Abstract

In this paper, an EOQ model for deteriorating items has been developed in infinite time horizon including two-level delay in payment in which one delay in payment (M) is offered to the retailer by the supplier and the another delay in payment (N) is offered by the retailer to all customers. Since the real business world is full of uncertainties and the supplier has to face different problems with the retailer, hence there may exist uncertainties in the credit period which is offered by the supplier to the retailer. Again, uncertainties may be linear or non-linear type. Till now, there is no standard fuzzy number by which linearity and non-linearity can be explored simultaneously. In this respect, a new type of fuzzy number known as q-fuzzy number has been introduced to consider linearity and non-linearity together and this is the novelty of the paper. On the other hand, the retailer intends to offer a credit period to all customers to give rise the demand of the items. So, here demand function depends on credit period and duration of offering the credit period. The aim of the retailer is that how much credit period be benefited to get maximum profit. Therefore the purpose of this model is to determine the optimal credit length for the customers and optimal replenishment cycle length. Also, the model has been discussed considering the situation when the retailer offers no credit to the customers. Then some theoretical results and an algorithm for defuzzification have been developed. Finally, some numerical examples have been carried out to interpret the model and a sensitivity analysis of the optimal solution has been provided with respect to some parameters.

Similar content being viewed by others

References

Aggarwal SP, Jaggi CK (1995) Ordering policies of deteriorating items under permissible delay in payments. J Oper Res Soc 46:658–662

Banu A, Mondal S (2016) Analysis of credit linked demand in an inventory model with varying ordering cost. Springerplus 5:916. https://doi.org/10.1186/s40064-016-2567-9

Chung KJ (1998) A theorem on the determination of economic order quantity under conditions of permissible delay in payments. Comput Oper Res 25(1):49–52

Covert RB, Philip GS (1973) An EOQ model with Weibull distribution deterioration. AIIE Trans 5:323–326

Das BC, Das B, Mondal SK (2013) Integrated supply chain model for a deteriorating item with procurement cost dependent credit period. Comput Ind Eng 64:788–796

Das BC, Das B, Mondal SK (2015) An integrated production inventory model under interactive fuzzy credit period for deteriorating item with several markets. Appl Soft Comput 28:435–465

Das BC, Das B, Mondal SK (2017) An ingrated production–inventory model with defective item dependent stochastic credit period. Comput Ind Eng 110:255–263

Diabat A, Taleizadeh AA, Lashgari M (2017) A lot sizing model with partial downstream delayed payment, partialupstream advance payment, and partial backordering fordeteriorating items. J Manuf Syst 45:322–342

Ghare PM, Schrader GP (1963) A model for an exponentially decaying inventory. J Ind Eng 14:238–243

Goyal SK (1985) Economic order quanity under conditions of permissible delay in payments. J Oper Res Soc 36:335–338

Ho CH (2011) The optimal integrated inventory policy with price-and-credit-linked demand under two-level trade credit. Comput Ind Eng 60:117–126

Huang YF (2003) Optimal retailer’s ordering policies in the EOQ model under trade credit financing. J Oper Res Soc 54:1011–1015

Hwang H, Shinn SW (1997) Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payments. Comput Ind Eng 24:539–547

Kazemi N, Shekarian E, Jaber MY (2010) An inventory model with backorders with fuzzy parameters and decision variables. Int J Approx Reason 51(8):964–972

Kazemi N, Olugu EU, Rashid SHA, Ghazilla RABR (2015a) Development of fuzzy economic order quantity model for imperfect quality items using the learning effect on fuzzy parameters. J Intell Fuzzy Syst 28:2377–2389

Kazemi N, Shekarian E, Cardenas-Barron LE (2015b) Incorporating human learning into a fuzzy EOQ inventory model with backorders. Comput Ind Eng 87:540–542

