Abstract

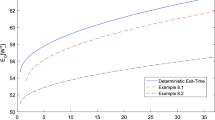

This paper studies three versions of the multi-period mean–variance portfolio selection problem, that are: minimum variance problem, maximum expected return problem and the trade-off problem, in a Markovian regime switching market where the exit-time is uncertain and exogenous. The underlying Markov chain contains an absorbing state, which denotes the bankruptcy state. When the Markov chain switches to this state, the investors only get a random fraction, known as the recovery rate, taking values in [0, 1] of their wealth. Asset returns, as well as recovery rate, depend on the market state. Dynamic programming and Lagrange duality method are used to derive analytical expressions for optimal investment strategies and the mean–variance efficient frontier. It is shown that portfolio selection models with no bankruptcy state and certain exit-time can be considered as special cases of our model. Some numerical examples are provided to demonstrate the effect of the recovery rate and exit-probabilities.

Similar content being viewed by others

Notes

In fact \(\omega _{k+1}(j)>0\) for all \(j\in {\mathbb {S}}\), if we assume that \(r_{n,0}(L)>0\) for all n (see (7)).

They considered a market with \(n\ge 1\) risky assets and solved problem \(P(\omega )\).

They considered a market with \(n\ge 1\) risky assets and assumed that the asset returns depend only on the market state but not the time period and solved problems \(P(\mu )\), \(P(\sigma )\) and \(P(\omega )\).

References

Bauerle N, Rieder U (2004) Portfolio optimization with Markov-modulated stock prices and interest rates. IEEE Trans Autom Control 49(3):442–447

Cakmak U, Ozekici S (2006) Portfolio optimization in stochastic markets. Math Methods Oper Res 63(1):151–168

Canakoglu E, Ozekici S (2009) Portfolio selection in stochastic markets with exponential utility functions. Ann Oper Res 166(1):281–297

Canakoglu E, Ozekici S (2010) Portfolio selection in stochastic markets with HARA utility functions. Eur J Oper Res 201(2):520–536

Canakoglu E, Ozekici S (2011) Portfolio selection with imperfect information: a hidden Markov model. Appl Stoch Models Bus Ind 27(2):95–114

Canakoglu E, Ozekici S (2012) HARA frontiers of optimal portfolios in stochastic markets. Eur J Oper Res 221(1):129–137

Celikyurt U, Ozekici S (2007) Multiperiod portfolio optimization models in stochastic markets using the mean–variance approach. Eur J Oper Res 179:186–202

Chen P, Yang HL, Yin G (2008) Markowitz’s mean–variance asset-liability management with regime switching: a continuous-time model. Insur Math Econ 43(3):456–465

Chen Z, Li G, Zhao Y (2014) Time-consistent investment policies in Markovian markets: a case of mean–variance analysis. J Econ Dyn Control 40:293–316

Chen ZP, Liu J, Li G (2016) Time consistent policy of multi-period mean–variance problem in stochastic markets. J Ind Manag Optim 12(1):229–249

Cheung KC, Yang H (2004) Asset allocation with regime-switching: discrete-time case. Astin Bull 34(1):247–257

Cheung KC, Yang H (2007) Optimal investment-consumption strategy in a discrete-time model with regime switching. Discrete Contin Dyn Syst Ser B 8(2):315–332

Costa OLV, Araujo MV (2008) A generalized multi-period mean–variance portfolio optimization with Markov switching parameters. Automatica 44(10):2487–2497

Elliott RJ, Siu TK, Badescu A (2010) On mean–variance portfolio selection under a hidden Markovian regime switching model. Econ Model 27(3):678–686

Hakansson N (1969) Optimal investment and consumption strategies under risk, an uncertain lifetime, and insurance. Int Econ Rev 10(3):443–466

Hakansson N (1971) Optimal entrepreuneurial decisions in a completely stochastic environment. Manag Sci 17(7):427–449

