Abstract

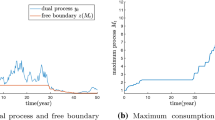

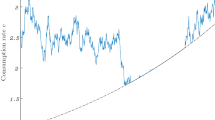

In this paper we study the portfolio selection problem of an agent who has a bliss point of consumption and does not tolerate a decline in consumption. We show that the optimal consumption process exhibits ratcheting and, as time elapses, the agent’s consumption approaches but never reaches the bliss level and her/his optimal investment in the risky asset approaches zero if the initial wealth level is not sufficient to maintain it. We use the martingale method and study the dual problem, which is similar to an incremental irreversible investment problem. We transform the dual problem into an optimal stopping problem, which has the same characteristic as finding the optimal exercise time of a perpetual American put option. We recover the value function by establishing a duality relationship and obtain a closed-form solution for the optimal consumption and portfolio strategy.

Similar content being viewed by others

Notes

Empirical estimates of the bliss levels are troublesome, but there is no definite evidence against their existence [12].

Classical study of the permanent income hypothesis often employed a quadratic utility function [7]. The utility function underlying the mean-variance analysis of portfolio selection (e.g., Markowitz [13]), which is still the most important and widely used model for asset management, is a quadratic function.

Then for \(T>0\), we can define a new measure \(\mathbb {Q}\), the risk-neutral measure, on \((\varOmega , \mathcal{F}_T)\) by

$$\begin{aligned} \mathbb {Q}(A) = {\mathbb {E}} [Z_T \mathbf {1}_A], \ \ \ A\in \mathcal{F}_T, \end{aligned}$$where \(\mathbf {1}_A\) is the characteristic function of A, i.e., \(\mathbf {1}_A(\omega )=1\) if \(\omega \in A\) and \( \mathbf {1}_A(\omega )=0\) if \(\omega \notin A\).

See Chapters 9 and 11 of Dixit and Pindyck [3] for a systematic exposition of the incremental irreversible investment problem and its solution.

References

Bellman, R.: The Theory of Dynamic Programming. Mimeo, Rand Corporation, Santa Monica (1954)

Cox, J., Huang, C.: Optimal consumption and portfolio policies when asset prices follow a diffusion process. J. Econ. Theory 49(1), 33–83 (1989)

Dixit, A., Pindyck, R.: Investment Under Uncertainty. Princeton University Press, Princeton (1994)

Dusenberry, J.: Income, Saving, and the Theory of Consumer Behavior. Harvard University Press, Cambridge (1949)

Dybvig, P.: Duesenberry’s ratcheting of consumption: optimal dynamic consumption and investment given intolerance for any decline in standard of living. Rev. Econ. Stud. 62(2), 287–313 (1995)

Dybvig, P., Rogers, C.: High hopes and disappointment. Working Paper (2013)

Hall, R.E.: Stochastic implications of the life cycle-permanent income hypothesis: theory and evidence. J. Polit. Econ. 86, 971–987 (1978)

Harrison, J.: Brownian Motion and Stochastic Flow Systems. Krieger Publishing Company, Malabar (1990)

Jeon, J.K., Koo, H.K., Shin, Y.H.: Portfolio Selection with Consumption Ratcheting. J. Econ. Dyn. Control 92, 153–182 (2018)

Koo, B., Koo, H., Koo, J., Hyun, C.: A generalization of Dybvig’s result on portfolio selection with intolerance for decline in consumption. Econ. Lett. 117, 646–649 (2012)

Koo, J.L., Ahn, S.R., Koo, B.L., Koo, H.K., Shin, Y.H.: Optimal consumption and portfolio selection with quadratic utility and a subsistence consumption constraint. Stoch. Anal. Appl. 34(1), 165–177 (2016)

Lewbel, A.: Bliss levels that aren’t. J. Polit. Econ. 95, 211–215 (1987)

Markowitz, H.: Portfolio selection. J. Finance 7(1), 77–91 (1952)

Peskir, G., Shiryaev, A.: Optimal Stopping and Free-Boundary Problems. Birkhäuser Verlag, Besel (2006)

Pindyck, R.: Irreversible investment. Capacity choice, and the value of the firm. Am. Econ. Rev. 78(5), 969–985 (1988)

Riedel, F.: Optimal consumption choice with intolerance for declining standard of living. J. Math. Econ. 45, 449–464 (2009)

Watson, J., Scott, J.: Ratchet consumption over finite and infinite planning horizons. J. Math. Econ. 54, 84–96 (2014)

Acknowledgements

Jeon gratefully acknowledges the support of the National Research Foundation of Korea (NRF) grant funded by the Korea government (Grant No. NRF-2017R1C1B1001811), the POSCO Science Fellowship of the POSCO TJ Park Foundation. Koo and Shin gratefully acknowledge the support of the National Research Foundation of Korea (NRF) grant funded by the Korea government (MSIP) (Grant No. NRF-2016R1A2B4008240).

Author information

Authors and Affiliations

Corresponding author

Appendix A derivation of the variational inequality (24)

Appendix A derivation of the variational inequality (24)

We consider the optimal stopping problem

where \(\mathcal{S}_t\) is the set of \({\mathcal {F}}\)-stopping times \(\tau \ge t\) and

It is clear that

From the optimal stopping problem (36), for any \(h>0\), the inclusion \(\mathcal{S}_t\supset \mathcal{S}_{t+h}\) gives

and the inequality (38) implies that \(e^{-\beta t}Q(y_t)\) is a supermartingale under \(\mathbb {P}\).

It follows that, by Itô’s Lemma

When \(Q(y_t) >H(y_t)\) which implies there exists \(h>0\) small enough such that the optimal stopping time \(\tau ^* \in \mathcal {S}_{t+h}\). Thus,

Hence, we can deduce that \(e^{-\beta (\tau ^*\wedge t)}Q(y_{\tau ^*\wedge t})\) is a martingale under \(\mathbb {P}\).

By applying Itô’s Lemma, we have

Hence, (37), (39) and (41) imply that Q(z) satisfies

Rights and permissions

About this article

Cite this article

Jeon, J., Koo, H.K. & Shin, Y.H. Ratcheting with a bliss level of consumption. Optim Lett 13, 1535–1556 (2019). https://doi.org/10.1007/s11590-018-1313-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-018-1313-3