Abstract

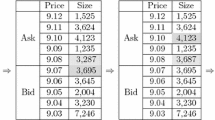

The shaping of a limit order book illustrates the dynamics of the trading process, the changing pattern of the execution probability of limit orders therefore plays an important role. This paper presents a computable execution probability model for limit order market, as well as a numerical example that intuitively characterizes the changing pattern of the execution probability. The common effects of the lengths of both buy and sell queues on the execution probability are explored. In the limit book, the cumulative probability of limit orders is introduced as a crucial index of market depth to describe the shaping process which brings new insights into the structure of the order placement decision.

Similar content being viewed by others

References

Cohen K J, Maier S F, and Whitcomb S D K, Transaction costs, order placement strategy, and existence of the bid-ask spread, Journal of Political Economy, 1981, 89(2): 287–305.

Harris L, Optimal order submission strategies in some stylized trading problems, Financial Markets, Institutions and Instruments, 1998, 7 (2): 1–76.

Parlour C, Price dynamics in limit order markets, Review of Financial Studies, 1998, 11: 789–816.

Seppi D, Liquidity provision with limit orders and a strategic specialist, Review of Financial Studies, 1997, 10: 103–150.

Biais B, Martimort D, and Rochet J C, Competing mechanisms in a common value environment, Econometrica, 2000, 68: 799–837.

Foucault T, Kadan O, and Kandel E, The limit order book as a market for liquidity, Review of Financial Studies, 2005, 18: 1171–1217.

Goettler R, Parlour C, and Rajan U, Equilibrium in a dynamic limit order market, Journal of Finance, 2005, 60: 2149–2192.

Goettler R, Parlour C, and Rajan U, Informed traders and limit order markets, Journal of Financial Economics, 2009, 93(1): 67–87.

Zhang Q, Liu S, and Qiu W, The effects of market depth on the arrival rate of orders, Journal of Systems Science & Complexity, 2014, 27(6): 1192–1203.

Cont R, Statistical modeling of high-frequency financial data, IEEE Signal Processing, 2011, 28(5): 16–25.

Cont R and Kukanov A, Optimal order placement in limit order markets, Quantitative Finance, 2017, 17(1): 21–39.

Baron M, Brogaard J, Hagstromer B, et al., Risk and return in high-frequency trading, Journal of Financial and Quantitative Analysis, 2019, 54(3): 993–1024.

Brogaard J and Garriott Corey, High-frequency trading competition, Journal of Financial and Quantitative Analysis, 2019, 54(4): 1469–1497.

Ranaldo A, Order aggressiveness in limit order book markets, Journal of Financial Markets, 2004, 7: 53–74.

Ahn H, Bae K, and Chan K, Limit orders, depth and volatility: Evidence from the stock exchange of Hong Kong, Journal of Finance, 2001, 56: 767–788.

Griffiths M, Smith B, Turnball A, et al., The costs and determinants of order aggressiveness, Journal of Financial Economics, 2000, 56: 65–88.

Hollifield B, Miller R, and Sandas P, Empirical analysis of limit order markets, Review of Economic Studies, 2004, 71: 1027–1063.

Hollifield B, Miller R, Sandas P, et al., Estimating the gains from trade in limit order markets, Journal of Finance, 2006, 16: 2753–2804.

Battalio R H, Corwin S A, and Jennings R H, Can brokers have it all? On the relation between make-take fees and limit order execution quality. Working paper, 2015, Available at SSRN: https://ssrn.com/abstract=2367462.

Bouchaud J P, Farmer D, and Lillo F, How markets slowly digest changes in supply and demand, In Handbook of Financial Markets: Dynamics and Evolution, edited by Hens Th, Schenk-Hoppe K, 2009, 57–160.

Smith E, Farmer J D, Gillemot L, et al., Statistical theory of the continuous double auction, Quantitative Finance, 2003, 3(6): 481–514.

Bovier A, Cerny J, and Hryniv O, The opinion game: Stock price evolution from microscopic market modeling, Int. J. Theor. Appl. Finance, 2006, 9: 91–111.

Luckock H, A steady-state model of the continuous double auction, Quantitative Finance, 2003, 3: 385–404.

Maslov S and Mills M, Price fluctuations from the order book perspective - Empirical facts and a simple model, Physica A, 2001, 299: 234–246.

Cont R, Stoivko S, and Talreja R, A stochastic model for order book dynamics, Operations Research, 2010, 58(3): 549–563.

Cont R and Adrien D L, Price dynamics in a Markovian limit order market, SIAM Journal on Financial Mathematics, 2013, 4(1): 1–25.

Omura K, Tanigawa Y, and Uno J, Execution probability of limit orders on the Tokyo stock exchange, Working Paper of Waseda University, From SRRN, 2000.

Predoiu S, Gennady S, and Steven S, Optimal execution in a general one-sided limit-order book, SIAM Journal on Financial Mathematics, 2011, 2(1): 183–212.

Obizhaeva A A and Jiang W, Optimal trading strategy and supply/demand dynamics, Journal of Financial Markets, 2012, 16(1): 1–32.

Gueant O and Lehalle C A, General intensity shapes in optimal liquidation, Mathematical Finance, 2015, 25(3): 457–495.

Guilbaud F and Pham H, Optimal high frequency trading in a pro-rata microstructure with predictive information, Mathematical Finance, 2015, 25(3): 545–575

Guo X, de Larrard A, and Ruan Z, Optimal placement in a limit order book, Mathematics and Financial Economics, 2017, 11: 189–213.

Rosu I, Dynamic model of the limit order book, Review of Financial Studies, 2009, 22: 4601–4641.

Rosu I, Liquidity and information in order driven markets, Working Paper, HEC Pairs, 2019, https://ssrn.com/abstract=1286193.

Handa P and Schwartz R A, Limit order trading, Journal of Finance, 1996, 51: 1835–1861.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China under Grant Nos. 71371024 and 71771008, the Funds for the First-Class Discipline Construction under Grant No. XK1802-5, and the Fundamental Research Funds for the Central University under Grant Nos. PTRW1808 and YWF-19-BJ-W-45.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Zhang, Q., Wang, C., Liu, S. et al. Order Execution Probability and Order Queue in Limit Order Markets. J Syst Sci Complex 33, 1545–1557 (2020). https://doi.org/10.1007/s11424-020-9100-5

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-020-9100-5