Kazemi N, Olugu EU, Rashid SHA, Ghazilla RABR (2016a) A fuzzy EOQ model with backorders and forgetting effect on fuzzy parameters: an empirical study. Comput Ind Eng 96:140–148

Kazemi N, Rashid SHA, Shekarian E, Bottani E, Montanari R (2016b) A fuzzy lot-sizing problem with two-stage composite human learning. Int J Prod Res 54(16):5010–5025

Lashgari M, Taleizadeh AA, Sana SS (2016a) An inventory control problem for deteriorating items with back-ordering and finantial consideration under two levels of trade credit linked to order quantity. J Ind Manag Optim 12(3):1091–1119

Lashgari M, Taleizadeh AA, Ahmadi A (2016b) Partial up-stream advanced payment and partial down-stream delayed payment in a three-level supply chain. Ann Oper Res 238:329–354

Mahata GC, Goswami A (2007) An EOQ model for deteriorating items under trade credit financing in the fuzzy sense. Prod Plan Control 18(8):681–692

Maiti MK, Maiti M (2006) Fuzzy inventory model with two warehouses under possibility constraints. Fuzzy Set Syst 157(1):52–73

Mishra SS, Mishra PP (2011) An image model for fuzzified deterioration under cob-web phenomenon and permissible delay in payment. Comput Math Appl 61(4):921–932

Mondal S, Maiti M (2002) Multi-item fuzzy EOQ models using genetic algorithm. Comput Ind Eng 44:105–117

Shah NH (1993) A lot-size model for exponentially decaying inventory when delay in payments is permissible. Cahiers du CERO 35:115–123

Shah NH, Cardenas-Barron LE (2015) Retailer’s decision for ordering and credit policies for deteriorating items when a supplier offers order-linked credit period or cash discount. Appl Math Comput 259:569–573

Shekarian E, Jaber MY, Kazemi N, Ehsani E (2014) A fuzzifed version of the economic production quantity (EPQ) model with backorders and rework for a single-stage system. Eur J Ind Eng 8(3):291–324

Shekarian E, Olugu EU, Rashid SHA, Kazemi N (2016) An economic order quantity model considering different holding costs for imperfect quality items subject to fuzziness and learning. J Intell Fuzzy Syst 30:2985–2997

Shekarian E, Rashid SHA, Bottan E, De SK (2017) Fuzzy inventory models: a comprehensive review. Appl Soft Comput 55:588–621

Shinn SW, Hwang HP, Sung S (1996) Joint price and lot size determination under conditions of permissible delay in payments and quantity discounts for freight cost. Eur J Oper Res 91:528–542

Taleizadeh AA, Moghadasi H, Niaki STA, Eftekhari A (2008) An economic order quantity under joint replenishment policy to supply expensive imported raw materials with payment in advance. J Appl Sci 8(23):4263–4273

Taleizadeh AA, Niaki STA, Aryanezha MB (2010) Optimising multi-product multi-chance-constraint inventory control system with stochastic period lengths and total discount under fuzzy purchasing price and holding costs. Int J Syst Sci 41(10):1187–1200

Taleizadeh AA, Barzinpour F, Wee HM (2011) Meta-heuristic algorithms for solving a fuzzy single-period problem. Math Comput Model 54:1273–1285

Taleizadeh AA, Wee HM, Jolai F (2013a) Revisiting a fuzzy rough economic order quantity model for deteriorating items considering quantity discount and prepayment. Math Comput Model 57:1466–1479

Taleizadeh AA, Niaki STA, Meibodi RG (2013b) Replenish-up-to multi-chance-constraint inventory control system under fuzzy random lost-sale and backordered quantities. Knowl Based Syst 53:147–156

Taleizadeh AA (2014) An EOQ model with partial backordering and advance payments for an evaporating item. Int J Prod Econ 155:185–193

Taleizadeh AA, Nematollahi M (2014) An inventory control problem for deteriorating items with back-ordering and financial considerations. Appl Math Model 38:93–109

