Abstract

Financial compensation is an effective marketing tool to deal with delivery delay issues in online retailing. In this paper, we develop an analytical model to study two different compensation policies prevalent in practice: uniform compensation and discriminated compensation. By endogenizing the customers’ choice behavior, we first characterize the optimal retail price and compensation level for these different compensation cases. Then, we conduct a sensitivity analysis of the optimal solutions with respect to driving factors. The results show how the retailer’s delivery quality, as well as the product characteristics, affect the optimal compensation and pricing policies, leading to interesting insights. For example, we show that the retailer optimally adopts a more generous compensation policy when the relative delay time becomes longer under the uniform compensation policy, but a lower retail price with a constrictive compensation policy can be a good choice for the retailer under discriminated compensation case. Through comparison to the benchmark case, we identify the impacts of the delay compensation policies from three aspects: the profit margin effect, total demand effect, and return rate effect. Then, the aggregate effect analysis verifies the profit implications of the compensation policies. The results show that the retailer is worse off due to deploying a compensation policy when both the cost-value rate and delay probability are sufficiently large. Furthermore, we also compare the optimal solutions, customer choice behavior, and retailer performance for these two compensation cases. The analytical and numerical insights can serve as a reference for internet retailers facing delivery delay problems.

Similar content being viewed by others

Notes

The subscript “a” denotes accept and “r” denotes return.

The subscript “c” denotes accept with delay compensation

References

Ahmad S (2002) Service failures and customer defection: a closer look at online shopping experiences. Manag Serv Qual 12(1):19–29

Aviv Y, Pazgal A (2008) Optimal pricing of seasonal products in the presence of forward-looking consumers. Manuf Serv Oper Manag 10(3):339–359

Baker W, Marn M, Zawada C (2001) Price smarter on the net. Harvard Business Review, February 2–7

Bitner MJ, Booms BH, Tetreault MS (1990) The service encounter: diagnosing favorable and unfavorable incidents. J Mark 54(1):71–84

Boyaci T, Ray S (2006) The impact of capacity costs on product differentiation in delivery time, delivery reliability, and price. Product Oper Manag 15(2):179–197

Cachon GP, Swinney R (2009) Purchasing, pricing, and quick response in the presence of strategic consumers. Manag Sci 55(3):497–511

Chang DS, Wang TH (2012) Consumer preferences for service recovery options after delivery delay when shopping online. Soc Behav Personal 40(6):1033–1043

Deng S, Wang T, Chang X (2018) Customer satisfaction incentives with budget constraints. Int Trans Oper Res 25(6):1973–1995

Forbes LP, Kelley SW, Hoffman KD (2005) Typologies of e-commerce retail failures and recovery strategies. J Serv Mark 19(5):280–292

Grewal D, Roggeveen AL, Tsiros M (2008) The effect of compensation on repurchase intentions in service recovery. J Retail 84(4):424–434

Gustafsson A (2009) Customer satisfaction with service recovery. J Bus Res 62(11):1220–1222

Guo X, Li B, Liu Y, Liang L (2017) Eliminating the inconvenience of carrying: optimal pricing of delivery service for retailers. Serv Sci 9(3):181–191

Ho TH, Zheng YS (2004) Setting customer expectation in service delivery: an integrated marketing-operations perspective. Manag Sci 50(4):479–488

Holloway BB, Beatty SE (2003) Service failure in online retailing: a recovery opportunity. J Serv Res 6(1):92–105

Hong L, Li Y, Wang S (2016) Improvement of online food delivery service based on consumers’ negative comments. Can Soc Sci 5(12):84–88

Huang J, Leng M, Parlar M (2013) Demand functions in decision modeling: comprehensive survey and research directions. Decis Sci 44(3):557–609

Kumar P, Kalwani MU, Dada M (1997) The impact of waiting time guarantees on customers’ waiting experiences. Mark Sci 16(4):295–314

