Abstract

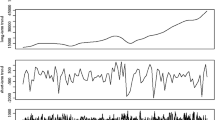

In this study, we propose a method for recommending appropriate combinations of stocks based on the waveforms of stock price changes. Many Japanese prefer to maintain stability when managing their assets. Specialized knowledge is required to invest in stocks while reducing risk. Hence, stock recommendation methods with different characteristics are required. Stock price movements can be captured as waveforms. Dynamic time warping (DTW), cross–correlation functions, and fast Fourier transforms (FFTs) are used to compare the features of the waveforms. A combination of stocks with different waveforms avoids the risk of simultaneous crashes. In the current experiment, one–year stock waveforms are used to obtain the recommended stock. The combined stocks selected using the DTW, cross–correlation functions, and FFT are shown to be suitable.

Similar content being viewed by others

Data availibility statement

References

Hochreiter S, Schmidhuber J (1997) Long short-term memory. Neural Comput 9(8):1735–1780

Roondiwala M, Patel H, Varma S (2017) Predicting stock prices using Lstm. Int J Sci Res (IJSR) 6(4):1754

Chen BT, Chen MY, Fan MH, Chen CC(2012) Forecasting stock price based on fuzzy time–series with equal–frequency partitioning and fast Fourier transform algorithm. In Proceedings of the Computing, Communications and Applications Conference (ComComAp):238–243

DTW suite. https://dynamictimewarping.github.io/

Zebende GF (2011) DCCA cross-correlation coefficient: quantifying level of cross-correlation. Phys A Stat Mech Appl 390(4):614–618

stooq. https://stooq.com/db/h/

Acknowledgements

This work was supported by the Organization for the Promotion of Gender Equality at Nara Women’s University. We would like to thank Editage (www.editage.jp) for English language editing.

Funding

the Organization for the Promotion of Gender Equality at Nara Women’s University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Takata, M., Kidoguchi, N. & Chiyonobu, M. Stock recommendation methods for stability. J Supercomput 80, 12091–12101 (2024). https://doi.org/10.1007/s11227-024-05902-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11227-024-05902-7