Abstract

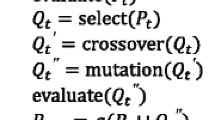

Portfolio optimization will apply the concept of diversification across asset classes, which means investing in a wide variety of asset types and classes for a risk-mitigation strategy. Portfolio optimization is a way to maximize net gains in a portfolio while minimizing risk. A portfolio means investing in a wide variety of asset types and classes for a risk-mitigation strategy by the investor. In this paper, factor analysis and cluster algorithm are used to screen stocks and an improved differential evolution algorithm for solving portfolio optimization model is proposed. By comprehensively analyzing the stock data with factor analysis and k-means clustering algorithm, it has found that important factors have important effect on stock price movement, and finally 10 stocks are selected with investment value. Besides, a Mean-Conditional Value at Risk (CVaR) model is constructed, which takes into account both the cost function and the diversification constraint. Finally, a second-order memetic differential evolution (SOMDE) algorithm is presented for solving the proposed model. The experiments show that the proposed SOMDE algorithm is valid for solving the Mean-CVaR model and that factor analysis for stock selection can benefit portfolio with higher return and less risk greatly.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Markowitz HM (1952) Portfolio selection. J Finance 7(1):77

Best MJ, Grauer RR (1991) Sensitivity analysis for mean-variance portfolio problems. Manag Sci 37(8):980–989

Zhou XY, Li D (2000) Continuous-time mean-variance portfolio selection: a stochastic LQ framework. Appl Math Optim 42(1):19–33

Cura T (2009) Particle swarm optimization approach to portfolio optimization. Nonlinear Anal Real World Appl 10(4):2396–2406

Lwin KT, Qu R, MacCarthy BL (2017) Mean-VaR portfolio optimization: a nonparametric approach. Eur J Oper Res 260(2):751–766

Czaplewski L, Bax R, Clokie M et al (2016) Alternatives to antibiotics-a pipeline portfolio review. Lancet Infect Dis 16(2):239–251

Brandt M W (2010). Portfolio choice problems. Handbook of financial econometrics: tools and techniques. North-Holland. pp 269–336

Devereux MB, Sutherland A (2010) Country portfolio dynamics. J Econ Dyn Control 34(7):1325–1342

Huberman G, Kandel S (1987) Mean-variance spanninge. J Finance 42(4):873–888

Markowitz H (2014) Mean-variance approximations to expected utility. Eur J Oper Res 234(2):346–355

Jorion P (1996) Measuring the risk in value at risk. Financ Anal J 52(6):47–56

Duffie D, Pan J (1997) An overview of value at risk. J Deriv 4(3):7–49

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2:21–42

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Finance 26(7):1443–1471

Alexander GJ, Baptista AM (2004) A comparison of VaR and CVaR constraints on portfolio selection with the mean-variance model. Manag Sci 50(9):1261–1273

Hong LJ, Hu Z, Liu G (2014) Monte Carlo methods for value-at-risk and conditional value-at-risk: a review. ACM Trans Model Comput Simulat (TOMACS) 24(4):1–37

Boudt K, Carl P, Peterson BG (2012) Asset allocation with conditional value-at-risk budgets. J Risk 15(3):39–68

Cui X, Gao J, Shi Y et al (2019) Time-consistent and self-coordination strategies for multi-period mean-conditional value-at-risk portfolio selection. Eur J Oper Res 276(2):781–789

Chen Y, Zhao X, Yuan J (2022) Swarm intelligence algorithms for portfolio optimization problems: overview and recent advances. Mobile Inform Syst 15:2022

Chen Y, Ye L, Li R et al (2023) A multi-period constrained multi-objective evolutionary algorithm with orthogonal learning for solving the complex carbon neutral stock portfolio optimization model. J Syst Sci Complexity 36(2):686–715

Chen Y, Zhao X, Hao J (2023) A novel MOPSO-SODE algorithm for solving three-objective SR-ES-TR portfolio optimization problem. Expert Syst Appl 14:120742

Ertenlice O, Kalayci CB (2018) A survey of swarm intelligence for portfolio optimization: algorithms and applications. Swarm Evol Comput 39:36–52

Zhu H, Wang Y, Wang K et al (2011) Particle swarm optimization (PSO) for the constrained portfolio optimization problem. Expert Syst Appl 38(8):10161–10169

Chen W, Zhang WG (2010) The admissible portfolio selection problem with transaction costs and an improved PSO algorithm. Physica A 389(10):2070–2076

Chang TJ, Yang SC, Chang KJ (2009) Portfolio optimization problems in different risk measures using genetic algorithm. Expert Syst Appl 36(7):10529–10537

Das S, Mullick SS, Suganthan PN (2016) Recent advances in differential evolution–an updated survey. Swarm Evolut Computat 27:1–30

Zhao X, Feng S, Hao J et al (2021) Neighborhood opposition-based differential evolution with Gaussian perturbation. Soft Comput 25(1):27–46

Krink T, Paterlini S (2011) Multiobjective optimization using differential evolution for real-world portfolio optimization. CMS 8(1):157–179

Zhao X, Xu G, Liu D et al (2017) Second-order DE algorithm. CAAI Trans Intell Technol 2(2):80–92

Noman N, Iba H (2008) Accelerating differential evolution using an adaptive local search. IEEE Trans Evol Comput 12(1):107–125

Li R, Zhao X, Zuo X et al (2021) Memetic algorithm with non-smooth penalty for capacitated arc routing problem. Knowl-Based Syst 220:106957

Rummel RJ (1988) Applied factor analysis. Northwestern University Press

Valadkhani A, Chancharat S, Harvie C (2008) A factor analysis of international portfolio diversification. Stud Econ Finance. 25:165–174

Bholowalia P, Kumar A (2014) A clustering technique based on elbow method and K-Means in WSN. Int J Comput Appl 105:9

Chung KL (1967) Markov chains. Springer-Verlag, New York

Lobo MS, Fazel M, Boyd S (2007) Portfolio optimization with linear and fixed transaction costs. Ann Oper Res 152(1):341–365

Fang CD, Wei ZX, Zhang MY (2015) The portfolio model with typical transaction cost based on CVaR. J Guangxi Univ 40:1611

Hoskisson RE, Hitt MA, Johnson RA et al (1993) Construct validity of an objective (entropy) categorical measure of diversification strategy. Strateg Manag J 14(3):215–235

Acknowledgements

This work is supported by the National Natural Science Foundation of China (61973042) and Beijing Natural Science Foundation (1202020). We will express our awfully thanks to the Swarm Intelligence Research Team of Beijing University of Posts and Telecommunications.

Author information

Authors and Affiliations

Contributions

Han Ning: Conceptualization, Methodology, Software, Validation, Writing Original Draft, Writing - Review & Editing, Data Curation Yinnan Chen: Methodology, Resources, Investigation, Writing - Review & Editing Lingjuan Ye: Methodology, Validation, Formal analysis, Review & Editing Xinchao Zhao: Conceptualization, Writing - Original Draft, Writing - Review & Editing, Project administration, Funding acquisition

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This work does not contain any studies with human participants performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in this work.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Han, N., Chen, Y., Ye, L. et al. Stock portfolio optimization based on factor analysis and second-order memetic differential evolution algorithm. Memetic Comp. 16, 29–44 (2024). https://doi.org/10.1007/s12293-024-00405-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12293-024-00405-7