Abstract

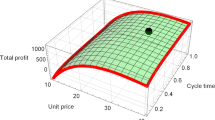

Motivated by the emerging practices of China's major e-commerce platforms, we investigate the effect of consumer’s valuation change, deposit expansion and return policy on retailer’s advance booking decisions. We establish the retailer’s expected profit based on a two-stage newsvendor model and derive his optimal deposit and order quantity decisions under different scenarios. Our conclusions show that: (1) the retailer gains further profit under the advance selling strategy with a deposit, due to the reduction of inventory risk and exploitation of consumer’s valuation uncertainty; (2) the retailer benefits more from advance selling when he has a lower profit margin or the consumers have low-level prior valuations; (3) the effectiveness of advance selling on exploiting consumer’s valuation uncertainty will be weakened if the retailer allows customers to return products; (4) a lower deposit expansion rate leads to higher deposit and expected profit.

Similar content being viewed by others

References

Cheng YS, LiThorstenson HYA (2018) Advance selling with double marketing efforts in a newsvendor framework. Comput Ind Eng 118:352–365

Chiang WK, Chhajed D, Hess JD (2003) Direct marketing, indirect profits: a strategic analysis of dual-channel supply-chain design. Manag Sci 49(1):1–20

DeGraba P (1995) Buying frenzies and seller-induced excess demand. RAND J Econ 26(2):331–342

Huang KL, Kuo CW, Shih HJ (2017) Advance selling with freebies and limited production capacity. Omega 73:18–28

Khouja M, Zhou J (2015) Channel and pricing decisions in a supply chain with advance selling of gift cards. Eur J Oper Res 244(2):471–489

Kuthambalayan TS, Mehta P, Shanker K (2015) Managing product variety with advance selling and capacity restrictions. Int J Prod Econ 170:287–296

Li C, Zhang F (2012) Advance demand information, price discrimination, and pre-order strategies. Manuf Serv Oper Manag 15(1):57–71

Lim WS, Tang CS (2013) Advance selling in the presence of speculators and forward-looking consumers. Prod Oper Manag 22(3):571–587

Mccardle K, Rajaram K, Tang CS (2004) Advance booking discount programs under retail competition. Manag Sci 50(5):701–708

Moe WW, Fader PS (2002) Using advance purchase orders to forecast new product sales. Marketing Sci 21(3):347–364

Mukherjee A, Jha S, Smith RJ (2017) Regular price $299; pre-order price $199: price promotion for a pre-ordered product and the moderating role of temporal orientation. J Retail 93(2):201–211

Nasiry J, Popescu I (2012) Advance selling when consumers regret. Manag Sci 58(6):1160–1177

Prasad A, Stecke KE, Zhao X (2011) Advance selling by a newsvendor retailer. Prod Oper Manag 20(1):129–142

Shugan SM, Xie JH (2000) Advance pricing of services and other implications of seperating purchase and consumption. J Serv Res 2(2–3):227–239

Shugan SM, Xie JH (2004) Advance selling for services. Calif Manag Rev 46(3):37–54

Tang CS, Rajaram K, Alptekinoglu A, Ou J (2004) The benefits of advance booking discount programs: model and analysis. Manag Sci 50(4):465–478

Tian ZJ, Wang YF (2016) Advance selling with preorder-dependent customer valuation. Res Lett 44:557–562

Wei MM, Zhang F (2018) Advance selling to strategic consumers: preorder contingent production strategy with advance selling target. Prod Oper Manag 27:1221–1235

Xie J, Shugan SM (2001) Electronic tickets, smart cards, and online prepayments: when and how to advance sell. Market Sci 20(3):219–243

Yu M, Ahn HS, Kapuscinski R (2015a) Rationing capacity in advance selling to signal quality. Manag Sci 61(3):560–577

Yu M, Kapuscinski R, Ahn H (2015b) Advance selling with interdependent customer valuations. Manag Sci 61(9):2100–2117

