Abstract

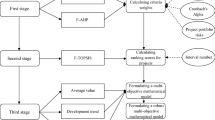

This research has concentrated on the project portfolio selection (PPS) in the petroleum industry. In this study, the PPS has been treated as a multi-attribute decision-making (MADM) problem; therefore, a hybrid framework comprising five MADM techniques has been proposed to tackle this problem. Several MADM techniques have been integrated to acquire more reliable decisions and consequently to decrease the risk of failure in the decision-making process. Since the proposed methodology is an MADM-based framework, there was a need to discover the influential attributes on selection of petroleum projects. In this respect, the literature of the PPS has been comprehensively reviewed and the most influential attributes have been detected. Sustainable development has been a concern for the researchers; hence, the sustainability-related attributes have been embraced in the decision-making process as well. To strengthen the practicality of the developed framework, the Delphi method has been employed to gather and converge the viewpoints of experts on the identified attributes. The Kruskal–Wallis statistical test has been implemented to compute the weights of the attributes. Having determined the influential attributes and their weights, the embedded MADM techniques in the proposed framework have been implemented to prioritize the potential petroleum projects of a real case study. To obtain the ultimate ranking of alternatives, the proposed framework consolidates the outputs of the aforementioned techniques through using the Copeland method. This paper has also proposed a mixed-integer mathematical formulation for the PPS problem to assess the precision and validity of the results delivered by the decision-making framework. Comparing the outputs of the proposed framework and the model revealed that the developed framework is capable of providing credible outcomes. Furthermore, several sensitivity analyses have been performed to demonstrate the robustness of the framework.

Similar content being viewed by others

Data availability

Please contact the corresponding author for accessing the data.

References

Sayed MA, Al-Muntasheri GA, Liang F (2017) Development of shale reservoirs: knowledge gained from developments in North America. J Petrol Sci Eng 157:164–186

Yazdi AK, Rashidi Komijan A, Wanke PF, Sardar S (2020) Oil project selection in Iran: a hybrid MADM approach in an uncertain environment. Appl Soft Comput 88:106066. https://doi.org/10.1016/j.asoc.2020.106066

Shahbaz M, Sarwar S, Chen W, Malik MN (2017) Dynamics of electricity consumption, oil price and economic growth: global perspective. Energy Policy 108:256–270

Amiri MP (2010) Project selection for oil-fields development by using the AHP and fuzzy TOPSIS methods. Expert Syst Appl 37(9):6218–6224

Xie F, Li H, Xu Z (2021) Multi-mode resource-constrained project scheduling with uncertain activity cost. Expert Syst Appl 168:114475. https://doi.org/10.1016/j.eswa.2020.114475

Bai L, Bai J, An M (2022) A methodology for strategy-oriented project portfolio selection taking dynamic synergy into considerations. Alex Eng J 61(8):6357–6369

Okeke A (2021) Towards sustainability in the global oil and gas industry: identifying where the emphasis lies. Environ Sustain Ind 12:100145. https://doi.org/10.1016/j.indic.2021.100145

Mardani A, Jusoh A, Nor KMD, Khalifah Z, Zakwan N, Valipour A (2015) Multiple criteria decision-making techniques and their applications—a review of the literature from 2000 to 2014. Econ Res Ekonomska Istraživanja 28(1):516–571

Liu S-S, Wang C-J (2011) Optimizing project selection and scheduling problems with time-dependent resource constraints. Autom Constr 20(8):1110–1119

Vidal L-A, Marle F, Bocquet J-C (2011) Using a Delphi process and the analytic hierarchy process (AHP) to evaluate the complexity of projects. Expert Syst Appl 38(5):5388–5405

Golmohammadi A, Pajoutan M (2011) Meta heuristics for dependent portfolio selection problem considering risk. Expert Syst Appl 38(5):5642–5649

Nassif LN, Filho JCS, Nogueira JM (2013) Project portfolio selection in public administration using fuzzy logic. Procedia Soc Behav Sci 74:41–50

Khalili-Damghani K, Sadi-Nezhad S (2013) A decision support system for fuzzy multi-objective multi-period sustainable project selection. Comput Ind Eng 64(4):1045–1060

Hassanzadeh F, Nemati H, Sun M (2014) Robust optimization for interactive multi-objective programming with imprecise information applied to R&D project portfolio selection. Eur J Oper Res 238(1):41–53

