Abstract

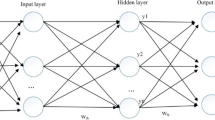

The present work aims to apply the Internet of Things (IoT) to help enterprises improve financial management, timely discover hidden financial risks, and enhance the ability to resist risks. Firstly, the traditional financial risk early-warning model based on accounting information is analyzed. Accordingly, a corporate risk early-warning model is put forward from the perspective of cash flow, and the financial risk early-warning indicator system is established. Secondly, the Backpropagation neural network (BPNN) is employed to mine the financial data of the enterprise. After pre-processing, the data are input into the model according to the type of financial risk early-warning indicators to obtain the financial risk prediction result of the company. Thirdly, the mobile edge computing (MEC) service is introduced into the corporate financial management to improve the calculation performance of the corporate financial information processing and strengthen the timeliness of cash flow information and risk warning cooperating with IoT. Finally, an edge service preloading optimization model is established based on the Geographic Point of Interest Information and BPNN. According to the feature vector of the user location, the next service probability of the user is predicted, and the service preloading is carried out on the accessed edge server. Finally, the effect of this model is verified by experiments. The experimental results indicate that the prediction accuracy of the risk early-warning model designed here for financial health and crisis is 91.6% and 75%, respectively, and the response rate of the service preloading optimization model is between 2.1% and 5%. Therefore, service preloading can improve the response speed of corporate financial risk early-warning to a certain extent. This exploration provides a reference for the study of the corporate financial risk early-warning model based on MEC and IoT.

Similar content being viewed by others

References

Chen L, Ye W, Huo C, James K (2020) Environmental regulations, the industrial structure, and high-quality regional economic development: evidence from China. Land-Basel 9(12):517

Foltean FS, Trif SM, Tuleu DL (2019) Customer relationship management capabilities and social media technology use: consequences on firm performance. J Bus Res 104:563–575

Zhou H, Sun G, Fu S, Liu J, Zhou X, Zhou J (2019) A big data mining approach of PSO-based BP neural network for financial risk management with IoT. IEEE Access 7:154035–154043

Oláh J, Kovács S, Virglerova Z, Lakner Z, Kovacova M, Popp J (2019) Analysis and comparison of economic and financial risk sources in SMEs of the Visegrad group and Serbia. Sustain-Basel 11(7):1853

Myšková R, Hájek P (2020) Mining risk-related sentiment in corporate annual reports and its effect on financial performance. Technol Econ Dev Eco 26(6):1422–1443

Samitas A, Kampouris E, Kenourgios D (2020) Machine learning as an early warning system to predict financial crisis. Int Rev Financ Anal 71:101507

Nie X, Deng G (2020) Enterprise financial early warning based on lasso regression screening variables. J Financ Intermed 9(4):454–461

Xu L, Qi Q, Sun P (2020) Early-warning model of financial crisis: an empirical study based on listed companies of information technology industry in China. Emerg Mark Financ Tr 56(7):1601–1614

Xu L, Kong J (2020) Financial risk assessment of marine enterprises based on analytic hierarchy process. J Coastal Res 112:171–173

Kang Q (2019) Financial risk assessment model based on big data. Int J Numer Anal Mod 10(04):1950021

Huang A, Qiu L, Li Z (2021) Applying deep learning method in TVP-VAR model under systematic financial risk monitoring and early warning. J Comput Appl Math 382:113065

Wang Q, Hui F, Wang X, Ding Q (2019) Research on early warning and monitoring algorithm of financial crisis based on fuzzy cognitive map. Cluster Comput 22(2):3689–3697

Ashraf S, Félix EGS, Serrasqueiro Z (2019) Do traditional financial distress prediction models predict the early warning signs of financial distress? J Risk Financ Manag 12(2):55. https://doi.org/10.3390/jrfm12020055

Du G, Liu Z, Lu H (2021) Application of innovative risk early warning mode under big data technology in Internet credit financial risk assessment. J Comput Appl Math 386:113260

Siekelova A, Kovalova E, Ciurlău CF (2019) Prediction financial stability of Romanian production companies through Altman Z-score. Manag Decis Econ 13(2):89–97