Zhang QH, Zhang DL, Segerstedt A, Luo JW (2018) Optimal ordering and pricing decisions for a company issuing product-specific gift cards. Omega 74:92–102

Zhao XY, Stecke KE (2010) Pre-orders for new to-be-released products considering consumer loss aversion. Prod Oper Manag 19(2):198–215

Zhao XY, Pang Z, Stecke KE (2016) When does a retailer’s advance selling capability benefit manufacturer, retailer, or both? Prod Oper Manag 25(6):1073–1087

Acknowledgements

The authors thank the anonymous referees for their helpful comments and suggestions. This research is supported in part by National Natural Science Foundation of China (71771146). This paper is also a part of the project funded by Shanghai Pujiang Talent Project (16PJC059).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Proof of Proposition 1

If \(0\le b<\frac{p-\overline{{v }_{0}}+M}{2}\) (Case III), we have \({D}_{c}-{D}_{r}=-\frac{{N}_{1}{\left(2b-M-p+\overline{{v }_{0}}\right)}^{2}}{4\overline{{v }_{0}}M}<0\). Hence, we have \({D}_{c}<{D}_{r}\). For case I and case II, Table 2 shows that \({D}_{c}={D}_{r}\).

Proof of Lemma 1

Since \({\pi }_{2}^{I}\left(\left.{Q}^{I}\right|{N}_{1},b\right)=\left(p-w\right){Q}^{I}-\frac{p\left(\overline{{v }_{0}}-p\right)}{\overline{{v }_{0}}}{\int }_{0}^{\frac{\overline{{v }_{0}}{Q}^{I}}{\overline{{v }_{0}}-p}}\Phi \left(n\right)dn+\frac{{N}_{1}\left(p-2b-w\right)\left(\overline{{v }_{0}}-p+b\right)}{\overline{{v }_{0}}}\), then the first order and the second order with respect to \({Q}^{I}\) are \(\frac{d{\pi }_{2}^{I}\left(\left.{Q}^{I}\right|{N}_{1},b\right)}{d{Q}^{I}}=p-w-p\Phi \left(\frac{\overline{{v }_{0}}{Q}^{I}}{\overline{{v }_{0}}-p}\right),\) and \(\frac{{d}^{2}{\pi }_{2}^{I}\left(\left.{Q}^{I}\right|{N}_{1},b\right)}{d{{Q}^{I}}^{2}}=-\frac{\overline{{v }_{0}}p}{\overline{{v }_{0}}-p}\phi \left(\frac{\overline{{v }_{0}}{Q}^{I}}{\overline{{v }_{0}}-p}\right)<0,\) respectively. Therefore, \({\pi }_{2}^{I}\left(\left.{Q}^{I}\right|{N}_{1},b\right)\) is a concave function of \({Q}^{I}\) and the optimal order quantity is \({Q}^{I}=\frac{\overline{{v }_{0}}-p}{\overline{{v }_{0}}}{\Phi }^{-1}\left(\frac{p-w}{p}\right).\) Hence, the total order quantity, \({Q}^{I}+\frac{{N}_{1}(\overline{{v }_{0}}-p+b)}{\overline{{v }_{0}}}\), is \(\frac{\overline{{v }_{0}}-p}{\overline{{v }_{0}}}{\Phi }^{-1}\left(\frac{p-w}{p}\right)+\frac{{N}_{1}(\overline{{v }_{0}}-p+b)}{\overline{{v }_{0}}}.\)

