Abstract

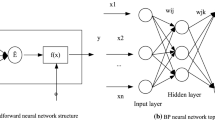

This paper examines the relevance of various financial and economic indicators in forecasting business cycle turning points using neural network (NN) models. A three-layer feed-forward neural network model is used to forecast turning points in the business cycle of China. The NN model uses 13 indicators of economic activity as inputs and produces the probability of a recession as its output. Different indicators are ranked in terms of their effectiveness of predicting recessions in China. Out-of-sample results show that some financial and economic indicators, such as steel output, M2, Pig iron yield, and the freight volume of the entire society are useful for predicting recession in China using neural networks. The asymmetry of business cycle can be verified using our NN method.

Similar content being viewed by others

References

Auerbach A J. The index of leading indicators: “measurement without theory,” thirty-five years later. Review of Economics and Statistics, 1982, 64(4): 589–595

Kaufmann S. Measuring business cycle with a dynamic Markov switching factor model: An assessment using Bayesian simulation methods. Econometrics Journal, 2000, 3(1): 39–65

Robert I, Jan J, Ward R. Business cycle indexes: Does a heap of data help? Journal of Business Cycle Measurement and Analysis, 2004, 1(3): 309–336

George E N, Ghassan D, Antoine A. Predicting business cycle turning points with neural network in an information-poor economy. In: Proceedings of The 2007 summer computer simulation conference (SCSC 2007), 2007: 627–631

Zhang D B, Yu L, Wang S Y, Song Y W. A novel PPGA-based clustering analysis method for business cycle indicator selection. Frontiers of Computer Science in China, 2009, 3(2): 217–225

Neftci S N. Are economic time series asymmetric over the business cycle? Journal of Political Economy, 1984, 92(2): 307–328

Sichel D E. Are business cycles asymmetric? A correction. Journal of Political Economy, 1989, 97(5): 1255–1260

Quandt R E. A new approach to estimating switching regressions. Journal of the American Statistical Association, 1972, 67(338): 306–310

Goldfeld S M, Quandt R E. A Markov model for switching regression. Journal of Econometrics, 1973, 1(1): 3–15

Ploberger W, Krämer W, Kontrus K. A new test for structural stability in the linear regression model. Journal of Econometrics, 1989, 40(2): 307–318

Wang J M, Gao T M, McNown R. Measuring Chinese business cycle with dynamic factor models. Journal of Asian Economics, 2009, 20(2): 89–97

Diebold F X, Rudebusch G D. Measuring business cycles: A modern perspective. Review of Economics and Statistics, 1996, 78(1): 67–77

Chauvet M. An econometric characterization of business cycle dynamics with factor structure and regime switching. International Economic Review, 1998, 39(4): 969–996

Kim C J, Nelson C R. Business cycle turning points, a new coincident index, and tests of duration dependence based on a dynamic factor model with regime switching. Review of Economics and Statistics, 1998, 80(2): 188–201

Hoptroff R G, Bramson M J, Hall T J. Forecasting economic turning points with neural nets. In: Proceedings of the 1991 IEEE International Joint Conference on Neural Networks. 1991: 347–352

Vishwakarma K P. A neural network for signal modeling in business cycle studies. In: Proceedings of 1994 IEEE International Conference on Systems, Man, and Cybernetics, ‘Humans, Information and Technologyapos’, 1994, 10: 2437–2442

Vishwakarma K P. Recognizing business cycle turning points by means of a neural network. Computational Economics, 1994, 7(3): 175–185

Soo H C, Joon S L. Economic turning point forecasting using neural network with weighted fuzzy membership functions. Lecture Notes in Computer Science, 2007, 4570: 145–154

Qi M. Predicting US recessions with leading indicators via neural network models. International Journal of Forecasting, 2001, 17(3): 383–401

Inoue A, Kilian L. In-Sample or Out-of-Sample Tests of Predictability: Which One Should We Use? ECB Working Paper, 2002, No. 195

Jagielska I, Jaworshi J. Neural networks for predicting the performance of credit card accounts. Computational Economics, 1996, 9(1): 77–82

Romero R D, Touretzky D S, Thibadeau R H. Optical Chinese character recognition using probabilistic neural networks. Pattern Recognition, 1997, 30(8): 1279–1292

Uncini A. Audio signal processing by neural networks. Neuro-computing, 2003, 55(3–4): 593–625

Kondo T. Evolutionary design and behavior analysis of neuromo-dulatory neural networks for mobile robots control. Applied Soft Computing, 2007, 7(1): 189–202

Bailey L D, Donna T. How to develop neural network applications. AI Expert, 1990, 5(6): 38–47

Bailey L D, Donna T. Developing neural network applications. AI Expert, 1990, 5(9): 34–41

Tamura S. Capabilities of a three layer feed-forward neural network. 1991 IEEE International Joint Conference on Neural Networks, 1991, 11: 2757–2762

Hamilton J D, Perez-Quiros G. What do the leading indicators lead? Journal of Business, 1996, 69(1): 27–49

Farley A M, Jones S. Using a genetic algorithm to determine an index of leading economic indicators. Computational Economics, 1994, 7(3): 163–173

Layton A P, Moore G H. Leading indicators for the service sector. Journal of Business & Economic Statistics, 1989, 7(3): 379–386

Stock J. H. and Watson M. W. New indexes of coincident and leading economic indicators. NBER Macroeconomics Annual 1989, 1989: 351–294

Banerji A, Hiris L. A framework for measuring international business cycles. International Journal of Forecasting, 2001, 17(3): 333–348

Zhang Y J. Research on econometric methods and application of business cycle. China Economic Publishing House, 2007, 11: 73–87

Layton A P. Dating and predicting phase changes in the U.S. business cycle. International Journal of Forecasting, 1996, 12(3): 417–428

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhang, D., Yu, L., Wang, S. et al. Neural network methods for forecasting turning points in economic time series: an asymmetric verification to business cycles. Front. Comput. Sci. China 4, 254–262 (2010). https://doi.org/10.1007/s11704-010-0506-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11704-010-0506-4