Abstract

This paper discusses optimal reinsurance strategy by minimizing insurer’s risk under one general risk measure: Distortion risk measure. The authors assume that the reinsurance premium is determined by the expected value premium principle and the retained loss of the insurer is an increasing function of the initial loss. An explicit solution of the insurer’s optimal reinsurance problem is obtained. The optimal strategies for some special distortion risk measures, such as value-at-risk (VaR) and tail value-at-risk (TVaR), are also investigated.

Similar content being viewed by others

References

Cai J, Tan K S, Wang C, and Zhang Y, Optimal reinsurance under VaR and CTE risk measures, Insurance: Mathematics and Economics, 2008, 43(1): 185–196.

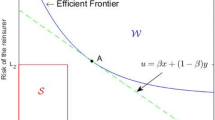

Cheung K C, Optimal reinsurance revisited —A geometric approach, Astin Bulletin, 2010, 40(1): 221–239.

Dhaene J, Vanduffel S, Goovaerts M J, Kaas R, Tang Q, and Vyncke D, Risk measures and comonotonicity: A review, 2006, Stochastic Models, 22: 573–606.

Wang S, A class of distortion operators for pricing financial and insurance risks, Journal of Risk and Insurance, 2000, 67(1): 15–36.

Chi Y and Tan K S, Optimal reinsurance under VaR and CVaR risk measures: A simplified approach, Astin Bulletin, 2011, 41(2): 487–509.

Bernard C and Tian W, Optimal reinsurance arrangements under tail risk measures, Journal of Risk and Insurance, 2009, 76(3): 706–725.

Gajek L and Zagrodny D, Reinsurance arrangements maximizing insurer’s survival probability, Journal of Risk and Insurance, 2004, 71(3): 421–435.

Kaluszka M, Optimal reinsurance under convex principles of premium calculation. Insurance: Mathematics and Economics, 2005, 36: 375–398.

Kaluszka M and Okolewski A, An extension of Arrow’s result on optimal reinsurance contract, Journal of Risk and Insurance, 2008, 75(2): 275–288.

Cui W, Yang J P, and Wu L, Optimal reinsurance minimizing the distortion risk measure under general reinsurance premium principles, Insurance: Mathematics and Economics, 2013, 53(1): 74–85.

Cai J and Wei W, Optimal reinsurance with positively dependent risks, Insurance: Mathematics and Economics, 2012, 50(1): 57–63.

Rao M, Measure Theory and Integration, Wiley, New York, 1987.

Zorich V, Mathematical Analysis I, Springer, Germany, 2004.

Author information

Authors and Affiliations

Corresponding author

Additional information

Zheng’s research was supported by the Program of National Natural Science Foundation of Youth of China under Grant No. 11201012 and PHR201007125; Yang’s research was supported by the Key Program of National Natural Science Foundation of China under Grant No. 11131002 and the National Natural Science Foundation of China under Grant No. 11271033.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Zheng, Y., Cui, W. & Yang, J. Optimal reinsurance under distortion risk measures and expected value premium principle for reinsurer. J Syst Sci Complex 28, 122–143 (2015). https://doi.org/10.1007/s11424-014-2095-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-014-2095-z