Honda T (2003) Optimal portfolio choice for unobservable and regime-switching mean returns. J Econ Dyn Control 28(1):45–78

Hu F, Wang R (2017) Optimal investment-consumption strategy with liability and regime switching model under value-at-risk constraint. Appl Math Comput 313:103–118

Li D, Ng WL (2000) Optimal dynamic portfolio selection: multiperiod mean–variance formulation. Math Finance 10(3):387–406

Li G, Chen ZP, Liu J (2016) Optimal policy for a time consistent mean–variance model with regime switching. IMA J Manag Math 27(2):211–234

Luenberger DG (1968) Optimization by vector space methods. Wiley, New York

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–91

Merton RC (1971) Optimal consumption and portfolio rules in a continuous-time model. J Econ Theory 3(4):373–413

Sotomayor L, Cadenillas A (2009) Explicit solutions of consumption-investment problems in financial markets with regime switching. Math Finance 19(2):215–236

Wei SZ, Ye ZX (2007) Multi-period optimization portfolio with bankruptcy control in stochastic market. Appl Math Comput 186(1):414–425

Wu HL, Li ZF (2011) Multi-period mean–variance portfolio selection with Markov regime switching and uncertain time-horizon. J Syst Sci Complex 24(1):140–155

Wu H, Li Z (2012) Multi-period mean–variance portfolio selection with regime switching and a stochastic cash flow. Insur Math Econ 50(3):371–384

Wu H, Zeng Y (2013) Multi-period mean–variance portfolio selection in a regime-switching market with a bankruptcy state. Optim Control Appl Methods 34(4):415–432

Wu HL, Zeng Y, Yao HX (2014) Multi-period Markowitz’s mean–variance portfolio selection with state-dependent exit probability. Econ Model 36:69–78

Yaari M (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32(2):137–150

Yao H, Lai Y, Hao Z (2013) Uncertain exit time multi-period mean–variance portfolio selection with endogenous liabilities and Markov jumps. Automatica 49(11):3258–3269

Yao H, Li X, Hao Z, Li Y (2016) Dynamic asset-liability management in a Markov market with stochastic cash flows. Quant Finance 16(10):1575–1597

Yin G, Zhou XY (2004) Markowitz’s mean–variance portfolio selection with regime switching: from discrete-time to their continuous-time limits. IEEE Trans Autom Control 49(3):349–360

Zeng Y, Wu H, Lai Y (2013) Optimal investment and consumption strategies with state-dependent utility functions and uncertain time-horizon. Econ Model 33:462–470

Zhang L (2014) Continuous-time mean-variance asset-liability management with hidden Markovian regime switching. Math Probl Eng 2014:1

Zhang M, Chen P (2016) Mean-variance portfolio selection with regime switching under shorting prohibition. Oper Res Lett 44(5):658–662

Zhang L, Li Z, Xu Y, Li Y (2016) Multi-period mean variance portfolio selection under incomplete information. Appl Stoch Model Bus 32(6):753–774

Zhang M, Chen P, Yao H (2017) Mean–variance portfolio selection with only risky assets under regime switching. Econ Model 62:35–42

Zhou XY, Li D (2000) Continuous-time mean–variance portfolio selection: a stochastic LQ framework. Appl Math Opt 42(1):19–33

Zhou XY, Yin G (2003) Markowitz’s mean–variance portfolio selection with regime switching: a continuous-time model. SIAM J Control Optim 42(4):1466–1482

Zhu DM, Xie Y, Ching WK, Siu TK (2016) Optimal portfolios with maximum value-at-risk constraint under a hidden Markovian regime-switching model. Automatica 74:194–205

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Keykhaei, R. Portfolio selection in a regime switching market with a bankruptcy state and an uncertain exit-time: multi-period mean–variance formulation. Oper Res Int J 20, 1231–1254 (2020). https://doi.org/10.1007/s12351-018-0372-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-018-0372-7