Abstract

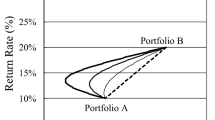

This paper proposes a new approach for stock efficiency evaluation based on multiple risk measures. A derived programming model with quadratic constraints is developed based on the envelopment form of data envelopment analysis (DEA). The derived model serves as an input-oriented DEA model by minimizing inputs such as multiple risk measures. In addition, the Russell input measure is introduced and the corresponding efficiency results are evaluated. The findings show that stock efficiency evaluation under the new framework is also effective. The efficiency values indicate that the portfolio frontier under the new framework is more externally enveloped than the DEA efficient surface under the standard DEA framework.

Similar content being viewed by others

References

Markowitz H M, Portfolio selection, The Journal of Finance, 1952, 7(1): 77–91.

Xu Y H, Li Z F, and Tan K S, Optimal investment with noise trading risk, Journal of Systems Science & Complexity, 2008, 21(4): 519–526.

Dong Y H, Xu C, and Wu S, Pricing a chained dynamic fund protection under Vasicek interest rate model with stochastic barrier, Journal of Systems Science & Complexity, 2019, 32(6): 1659–1674.

Chang H, Wang C, and Fang Z, Portfolio selection with random liability and affine interest rate in the mean-variance framework, Journal of Systems Science and Information, 2017, 5(3): 229–249.

Deng X and Liu Y, A high-moment trapezoidal fuzzy random portfolio model with background risk, Journal of Systems Science & Information, 2018, 6(1): 1–28.

Zhou Z, Maximum principle of optimal stochastic control with terminal state constraint and its application in finance, Journal of Systems Science & Complexity, 2018, 31(4): 907–926.

Li C L, Liu Z M, and Wu J B, The stochastic maximum principle for a jump-diffusion mean-field model involving impulse controls and applications in finance, Journal of Systems Science & Complexity, 2020, 33(1): 26–42.

Morey M R and Morey R C, Mutual fund performance appraisals: A multi-horizon perspective with endogenous benchmarking, Omega, 1999, 27: 241–258.

Charnes A, Cooper W W, and Rhodes E L, Measuring the efficiency of decision making units, European Journal of Operational Research, 1978, 2(6): 429–444.

Xi W and Cheng X R, The difference of capital input and productivity in service industries: Based on four stages bootstrap-DEA model, Journal of Systems Science & Information, 2018, 6(4): 320–335.

Murthi B P S, Choi Y K, and Desai P, Efficiency of mutual funds and portfolio performance measurement: A non-parametric approach, European Journal of Operational Research, 1997, 98(2): 408–418.

Basso A and Funari S, The role of fund size in the performance of mutual funds assessed with DEA models, European Journal of Finance, 2017, 23(4/6): 457–473.

Hassan A, Chachi A, and Munshi M R, Performance measurement of Islamic mutual funds using DEA method, Journal of Islamic Accounting and Business Research, 2020, 31(8): 1481–1496.

Joro T and Na P, Portfolio performance evaluation in a mean-variance-skewness framework, European Journal of Operational Research, 2006, 175(1): 446–461.

Briec W, Kerstens K, and Jokung O, Mean-variance-skewness portfolio performance gauging a general shortage function and dual approach, Management Science, 2007, 53(1): 135–149.

Briec W and Kerstens K, Multi-horizon Markowitz portfolio performance appraisals a general approach, Omega, 2009, 37(1): 50–62.

Lamb J D and Tee K H, Data envelopment analysis models of investment funds, European Journal of Operational Research, 2012, 216(3): 687–696.

Branda M, Reformulations of input-output oriented DEA tests with diversification, Operations Research Letters, 2013, 41(5): 516–520.

Basso A and Funari S, A data envelopment analysis approach to measure the mutual fund performance, European Journal of Operational Research, 2001, 135(3): 477–492.

Basso A and Funari S, Measuring the performance of ethical mutual funds: A DEA approach, Journal of the Operational Research Society, 2003, 54(5): 521–531.

Gregoriou G N, Sedzro K, and Zhu J, Hedge fund performance appraisal using data envelopment analysis, European Journal of Operational Research, 2005, 164(2): 555–571.

Branda M and Kopa M, DEA-risk efficiency and stochastic dominance efficiency of stock indices, Journal of Economics and Finance, 2012, 62(2): 106–124.

Chen H H, Stock selection using data envelopment analysis, Industrial Management & Data Systems, 2008, 108(9): 1255–1268.

