Abstract

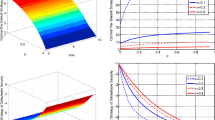

Default risk in commercial lending is one of the major concerns of the creditors. In this article, we introduce a new hidden Markov model (HMM) with multiple observable sequences (MHMM), assuming that all the observable sequences are driven by a common hidden sequence, and utilize it to analyze default data in a network of sectors. Efficient estimation method is then adopted to estimate the model parameters. To further illustrate the advantages of MHMM, we compare the hidden risk state process obtained by MHMM with that from the traditional HMMs using credit default data. We then consider two applications of our MHMM. The calculation of two important risk measures: Value-at-risk (VaR) and expected shortfall (ES) and the prediction of global risk state. We first compare the performance of MHMM and HMM in the calculation of VaR and ES in a portfolio of default-prone bonds. A logistic regression model is then considered for the prediction of global economic risk using our MHMM with default data. Numerical results indicate our model is effective for both applications.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.References

Li D. On default correlation: a Copula function approach. Journal of Fixed Income, 2000, 9(4): 43–54

McNeil A, Frey R, Embrechts P. Quantitative risk management: concepts, techniques and tools. Princeton University Press, 2005

Credit Suisse Financial Products. Credit Risk+ a Credit Risk Management Framework, 1997, http://www.csfb.com/institutional/research/creditrisk.html

Duffie D, Eckner A, Horel G, Saita L. Frailty correlated default, Graduate School of Business, Stanford University, 2006, Preprint

Das S, Duffie D, Kapadia N, Saita L. Common failings: how corporate defaults are correlated? Journal of Finance, 2007, 62(1): 93–117

Moody’s Investment Services. The Binomial Expansion Method Applied to CBO/CLO Analysis. 1999

Davis M, Lo V. Infectious defaults. Quantitative Finance, 2001, 1(4): 382–387

Davis M, Lo V. Modeling default correlation in bond portfolio. In: Alescander C, ed. Mastering Risk Volume 2: Applications. Financial Times, Prentice Hall, 2001, 141–151

Giampieri G, Davis M, Crowder M. Analysis of default data using hidden Markov models. Quantitative Finance, 2005, 5(1): 27–34

MacDonald I, Zucchini W. Hidden Markov and Other Models for Discrete-Valued Time Series. London:. Chapman & Hall, 1999

Rabiner L R. A tutorial on hidden Markov models and selected applications in speech recognition. Proceedings of the IEEE, 1989, 77(2): 257–286

Ching W, Ng M. Markov Chains: Models, Algorithms and Applications. International Series on Operations Research and Management Science, New York: Springer, 2006

Ching W, Ng M, Wong K. Hidden Markov models and thier applications to customer relationship management. IMA Journal of Management Mathematics, 2004, 15(1): 13–24

Ching W, Fung E, Ng M, Siu T, Li W. Interactive hidden Markov models and their applications. IMA Journal of Management Mathematics, 2007, 18(1): 85–97

Ching W, Siu T, Li L, Li T, Li W. Modeling default data via an interactive hidden Markov model, Computational Economics. Computational Economics, 2009, 34(1): 1–19

Ching W K, Leung H, Jiang H, Wu Z. Hidden Markov models for default risk. In: Proceedings of the 2nd International Symposium on Financial Information Processing (FIP), Beijing, China, 2009

Levinson S, Rabiner L, Sondhi M. An introduction to the application if theory of probabilistic functions of Markov process to automatic speech recognition. Bell System Technical Journal, 1983, 62: 1035–1074

Li X, Parizeau M, Plamondon R. Training hidden Markov models with multiple observation- a combinatorial method. IEEE Transactions on Pattern Analysis and Machine Intelligence, 2000, 22(4): 371–377

Zhang D, Shi Y, Tian Y, Zhu M. A class of classification and regression methods by multiobjective programming. Frontiers of Computer Science in China, 2009, 3(2): 192–204

Zhou L, Lai K. Benchmarking binary classification models on data sets with different degrees of imbalance. Frontiers of Computer Science in China, 2009, 3(2): 205–216

Richard A, Johnson, Dean W. Wichern. Applied Multivariate Statistical Analysis. Prentice Hall International Series, U.S. 1992, 553

Siu T K, Ching W K, Fung E S, Ng M K. Extracting information from spot interest rates and credit ratings using double higher-order hidden Markov models. Computational Economics, 2005, 26(3): 69–102

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ching, WK., Leung, HY., Wu, Z. et al. Modeling default risk via a hidden Markov model of multiple sequences. Front. Comput. Sci. China 4, 187–195 (2010). https://doi.org/10.1007/s11704-010-0501-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11704-010-0501-9