Abstract

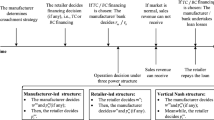

Supply chain finance plays a significant role in alleviating capital shortage, which optimizes supply chain performance. In this paper, we discuss the interaction of credit financing and channel encroachment in a dual-channel supply chain structure consisting of a supplier and a retailer. Under the Stackelberg structure, we observe the interaction between credit financing and channel encroachment is heavily dependent on the substitution degree, potential online market, and production cost. Intuitively, the supplier is more likely to choose trade credit financing, except in the case where both the potential online market, substitution degree, and production cost are small; under these conditions, bank credit financing may be an equilibrium strategy. As long as the production cost is below a certain threshold, the supplier will choose the trade credit financing strategy.

Similar content being viewed by others

References

An S, Li B, Song D, Chen X (2021) Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur J Oper Res 292:125–145

Babich V, Tang C (2004) Managing opportunistic supplier product adulteration: deferred payments, inspection, and combined mechanisms. Manuf Serv Oper Manag 14:301–314

Bernabucci RJ (2008) Supply chain gains from integration. Finan Execut 24:46–48

Chakuu S, Masi D, Godsell J (2020) Towards a framework on the factors conditioning the role of logistics service providers in the provision of inventory financing. Int J Oper Prod Manage, ahead-of-print.

Chao X, Chen J, Wang S (2008) Dynamic inventory management with cash flow constrains. Nav Res Logist 55:758–768

Chiang W, Chhajed D, Hess J (2003) Direct marketing, indirect profits: a strategic analysis of dual-channel supply-chain design. Manage Sci 49:1–20

Chod J (2017) Inventory, risk shifting, and trade credit. Manage Sci 63:3187–3206

Deng S, Gu C, Cai GG, Li Y (2018) Financing multiple heterogeneous suppliers in assembly systems: buyer finance vs. bank finance. Manuf Serv Oper Manag 20:53–69

Deng S, Fu K, Xu J, Zhu K (2021) The supply chain effects of trade credit under uncertain demands. Omega 98:102113

Deo S, Corbett C (2009) Cournot competition under yield uncertainty: the case of the U.S. influenza vaccine market. Manuf Serv Oper 11:563–576

Ding W, Wan G (2020) Financing and coordinating the supply chain with a capital-constrained supplier under yield uncertainty. Int J Prod Econ 230:107813

Frazier G, Lassar W (1996) Determinants of distribution intensity. J Mark 60:39–51

Fu K, Gong X, Hsu VN, Xue J (2020) Dynamic inventory management with inventory-based financing. Prod Oper Manag. https://doi.org/10.1111/poms.13323

Granot D, Sosic G (2005) Formation of alliances in Internet-based supply exchanges. Manage Sci 51:92–105

Guan H, Gurnani H, Geng X, Luo Y (2019) Strategic inventory and supplier encroachment. Manuf Serv Oper Manag 21:536–555

Gupta D, Wang L (2009) A stochastic inventory model with trade credit. Manuf Serv Oper Manag 11:4–18

Haley CW, Higgins RC (1973) Inventory policy and trade credit financing. Manage Sci 20:464–471

He Y, Huang HF, Li D (2020) Inventory and pricing decisions for a dual-channel supply chain with deteriorating products. Oper Res Int J 20:1461–1503

Huang G, Ding Q, Dong C, Pan Z (2018) Joint optimization of pricing and inventory control for dual-channel problem under stochastic demand. Ann Oper Res 298:307–337

Kim S, Shin H (2012) Sustaining production chains through financial linkages. Am Econ Rev 102:402–406

Kouvelis P, Zhao W (2012) Financing the newsvendor: supplier vs. bank, and the structure of optimal trade credit contracts. Oper Res 60:566–580

Lai G, Debo LG, Sycara K (2009) Sharing inventory risk supply chain: the implication of financial constraint. Omega 37:811–825

Lee YW, Stowe JD (1993) Product risk, asymmetric information, and trade credit. J Financ Quant Anal 28:285–300

Lei M, Liu H, Deng H, Huang T, Leong GK (2014) Demand information sharing and channel choice in a dual-channel supply chain with multiple retailers. Int J Prod Res 52:6792–6818

Li T, Xie J, Zhao X (2015) Supplier encroachment in competitive supply chains. Int J Prod Econ 165:120–131

Li B, An S, Song D (2018) Selection of financing strategies with a risk-averse supplier in a capital-constrained supply chain. Transp Res E Logist Transp Rev 118:163–183