Lopes YG, de Almeida AT (2015) Assessment of synergies for selecting a project portfolio in the petroleum industry based on a multi-attribute utility function. J Petrol Sci Eng 126:131–140

Costantino F, Gravio GD, Nonino F (2015) Project selection in project portfolio management: an artificial neural network model based on critical success factors. Int J Project Manage 33(8):1744–1754

Minken H (2016) Project selection with sets of mutually exclusive alternatives. Econ Transp 6:11–17

Huang X, Zhao T, Kudratova S (2016) Uncertain mean-variance and mean-semivariance models for optimal project selection and scheduling. Knowl Based Syst 93:1–11

Sefair JA, Méndez CY, Babat O, Medaglia AL, Zuluaga LF (2017) Linear solution schemes for Mean-semivariance project portfolio selection problems: an application in the oil and gas industry. Omega 68:39–48

Tsiga Z, Emes M, Smith A (2017) Critical success factors for projects in the petroleum industry. Procedia Comput Sci 121:224–231

Shariatmadari M, Nahavandi N, Zegordi SH, Sobhiyah MH (2017) Integrated resource management for simultaneous project selection and scheduling. Comput Ind Eng 109:39–47

Jafarzadeh H, Akbari P, Abedin B (2018) A methodology for project portfolio selection under criteria prioritisation, uncertainty and projects interdependency–combination of fuzzy QFD and DEA. Expert Syst Appl 110:237–249

Wu Y, Xu C, Ke Y, Chen K, Sun X (2018) An intuitionistic fuzzy multi-criteria framework for large-scale rooftop PV project portfolio selection: case study in Zhejiang, China. Energy 143:295–309

Pérez F, Gómez T, Caballero R, Liern V (2018) Project portfolio selection and planning with fuzzy constraints. Technol Forecast Soc Chang 131:117–129

Kumar M, Mittal ML, Soni G, Joshi D (2018) A hybrid TLBO-TS algorithm for integrated selection and scheduling of projects. Comput Ind Eng 119:121–130

Yücel N, Taşabat SE (2019) The selection of railway system projects with multi-criteria decision making methods: a case study for Istanbul. Procedia Comput Sci 158:382–393

Tavana M, Khosrojerdi G, Mina H, Rahman A (2019) A hybrid mathematical programming model for optimal project portfolio selection using fuzzy inference system and analytic hierarchy process. Eval Progr Plan. https://doi.org/10.1016/j.evalprogplan.2019.101703

Song S, Yang F, Xia Q (2019) Multi-criteria project portfolio selection and scheduling problem based on acceptability analysis. Comput Ind Eng 135:793–799

Liu F, Chen Y, Yang J, Xu D, Liu W (2019) Solving multiple-criteria R&D project selection problems with a data-driven evidential reasoning rule. Int J Project Manage 37(1):87–97

Toloo M, Mirbolouki M (2019) A new project selection method using data envelopment analysis. Comput Ind Eng 138:106119. https://doi.org/10.1016/j.cie.2019.106119

Zhang X, Fang L, Hipel KW, Ding S, Tan Y (2020) A hybrid project portfolio selection procedure with historical performance consideration. Expert Syst Appl 142:113003. https://doi.org/10.1016/j.eswa.2019.113003

Miralinaghi M, Seilabi SE, Chen S, Hsu Y-T, Labi S (2020) Optimizing the selection and scheduling of multi-class projects using a Stackelberg framework. Eur J Oper Res 286(2):508–522

Ma J, Harstvedt JD, Jaradat R, Smith B (2020) Sustainability driven multi-criteria project portfolio selection under uncertain decision-making environment. Comput Ind Eng 140:106236. https://doi.org/10.1016/j.cie.2019.106236

Bai L, Han X, Wang H, Zhang K, Sun Y (2021) A method of network robustness under strategic goals for project portfolio selection. Comput Ind Eng 161:107658. https://doi.org/10.1016/j.cie.2021.107658

Zolfaghari S, Mousavi SM (2021) A novel mathematical programming model for multi-mode project portfolio selection and scheduling with flexible resources and due dates under interval-valued fuzzy random uncertainty. Expert Syst Appl 182:115207. https://doi.org/10.1016/j.eswa.2021.115207

