Abstract

We study the robust portfolio optimization model for the Omega ratio when the joint ambiguity in the returns distributions is modeled utilizing copulas. We propose the copula formulation of the Omega ratio and use it to formulate the worst-case robust optimization model. Furthermore, we propose a Markov chain predicated filtering strategy to filter a set of fewer assets from a large pool of available assets in the market to amend the performance of the conventional Omega ratio model. We propose an R-vine copula Autoregressive Moving Average Generalized Autoregressive Conditional Heteroskedasticity (ARMA-GARCH) model for the joint distribution of assets returns. We obtain the standardized residuals for each return series of the filtered assets using the ARMA-GARCH model and, subsequently, exploit the regular vine copulas to model the joint dependence among the transformed residuals. The tree structure in the regular vines is accomplished using Kendall’s tau. The dependence structure so obtained is used to simulate scenarios for the returns of assets. The simulated data is used to obtain optimal portfolios in the worst-case Copula Omega ratio model. Empirical evidence shows the aptness of the proposed filtering strategy and analyzes the performance of the worst-case copula Omega portfolios on several datasets using a rolling window approach. The optimal portfolios from the worst-case copula Omega model are found to outperform the portfolios from the Gaussian copula Omega ratio model by having a higher information ratio, Value-at-risk ratio, and Rachev ratio.

Similar content being viewed by others

Notes

The choice of copulas considered for the formation of mixture copulas is inspired from Rustem ([27]) and the earlier works ([21, 22]), seen along with the research in ([19, 20]). Each chosen copula better describes different dependency. Clayton, Joe and Gumbel are non-symmetric to explain stronger dependence below and above the 50-th percentile, respectively; Frank copula is symmetric but it has different properties to the Gaussian copula. Hence, by using them in a mixture structure we can cover a large spectrum of possible dependencies.

A Naive portfolio of n assets has 1/n weight allocated to each asset.

The performance measures used are mean return, Sortino ratio (SR), standard deviation (Std Dev), downside deviation (DD), Information ratio, Omega Sharpe ratio, Sharpe ratio with standard deviation, VaR and CVaR as risk measures, VaR, CVaR, Rachev ratios, and VaR ratios, at 97 and 95% level of confidence

We first select a copula family among these five. Then determine the best pair-copula at each node amongst the various rotations of the chosen copula family which are available in the R package VineCopula. We follow this procedure with each of the five copulas.

References

Developments in modelling risk aggregation, Basel Committee on Banking Supervision. Bank for International Settlements (2010)

Bacon, C.R.: Practical Portfolio Performance Measurement and Attribution, vol. 568. Wiley, Hoboken (2011)

Bedford, T., Cooke, R.M.: Probability density decomposition for conditionally dependent random variables modeled by vines. Ann. Math. Artif. Intell. 32(1–4), 245–268 (2001)

Bedford, T., Cooke, R.M.: Vines: a new graphical model for dependent random variables. Ann. Stat. 30(4), 1031–1068 (2002)

Charnes, A., Cooper, W.W.: Programming with linear fractional functionals. Naval Res. Logist. 9(3–4), 181–186 (1962)

Cherubini, U., Luciano, E., Vecchiato, W.: Copula Methods in Finance. Wiley, Chichester (2004)

Chollete, L., Heinen, A., Valdesogo, A.: Modeling international financial returns with a multivariate regime-switching copula. J. Financ. Econom. 7(4), 437–480 (2009)

Dennis, P., Mayhew, S., Stivers, C.: Stock returns, implied volatility innovations, and the asymmetric volatility phenomenon. J. Financ. Quant. Anal. 41(2), 381–406 (2006)

van Dijk, D.: Brooks-introductory econometrics for finance. De Economist (2003)

Dissmann, J., Brechmann, E.C., Czado, C., Kurowicka, D.: Selecting and estimating regular vine copulae and application to financial returns. Comput. Stat. Data Anal. 59, 52–69 (2013)

Engle, R.F.: Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econom. J. Econom. Soc. 50, 987–1007 (1982)

Engle, R.F., Bollerslev, T.: Modelling the persistence of conditional variances. Econom. Rev. 5(1), 1–50 (1986)

Fabozzi, F.J., Huang, D., Zhou, G.: Robust portfolios: contributions from operations research and finance. Ann. Oper. Res. 176(1), 191–220 (2010)

Fishburn, P.C.: Mean-risk analysis with risk associated with below-target returns. Am. Econ. Rev. 67(2), 116–126 (1977)

Goel, A., Sharma, A., Mehra, A.: Index tracking and enhanced indexing using mixed conditional value-at-risk. J. Comput. Appl. Math. 335, 361–380 (2018). https://doi.org/10.1016/j.cam.2017.12.015. http://www.sciencedirect.com/science/article/pii/S0377042717306350

Goel, A., Sharma, A., Mehra, A.: Robust optimization of mixed cvar starr ratio using copulas. J. Comput. Appl. Math. (2018). https://doi.org/10.1016/j.cam.2018.08.001