Li X, Lin C, Zhan X (2019) Does change in the information environment affect financing choices? Manage Sci 65:5676–5696

Li T, Fang W, Dash WD, Zhang B (2020a) Inventory financing a risk-averse newsvendor with strategic default. Ind Manag Data Syst 120:1003–1038

Li J, Yi L, Shi V, Chen X (2020b) Supplier encroachment strategy in the presence of retail strategic inventory: centralization or decentralization? Omega 98:102213

Li G, Zheng H, Sethi SP, Guan X (2020c) Inducing downstream information sharing via manufacturer information acquisition and retailer subsidy. Decision Sci 51:691–719

Li R, Yang H, Shi Y, Teng J, Lai K (2021) EOQ-based pricing and customer credit decisions under general supplier payments. Eur J Oper Res 289:652–665

Liu Y, Zhang J (2006) Research note-The benefits of personalized pricing in a channel. Manage Sci 25:97–105

Liu M, Cao E, Salifou C (2016) Pricing strategies of a dual-channel supply chain with risk aversion. Transp Res E Logist Transp Rev 90:108–120

Long M, Malitz I, Ravid A (1993) Trade credit, quality guarantees, and product marketability. Financ Manage 22:117–127

Luo W, Shang K (2019) Technical note-managing inventory for firms with trade credit and deficit penalty. Oper Res 67:468–478

Maglaras C, Meissner J (2006) Dynamic pricing strategies for multiproduct revenue management problems. Manuf Serv Oper Manag 8:136–148

McGuire T, Staelin R (1983) An industry equilibrium analysis of downstream vertical integration. Mark Sci 27:115–130

Nalca A (2017) Price-matching guarantees in dual channels. Quant Mark Econ 15:1–22

Niu B, Xie F, Mu Z, Ji P (2020) Multinational firms’ local sourcing strategies considering unreliable supply and environmental sustainability. Resour Conserv Recycl 155:104648

Rui H, Lai G (2015) Sourcing with deferred payment and inspection under supplier product adulteration risk. Prod Oper Manag 24:934–946

Sang B (2021) Application of genetic algorithm and BP neural network in supply chain finance under information sharing. J Comput Appl Math 384:113170

Seifert RW, Seifert D (2011) Financing the chain. Int Commerce 10:32–44

Shen Y, Willems SP, Dai Y (2018) Channel selection and contracting in the presence of a retail platform. Prod Oper Manag 28:1173–1185

Shi J, Du Q, Lin F, Li Y, Lai KK (2020) Coordinating the supply chain finance system with buyback contract: a capital-constrained newsvendor problem. Comput Ind Eng 146:106587

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. Rand J Econ 15:546–554

Sun X, Tang W, Chen J, Li S, Zhang J (2019) Manufacturer encroachment with production cost reduction under asymmetric information. Transp Res E Logist Transp Rev 128:191–211

Taleizadeh AA, Pourmohammad-Zia N, Konstantaras I (2019) Partial linked-to-order delayed payment and life time effects on decaying items ordering. Oper Res Int Journal 21:2077–2099

Tang W, Li H (2020) Optimizing the credit term decisions in a dual-channel supply chain. Int J Prod Res. https://doi.org/10.1080/00207543.2020.1762018

Tang C, Yang S, Wu J (2017) Sourcing from suppliers with financial constraints and performance risk. Manuf Serv Oper 20:70–84

Wang W, Zhang Q (2019) Financing the newsvendor: raising the loan limit by insurance contract. Oper Res Int J 21:2907–2932

Wu D, Zhang B, Baron O (2018) A trade credit model with asymmetric competing retailers. Prod Oper Manag 28:206–231

Xu L, Shi J, Chen J (2021) Platform encroachment with price collusion: introducing a self-constructing online platform into the sea-cargo market. Comput Ind Eng 156:107266

Yan W, Xiong Y, Chu J, Li G, Xiong Z (2018) Clicks versus bricks: the role of durability in marketing channel strategy of durable goods manufacturers. Eur J Oper Res 265:909–918

Yan N, Jin X, Zhong H, Xu X (2020) Loss-averse retailers’ financial offerings to capital-constrained suppliers: loan vs investment. Int J Prod Econ 227:107665

Yang A, Birge J (2018) Trade credit, risk sharing, and inventory financing portfolios. Manage Sci 64:3667–3689

Yang H, Zhou W, Shao L, Talluri S (2021) Mean-variance analysis of wholesale price contracts with a capital-constrained retailer: trade credit financing vs bank credit financing. Eur J Oper Res (forthcoming)