Ecer F (2021) A consolidated MCDM framework for performance assessment of battery electric vehicles based on ranking strategies. Renew Sustain Energy Rev 143:110916. https://doi.org/10.1016/j.rser.2021.110916

Chen H, Li X-Y, Lu X-R, Sheng N, Zhou W, Geng H-P, Yu S (2021) A multi-objective optimization approach for the selection of overseas oil projects. Comput Ind Eng. https://doi.org/10.1016/j.cie.2020.106977

Sarnataro M, Barbati M, Greco S (2021) A portfolio approach for the selection and the timing of urban planning projects. Socio Econ Plan Sci. https://doi.org/10.1016/j.seps.2020.100908

Mavrotas G, Makryvelios E (2021) Combining multiple criteria analysis, mathematical programming and Monte Carlo simulation to tackle uncertainty in research & development project portfolio selection: a case study from Greece. Eur J Oper Res 291(2):794–806

Miranda J, Tereso A, Teixeira JC (2021) Multi-criteria analysis as a better tool for the selection of public projects alternatives. Procedia Comput Sci 181:545–552

Hesarsorkh AH, Ashayeri J, Naeini AB (2021) Pharmaceutical R&D project portfolio selection and scheduling under uncertainty: a robust possibilistic optimization approach. Comput Ind Eng 155:107114. https://doi.org/10.1016/j.cie.2021.107114

Biscaia RVB, Braghini Junior A, Colmenero JC (2021) Selection of projects for automotive assembly structures using a hybrid method composed of the group-input compatible, best-worst method for criteria weighting and TrBF-TOPSIS. Expert Syst Appl 184:115557. https://doi.org/10.1016/j.eswa.2021.115557

Wang X, Zhao T, Chang C-T (2021) An integrated FAHP-MCGP approach to project selection and resource allocation in risk-based internal audit planning: a case study. Comput Ind Eng 152:107012. https://doi.org/10.1016/j.cie.2020.107012

Rudnik K, Bocewicz G, Kucińska-Landwójtowicz A, Czabak-Górska ID (2021) Ordered fuzzy WASPAS method for selection of improvement projects. Expert Syst Appl 169:114471. https://doi.org/10.1016/j.eswa.2020.114471

Namazi M, Tavana M, Mohammadi E, Naeini AB (2022) A new strategic approach for R&D project portfolio selection using efficiency-uncertainty maps. Benchmarking Int J. https://doi.org/10.1108/BIJ-02-2022-0129

Chungsawanant P, Chutima P, Pongpanich C (2023) Multi-criteria decision making and project portfolio management for transport infrastructure investment in Thailand. Int J Process Manag Benchmarking 13(1):47–72

Zhang K, Bai L, Xie X, Wang C (2023) Modeling of risk cascading propagation in project portfolio network. Phys A Stat Mech Appl 612:128450. https://doi.org/10.1016/j.physa.2023.128450

Hong KR, Huang X, Kim JS, Kim NH (2023) A multi-objective mean–semivariance model for project selection using reinvestment and synergy under uncertainty. Expert Syst Appl 217:119586. https://doi.org/10.1016/j.eswa.2023.119586

Wang X, Wang B, Li T, Li H, Watada J (2023) Multi-criteria fuzzy portfolio selection based on three-way decisions and cumulative prospect theory. Appl Soft Computi 134:110033. https://doi.org/10.1016/j.asoc.2023.110033

Zavadskas EK, Turskis Z, Antucheviciene J (2012) Optimization of weighted aggregated sum product assessment. Electron Electr Eng 122(6):3–6

Brauers WK, Zavadskas EK (2010) Project management by MULTIMOORA as an instrument for transition economies. Technol Econ Dev Econ 16(1):5–24

Chakraborty S, Zavadskas EK (2014) Applications of WASPAS method in manufacturing decision making. Informatica 25(1):1–20

Zavadskas EK, Govindan K, Antucheviciene J, Turskis Z (2016) Hybrid multiple criteria decision-making methods: a review of applications for sustainability issues. Econ Res Ekonomska Istraživanja 29(1):857–887

Dey PK (2004) Analytic hierarchy process helps evaluate project in Indian oil pipelines industry. Int J Oper Prod Manag 24(6):588–604

Tang B-J, Zhou H-L, Chen H, Wang K, Cao H (2017) Investment opportunity in China’s overseas oil project: an empirical analysis based on real option approach. Energy Policy 105:17–26