Gouriéroux, C.: ARCH Models and Financial Applications. Springer, New York (2012)

Gregoriou, G.N., Gueyie, J.P.: Risk-adjusted performance of funds of hedge funds using a modified Sharpe ratio. J. Wealth Manag. 6(3), 77–83 (2003)

Hasselblad, V.: Estimation of parameters for a mixture of normal distributions. Technometrics 8(3), 431–444 (1966)

Hasselblad, V.: Estimation of finite mixtures of distributions from the exponential family. J. Am. Stat. Assoc. 64(328), 1459–1471 (1969)

Hu, L.: Dependence patterns across financial markets: methods and evidence. Preprint, Department of Economic, Yale University (2002)

Hu, L.: Dependence patterns across financial markets: a mixed copula approach. Appl. Financ. Econ. 16(10), 717–729 (2006)

Hyndman, R.J., Khandakar, Y., et al.: Automatic time series for forecasting: the forecast package for R. 6/07. Department of Econometrics and Business Statistics, Monash University (2007)

Linsmeier, T.J., Pearson, N.D.: Value at risk. Financ. Anal. J. 56(2), 47–67 (2000)

Joe, H.: Families of \(m\)-variate distributions with given margins and \(m(m-1)/2\) bivariate dependence parameters. Lecture Notes-Monograph Series, pp. 120–141 (1996)

Joe, H., Li, H., Nikoloulopoulos, A.K.: Tail dependence functions and vine copulas. J. Multivar. Anal. 101(1), 252–270 (2010)

Kakouris, I., Rustem, B.: Robust portfolio optimization with copulas. Eur. J. Oper. Res. 235(1), 28–37 (2014)

Kapsos, M., Christofides, N., Rustem, B.: Worst-case robust omega ratio. Eur. J. Oper. Res. 234(2), 499–507 (2014)

Kapsos, M., Zymler, S., Christofides, N., Rustem, B.: Optimizing the omega ratio using linear programming. J. Comput. Finance 17(4), 49–57 (2014)

Keating, C., Shadwick, W.F.: A universal performance measure. J. Perform. Meas. 6(3), 59–84 (2002)

Konno, H., Yamazaki, H.: Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Manag. Sci. 37(5), 519–531 (1991)

Markowitz, H.: Portfolio selection. J. Finance 7(1), 77–91 (1952)

Mohammadi, H., Su, L.: International evidence on crude oil price dynamics: applications of ARIMA-GARCH models. Energy Econ. 32(5), 1001–1008 (2010)

Nelsen, R.B.: An Introduction to Copulas. Springer, New York (2006)

Peel, D., McLachlan. G.J.: Robust mixture modelling using the t distribution. Stat. Comput. 10(4), 339–348 (2000)

Prim, R.C.: Shortest connection networks and some generalizations. Bell Syst. Tech. J. 36(6), 1389–1401 (1957)

Rockafellar, R.T., Uryasev, S.: Optimization of conditional value-at-risk. J. Risk 2, 21–42 (2000)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Finance 26(7), 1443–1471 (2002)

Sharma, A., Mehra, A.: Extended omega ratio optimization for risk-averse investors. Int. Trans. Oper. Res. 24(3), 485–506 (2017)

Sharma, A., Utz, S., Mehra, A.: Omega-CVaR portfolio optimization and its worst case analysis. OR Spectr. 39(2), 505–539 (2017)

Sharpe, W.F.: The sharpe ratio. J. Portf. Manag. 21(1), 49–58 (1994)

Sklar, M.: Fonctions de répartition à n dimensions et leurs marges. Université Paris 8 (1959)

Sortino, F.A., Price, L.N.: Performance measurement in a downside risk framework. J. Invest. 3(3), 59–64 (1994)

Treynor, J.L.: How to rate management of investment funds. Harv. Bus. Rev. 43(1), 63–75 (1965)

Tsay, R.S.: Analysis of Financial Time Series. Wiley, Hoboken (2005)

Zhu, S., Fukushima, M.: Worst-case conditional value-at-risk with application to robust portfolio management. Oper. Res. 57(5), 1155–1168 (2009)

Acknowledgements

The first author is thankful to the Council of Scientific and Industrial Research, India, for providing the financial grant in initiating the present research and IIT Delhi for extending the financial support to conclude the same. The authors are grateful to the editor and referees for their valuable support and constructive suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix I: Empirical Analysis of the Proposed Filtering Strategy and Optimization Models

Appendix I: Empirical Analysis of the Proposed Filtering Strategy and Optimization Models

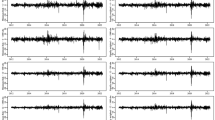

See Figs. 4, 5, 6, 7, 8 and Tables 2, 3, 4, 5, 6.

Rights and permissions

About this article

Cite this article

Goel, A., Mehra, A. Robust Omega ratio optimization using regular vines. Optim Lett 15, 2067–2108 (2021). https://doi.org/10.1007/s11590-020-01629-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-020-01629-5