Yoo S, Choi T, Kim D (2021) Integrating sourcing and financing strategies in multi-tier supply chain management. Int J Prod Econ 234:108039

Zhang S, Zhang J, Zhu G (2019a) Retail service investing: an anti-encroachment strategy in a retailer-led supply chain. Omega 84:212–231

Zhang J, Li S, Zhang S, Dai R (2019b) Manufacturer encroachment with quality decision under asymmetric demand information. Eur J Oper Res 273:217–236

Zhang C, Tian YX, Fan LW, Yang SM (2019c) Optimal ordering policy for a retailer with consideration of customer credit under two-level trade credit financing. Oper Res Int Journal 21:2409–2432

Zhen X, Shi D, Li Y, Zhang C (2020) Manufacturer’s financing strategy in a dual-channel supply chain: third-party platform, bank, and retailer credit financing. Transp Res Part E 133:101820

Zhou W, Lin T, Cai GG (2020) Guarantor financing in a four-party supply chain game with leadership influence. Prod Oper Manage Soc 29:2035–2056

Acknowledgements

Funding was provided by Shanghai Philosophy and Social Sciences Youth Project (Garnt No. 2020ECK002).

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Proposition 1

Under the scenario without capital constraint for supplier, we have

Under BCF scenario and retailer does not encroach the online market. In this case, the retailer’s profit is as \(\pi_{r} = \left( {p - w} \right)D_{r}^{{\text{N}}}\). In third stage, the retailer decides on her retail price. With \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {p^{BN} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{r}}} /\partial p^{BN} = 0\), we can derive expression of the optimal retail price in relation to the supplier’s direct price and wholesale price is \(p^{BN} = \frac{1 - a + w + d\delta }{2}\). In second stage, the supplier decides on his direct price and wholesale price. With \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (d^{BN} )^{2} < 0\) and \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (w^{BN} )^{2} < 0\), \(\partial {\uppi }_{{\text{s}}} /\partial d^{BN} = 0\) and \(\partial {\uppi }_{{\text{s}}} /\partial w^{BN} = 0\), we can derive expressions of the optimal direct price and wholesale price in relation to the creditor’s interest rate are \(w^{BN} = \frac{ - 1 + a - a\delta }{{2\left( { - 1 + \delta^{2} } \right)}} + \frac{{c\left( {1 + I_{BN} } \right)}}{2},d^{BN} = \frac{{a\left( { - 1 + \delta } \right) - \delta }}{{2\left( { - 1 + \delta^{2} } \right)}} + \frac{{c\left( {1 + I_{BN} } \right)}}{2}\). In first stage, the creditor sets interest rate. With \(\partial^{2} {\uppi }_{{\text{b}}} /\partial \left( {I_{BN} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{b}}} /\partial I_{BN} = 0\), we solve the optimal interest rate \(I_{BN} = \frac{{1 + \delta + a\left( {1 - \delta } \right)}}{{2c\left( {1 - \delta } \right)\left( {3 + \delta } \right)}} - \frac{1}{2}\). Then taking \(I_{BN}\) to \(w^{BN}\) and \(d^{BN}\), we can get the optimal wholesale price \(w^{BN} = - \frac{{7 + 4\delta + \delta^{2} + a\left( { - 5 + 4\delta + \delta^{2} } \right)}}{{4\left( {3 + \delta } \right)\left( { - 1 + \delta^{2} } \right)}} + \frac{c}{4}\) and direct price \(d^{BN} = \frac{{ - 1 - 8\delta - 3\delta^{2} + a\left( { - 7 + 4\delta + 3\delta^{2} } \right)}}{{4\left( {3 + \delta } \right)\left( { - 1 + \delta^{2} } \right)}} + \frac{c}{4}\). Next, we take \(w^{BN}\) and \(d^{BN}\) to \(p^{BN}\), we can get the optimal retail price \(p^{BN} = \frac{{ - 19 - 9\delta + 3\delta^{2} + \delta^{3} - a\left( { - 17 + 7\delta + 9\delta^{2} + \delta^{3} } \right)}}{{8\left( {3 + \delta } \right)\left( { - 1 + \delta^{2} } \right)}} + \frac{{c\left( {1 + \delta } \right)}}{8}\). Finally, we can derive out the participates’ profits as \(\pi_{b}^{{{\text{BN}}}} = \frac{{c^{2} \left( {1 - \delta } \right)\left( {3 + \delta } \right)}}{4}I_{{{\text{BN}}}}^{2}\), \(\pi_{s}^{{{\text{BN}}}} = \pi_{s}^{{{\text{NN}}}} - \frac{{3c^{2} \left( {1 - \delta } \right)\left( {3 + \delta } \right)}}{8}I_{{{\text{BN}}}}^{2}\) and \(\pi_{r}^{{{\text{BN}}}} = \frac{{\left[ {1 - a - c\left( {1 - \delta } \right)\left( {1 + I_{{{\text{BN}}}} } \right)} \right]^{2} }}{16}\).

