Abstract

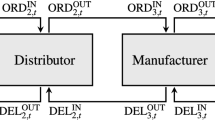

This paper proposes a double Markov model of the double continuous auction for describing intra-day price changes. The model splits intra-day price changes as the repetition of one tick price moves and assumes order arrivals are independent Poisson random processes. The dynamic process of price formation is described by a birth-death process of the double M/M/1 server queue corresponding to the best bid/ask. The initial depths of the best bid and ask are defined as different constants depending on the last price change. Thus, the price changes in the model follow a first-order Markov process. As the initial depth of the best bid/ask is originally larger than that of the opposite side when the last price is down/up, the model may explain the negative autocorrelations of the price of the best bid/ask. The estimated parameters are based on the real tick-by-tick data of the Nikkei 225 futures listed in Osaka Stock Exchanges. The authors find the model accurately predicts the returns of Osaka Stock Exchange average.

Similar content being viewed by others

References

Bianchi S and Pantanella A, Modeling stock prices by multifractional Brownian motion: An improved estimation of the pointwise regularity, Quantitative Finance, 2013, 13(8): 1317–1330.

Zheng X L and Chen B M, Modeling and forecasting of stock markets under a system adaptation framework, Journal of System Science & Complexity, 2012, 25(4): 641–674.

Soofi A S, Wang S Y, and Zhang Y Q, Testing for long memory in the Asian foreign exchange rates, Journal of System Science & Complexity, 2006, 19(2): 182–190.

Garman M, Market microstructure, Journal of Financial Economics, 1976, 2: 257–275.

Madhavan A and Smidt S, An analysis of daily changes in specialist’s inventories and quotations, Journal of Finance, 1993, 48: 1959–1628.

Hasbrouck J and Sofianos G, The traders of market makers: An empirical analysis of NYSE specialist, Journal of Finance, 48: 1565–1594.

Amihud Y and Mendelson H, Dealership market: Market making with inventory, Journal of Financial Economics, 1980, 8: 31–53.

Stoll H, The supply of dealer services in securities markets, Journal of Finance, 1978, 33: 1133–1151.

Ho T and Stoll H, Optimal dealer pricing under transactions and return uncertainty, Journal of Financial Economics, 1981, 9: 47–73.

O’Hara M and Oldfield G, The microeconomics of market making, Journal of Financial and Quantitative Analysis, 1986, 21: 361–376.

Hakansson N H, Optimal investment and consumption strategies under risk for a class of utility functions, Econometrica, 1970, 38: 587–607.

Mendelson H, Market Behavior in a clearing house, Econometrica, 1982, 50: 1505–1524.

Cohen K, Conroy R, and Maier S, Market Making and the Changing Structure of the Securities Industry, Rowman and Littlefield, Lanham, 1985.

Domowitz I and Wang J, Auctions as algorithms: Computerized trade execution and price discovery, Journal of Economic Dynamics and Control, 1994, 18: 29–60.

Luckock H, A steady-state model of the continuous double auction, Quantitative Finance, 2003, 3: 385–404.

Tang L and Tian G, Reaction-diffusion-branching models of stock price fluctuations, Physica A: Statistical Mechanics and Its Applications, 1999, 264: 543–550.

Maslov S, Simple model of a limit order-driven market, Physica A: Statistical Mechanics and Its Applications, 2000, 278: 571–578.

Slanina F, Mean-field approximation for a limit order driven market model, Physical Review E, 2001, 64(5): 056136.

Daniels M, Farmer J, Iori G, and Smith E, Quantitative model of price diffusion and market friction based on trading as a mechanistic random process, Physical Review Letters, 2003, 90(10): 108102.

Smith E, Farmer J, Gillemot L, and Krishnamurthy S, Statistical theory of the continuous double auction, Quantitative Finance, 2003, 3: 481–514.

Farmer J, Patelli P, and Zovko I, The predictive power of zero intelligence in financial markets, Technical Report, Santa Fe Institute Working Paper, 2003.

Li M, Endo M, Zuo S, and Kishimoto K, Order imbalances explain 90% of returns of Nikkei 225 futures, Applied Economics Letters, 2010, 17: 1241–1245.

Endo M, Zuo S, and Kishimoto K, Modelling intra-day stock price changes in terms of a continuous double auction system, Transactions of the Japan Society for Industrial and Applied Mathematics, 2006, 16: 305–316.

Suzuki T, Queueing, A Library of Basal Mathematics (in Japanese), Shokabo, Tokyo, 1972.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China under Grant Nos. 71173060, 71031003, and the Fundamental Research Funds for the Central Universities under Grant No. HIT.HSS.201120, and the last author is partially supported by JSPS KAKENHI under Grant No. 22560059.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Li, M., Hui, X., Endo, M. et al. A quantitative model for intraday stock price changes based on order flows. J Syst Sci Complex 27, 208–224 (2014). https://doi.org/10.1007/s11424-014-3300-9

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-014-3300-9