Kwon SY, Jang SCS (2012) Effects of compensation for service recovery: from the equity theory perspective. Int J Hosp Manag 31(4):1235–1243

Lin J, Zhou W, Du L (2018) Is on-demand same day package delivery service green? Transp Res Part D 61:118–139

Liu L, Parlar M, Zhu SX (2007) Pricing and lead time decisions in decentralized supply chains. Manag Sci 53(5):713–725

Shang W, Liu L (2011) Promised delivery time and capacity games in time-based competition. Manag Sci 57(3):599–610

So KC, Song JS (1998) Price, delivery time guarantees and capacity selection. Eur J Oper Res 111(1):28–49

Steever Z, Karwan M, Murray C (2019) Dynamic courier routing for a food delivery service. Comput Oper Res 107:173–188

Suhartanto D, Helmi Ali M, Tan KH, Sjahroeddin F, Kusdibyo L (2019) Loyalty toward online food delivery service: the role of e-service quality and food quality. J Foodserv Bus Res 22(1):81–97

Su X, Zhang F (2009) On the value of commitment and availability guarantees when selling to strategic consumers. Manag Sci 55(5):713–726

Urban TL (2009) Establishing delivery guarantee policies. Eur J Oper Res 196(3):959–967

Wirtz J, Mattila AS (2004) Consumer responses to compensation, speed of recovery and apology after a service failure. Int J Serv Ind Manag 15(2):150–166

Xiao T, Qi X (2016) A two-stage supply chain with demand sensitive to price, delivery time, and reliability of delivery. Annu Oper Res 241(1–2):475–496

Yu J, Subramanian N, Ning K, Edwards D (2015) Product delivery service provider selection and customer satisfaction in the era of internet of things: a Chinese e-retailers’ perspective. Int J Product Econ 159:104–116

Zhang T, Ge L, Gou Q, Chen L (2018) Consumer showrooming, the sunk cost effect and online-offline competition. J Electron Commerce Res 19(1):55–74

Acknowledgement

The authors are grateful to the editor, the associate editor and the anonymous referees for their thoughtful comments and constructive suggestions to the earlier version of this paper. This research was partially supported by National Natural Science Foundation of China (Grant No. 71971200 and 71921001) and New Arts Foundation of USTC (No. YD2040002008).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 1

By equating \(U_a=U_r\), we can derive \(\theta _0\) directly. For \(\theta \le \theta _0\), \(U_a\ge U_r\), the customers choose to wait the delayed product. Otherwise, for \(\theta >\theta _0\), the expected utility to buy the product is

Comparing this equation to the outside option 0, we can also obtain \(\theta _2\) directly. Since \(1-f-\beta >0\) is assumed, i.e., \(\theta _0<\theta _2\), we know that the customers choose to return the product for \(\theta _0<\theta <\theta _2\), and the others choose to buy from the outside option. \(\square\)

Proof of Lemma 2

Taking the second-order condition with respect to p, we have

Thus, the profit in Eq. (5) is a concave function. From the first-order condition, we can derive the optimal price as

\(\square\)

Proof of Lemma 3

By equating \(U_r =U_c\) in (7) and \(EU(Buy)=0\) in (9), we can derive \(\theta _1\), \(\theta _2\), \(\theta _3\) directly. Then, we have two cases:

-

(1)

If \(\theta _1\le \theta _3\), we have \(\theta _2\ge \theta _3\). Thus, when \(\theta \le \theta _1\), \(U_c\ge U_r\), the customers accept the compensation and wait for the delayed product; when \(\theta _1<\theta \le \theta _2\), \(U_c< U_r\), the customers return the delayed product; when \(\theta >\theta _2\), the customers buy from the outside option.

-

(2)

If \(\theta _1>\theta _3\), we have \(\theta _2<\theta _3\). Thus, when \(\theta \le \theta _3\), \(U_c\ge U_r\ge 0\), the customers accept the compensation and wait for the delayed product; when \(\theta >\theta _3\), the customers buy from the outside option.

