Abstract

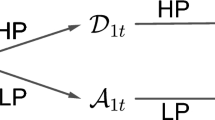

The financial market volatility forecasting is regarded as a challenging task because of irregularity, high fluctuation, and noise. In this study, a multiscale ensemble forecasting model is proposed. The original financial series are decomposed firstly different scale components (i.e., approximation and details) using the maximum overlap discrete wavelet transform (MODWT). The approximation is predicted by a hybrid forecasting model that combines autoregressive integrated moving average (ARIMA) with feedforward neural network (FNN). ARIMA model is used to generate a linear forecast, and then FNN is developed as a tool for nonlinear pattern recognition to correct the estimation error in ARIMA forecast. Moreover, details are predicted by Elman neural networks. Three weekly exchange rates data are collected to establish and validate the forecasting model. Empirical results demonstrate consistent better performance of the proposed approach.

Similar content being viewed by others

References

Meese R A and Rogoff K S, Empirical exchange rate models of the seventies: Do they fit out of sample? Journal of International Economics, 1983, 14(1–2): 3–24.

Marcos D B, Maximo C, and Gabriel P Q, Short-run forecasting of the euro-dollar exchange rate with economic fundamentals, Journal of International Money and Finance, 2012, 31(2): 377–396.

Pasquale D C, Lucio S, and Giulia S, The predictive information content of external imbalances for exchange rate returns: How much is it worth? Review of Economics and Statistics, 2012, 94(1): 100–115.

Kilian L and Taylor M P, Why is it so difficult to beat random walk forecast of exchange rates, Journal of International Economics, 2003, 60(1): 85–107.

Yu L, Lai K K, and Wang S Y, Multistage RBF neural network ensemble learning for exchange rates forecasting, Neurocomputing, 2008, 71(16–18): 3295–3302.

Yu L, Wang S Y, Lai K K, and Huang W W, Developing and assessing an intelligent forex rolling forecasting and trading decision support system for online e-service, International Journal of Intelligent Systems, 2007, 22(5): 475–499.

Yu L, Chen H H, Wang S Y, and Lai K K, Evolving least squares support vector machines for stock market trend mining, IEEE Transactions on Evolutionary Computation, 2009, 13(1): 87–102.

Wang Y Q, Wang S Y, and Lai K K, Measuring financial risk with generalized asymmetric least squares regression, Applied Soft Computing, 2011, 11(8): 5793–5800.

Huang W, Lai K K, Nakamori Y, Wang S Y, and Yu L, Neural networks in finance and economics forecasting, International Journal of Information Technology and Decision Making, 2007, 6(1): 113–140.

Yu L, Wang S Y, and Lai K K, A neural-network-based nonlinear metamodeling approach to financial time series forecasting, Applied Soft Computing, 2009, 9(2): 563–574.

Yu L, Wang S Y, Lai K K, and Wen F H, A multiscale neural network learning paradigm for financial crisis forecasting, Neurocomputing, 2010, 73(4–6): 716–725.

Dhamija A K and Bhalla V K, Exchange rate forecasting: Comparison of various architectures of neural networks, Neural Computing & Applications, 2011, 20(3): 355–363.

Yu L, Wang S Y, and Lai K K, Credit risk assessment with a multistage neural network ensemble learning approach, Expert Systems with Applications, 2008, 34(2): 1434–1444.

Yu L, Wang S Y, and Lai K K, Foreign-Exchange-Rate Forecasting with Artificial Neural Networks, Springer, New York, 2007.

Xiao Y, Xiao J, and Wang S Y, A hybrid forecasting model for non-stationary time series: An application to container throughput prediction, International Journal of Knowledge and Systems Science, 2012, 3(2): 67–81.

Xiao Y, Xiao J, and Wang S Y, A hybrid model for time series forecasting, Human Systems Management, 2012, 31(2): 133–143.

Xiao Y, Xiao J, Lu F B, and Wang S Y, Ensemble ANNs-PSO-GA approach for day-ahead stock e-exchange prices forecasting, International Journal of Computational Intelligence Systems, 2013, 6(1): 96–114.

Yu L, Wang S Y, and Lai K K, A novel nonlinear ensemble forecasting model incorporating GLAR and ANN for foreign exchange rates, Computers & Operations Research, 2005, 32(10): 2523–2541.

Percival D B and Walden A T, Wavelet Methods for Time Series Analysis, Cambridge University Press, Cambridge, 2000.

Baillie R T and Bollerslev T, Cointegration, fractional cointegration, and exchange rate dynamics, Journal of Finance, 1994, 49(2): 737–745.

Zhang G, Patuwo B E, and Hu M Y, Forecasting with artificial neural networks: The state of the art, International Journal of Forecasting, 1998, 14: 35–62.

Author information

Authors and Affiliations

Additional information

This research is supported by the Humanities and Social Sciences Youth Foundation of the Ministry of Education of PR of China under Grant No. 11YJC870028, the Selfdetermined Research Funds of CCNU from the Colleges’ Basic Research and Operation of MOE under Grant No. CCNU13F030, China Postdoctoral Science Foundation under Grant No. 2013M530753 and National Science Foundation of China under Grant No. 71390335.

This paper was recommended for publication by Guest Editor ZHANG Xun

Rights and permissions

About this article

Cite this article

Xiao, Y., Xiao, J., Liu, J. et al. A multiscale modeling approach incorporating ARIMA and anns for financial market volatility forecasting. J Syst Sci Complex 27, 225–236 (2014). https://doi.org/10.1007/s11424-014-3305-4

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-014-3305-4