with convolutional neural network. Neural Process Lett 46:1095–1119

Hajiabotorabi Z, Kazemi A, Samavati FF, Ghaini FMM (2019) Improving DWT-RNN model via B-spline wavelet multiresolution to forecast a high-frequency time series. Expert Syst Appl 138:112842

Shahid F, Zameer A, Mehmood A, Raja MAZ (2020) A novel wavenets long short term memory paradigm for wind power prediction. Appl Energy 269:115098

Shahid F, Zameer A, Muneeb M (2020) Predictions for COVID-19 with deep learning models of LSTM, GRU and Bi-LSTM. Chaos Solitons Fractals 140:110212

Shen F, Chao J, Zhao JX (2015) Forecasting exchange rate using deep belief networks and conjugate gradient method. Neurocomputing 1671:243–253

Rahman A, Srikumar V, Smith AD (2018) Predicting electricity consumption for commercial and residential buildings using deep recurrent neural networks. Appl Energy 212:372–385

Li JP, Hao J, Feng QQ, Sun XL, Liu MX (2021) Optimal selection of ensemble strategies of time series forecasting with multi-objective programming. Expert Syst Appl 166:114091

Bui LT, Vu VT, Dinh TTH (2018) A novel evolutionary multi-objective ensemble learning approach for forecasting currency exchange rates. Data Knowl Eng 114:40–66

Li JP, Hao J, Sun XL, Feng QQ (2021) Forecasting China’s sovereign CDS with a decomposition reconstruction strategy. Appl Soft Comput 105:107291

Mohammed SA, Bakar MAA, Ariff NM (2018) Volatility forecasting of financial time series using wavelet based exponential generalized autoregressive conditional heteroscedasticity model. Commun Stat-Theory M 49:178–188

Wang JN, Du JZ, Jiang CH, Lai KK (2019) Chinese currency exchange rates forecasting with emd-based neural network. Complexity 2:1–15

He KJ, Chen YH, Tso GKF (2018) Forecasting exchange rate using variational mode decomposition and entropy theory. Phys A 510:15–25

Wu YG, Gao JW (2019) Application of support vector neural network with variational mode decomposition for exchange rate forecasting. Soft Comput 23:6995–7004

Sun SL, Wang SY, Wei YJ, Zhang GW (2018) A clustering-based nonlinear ensemble approach for exchange rates forecasting. IEEE T Syst Man CY-S 50(6):1–9

Mallqui DCA, Fernandes RAS (2019) Predicting the direction, maximum, minimum and closing prices of daily Bitcoin exchange rate using machine learning techniques. Appl Soft Comput 75:596–606

Wei YJ, Sun SL, Ma J, Wang SY, Lai KK (2019) A decomposition clustering ensemble learning approach for forecasting foreign exchange rates. Int J Manag Sci Eng Manag 4(1):45–54

Chen WL, Yeo CK, Lau CT, Lee BS (2018) Leveraging social media news to predict stock index movement using RNN-boost. Data Knowl Eng 118:14–24

Schapire RE (2003) The boosting approach to machine learning: an overview. Nonlinear estimation and classification. Springer, New York, pp 149–171

Kim MJ, Kang DK (2010) Ensemble with neural networks for bankruptcy prediction. Expert Syst Appl 31(4):3373–3379

Li JP, Li GW, Zhu XQ, Wei L (2020) A novel text-based framework for forecasting agricultural futures using massive online news headlines. Int J Forecast. https://doi.org/10.1016/j.ijforecast.2020.02.002

Beckmann J, Czudaj RL, Arora V (2020) The relationship between oil prices and exchange rates: revisiting theory and evidence. Energy Econ 88:104772

Reboredo JC, Castro MAR (2013) A wavelet decomposition approach to crude oil price and exchange rate dependence. Econ Model 32:42–57

Xie ZX, Chen SW, Wu AC (2020) The foreign exchange and stock market nexus: New international evidence. Int Rev Econ Financ 67:240–266

Hamori Y (2014) Gold prices and exchange rates: a time-varying copula analysis. Appl Financ Econ 24(1):41–50

Apergis N (2014) Can gold prices forecast the Australian dollar movements? Int Rev Econ Financ 29:75–82

Zhong X, Enke D (2017) Forecasting daily stock market return using dimensionality reduction. Expert Syst Appl 67:126139

Panopoulou E, Souropanis I (2019) The role of technical indicators in exchange rate forecasting. J Empir Financ 53:197–221

Chen TL, Cheng CH, Liu JW (2019) A causal time-series model based on multilayer perceptron regression for forecasting taiwan stock index. Int J Inf Technol Decis Mak 18:1967–1987

Zhang YH, Lu ZM, Wang SP (2021) Unsupervised feature selection via transformed auto-encoder. Knowl-based Syst 215:106748

Wang YS, Yao HX, Zhao SC (2016) Auto-encoder based dimensionality reduction. Neurocomputing 184:232–242

Mohanty DK, Parida AK, Khuntia SS (2021) Financial market prediction under deep learning framework using auto encoder and kernel extreme learning machine. Appl Soft Comput 99:106898

Kohonen T (1990) The self-organizing map. Proc IEEE 78(9):1464–1480

Freund Y, Schapire RE (1997) A decision-theoretic generalization of on-line learning and an application to boosting. J Comput Syst Sci 55:119–139

Acknowledgements

This research was supported by the National Natural Science Foundation of China (Grant No. 71971122 and 71501101).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, J., Chen, Y. Adaboost-based Integration Framework Coupled Two-stage Feature Extraction with Deep Learning for Multivariate Exchange Rate Prediction. Neural Process Lett 53, 4613–4637 (2021). https://doi.org/10.1007/s11063-021-10616-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11063-021-10616-5