Combining the two cases, we can derive the results in Lemma 3. \(\square\)

Proof of Proposition 1

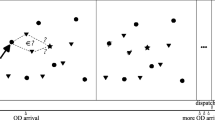

To solve the retailer’s optimization problem in Eqs. (11) and (12), we first need to determine the feasible regions for different constraints. With simplification, we find that the constraints \(\theta _1\le (>) \theta _3\) are equivalent to the conditions,

which are shown in the following figure. As illustrated, the optimization problem should be solved within their feasible regions.

Next, we take the first partial derivatives of Eqs. (11) and (12) with respect to p and r respectively, and have two cases:

-

(1)

For \(\theta _1\le \theta _3\),

$$\begin{aligned} \frac{\partial \Pi _U}{\partial p}= \;& {} \frac{(1-f)^2(v-2p+c)-f(1-f)(s-c)}{d}+\frac{f(v-2p+2r+s)}{d_0}, \end{aligned}$$(30)$$\begin{aligned} \frac{\partial \Pi _U}{\partial r}= \;& {} \frac{-f(v-2p+2r+s)}{d_0}. \end{aligned}$$(31)Taking the second-order partial derivatives of \(\Pi _U\) with respect to p and r and using simplification, we know that the Hessian matrix is negative definite. Thus, \(\Pi _U\) is strictly jointly concave in p and r, and the optimal solutions without considering the constraint is

$$\begin{aligned} p_U^* = \frac{(1-f)(v+c)-f(s-c)}{2(1-f)},\ \ \ \ r_U^* = \frac{c-s}{2(1-f)}. \end{aligned}$$(32)Substituting the above optimal solutions into the constraint, we can derive that \((p_U^*,r_U^*)\) is the feasible optimal solution to the optimization problem (11) only when \(\alpha \le 1-f-\beta\). Otherwise, the optimal solutions must occur on the boundary. In this case, we substitute \(\theta _1= \theta _3\) into the profit function, and with optimization, we can derive the optimal solutions for \(\alpha > 1-f-\beta\) as follows

$$\begin{aligned} p_U^* = \frac{\bigl [2(1-f)(d+fd_0)-d\bigr ]v+dc}{2(1-f)(d+fd_0)},\ \ \ \ r_U^* = \frac{\bigl [d_0(1-f)-d\bigr ](v-c)}{2(1-f)(d+fd_0)}. \end{aligned}$$(33) -

(2)

For \(\theta _1>\theta _3\),

$$\begin{aligned} \frac{\partial \Pi _U}{\partial p}=\frac{v-2p+c+2fr}{d+fd_0},\ \ \ \ \frac{\partial \Pi _U}{\partial r}=\frac{-f(v-2p+c+2fr)}{d+fd_0}, \end{aligned}$$(34)Also, we can show that the Hessian matrix is negative semi-definite. Combining the first-order conditions, the possible extreme point must occur on the red line in Fig. 7. Since each solution on the red line brings the same profit level to the retailer, we select a specific point on the constraint boundary and compare it to the region that \(\theta _1\le \theta _3\). Recall that when \(\theta _1\le \theta _3\), if the optimal solutions occur in the interior region, it must dominate any solutions on the boundary, including optimal solutions on boundary for \(\theta _1> \theta _3\). If optimal solutions occur on the boundary, they would also perform equal to or better than any specific optimal point for \(\theta _1> \theta _3\). Hence, we cannot derive the global optimal solutions in this case.

