Abstract

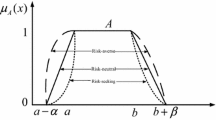

In this paper we propose multicriteria credibilistic framework for portfolio rebalancing (adjusting) problem with fuzzy parameters considering return, risk and liquidity as key financial criteria. The portfolio risk is characterized by a risk curve that represents each likely loss of the portfolio return and the corresponding chance of its occurrence rather than a single pre-set level of the loss. Furthermore, we consider an investment market scenario where, at the end of a typical time period, the investor would like to modify his existing portfolio by buying and/or selling assets in response to changing market conditions. We assume that the investor pays transaction costs based on incremental discount schemes associated with the buying and/or selling of assets, which are adjusted in the net return of the portfolio. A hybrid intelligent algorithm that integrates fuzzy simulation with a real-coded genetic algorithm is developed to solve the portfolio rebalancing (adjusting) problem. The proposed solution approach is useful particularly for the cases where fuzzy parameters of the problem are characterized by general functional forms.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Bhattacharyya R, Kar S, Majumder DD (2011) Fuzzy mean-variance-skewness portfolio selection models by interval analysis. Comput Math Appl 61:126–137

Carlsson C, Fullér R, Majlender P (2002) Majlender. Fuzzy Set Syst 131:13–21

Charnes A, Cooper WW (1961) Management models and industrial applications of linear programming. Wiley, New York

Chellathurai T, Draviam T (2005) Dynamic portfolio selection with nonlinear transaction costs. Proc R Soc A 461:3183–3212

Chen JS, Hou JL, Wu SM, Chang-Chien YW (2009) Constructing investment strategy portfolios by combination genetic algorithms. Expert Syst Appl 36:3824–3828

Chen W (2009) Weighted portfolio selection models based on possibility theory. Fuzzy Inf Eng 2:115–127

Choi UJ, Jang BG, Koo HK (2007) An algorithm for optimal portfolio selection problems with transaction costs and random lifetimes. Appl Math Comput 191:239–252

Dong W, Peng J (2009) Credibilistic risk optimization models and algorithms. In: Proceedings of the international conference on computational intelligence and natural computing IEEE, pp 378–381

Fang Y, Lai KK, Wang SY (2006) Portfolio rebalancing model with transaction costs based on fuzzy decision theory. Eur J Oper Res 175:879–893

Gupta P, Mehlawat MK, Saxena A (2008) Asset portfolio optimization using fuzzy mathematical programming. Inform Sci 178:1734–1755

Gupta P, Mehlawat MK, Saxena A (2010) A hybrid approach to asset allocation with simultaneous consideration of suitability and optimality. Inform Sci 180:2264–2285

Gupta P, Inuiguchi M, Mehlawat MK (2011) A hybrid approach for constructing suitable and optimal portfolios. Expert Syst Appl 38:5620–5632

Gupta P, Mehlawat MK, Mittal G (2012) Asset portfolio optimization using support vector machines and real- coded genetic algorithm. J Global Optim 53:297–315

Hasuike T, Katagiri H, Ishii H (2009) Portfolio selection problems with random fuzzy variable returns. Fuzzy Set Syst 160:2579–2596

Holland JH (1975) Adaptation in natural and artificial systems. University of Michigan Press, Ann Arbor

Huang X (2007) Portfolio selection with fuzzy returns. J Intell Fuzzy Syst 18:383–390

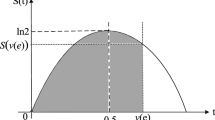

Huang X (2008) Risk curve and fuzzy portfolio selection. Comput Math Appl 55:1102–1112

Huang X (2009) A review of credibilistic portfolio selection. Fuzzy Optim Decis Making 8:263–281

Huang X (2012) An entropy method for diversified fuzzy portfolio selection. Int J Fuzzy Syst 14:160–165

Inuiguchi M, Ramik J (2000) Possibilistic linear programming: a brief review of fuzzy mathematical programming and a comparison with stochastic programming in portfolio selection problem. Fuzzy Set Syst 111:3–28

Inuiguchi M, Tanino T (2000) Portfolio selection under independent possibilistic information. Fuzzy Set Syst 115:83–92