Zhao X J and Zhang H S, Application of Malmquist index in equity mutual funds evaluation in China, Systems Engineering — Theory & Practice, 2010, 30(4): 646–653.

Ismail M K A, Salamudin N, Rahman N M N A, et al., DEA portfolio selection in Malaysian stock market, 2012 International Conference on Innovation Management and Technology Research (ICIMTR), Malaysia, 2012.

Chi G T, Wu H W, and Yan D W, Optimal model of loan portfolio based on the higher central-moment constraints, Systems Engineering — Theory & Practice, 2012, 32(2): 257–267.

Yan D, Hu Y, and Lai K, A nonlinear interval portfolio selection model and its application in banks, Journal of Systems Science & Complexity, 2018, 31(3): 696–733.

Leland H E, Beyond mean-variance: Performance measurement in a nonsymmetrical world, Financial Analysts Journal, 1999, 55(1): 27–36.

Markowitz H M, Portfolio Selection: Efficient Diversification of Investments, Yale University Press, New Haven, 1959.

Bawa V S and Lindenberg E B, Capital market equilibrium in a mean-lower partial moment framework, Journal of Financial Economics, 1977, 5(2): 189–200.

Konno H and Yamazaki H, Mean absolute deviation portfolio model and its application to Tokyo stock market, Management Science, 1991, 37(1): 519–531.

Cheng P and Wolverton M L, MPT and the downside risk framework: A comment on two recent studies, Journal of Real Estate Portfolio Management, 2001, 7(2): 125–131.

Chen Z and Lin R, Mutual fund performance evaluation using data envelopment analysis with new risk measures, OR Spectrum, 2006, 28(3): 375–398.

Banker R D, Charnes A, and Cooper W W, Some models for estimating technical and scale inefficiencies in data envelopment analysis, Management Science, 1984, 30(9): 1078–1092.

Färe R, Grosskopf S, and Lovell C A K, The Measurements of Efficiency of Production, Springer, Dordrecht, 1985.

Farrell M J, The measurement of productive efficiency, Journal of the Royal Statistical Society, 1957, 120(3): 253–290.

Wu J and Liang L, A DEA model for identifying critical input-output performance measures, Journal of Systems Science & Complexity, 2012, 25(2): 275–286.

Dai Q Z, Li L, Lei X Y, et al., Considering monopoly maintenance cost for an automobile purchase in China: A DEA-based approach, Journal of Systems Science & Complexity, 2019, 32(4): 1167–1179.

Markowitz H, Todd P, Xu G L, et al., Computation of mean-semivariance efficient sets by the Critical Line Algorithm, Annals of Operations Research, 1993, 45(1): 307–317.

Färe R and Lovell C A K, Measuring the technical efficiency of production, Journal of Economic Theory, 1978, 19(1): 150–162.

Färe R, Grosskopf S, and Lovell C A K, Production Frontiers, Cambridge University Press, Cambridge, 1994.

Russell R R, Measures of technical efficiency, Journal of Economic Theory, 1985, 35(1): 109–126.

Tone K, A slacks-based measure of efficiency in data envelopment analysis, European Journal of Operational Research, 2001, 130(3): 498–509.

Shi Y, Yang Z F, Yan H, et al., Delivery efficiency and supplier performance evaluation in China’s e-retailing industry, Journal of Systems Science & Complexity, 2017, 30(2): 144–162.

Thompson R G, Lee E, and Thrall R M, DEA/AR-efficiency of US independent oil/gas producers over time, Computers & Operations Research, 1992, 19(5): 377–391.

Thompson R G, Brinkmanne E J, Dharmapala P S, et al., DEA/AR profit ratios and sensitivity of 100 large US banks, European Journal of Operational Research, 1997, 98(2): 213–229.

Author information

Authors and Affiliations

Corresponding authors

Additional information

This paper was supported by the National Natural Science Foundation of China under Grant Nos. 72071192, 71671172, the Anhui Provincial Quality Engineering Teaching and Research Project Under Grant No. 2020jyxm2279, the Anhui University and Enterprise Cooperation Practice Education Base Project under Grant No. 2019sjjd02, Teaching and Research Project of USTC (2019xjyxm019, 2020ycjg08), and the Fundamental Research Funds for the Central Universities (WK2040000027).

Rights and permissions

About this article

Cite this article

Li, J., Gao, H., Li, Y. et al. Stock Efficiency Evaluation Based on Multiple Risk Measures: A DEA-Like Envelopment Approach. J Syst Sci Complex 35, 1480–1499 (2022). https://doi.org/10.1007/s11424-022-0034-y

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-022-0034-y