Proof of Proposition 2

Given \({\pi }_{1}^{I}\left(b|{N}_{1}\right)=\frac{E({N}_{1})(\overline{{v }_{0}}-p+b)(p-b-w)}{\overline{{v }_{0}}}+\left(p-w\right)\frac{\overline{{v }_{0}}-p}{\overline{{v }_{0}}}{\Phi }^{-1}\left(\frac{p-w}{p}\right)-\frac{p\left(\overline{{v }_{0}}-p\right)}{\overline{{v }_{0}}}{\int }_{0}^{\frac{\overline{{v }_{0}}{Q}^{I}}{\overline{{v }_{0}}-p}} \Phi \left(n\right)dn\), then the first order and the second order with respect to \(b\) is

and

respectively. Therefore, the first-order condition is \(b=\frac{2p-w-\overline{{v }_{0}}}{2}.\) If\(\frac{2p-w-\overline{{v }_{0}}}{2}<0\), then \(\frac{d{\pi }_{1}^{I}\left(b\right)}{d b}<0\) for all \(b\ge 0\) which means\({b}^{*}=M\); if\(\frac{2p-w-\overline{{v }_{0}}}{2}\ge 0\), then the optimal deposit is \(b=\frac{2p-w-\overline{{v }_{0}}}{2}.\) Therefore, the optimal booking is \(b_{1}^{*} = \left\{ {\begin{array}{*{20}c} {\frac{{2p - w - \overline{{v_{0} }} }}{2},} & { if\;\frac{{2p - w - \overline{{v_{0} }} }}{2} > M} \\ {M,} & {otherwise} \\ \end{array} } \right..\)

Proof of Lemma 2

The proof is the same as Lemma 1, and we omit it.

Proof of Proposition 3

For case II, differentiate \({\pi }_{1}^{II}\left(b\right)\) with respect to \(b\) yields

Further, we have

which proves the concavity of \({E}_{{N}_{1}}\left[{\pi }_{1}^{II}\left(b\right)\right]\). Hence the first order with respect to \(b\) is the optimal decision. The optimal solution is \(b=\frac{4M}{3}\pm \frac{\sqrt{M(13M-12p+6\overline{{v }_{0}}+6w)}}{3}\). Since \(b<M\) we have

Recall that the optimal value of \(b\) is derived with the condition, \(\frac{p-\overline{{v }_{0}}+M}{2}\le b<M\), the optimal value of \(b\) is

For case III, we have:

It is not determined whether the second-order is less than zero. For the first order with respect to \(b\), we have:

Then the first-order condition is:

We derive the optimal solution by comparing the function value of the first order and the boundary points. That is

where,

Proof of Proposition 5

The proof is similar to Proposition 3. In particular, we can easily derive the retailer’s profit at the first stage is

-

(1)

if \(M\le b\);

$$\underset{b}{\mathit{max}}E\left[{\pi }_{1}^{I}\left(b\right)\right]=\left(p-w\right){Q}_{r}^{I}-\frac{p\left(\overline{{v }_{0}}-p\right)}{\overline{{v }_{0}}}{\int }_{0}^{{\Phi }^{-1}\left(\frac{p-w}{p}\right)} \Phi \left(n\right)dn+\frac{E\left({N}_{1}\right)\left(p-2b-w\right)\left(\overline{{v }_{0}}-p+b\right)}{\overline{{v }_{0}}}+\frac{bE\left({N}_{1}\right)M}{4\overline{{v }_{0}}}.$$ -

(2)

if \(p-\overline{{v }_{0}}+M\le b<M\);

$$ \begin{aligned} \mathop {\max }\limits_{b} E\left[ {\pi_{1}^{II} \left( b \right)} \right] & = \left( {p - w} \right)Q_{r}^{II} - \frac{{p\left( {\overline{{v_{0} }} - p} \right)}}{{\overline{{v_{0} }} }}\mathop \int \limits_{0}^{{{\Phi }^{ - 1} \left( {\frac{p - w}{p}} \right)}} \Phi \left( n \right)dn \\ & \quad + E\left( {N_{1} } \right)\left( {p - 2b - w} \right)\frac{{\left( {\overline{{v_{0} }} - p + b} \right)}}{{\overline{{V_{0} }} }} + \frac{{\left( {p - w} \right)E\left( {N_{1} } \right)\left( {M - b} \right)^{2} }}{{4\overline{{v_{0} }} M}} + \frac{{bE\left( {N_{1} } \right)M}}{{4\overline{{v_{0} }} }}. \\ \end{aligned} $$ -

