Abstract

This paper studies a financial market transaction model and convergence of Markovian price processes generated by an \(\alpha\)-double auction in Xu et al. (Expert Syst Appl 41(16):7032–7045, 2014) and extends their results for a fixed \(\alpha\) in [0, 1] to the case where \(\alpha\) is governed by a time non-homogeneous Markov chain over a set of finite states defined by \(R\equiv \{\alpha _1, \alpha _2, \ldots , \alpha _r\}\), \(0\le \alpha _1<\alpha _2<\cdots <\alpha _r\le 1\). A convergence result similar to that in Xu et al. (2014) holds, with the fixed \(\alpha\) replaced with the average \(\alpha ^*=\frac{1}{r}\sum _{\theta =1}^r \alpha _\theta\). We also identify the conditions under which a price process generated by such a Markovian \(\alpha\)-double auction converges in probability to a Walrasian equilibrium of the underlying financial market transaction model. A number of simulations are conducted and these simulations are consistent with the theoretical results of the paper.

Similar content being viewed by others

Notes

This is the same as the k-double auction but k has been reserved to denote iterations in this paper.

Bubbles and crashes in economics and finance are the price movements of an asset that are not supported by its fundamentals. Changes in fundamentals that result in higher or lower prices are not seen as bubbles or crashes. But sentiments that over or under-react to the news in fundamentals can lead to a formation of a bubble and a crash.

In practice, an execution of a trade is complicated. Given a quote (bid, ask) \(=(200, 201)\) for a stock in a dealer’s market, the ask 201 is the best price available from the dealer to sell when a buyer places a market order to buy and the bid 200 is the best offer available from the dealer to buy when a seller places a market order to sell. The actual posted price may often lie within (200, 201). In a “bull” market for a stock where its price goes up more often than down, the actual executed price is likely closer to the ask price of the dealer.

References

Bertsekas D (2009) Convex optimization theory. Athena Scientific, Belmont

Bertsekas D (2010) Incremental gradient, subgradient, and proximal methods for convex optimization: a survey. Lab. for Information and Decision Systems ReportLIDS-P-2848, MIT. arXiv:1507.01030

Bertsekas D, Tsitsiklis J (2000) Gradient convergence in gradient methods with errors. SIAM J Optim 10:627–642

Bikhchandani S, Mamer JW (1997) Competitive equilibrium in an exchange economy with indivisibilities. J Econ Theory 74:384–413

Chatterjee K, Samuelson W (1983) Bargaining under incomplete information. Oper Res 31:835–851

Clarke F, Ledyaev Y, Stern R, Wolenski P (1988) Nonsmooth analysis and control theory. Springer, New York

Ellison G (1993) Learning, local interaction, and coordination. Econometrica 61:1047–1071

Fama EF (1965) Random walks in stock-market prices. Financ Anal J 51(1):55–59. doi:10.2469/faj.v21.n5.55

Fama EF (1991) Efficient capital markets: II. J Finance 46(5):1575–1617

Hayek FA (1945) The use of knowledge in society. Am Econ Rev 35:519–530

Kelso AS, Crawford V (1982) Job matching, coalition formation and gross substitute. Econometrica 50:1483–1504

Kibardin VM (1980) Decomposition into functions in the minimization problem. Autom Remote Control 40(9):1311–1333

LeRoy SF, Porter RD (1981) The present-value relation: tests based on implied variance bounds. Econometrica 49:555–574

Ma J, Nie F (2003) Walrasian equilibrium in an exchange economy with indivisibilities. Math Soc Sci 46:159–192

Ma J, Li Q (2011) Bubbles, crashes and efficiency with double auction mechanisms. ssrn2163435, Social Science Research Network, SSRN.COM

Myerson RB, Satterthwaite (1983) Efficient mechanisms for bilateral trading. J Econ Theory 29:265–281

Nedić A, Bertsekas DP (2001) Incremental subgradient methods for nondifferentiable optimization. SIAM J Optim 12:109–138

Ram SS, Nedić A, Veeravalli VV (2009) Incremental stochastic subgradient algorithms for convex optimization. SIAM J Optim 20:691–717

Shiller RJ (1981) Do stock prices move too much to be justified by subsequent changes in dividends? Am Econ Rev 71:421–436

Smith A (1776) An inquiry into the nature and causes of the wealth of nations. Methuen, London. http://www.econlib.org/library/Smith/smWN2.html#firstpage-bar

Smith VL, Suchanek GL, Williams AA (1988) Bubbles, crashes, and endogenous expectations in experimental spot asset markets. Econometrica 56:1119–1151

Wilson R (1985) Incentive efficiency of double auctions. Econometrica 53:1101–1115

Xu X, Ma J, Xie X (2014) Double auction mechanisms on Markovian networks. Expert Syst Appl 41(16):7032–7045

Acknowledgments

The authors thank two anonymous referees for many helpful comments that have greatly improved the paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical standard

This study was funded by Major Research Plan of National Science Foundation of China (91430105).

