Abstract

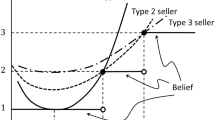

We consider two simultaneous, private value, second-price auctions with identical objects for sale and two types of bidders, strong and weak, in the sense of hazard rate stochastic dominance. We show that if the strong bidders are not too strong with respect to the weak bidders, then, by setting an appropriate reserve price, a separating equilibrium exists in which strong bidders will participate in the auction with only strong bidders, and weak bidders will participate in the auction with only weak bidders.

Similar content being viewed by others

Notes

The “authorities” refer to government and public sector auctioneers.

Weak bidders in Janssen’s [9] case would be considered firms without proper infrastructure (newcomers) and strong bidders would be firms with proper infrastructure (incumbents).

Note that there is no restriction on n and m.

Observe that since the strategy sets are finite, the standard existence theorem ensures that Nash equilibria exist but not necessarily in pure strategies, which is the separation form we are seeking (Klemperer [10]).

The expected payoff is \(\int _{s_{j}}^{v}P^{j}(t)dt\) only if \(v\ge s_{j}\). Otherwise, it is zero.

Observe that once a bidder learns his or her valuation, the title “strong” or “weak” is irrelevant.

Observe that in equilibrium \(P^{j}(v),j=I,II\) is \( F_{s}^{n-1}(v),F_{w}^{m-1}(v),\) if strong bidders participate in auction I and weak bidders take part in auction II respectively. If a weak bidder deviates from this equilibrium and participates in auction I, the probability that s/he will win is \(P^{1}(v)=F_{s}^{n}(v)\). Similarly, if a strong bidder deviates from this equilibrium and participates in auction II, the probability that s/he will win is \(P^{2}(v)=F_{w}^{m}(v)\).

Observe that \(y_{I}(x)\) and \(y_{II}(x)\) are continuously differentiable by the implicit function theorem.

Note that in the case of \(x=1\) the equality (3) will hold only if \(\int _{y_{I}}^{1}F_{w}^{m}(v)(1-F_{s}(v))dv\) =0, and it will be satisfied only if \(y_{I}(1)=1.\)

Observe that (5) is an implicit function with respect to x and \(y_{I}(x)\) is a function of x. Thus, we can differentiate the implicit function and extract \(y_{I}^{\prime }(x)\).

References

Ashlagi, I., Monderer, D., Tennenholtz, M.: Simultaneous ad auctions. Math. Oper. Res. 36(1), 1–13 (2011)

Athey, S., Coey, D., Levin, J.: Set-asides and subsidies in auctions. Am. Econ. J. Microecon. 5(1), 1–27 (2013)

Athey, S., Levin, J., Seira, E.: Comparing open and sealed bid auctions: evidence from timber auctions. Q. J. Econ. 126, 207–257 (2011)

Bergemann, D., Brooks, B., Morris, S.: First-price auctions with general information structers: implications for bidding and revenue. Econometrica 85(1), 107–143 (2017)

Burguet, R., Sakovics, J.: Imperfect competition in auction design. Int. Econ. Rev. 40, 231–247 (1999)

Cheng, H.: Ranking sealed high-bid and open asymmetric auctions. J. Math. Econ. 42, 471–498 (2006)

Gavious, A.: Separating equilibria in public auctions. B.E J. Econ. Anal. Policy 9(1), Article 37 (2009)

Gavious, A., Minchuk, M.: The effect of asymmetry on revenue in second-price auctions. Int. Game Theory Rev. 14(03), 1–8 (2012)

Janseen, M.C.W.: Auctioning Public Assets. Cambridge University Press, Cambridge (2004)

Klemperer, P.: Auction: Theory and Practice. Princeton University Press, Princeton (2004)

Myerson, R.B.: Optimal auction design. Math. Oper. Res. 6, 58–73 (1980)