\(\square\)

Proof of Proposition 2

Considering the different optimal solutions in Eqs. (13) and (14), we conduct the sensitivity analysis in two cases:

-

(1)

When \(\alpha \le t_u\), we have

$$\begin{aligned}&\frac{\partial p_U^*}{\partial \beta }=0, \ \ \ \ \frac{\partial r_U^*}{\partial \beta }=0;\\&\frac{\partial p_U^*}{\partial f}=\frac{c-s}{2(1-f)^2}>0,\ \ \ \ \frac{\partial r_U^*}{\partial f}=\frac{c-s}{2(1-f)^2}>0;\\&\frac{\partial p_U^*}{\partial c}=\frac{1}{2(1-f)}>0,\ \ \ \ \frac{\partial r_U^*}{\partial c}=\frac{1}{2(1-f)}>0;\\&\frac{\partial p_U^*}{\partial s}=\frac{-f}{2(1-f)}<0,\ \ \ \ \frac{\partial r_U^*}{\partial s}=-\frac{1}{2(1-f)}<0;\\&\frac{\partial p_U^*}{\partial v}=\frac{1}{2}>0,\ \ \ \ \frac{\partial r_U^*}{\partial v}=0. \end{aligned}$$ -

(2)

When \(\alpha > t_u\), we have

$$\begin{aligned}&\frac{\partial p_U^*}{\partial \beta }=-\frac{f(v-c)}{2(1-f)(f+\beta )^2}<0, \ \ \ \ \frac{\partial r_U^*}{\partial \beta }=-\frac{v-c}{2(1-f)(f+\beta )^2}<0;\\&\frac{\partial p_U^*}{\partial f}=\frac{d(d_0-2fd_0-d)(v-c)}{2(1-f)^2(d+fd_0)^2}>0\ \ \text {for} \\&f\in \Bigl (0,\frac{1}{2}-\beta \Bigr ), \le 0 \ \ \text {for}\ \ f\in \Bigl [\frac{1}{2}-\beta ,1-\beta \Bigr ),\\&\frac{\partial r_U^*}{\partial f}=-\frac{(v-c)(\beta ^2+f^2+2\beta f-\beta -2f+1)}{2(1-f)^2(f+\beta )^2}<0;\\&\frac{\partial p_U^*}{\partial c}=\frac{d}{2(1-f)(d+fd_0)}>0,\ \ \ \ \frac{\partial r_U^*}{\partial c}=-\frac{d_0(1-f)-d}{2(1-f)(d+fd_0)}<0;\\&\frac{\partial p_U^*}{\partial s}=0,\ \ \ \ \frac{\partial r_U^*}{\partial s}=0;\\&\frac{\partial p_U^*}{\partial v}=\frac{2(1-f)(d+fd_0)-d}{2(1-f)(d+fd_0)}>0,\ \ \ \ \frac{\partial r_U^*}{\partial v}=\frac{d_0(1-f)-d}{2(1-f)(d+fd_0)}>0. \end{aligned}$$

Combining the two cases, we can derive the results in Proposition 2. \(\square\)

Proof of Proposition 3

Note that

Combining these results, we derive that: \(p_U^*>p_B^*\) for \(\alpha <t_1^p\), otherwise \(p_U^*\le p_B^*\) for \(\alpha \ge t_1^p\).

Since we have

the change of total purchase rates must be opposite to that of the prices. Therefore, we can directly derive the comparison results of the purchase rates.

The return rates can be written as

Thus, the return rate under uniform compensation policy is lower.

For \(\alpha \le t_u\), we have

which implies that \(\Pi _{U}^*>\Pi _{B}^*\) in this case. \(\square\)

Proof of Lemma 4

As stated in the main text, we first derive the values of \(\theta _0\), \(\theta _1\), \(\theta _2\), and \(\theta _4\) in this case. Since \(1-f-\beta <0\), we know that \(\theta _0<\theta _1<\theta _4<\theta _2\) must hold. Thus, when \(\theta \le \theta _0\), \(U_a\ge U_r\), the customers do not claim for return and wait to accept the delayed product. When \(\theta _0<\theta \le \theta _1\), we have \(U_a< U_r\) and \(U_c\ge U_r\), so the customers accept the compensation and wait for the delayed product. When \(\theta _1<\theta \le \theta _2\), we have \(U_c< U_r\), so the customers return the delayed product When \(\theta _2<\theta \le 1\), we have \(EU(Buy)< 0\), so the customers buy from the outside option. \(\square\)