Jacob NL (1974) A limited-diversification portfolio selection model for the small investor. J Finance 29:847–856

Jana P, Roy TK, Mazumder SK (2009) Multi-objective possibilistic model for portfolio selection with transaction cost. J Comput Appl Math 228:18–196

Kozhan R, Schmid W (2009) Asset allocation with distorted beliefs and transaction costs. Eur J Oper Res 194:236–249

Li X, Liu B (2006) A sufficient and necessary condition for credibility measures. Int J Uncertain Fuzz 14:527–535

Li X, Zhang Y, Wong HS, Qin Z (2009) A hybrid intelligent algorithm for portfolio selection problem with fuzzy returns. J Comput Appl Math 233:264–278

Li X, Qin Z, Kar S (2010) Mean-Variance-Skewness model for portfolio selection with fuzzy returns. Eur J Oper Res 202:239–247

Li X, Shou B, Qin Z (2012) An expected regret minimization portfolioselection model. Eur J Oper Res 218:484–492

Li Y, Wang B, Watada J (2011) Building a fuzzy multi-objective portfolio selection model with distinct risk measurements. In: Proceedings of the IEEE international conference on fuzzy systems (FUZZ-IEEE 2011), pp 1096–1102

Liu B (2002) Theory and Practice of Uncertain Programming. Physica-Verlag, Heidelberg

Liu B, Liu YK (2002) Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans Fuzzy Syst 10:445–450

Liu B (2006) A survey of credibility theory. Fuzzy Optim Decis Making 5:387–408

Luengo EA (2010) Fuzzy mean-variance portfolio selection problems. Adv Model Optim 12:399–410

Mao JCT (1970) Essentials of portfolio diversification strategy. J Finance 25:1109–1121

Markowitz HM (1952) Portfolio selection. J Finance 7:77–91

Morton AJ, Pliska SR (1995) Optimal portfolio management with fixed transaction costs. Math Finance 5:337–356

Murata T, Ischibuchi H (1995) MOGA: multi-objective genetic algorithms. In: Proceedings of the second IEEE international conference on, evolutionary computation, pp 289–294

Wang SY, Zhu SS (2002) On fuzzy portfolio selection problem. Fuzzy Optim Decis Making 1:361–377

Yoshida Y (2009) An estimation model of value-at-risk portfolio under uncertainity. Fuzzy Set Syst 160:3250–3262

Yu JR, Lee WY (2011) Portfolio rebalancing model using multiple criteria. Eur J Oper Res 209:166–175

Zadeh LA (1965) Fuzzy sets Inform Contr 8:338–353

Zadeh LA (2005) Towards a generalized theory of uncertainity (GTU)-an outline. Inform Sci 172:1–40

Zhang WG, Wang YL, Chen ZP, Nie ZK (2007) Possibilistic mean-variance models and efficient frontiers for portfolio selection problem. Inf Sci 177:2787–2801

Zhang WG, Zhang X, Xu W (2010) A risk tolerance model for portfolio adjusting problem with transaction costs based on possibilistic moments. Insur Math Econ 46:496–499

Zhang WG, Zhang X, Chen Y (2011) Portfolio adjusting optimization with added assets and transaction costs based on credibility measures. Insur Math Econ 49:353–360

Zhang X, Zhang WG, Cai R (2010) Portfolio adjusting optimization under credibility measures. J Comput Appl Math 234:1458–1465

Zhang Y, Li X, Wong H-S, Tan L (2009) Fuzzy multi-objective portfolio selection model with transaction costs. In: Proceedings of the IEEE international conference on fuzzy systems (FUZZ-IEEE 2009), pp 273–278

Acknowledgments

We are thankful to the Editor-in-chief, Guest Editor and the anonymous referees for their valuable comments and suggestions to improve presentation of the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gupta, P., Mittal, G. & Mehlawat, M.K. A multicriteria optimization model of portfolio rebalancing with transaction costs in fuzzy environment. Memetic Comp. 6, 61–74 (2014). https://doi.org/10.1007/s12293-012-0102-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12293-012-0102-2