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Proof of Corollary 1

Using the proposition, it is sufficient to prove that \(\lambda _{w}\ge \lambda _{s}\) and the condition \(\frac{\lambda _{w}}{\lambda _{s}}\le \frac{1}{F_{s}}\) is satisfied for \(F_{s}(x)=x^{\alpha }\) and \( F_{w}(x)=x^{\beta \text { }}\)where \(\alpha >\beta .\)

Let us first prove the first part, namely, \(1\le \frac{\lambda _{w}}{ \lambda _{s}}.\)

Substituting the distributions, we need to prove that the following inequality holds for all x

or, alternatively, we need to show that

Note that in the case of \(x=0\), we get \(-\beta \), and when \(x=1\), we get zero. Thus, what we have left to prove is that the function is increasing. The derivative of the LHS is

providing the proof of the first part.

Now consider the proof of the following inequality \(\frac{\lambda _{w}}{ \lambda _{s}}\le \frac{1}{F_{s}}.\) In other words,

or, alternatively, we need to show that

Note that when \(x=0\), we get \(-\alpha \), and if \(x=1\), we get zero. Then, if the function is increasing, we will complete the proof. Differentiating the LHS gives

\(\square \)

Appendix B: Proof of Corollary 2

First, we show that \(F_{s}=x^{\alpha }\) stochastically dominates \(F_{w}(v)= \frac{1-e^{-\lambda x}}{1-e^{-\lambda }}\) in the sense of the hazard rate. Namely, \(\lambda _{w}=\frac{\lambda e^{-\lambda x}}{e^{-\lambda x}-e^{-\lambda }}\ge \lambda _{s}=\frac{\alpha x^{\alpha -1}}{1-x^{\alpha }} \) or \(\frac{\lambda e^{-\lambda x}}{e^{-\lambda x}-e^{-\lambda }}-\frac{ \alpha x^{\alpha -1}}{1-x^{\alpha }}\ge 0\). Alternatively, for \(x<1\) and \( x>0\) we should prove that \(z(x)=\lambda e^{-\lambda x}\left( 1-x^{\alpha }\right) -\alpha x^{\alpha -1}\left( e^{-\lambda x}-e^{-\lambda }\right) \ge 0\). Observe that in the bounds, \(z(0)=\lambda \) and that \(z(1)=0\) thus, if \(z^{\prime }(x)<0\) we find that \(z(x)\ge 0\). Differentiating z(x) gives

Observe that \(e^{-\lambda x}-e^{-\lambda }>0\) then, \(z^{\prime }(x)<0\) if \( \alpha \ge 1\) and thus \(\lambda _{w}\ge \lambda _{s}\). To prove that \( \frac{\lambda _{w}}{\lambda _{s}}\le \frac{1}{F_{s}}\) we show that \(\lambda _{w}F_{s}\le \lambda _{s}\) namely, \(\frac{\lambda e^{-\lambda x}}{ e^{-\lambda x}-e^{-\lambda }}x^{\alpha }\le \frac{\alpha x^{\alpha -1}}{ 1-x^{\alpha }}\) or \(\frac{\alpha }{1-x^{\alpha }}-\frac{\lambda xe^{-\lambda x}}{e^{-\lambda x}-e^{-\lambda }}\ge 0\). Again, for \(x<1\) we may show that \( T(x)=\alpha \left( e^{-\lambda x}-e^{-\lambda }\right) -\lambda xe^{-\lambda x}\left( 1-x^{\alpha }\right) >0\). In the bounds \(T(0)=\alpha \left( 1-e^{-\lambda }\right) >0\) and \(T(1)=0\) thus, if \(T^{\prime }(x)<0\) we complete the proof. Differentiating T(x) gives

If \(\alpha +1-\lambda x>0\) we have \(T^{\prime }(x)<0\) and this condetion is satidfied if \(\lambda <\alpha +1\). \(\square \)

Rights and permissions

About this article

Cite this article

Gavious, A., Minchuk, Y. Separating equilibria in auctions with two types of bidders. Optim Lett 13, 69–79 (2019). https://doi.org/10.1007/s11590-018-1248-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-018-1248-8