Proof of Proposition 4

Taking the first partial derivatives of \(\Pi _D\) in Eq. (18) with respect to p and r, we have

By taking the second partial derivatives, we can show that \(\frac{\partial ^2\Pi }{\partial p^2}<0\), and the Hessian matrix is negative definite. Thus, the profit function is jointly concave in p and r. Without considering the constraint \(\theta _1\le \theta _2\), we first derive the optimal solutions as

Substituting these expressions into the constraint, we find that these results are the global optimal solutions for \(\alpha \le t_d\). Otherwise, for \(\alpha > t_d\), the feasible optimal solutions must occur on the boundary. Thus, by equating \(\theta _1= \theta _2\) and solving the optimization problem, we can derive the optimal solutions for \(\alpha > t_d\) as

\(\square\)

Proof of Proposition 5

Considering the different optimal solutions in Eqs. (20) and (21), we conduct the sensitivity analysis in two cases:

-

1

When \(\alpha \le t_d\), we have

Define \(G(f)=\beta (1-f^2)(v-s)+(4f^2-3\beta -8f+4)(c-s)\), which is a decreasing function of f. Note that

Thus, we have two subcases: First, for \(\beta \ge \frac{3}{4}\), we have \(\frac{\partial p_D^*}{\partial f}\ge 0\), \(\frac{\partial r_D^*}{\partial f}\ge 0\). Second, for \(\beta < \frac{3}{4}\), there must exist a unique threshold \(f_0\in (0,1-\beta )\) such that \(\frac{\partial p_D^*}{\partial f}\ge 0\), \(\frac{\partial r_D^*}{\partial f}\ge 0\) for \(f\in (0,f_0)\), and \(\frac{\partial p_D^*}{\partial f}< 0\), \(\frac{\partial r_D^*}{\partial f}< 0\) for \(f\in [f_0,1-\beta )\).

-

(2)

When \(\alpha > t_d\), we have

Combining the two cases, we can derive the results in Proposition 5. \(\square\)

Proof of Proposition 6

We have

Therefore, we derive that: \(p_D^*>p_B^*\) if \(\alpha <t_2^p\), and \(p_U^*\le p_B^*\) for \(\alpha \ge t_2^p\).

Note that

so the change of total purchase rates is opposite to that of the prices. Therefore, we can directly derive the comparison results of the purchase rates.

The return rates can be written as

Thus, the return rate under discriminated compensation policy is lower.

For \(\alpha \le t_d\), we have

which implies that \(\Pi _{D}^*>\Pi _{B}^*\) in this case. \(\square\)

Proof of Proposition 7

Before analyzing, we note that the conditions \(t_u\le t_d\) (\(t_u> t_d\)) is equivalent to \(f^2+\beta f-f+\beta \le 0\) (\(f^2+\beta f-f+\beta > 0\)). Based on this result, we discuss two cases:

-

(1)

When \(f^2+\beta f-f+\beta \le 0\), i.e, \(t_u\le t_d\), we have three subcases:

-

For \(0<\alpha \le t_u\), we have

$$\begin{aligned} p_D^*- p_U^*=\frac{\beta f[(1-f)(v-s)-3(c-s)]}{2(1-f)(4f^2+3\beta f-8f+4)}. \end{aligned}$$(48)Note that \(t_u>\frac{1-f}{3}\) can be proved in this case, so we derive that \(p_D^*\ge p_U^*\) for \(0<\alpha \le \frac{1-f}{3}\), and \(p_D^*< p_U^*\) for \(\frac{1-f}{3}<\alpha \le t_u\);

$$\begin{aligned} r_D^*- r_U^*=\frac{2(1-f)(f^2+\beta f-2f+1)(v-s)-(2f^2+3\beta f-4f+2)(c-s)}{2(1-f)(4f^2+3\beta f-8f+4)}. \end{aligned}$$(49)Denoting

$$\begin{aligned} t_1^r=\frac{2(1-f)(f^2+\beta f -2f+1)}{2f^2+3\beta f-4f+2}, \end{aligned}$$(50)we get that \(r_D^*\ge r_U^*\) for \(0<\alpha \le \min \{t_1^r,t_u\}\), and \(r_D^*< r_U^*\) for \(\min \{t_1^r,t_u\}<\alpha \le t_u\).