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

This paper supersedes the paper entitled “Markovian \(\alpha\)-Double Auctions”.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Proofs of Lemma 7.1 and Theorem 7.1

Appendix: Proofs of Lemma 7.1 and Theorem 7.1

1.1 Proof of Lemma 7.1

Proof

The proof is similar to that of Lemma 4.2 in Ram et al. (2009). In fact, from the iteration (5.1)–(5.2), the “non-expansion” property of the Euclidean projection and the definition of subgradient, we have

Taking conditional expectations with respect to \(G_{d(k)}\), we get

Now, we will estimate the second term to the seventh term in the second “\(\le\)” of (10.2) respectively. For the second term , by the definition of subgradient, subgradient boundedness (5.4) and the fact that \(\alpha _{w_k^{\prime \prime }} \in [0, 1]\), we have

Similarly, we can obtain

As for the third term in the second “\(\le\)” of (10.2), noting that \(G_{d(k)}\) denotes the entire history of the method up to time \(d(k)-1\), and the probability transition matrices for the Markov chains \(\{w_k\}\), \(\{w_k^{\prime \prime }\}\) from time \(d(k)-1\) to k are \(\Phi _I(k, d(k)-1)\) and \(\Phi _R(k, d(k)-1)\) respectively, we have

where in the second “\(\ge\)”, we have used the fact that \([\Phi _{R}(k,d(k)-1)]_{w^{\prime \prime }_{d(k)},t}\le 1\) and \(\alpha _t\in [0,1]\), in the third “\(\ge\)”, we have used (3.1), and in the last “\(\ge\)”, we have used (3.3). Similarly, it holds

For the sixth term in the second “\(\le\)” of (10.2), from Assumption 7.1, the boundedness (5.4)–(5.5) and the fact that \(\alpha _{w_k^{\prime \prime }}\in [0,1]\), it follows

As for the last term in the second “\(\le\)” of (10.2), since \(G_{d(k)} \subset G_k\), it holds

Substituting the preceding estimates (10.3)–(10.8) into (10.2) yields the desired estimate (7.1). \(\square\)

1.2 Proof of Theorem 7.1

Proof

Since Y is compact, f, g is convex functions, it follows that \(Y^{*}(\alpha ^*,\lambda )\) is nonempty, closed and convex. By Lemma 7.1, we obtain that for any \(y^*\in Y^*(\alpha ^*,\lambda )\)

Denote

Taking expectations to (10.9) yields

Following the same routine as in the proof of Theorem 4.3 in Ram et al. (2009), we easily know that for some non-negative integer sequence \(\{d(k)\}\), it holds

In addition, in view of (7.2), the inequality

and Lemma 1 in Bertsekas and Tsitsiklis (2000), we conclude that \(E[\text {dist}(x_{k}, Y^*(\alpha ^*,\lambda ))^2]\) converges to a non-negative scalar and

which, together with the fact \(\sum _{k=2}^{\infty }a_{k}=\infty\) for \(\frac{2}{3}< p\le 1\), yields

Since f, g are continuous and Y is compact, from Fatou’s lemma it follows

which implies that

with probability 1, i.e. the first result of (7.4) holds. Using again the continuity of f, g and the compactness of Y, we know that

with probability 1, i.e. the second result of (7.4) holds.

Now we aim to prove (7.5). Since \(\liminf _{k\rightarrow \infty }\text {dist}\left( x_k,Y^*(\alpha ^*,\lambda )\right) =0\) with probability 1, there exists a subsequence of \(\{\text {dist}\left( x_k,Y^*(\alpha ^*,\lambda )\right) ^2\}\), which we denote by \(\{\text {dist}\left( x_{k_\ell },Y^*(\alpha ^*,\lambda )\right) ^2\}\), such that \(\lim _{k_\ell \rightarrow \infty }\text {dist}\left( x_{k_\ell },Y^*(\alpha ^*,\lambda )\right) ^2=0\) with probability 1. For the set Y is bounded, we know the sequence \(\{\text {dist}\left( x_{k_\ell },Y^*(\alpha ^*,\lambda )\right) ^2\}\) is bounded. By the dominated convergence theorem, we have

Since we already obtain that \(E[\text {dist}(x_{k}, Y^*(\alpha ^*,\lambda ))^2]\) converges to a non-negative scalar, then it has to converge to 0, i.e.

which completes the proof. \(\square\)

1.3 Experiments for Sect. 8.5

The weight \(\alpha\) follows a Markov chain in a state \(R=\{\alpha _1, \alpha _2,\alpha _3\}\) and in all cases, the transition matrix for the Markov chain for \(\alpha\) is given by, \(k=0, 1,2,\ldots\),

which equals \(P_I\) in Fig. 2. We let \(\lambda =1\). The two step sizes are given by

so that the \(\lambda\) condition (7.2) is satisfied. In the situations with noises, we add the Gauss noises with mean and variance (0, 25), as before.