Roychaudhuri PS, Kazantzi V, Foo DCY, Tan RR, Bandyopadhyay S (2017) Selection of energy conservation projects through Financial Pinch Analysis. Energy 138:602–615

Li Y, Hu Z (2022) A review of multi-attributes decision-making models for offshore oil and gas facilities decommissioning. J Ocean Eng Sci 7(1):58–74

Moghimi F, Baradaran V, Hosseinian AH (2022) Identifying the influential factors on the effectiveness of industrial parks and using an MCDM method to rank them: case study of Iran. J Facil Manag. https://doi.org/10.1108/JFM-12-2021-0151

Sweis R, Moarefi A, Amiri MH, Moarefi S, Saleh R (2020) Causes of delay in Iranian oil and gas projects: a root cause analysis. Int J Energy Sect Manage 13(3):630–650

Leutner F, Yearsley A, Codreanu S-C, Borenstein Y, Ahmetoglu G (2017) From Likert scales to images: validating a novel creativity measure with image based response scales. Personal Individ Differ 106:36–40

Fischer H (2021) A history of the central limit theorem. Springer, New York. https://doi.org/10.1007/978-0-387-87857-7

Zavadskas EK, Bausys R, Lazauskas M (2015) Sustainable assessment of alternative sites for the construction of a waste incineration plant by applying WASPAS method with single-valued neutrosophic set. Sustainability 7(12):15923–15936

Zavadskas EK, Antucheviciene J, saparauskas J, Turskis Z (2013) MCDM methods WASPAS and MULTIMOORA: verification of robustness of methods when assessing alternative solutions. Econ Comput Econ Cybern Stud Res 47(2):5–20

Jurkowska B (2014) The Federal States of Germany-Analysis and measurement of development using taxonomic methods. Oeconomia Copernicana 5(3):49–73

Alinezhad A, Khalili J (2019) New methods and applications in multiple attribute decision making (MADM). Int Ser Oper Res Manag Sci. https://doi.org/10.1007/978-3-030-15009-9

Rochat D, Binder CR, Diaz J, Jolliet O (2013) Combining material flow analysis, life cycle assessment, and multiattribute utility theory. J Ind Ecol 17(5):642–655

Emovon I, Norman RA, Murphy AJ (2016) Methodology of using an integrated averaging technique and MAUT method for failure mode and effects analysis. J Eng Technol (JET) 7(1):140–155

Karande P, Chakraborty S (2012) Decision making for supplier selection using the MOORA method. IUP J Oper Manag 11(2):6–18

Hosseinian AH, Baradaran V (2021) A multi-objective multi-agent optimization algorithm for the multi-skill resource-constrained project scheduling problem with transfer times. RAIRO Oper Res 55(4):2093–2128

Brauers WK, Zavadskas EK (2006) The MOORA method and its application to privatization in a transition economy. Control Cybern 35:445–469

Brauers WK, Zavadskas EK (2009) Robustness of the multi objective MOORA method with a test for the facilities sector. Technol Econ Dev Econ 15(2):352–375

Ghorabaee MK, Zavadskas EK, Olfat L, Turskis Z (2015) Multi-criteria inventory classification using a new method of evaluation based on distance from average solution (EDAS). Informatica 26(3):435–451

Zavadskas E, Cavallaro F, Podvezko V, Ubarte I, Kaklauskas A (2017) MCDM assessment of a healthy and safe built environment according to sustainable development principles: a practical neighborhood approach in Vilnius. Sustainability 9(5):702. https://doi.org/10.3390/su9050702

Christmann A, Van Aelst S (2006) Robust estimation of Cronbach’s alpha. J Multivar Anal 97(7):1660–1674

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

Amir Hossein Hosseinian contributed to the subject, methodology, algorithm, mathematical modeling, writing, and analysis. Hamid Esmaeeli contributed to the analysis, validation, supervision, and project administration.

Corresponding author

Ethics declarations

Competing interests

The authors have no competing interests.

Ethical approval

We confirm that this work has been conducted by the authors themselves, and it has not been submitted or published elsewhere in whole or in part.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hosseinian, A.H., Esmaeeli, H. A sustainable decision-making framework and a mixed-integer formulation for the project portfolio selection problem. J Supercomput 80, 20743–20792 (2024). https://doi.org/10.1007/s11227-024-06241-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11227-024-06241-3