-

For \(t_u<\alpha \le t_d\), we have

$$\begin{aligned} p_D^*- p_U^*=\frac{f[(-2\beta ^2f-6\beta f^2-4f^3-\beta ^2+10\beta f+12f^2-4\beta -12f+4)(v-s)+(3\beta ^2-4f^2+8f-4)(c-s)] }{-2(4f^2+3\beta f-8f+4)(1-f)(\beta +f)}. \end{aligned}$$(51)Since

$$\begin{aligned}&\frac{-2\beta ^2f-6\beta f^2-4f^3-\beta ^2+10\beta f+12f^2-4\beta -12f+4}{-(3\beta ^2-4f^2+8f-4)}-t_d\end{aligned}$$(52)$$\begin{aligned}&\quad =\frac{2\beta ^2(4f^2+3\beta f-8f+4)(1-f-\beta )}{(3\beta ^2-4f^2+8f-4)(1-f)(2f+\beta -2)}>0, \end{aligned}$$(53)we have \(p_D^*< p_U^*\) in this case.

$$\begin{aligned} r_D^*- r_U^*= & {} \frac{(2\beta ^2f^2+4\beta f^3+2f^4-5\beta ^2 f-15\beta f^2-10f^3+17\beta f+18 f^2-6\beta -14f+4)(v-s)}{-2(4f^2+3\beta f-8f+4)(1-f)(\beta +f)}\nonumber \\&+\frac{(3\beta ^2f+5\beta f^2+2f^3-7\beta f-8f^2+2\beta +10f-4)(c-s)}{-2(4f^2+3\beta f-8f+4)(1-f)(\beta +f)}. \end{aligned}$$(54)Denoting

$$\begin{aligned} t_2^r=\frac{2\beta ^2 f^2 +4\beta f^3 +2f^4-5\beta ^2 f-15\beta f^2-10f^3+17 \beta f+18f^2-6\beta -14f+4}{-(3\beta ^2 f+5\beta f^2+2f^3-7\beta f-8f^2+2\beta +10f-4)}, \end{aligned}$$(55)we know that

$$\begin{aligned} t_2^r-t_d=\frac{2\beta f(4f^2+3\beta f-8f+4)(1-f-\beta )^2}{(3\beta ^2 f+5\beta f^2+2f^3-7\beta f-8f^2+2\beta +10f-4)(1-f)(2-2f-\beta )}<0, \end{aligned}$$(56)i.e., \(t_2^r<t_d\). Therefore, we can derive that \(r_D^*> r_U^*\) for \(\max \{t_2^r,t_u\}<\alpha \le t_d\), and \(r_D^*\le r_U^*\) for \(t_u<\alpha \le \max \{t_2^r,t_u\}\).

-

For \(t_d\le \alpha <1\), we have

$$\begin{aligned} p_D^*-p_U^*=\frac{-\beta ^2 f(1-f_\beta )(v-c)}{2(\beta ^2f+2\beta f^2+f^3-3\beta f-2f^2+\beta +f)(1-f)(\beta +f)}<0, \end{aligned}$$(57)i.e., \(p_D^*<p_U^*\).

$$\begin{aligned} r_D^*-r_U^*=\frac{\beta f(1-f-\beta )^2(v-c)}{2(\beta ^2f+2\beta f^2+f^3-3\beta f-2f^2+\beta +f)(1-f)(\beta +f)}>0, \end{aligned}$$(58)i.e., \(r_D^*>r_U^*\).