Experiment 1 \(m=5, n=5\). The two transition matrices \(P_I(k)\) and \(P_J(k)\) are given by, \(k=0,1,2,\ldots ,\)

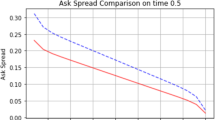

We let \(R=\{0.25, 0.5, 0.75\}\). Thus, \(\alpha ^*=0.5\) and \(Y^*=Y^*(\alpha ^*, \lambda )=\{1\}\), since \(\lambda =1\). Figure 8 reports the result, which shows that the price process \(\{x_k\}\) converges to the equilibrium price 1, with or without noises. Next we increase the number of buyers from \(n=5\) to \(n=10\) while m remains at 5.

Experiment 2 \(m=5, n=10\). The two transition matrices \(P_I(k)\) and \(P_J(k)\) are given by, \(k=0,1,2,\ldots\),

We select two different states for \(\alpha\)s, \(R=\{0.25, 0.5, 0.75\}\) and \(R1=\{0.25, 0.75, 1\}\), with different average weights \(\alpha ^*=\frac{1}{2}\) and \(\alpha _1^*=\frac{2}{3}\). Thus, \(Y^*=Y^*(\alpha ^*, \lambda )=\{1.8028\}\) and \(Y^*(\alpha _1^*, \lambda )=\{1.2748\}\). Clearly, \(Y^*\ne Y^*(\alpha _1^*, \lambda )\). Figure 9 presents the results, which confirm what has been shown in Theorem 7.1. Note that the fundamentals remain the same. But the price process converges to the price 1.2748, purely due to a change in the average weight from \(\alpha ^*\) to \(\alpha ^*_1\). The interesting part is that what matters is the average \(\alpha ^*\). This implies that if we change R1 to \(R1^\prime =\{0.1, 0.9, 1\}\), then our experiments will also converge to the same price 1.2748. Next we increase the number of buyers further from \(n=10\) to \(n=20\) while m stays put at 5.

Experiment 3 \(m=5, n=20\). The two transition matrices \(P_I(k)\) and \(P_J(k)\) are given by, \(k=0,1,2,\ldots ,\)

We also consider two different states \(R=\{0.25, 0.5, 0.75\}\) and \(R2=\{0.4, 0.8, 1\}\). Then \(\alpha ^*=0.5\) and \(\alpha ^*_2=2.2/3\). So, \(Y^*=\{3.3912\}\) and \(Y^*(\alpha ^*_2, \lambda )=\{2.0449\}\). Figure 10 presents the experimental results. Once again, with a higher average weight \(\alpha ^*_2\) than \(\alpha ^*\), the price process converges to a price that is substantially lower than the equilibrium price of the original economy. Next we keep \(n=5\) as in Experiment 1 while increase the number of sellers from \(m=5\) to \(m=10\). One can expect that the equilibrium price is lower than 1 because there are more sellers.

Experiment 4 \(m=10, n=5\). The two transition matrices \(P_I(k)\) and \(P_J(k)\) are given by, \(k=0,1,2,\ldots\),

We set \(R=\{0.25, 0.5, 0.75\}\) and \(R3=\{0, 0.25, 0.75\}\) in our experiments. Thus, \(\alpha ^*=0.5\) and \(\alpha ^*_3=\frac{1}{3}\). So, \(Y^*=\{0.5547\}\) and \(Y^*(\alpha ^*_3, \lambda )=\{0.7845\}\). The experimental results are reported in Fig. 11, which confirms our theoretical result in Theorem 7.1. Note that when \(\alpha ^*\) is lower from \(\frac{1}{2}\) to \(\frac{1}{3}\), the price process converges to a higher price 0.7845 than the equilibrium price 0.5547 of the original economy, higher by more than 41 %. Next we increase the number of sellers from \(m=10\) to \(m=20\). The equilibrium price in \(Y^*\) will be even lower, as expected.

Experiment 5 \(m=20, n=5\). The two transition matrices \(P_I(k)\) and \(P_J(k)\) are given by, \(k=0,1,2,\ldots\),

We set \(R=\{0.25, 0.5, 0.75\}\) and \(R4=\{0, 0.2, 0.4\}\) in our experiments. Thus, \(\alpha ^*=0.5\) and \(\alpha ^*_4=0.2\). So, \(Y^*=\{0.2949\}\) and \(Y^*(\alpha ^*_4, \lambda )=\{0.5898\}\). The experimental results are reported in Fig. 12. When the average weight \(\alpha ^*\) moves lower from 0.5 to 0.2, the price process converges to a higher price 0.5898, which is twice as much as the equilibrium price of the original economy because \(\sqrt{\frac{\lambda (1-\alpha _4^*)}{\alpha ^*_4}}=2\). In summary, we have done 18 experiments each of which has shown how a change in \(\alpha\) may affect the convergence of the price process \(\{x_k\}\) of an \(\alpha\)-double auction. These experiments provide solid evidence a double auction implemented in a real exchange market may indeed contribute to the excess volatility.

Rights and permissions

About this article

Cite this article

Xu, X., Ma, J. & Xie, X. Convergence of Markovian price processes in a financial market transaction model. Oper Res Int J 17, 239–273 (2017). https://doi.org/10.1007/s12351-015-0224-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-015-0224-7