Shang H, Lu D, Zhou Q (2020) Early warning of enterprise finance risk of big data mining in internet of things based on fuzzy association rules. Neural Comput Appl 1:1–9

Peng X, Huang H (2020) Fuzzy decision-making method based on CoCoSo with critic for financial risk evaluation. Technol Econ Dev Eco 26(4):695–724

Wang J, Xie S (2020) Application of BP neural network in early-warning analysis of investment financial risk in coastal areas. J Coastal Res 106(1):259

Wang B (2020) Early warning method of marine products network marketing risk based on BP neural network algorithm. J Coastal Res 103:177–181

Li G (2019) An integrated model of rough set and radial basis function neural network for early warning of enterprise human resource crisis. Int J Fuzzy Syst 21(8):1–10

Bouchti AE, Tribis Y, Nahhal T, Okar C (2019) Forecasting financial risk using quantum neural networks. Inform Sci Res 10(3):97–104

Xu YZ, Zhang JL, Hua Y, Wang L (2019) Dynamic credit risk evaluation method for e-commerce sellers based on a hybrid artificial intelligence model. Sustain-Basel 11(19):5521

Duan J (2019) Financial system modeling using deep neural networks (DNNs) for effective risk assessment and prediction. J Franklin I 356(8):4716–4731

Wang W, Li W, Zhang N, Kecheng L (2020) Portfolio formation with preselection using deep learning from long-term financial data. Expert Syst Appl 143(4):113042.1-113042.17

Li S, Quan Y (2019) Financial risk prediction for listed companies using IPSO-BP neural network. Expert Syst Appl 15(4):1209–1219

Chen S, Wen H, Wu J, Lei W, Hou W, Liu W, Xu W, Xu A, Jiang Y (2019) Internet of things based smart grids supported by intelligent edge computing. IEEE Access 7:74089–74102

Duc TL, Leiva RG, Casari P (2019) Machine learning methods for reliable resource provisioning in edge-cloud computing: a survey. ACM Comput Surv 52(5):1–39

Sun W, Liu J, Yue Y (2019) AI-enhanced offloading in edge computing: when machine learning meets industrial IoT. IEEE Network 33(5):68–74

Cicirelli F, Guerrieri A, Mercuri A (2019) ITEMa: a methodological approach for cognitive edge computing IoT ecosystems. Future Gener Comp Sy 92:189–197

Xu T, Han G, Qi X, Du J, Lin C, Shu L (2020) A hybrid machine learning model for demand prediction of edge-computing-based bike-sharing system using internet of things. IEEE Internet Things 7(8):7345–7356

Sittón-Candanedo I, Alonso RS, García Ó (2019) Edge computing, iot and social computing in smart energy scenarios. Sens-Basel 19(15):3353

Fantacci R, Picano B (2020) Federated learning framework for MEC networks. IEEE T Pattern Anal 5(1):15–21

Yao C, Wang X, Zheng Z, Sun G, Song L (2019) EdgeFlow: open-source multi-layer data flow processing in edge computing for 5G and beyond. IEEE Network 33(2):166–173

Hu K, Gui Z, Cheng X (2019) The concept and technologies of quality of geographic information service: improving user experience of GIServices in a distributed computing environment. ISPRS Int J Geo-Inf 8(3):118

Saeedi M, Moradi M, Hosseini M, Emamifar A (2019) Robust optimization based optimal chiller loading under cooling demand uncertainty. Appl Therm Eng 148:1081–1091

Jafarnejad Ghomi E, Masoud Rahmani A, Nasih QN (2019) Service load balancing, task scheduling and transportation optimisation in cloud manufacturing by applying queuing system. Enterp Inf Syst-Uk 13(6):865–894

Acknowledgements

This work was supported by Social Science Planning Project of Qinghai Province in 2020 (No.20011).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zeng, H. Influences of mobile edge computing-based service preloading on the early-warning of financial risks. J Supercomput 78, 11621–11639 (2022). https://doi.org/10.1007/s11227-022-04329-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11227-022-04329-2