-

-

(2)

When \(f^2+\beta f-f+\beta > 0\), i.e, \(t_u> t_d\), we have three subcases:

-

For \(0<\alpha \le t_d\), we have

$$\begin{aligned} p_D^*- p_U^*=\frac{\beta f[(1-f)(v-s)-3(c-s)]}{2(1-f)(4f^2+3\beta f-8f+4)}. \end{aligned}$$(59)Then, we can derive that \(p_D^*\ge p_U^*\) for \(0<\alpha \le \min \{\frac{1-f}{3},t_d\}\), and \(p_D^*< p_U^*\) for \(\min \{\frac{1-f}{3},t_d\}<\alpha \le t_d\).

$$\begin{aligned} r_D^*- r_U^*=\frac{2(1-f)(f^2+\beta f-2f+1)(v-s)-(2f^2+3\beta f-4f+2)(c-s)}{2(1-f)(4f^2+3\beta f-8f+4)}. \end{aligned}$$(60)Since

$$\begin{aligned} \frac{2(1-f)(f^2+\beta f-2f+1)}{2f^2+3\beta f-4f+2}-t_d>0, \end{aligned}$$(61)we know that \(r_D^*> r_U^*\).

-

For \(t_d<\alpha \le t_u\), we have

$$\begin{aligned} p_D^*- p_U^*=\frac{f[(1-f)(1-f-\beta )^2(v-s)-(\beta ^2+\beta f+f^2-\beta -2f+1)(c-s)}{2(1-f)(\beta ^2f+2\beta f^2+f^3-3\beta f-2f^2+\beta +f)}. \end{aligned}$$(62)Define

$$\begin{aligned} t_3^p=\frac{(1-f)(1-f-\beta )^2}{\beta ^2+\beta f+f^2-\beta -2f+1}, \end{aligned}$$(63)we know that

$$\begin{aligned} t_3^p-t_u=\frac{-\beta ^2(1-f-\beta )}{\beta ^2+\beta f+f^2-\beta -2f+1}<0, \end{aligned}$$(64)i.e., \(t_3^p<t_u\). Then, we can derive that \(p_D^*\ge p_U^*\) for \(t_d<\alpha \le \max \{t_3^p,t_d\}\), and \(p_D^*< p_U^*\) for \(\max \{t_3^p,t_d\}<\alpha \le t_u\);

$$\begin{aligned} r_D^*- r_U^*=\frac{(1-f)^2(1-f-\beta )(v-s)-(\beta ^2 f+\beta f^2-\beta f+f^2-2f+1)(c-s)}{2(1-f)(\beta ^2f+2\beta f^2+f^3-3\beta f-2f^2+\beta +f)}. \end{aligned}$$(65)Since

$$\begin{aligned}&\frac{(1-f)^2(1-f-\beta )}{\beta ^2 f+\beta f^2-\beta f+f^2-2f+1}-t_u\nonumber \\&\quad =\frac{\beta f (1-\beta -f)^2}{\beta ^2 f+\beta f^2-\beta f+f^2-2f+1}>0, \end{aligned}$$(66)we know that \(r_D^*> r_U^*\);

-

For \(t_u\le \alpha <1\), the proof is the same as the third subcase in case (1), i.e., \(p_D^*<p_U^*\), \(r_D^*>r_U^*\). We avoid the repetition here.

-

\(\square\)

Moreover, by comparing the optimal profits in the two compensation cases, we have

which implies that \(\Pi _D^*\ge \Pi _U^*\).

Rights and permissions

About this article

Cite this article

Yuan, Z., Qin, J., Yan, X. et al. Compensation policy for delivery delay in online retailing. Oper Res Int J 22, 3869–3900 (2022). https://doi.org/10.1007/s12351-021-00687-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-021-00687-6