Abstract

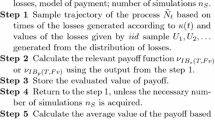

This article develops a computational method to implement the effect of imperfect information on the value of defaultable bonds. A fuzzy modeling is adopted and the numerical experiments show that an imprecise value of the stochastic underlying asset and/or the barrier triggering default have material impact on the qualitative shape of the term structures of credit spreads.

Similar content being viewed by others

References

Agliardi E, Agliardi R (2009) Fuzzy defaultable bonds. Fuzzy Sets Syst 160:2597–2607

Agliardi R (2010) A comprehensive structural model for defaultable fixed-income bonds, Quantitative Finance 1–14 i First (doi:10.1080/14697680903222451)

Altman EI, Hotchkiss E (2006) Corporate financial distress and bankruptcy: predict and avoid bankruptcy, analyze and invest in distressed debt, 3rd edn. J. Wiley & Sons, New Jersey

Black F, Cox JC (1976) Valuing corporate securities: some effects of bond indenture provisions. J Finance 31(2):351–367

Crouhy M, Jarrow RA, Turnbull S (2008) The Subprime crisis of 07. http://ssrn.com/abstract=1112467

Dubois D, Prade H (eds) (2000) Fundamentals of fuzzy sets, the handbook of fuzzy sets series. Kluwer, Boston

Duffie D, Lando D (2001) Term structures of credit spreads with incomplete accounting information. Econometrica 69(3):633–664

Eom Y, Helwege J, Huang J (2004) Structural models of corporate bond pricing: an empirical analysis. Rev Financ Stud 17:499–544

Giesecke K, Goldberg L (2004) Forecasting default in the face of uncertainty. J Derivatives 12(1):1–15

Grossman S (1980) The role of warranties and private disclosure about productivity. J Law Econ 24:461–483

Helwege J, Turner M (1999) The slope of the credit yield curve for speculative grade issuers. J Finance LIV 5:1869–1884

Huang J, Huang M (2003) How much of the corporate -treasury yield spread is due to credit risk? W.P. Stanford University

Hui CH, Lo CF, Ku KC (2007) Pricing vulnerable European options with stochastic default barriers. IMA J Manage Math 18:315–329

Hull J, While A (1995) The impact of default risk on the price of options and other derivative securities. J Bank Finance 19:299–322

Kurano M, Yasuda M, Nakagami J, Yoshida Y (1992) A limit theorem in some dynamic fuzzy systems. Fuzzy Sets Syst 51:83–88

Longstaff F, Schwartz E (1995) A simple approach to valuing risky fixed and floating rate debt. J Finance 50:789–819

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Finance 29:449–470

Milgrom P (1981) Good news and bad news: representation theorems and applications. Bell J Econ 12:380–391

Milgrom P, Roberts J (1986) Relying on the information of interested parties. RAND J Econ 17:18–32

Nielsen L, Saà-Requejo J, Santa-Clara P (1993) Default risk and interest rate risk: the term structure of default spreads. Working paper, INSEAD

Okuno-Fujiwara M, Postlewaite A, Suzumura K (1990) Strategic information revelation. Rev Econ Stud 57:25–47

Schwarcz SL (2004) Rethinking the disclosure paradigm in a world of complexity, U. Ill. L. Review, 1

Zadeh LA (1965) Fuzzy Sets, Information and Control 8:338–353

Zhou C (1997) A jump-diffusion approach to modeling credit risk and valuing defaultable securities. Federal Reserve Board W.P:1–47

Acknowledgments

This paper has been presented at the EEFS2009 Conference in Warsaw. The authors would like to thank the participants for their comments, in particular A. Cieslik, J. Michalek, K. Pilbeam, and an anonymous referee for useful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Agliardi, E., Agliardi, R. Bond pricing under imprecise information. Oper Res Int J 11, 299–309 (2011). https://doi.org/10.1007/s12351-010-0087-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-010-0087-x