Abstract

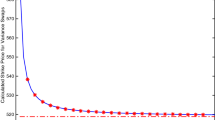

Pricing variance swaps under stochastic volatility has been an important subject pursued recently. Various approaches have been proposed, mainly due to the substantially increased trading activities of volatility-related derivatives in the past few years. In this note, the authors develop analytical method for pricing variance swaps under stochastic volatility with an Ornstein-Uhlenbeck (OU) process. By using Fourier transform algorithm, a closed-form solution for pricing variance swaps with stochastic volatility is obtained, and to give a comparison of fair strike value based on the discrete model, continuous model, and the Monte Carlo simulations.

Similar content being viewed by others

References

Little T and Pant A, A finite-difference method for the valuation of variance swaps, Journal Comp. Finance, 2001, 5(1): 81–4.

Black F and Scholes M, The pricing of options and corporate liabilities, Journal of Political Economy, 1973, 81(3): 637–4.

Windcliff H, Forsyth P, and Vetzal K, Pricing methods and hedging strategies for volatility derivatives, Journal of Banking Finance, 2006, 30(2): 409–4.

Broadie M and Jain A, The effect of jumps and discrete sampling on volatility and variance swaps, International Journal of Theoretical and Applied Finance, 2008, 11(8): 761–4.

Heston S, A closed-form solution for options with stochastic volatility with applications to bond and currency options, Review of Financial Studies, 1993, 6(2): 327–4.

Merton R, Option pricing when underlying stock returns are discontinuous, Journal of Financial Economics, 1976, 3: 195–3.

Bates D, Jumps and stochastic volatility: Exchange rate processes implicit in deutsche mark options, Review of Financial Studies, 1996, 9(1): 69–4.

Scott L, Pricing stock options in a jump diffusion model with stochastic volatility and interest rates: Applications of Fourier inversion methods Mathematical Finance, 1997, 7(4): 413–4.

Itkin A and Carr P, Pricing swaps and options on quadratic variation under stochastic time change modelsdiscrete observations case, Review of Derivatives Research, 2010, 13: 141–3.

Sepp A, Pricing options on realized variance in the Heston model with jumps in returns and volatility, Journal of Computational Finance, 2008, 11(4): 33–4.

Buehler H, Consistent variance curve models, Finance and Stochastics, 2006, 10: 178–3.

Zhu S P and Lian G H, A closed-form exact solution for pricing variance swaps with stochastic volatility, Mathematical Finance, 2011, 21(2): 233–4.

Zhu S P and Lian G H, On the valuation of variance swaps with stochastic volatility, Applied Mathematics and Computation, 2012, 219: 1654–3.

Stein E and Stein J, Stock price distributions with stochastic volatility: An analytic approach, Review of Financial Studies, 1991, 4: 727–3.

Higham D and Mao X, Convergence of Monte Carlo simulations involving the mean reverting square root process, J. Comput. Finance, 2005, 8(3): 35–4.

Karatzas I, Lehoczky J, and Shreve S, Equilibrium models with singular asset prices, Math. Finance, 1991, 1(3): 11–4.

Hull J andWhite A, The pricing of options on assets with stochastic volatilities, Journal of Finance, 1987, 42: 281–3.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper was supported by the National Social Science Fund of China under Grant No. 14ATJ005, Anhui Provincial Natural Science Foundation under Grant Nos. 1308085MF93 and 1408085MKL84, and the National Natural Science Foundations of China under Grant No. 11401556.

This paper was recommended for publication by Editor ZOU Guohua.

Rights and permissions

About this article

Cite this article

Jia, Z., Bi, X. & Zhang, S. Pricing variance swaps under stochastic volatility with an Ornstein-Uhlenbeck process. J Syst Sci Complex 28, 1412–1425 (2015). https://doi.org/10.1007/s11424-015-3165-6

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-015-3165-6