Taleizadeh AA, Lashgari M, Akram R, Heydari J (2016) An imperfect EPQ model with up-stream trade credit periods linked to raw material order quantity and down-stream trade credit periods. Appl Math Model 40(19–20):8777–8793

Wu J, Chan YL (2014) Lot-sizing policies for deteriorating items with expiration dates and partial trade credit to credit-risk customers. Int J Prod Res 155:292–301

Yang PC, Wee HM (2003) An integrated multi-lot-size production inventory model for deteriorating item. Comput Oper Res 30(5):671–682

Zimmermann HJ (1991) Fuzzy set theory and its applications, 2nd revised edn. Kluwer, Dordrecht

Acknowedgements

The authors are grateful to the anonymous referees and the Editor of the Journal for their valuable comments and suggestions on earlier version of the paper, which have helped them to improve the presentation of this work significantly. Also, the 1st author is highly thankful to the University Grant Commission (UGC) of India for financial support under F1-17.1/2014-15/MANF-2014-15-MUS-WES-35615.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Preliminaries

Here, we state some basic concepts which are eventual for the paper.

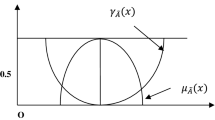

Definition 2.1

Let X be domain set. If \(\tilde{A}\) is a fuzzy subset of X, for any \(\chi \in X\)

\(\mu _{\tilde{A}}:X\rightarrow [0,1]\), \(\chi \rightarrow \mu _{A}(\chi )\)

\(\mu _{\tilde{A}}\) is called a membership function of \(\chi\) with respect to \(\tilde{A}\), \(\mu _{A}(\chi )\) denotes the grade to each point in X with a real number in the interval [0, 1] that represents the grade of membership of \(\chi\) in A. \(\tilde{A}\) is called a fuzzy set and describe as follows

\(\tilde{A}=\{(\chi ,\mu _{A}(\chi ))|\chi \in X\}\).

Definition 2.2

A fuzzy number \(\tilde{M}\) is a convex normalized fuzzy set \(\tilde{M}\) of the real line \(\mathfrak {R}\) such that

-

(i)

It exists exactly one \(x_0\in \mathfrak {R}\) with \(\mu _{\tilde{M}}(x_0)=1\) ( \(x_0\) is called the mean value of \(\tilde{M}\)).

-

(ii)

\(\mu _{\tilde{M}}(x)\) is piece wise continuous.

Definition 2.3

Let X and Y be the universes and \(\tilde{P}(Y)\) be the set of all fuzzy sets in Y (power set), \(\tilde{f}:X\rightarrow \tilde{P}(Y)\) is a mapping. Then \(\tilde{f}\) is a fuzzy function iff

where, \(\mu _{\tilde{R}}(x,y)\) is the membership function of the fuzzy relation.

Definition 2.4

Let X be a cartesian product of universes \(X= X_1, X_2, \ldots , X_r\) and \(\tilde{A_1},\tilde{A_2},\ldots ,\tilde{A_r}\) be fuzzy sets in \(X= X_1, X_2, \ldots , X_r\) respectively. Assume that f is a mapping from X to a universe Y, \(y=f(x_1,x_2,\ldots ,x_r)\). Then the extension principle allows us to define a fuzzy set B in Y by

where,

Appendix 2

Integrating both side when \(0\le t\le M-N\), we have

Again, integrating both side when \(M-N\le t\le T\), we have

Appendix 3

Appendix 4

The first order derivatives of the Eq. (14) with respect to T is given by

The second order derivatives of the Eq. (14) with respect to T is given by

Rights and permissions

About this article

Cite this article

Banu, A., Mondal, S.K. Analyzing an inventory model with two-level trade credit period including the effect of customers’ credit on the demand function using q-fuzzy number. Oper Res Int J 20, 1559–1587 (2020). https://doi.org/10.1007/s12351-018-0391-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-018-0391-4