(3)

if \(0\le b<p-\overline{{v }_{0}}+M\);

$$ \begin{aligned} \mathop {\max }\limits_{b} E\left[ {\pi_{1}^{II} \left( b \right)} \right] & = \left( {p - w} \right)Q_{r}^{II} - \frac{{p\left( {\overline{{v_{0} }} - p} \right)}}{{\overline{{v_{0} }} }}\mathop \int \limits_{0}^{{{\Phi }^{ - 1} \left( {\frac{p - w}{p}} \right)}} \Phi \left( n \right)dn + E\left( {N_{1} } \right)\left( {p - 2b - w} \right)\frac{{\left( {\overline{{v_{0} }} - p + b} \right)}}{{\overline{{V_{0} }} }} \\ & \quad + \frac{{\left( {p - w} \right)E\left( {N_{1} } \right)\left( {M - b} \right)^{2} }}{{4\overline{{v_{0} }} M}} + b \frac{{3\left( {\overline{{v_{0} }} - p + b} \right)^{2} + 2\left( {\overline{{v_{0} }} - p + b} \right)M}}{{4M\overline{{v_{0} }} }} \\ \end{aligned} $$

Solve the above problem yields Proposition 5. Further, for the proof of \({b}_{rI}^{*}<{b}_{I}^{*}\). since \(\frac{2p-w-\overline{{v }_{0}}}{2}>M\), we have \(-\frac{p}{4}+\frac{w}{4}+\frac{M}{16}<\frac{7w-6p-\overline{{v }_{0}}}{32}<0\). Hence, we have \({b}_{rI}^{*}<{b}_{I}^{*}\).

This completes the proof.

Proof of Lemma 4

It is easy to prove that

and \({N}_{1}{(M-\alpha b)}^{2}-{N}_{1}{\left(M-b\right)}^{2}>0,\) when \(0<{\alpha }<1\).

Therefore, we have:

Recall that: \({D}_{c}=\frac{{N}_{1}\left(\overline{{v }_{0}}-p+\alpha b\right)(p-(2+\alpha )b+2M-\overline{{v }_{0}})}{4\overline{{v }_{0}}M}\), \({D}_{r}=\frac{{N}_{1}{(M-\alpha b)}^{2}}{4\overline{{v }_{0}}M}\). Thus, we have \({\mathrm{D}}_{\mathrm{c}}<{\mathrm{D}}_{\mathrm{r}}\).

Proof of Lemma 5

The proof is similar to the proof of Lemma 1, and we omit it.

Proof of Proposition 6

Notice that when \(0<\alpha <1\) & \(b>\frac{M}{\alpha }\) and \({\alpha }\ge 1\) & \(b>M\), from \(\frac{d{\pi }_{1}^{I}}{d\alpha }=0\), \(\frac{d{\pi }_{1}^{I}}{db}=0\), we derive:

When \(0<\alpha <1\) and \(M\le b<\frac{M}{\alpha }\), from \(\frac{d{\pi }_{1}^{I}}{d\alpha }=0\), \(\frac{d{\pi }_{1}^{I}}{db}=0\), we derive:

Thus, under the above cases, the retailer actually jointly decides expansion rate and deposit. Namely, since the optimal final discount \(\alpha b\) is a constant, a lower expansion rate will lead to a higher-level deposit.

Other parts of the proof are similar to the proof of Lemma 1, so we omit it.

Rights and permissions

About this article

Cite this article

Zhang, Q., Cheng, X., Tsao, YC. et al. Advance selling under deposit expansion and consumer’s valuation change. Oper Res Int J 22, 3633–3661 (2022). https://doi.org/10.1007/s12351-021-00676-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-021-00676-9