1.2 Proof of Proposition 2

Under BCF scenario and retailer encroaches the online market. In this case, the retailer’s profit is as \(\pi_{r} = \left( {p - w} \right)D_{r}^{{\text{E}}} + \left( {b - w} \right)Q_{r}^{{\text{E}}}\). In third stage, the retailer decides on her retail price and booking price. With \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {p^{BE} } \right)^{2} < 0\), \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {b^{BE} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{r}}} /\partial p^{BE} = 0\), \(\partial {\uppi }_{{\text{r}}} /\partial b^{BE} = 0\), we can derive expression of the optimal retail price \(p^{BE} = \frac{{4 + a\left( { - 4 + \delta } \right) + 2d\delta + d\delta^{2} }}{{8 - 2\delta^{2} }} + \frac{w}{2}\) and booking price \(b^{BE} = \frac{{2a\left( { - 1 + \delta } \right) - \delta \left( {2 + d\left( {2 + \delta } \right)} \right)}}{{2\left( { - 4 + \delta^{2} } \right)}} + \frac{w}{2}\) in relation to the supplier’s direct price and wholesale price. In second stage, the supplier decides on his direct price and wholesale price. With \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (d^{BE} )^{2} < 0\) and \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (w^{BE} )^{2} < 0\), \(\partial {\uppi }_{{\text{s}}} /\partial d^{BE} = 0\) and \(\partial {\uppi }_{{\text{s}}} /\partial w^{BE} = 0\), we can derive expressions of the optimal direct price and wholesale price in relation to the creditor’s interest rate are \(d^{BE} = \frac{{a\left( { - 1 + \delta } \right) - \delta }}{{2\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{{c\left( {1 + I_{BE} } \right)}}{2},w^{BE} = \frac{ - 2 + a - a\delta }{{4\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{{c\left( {1 + I_{BE} } \right)}}{2}\). In first stage, the creditor sets interest rate. With \(\partial^{2} {\uppi }_{{\text{b}}} /\partial \left( {I_{BE} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{b}}} /\partial I_{BE} = 0\), we solve the optimal interest rate \(I_{{{\text{BE}}}} = \frac{{a\left( {1 - \delta } \right) + 2}}{{4c\left( {1 - \delta } \right)\left( {4 - \delta } \right)}} - \frac{1}{2}\). Then taking \(I_{BE}\) to \(w^{BE}\) and \(d^{BE}\), we can get the optimal wholesale price \(w^{BE} = \frac{{20 - 2\delta - 3a\left( {2 - 3\delta + \delta^{2} } \right)}}{{8\left( { - 4 + \delta } \right)\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{c}{4}\) and direct price \(d^{BE} = \frac{{4 + 18\delta - 4\delta^{2} + 3a\left( {6 - 7\delta + \delta^{2} } \right)}}{{8\left( { - 4 + \delta } \right)\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{c}{4}\). Next, we take \(w^{BE}\) and \(d^{BE}\) to \(p^{BE}\), we can get the optimal retail price \(p^{BE} = \frac{{ - 84 + 90\delta - 26\delta^{2} + 2\delta^{3} + a\left( {70 - 117\delta + 54\delta^{2} - 7\delta^{3} } \right)}}{{8\left( { - 4 + \delta } \right)\left( { - 1 + \delta } \right)\left( { - 4 + \delta^{2} } \right)}} + \frac{c}{{4\left( {2 - \delta } \right)}}\). Finally, we derive the participates’ profits as \(\pi_{b}^{{{\text{BE}}}} = \frac{{c^{2} \left( {1 - \delta } \right)\left( {4 - \delta } \right)}}{{2\left( {2 - \delta } \right)}}I_{{{\text{BE}}}}^{2}\),\({ }\pi_{s}^{{{\text{BE}}}} = \pi_{s}^{{{\text{NE}}}} - \frac{3}{2}\pi_{b}^{{{\text{BE}}}}\) and.

1.3 Proof of Lemma 1

When \({ }c \in \left[ {0,} \right.\left. {\overline{c}} \right)\),\(a \in \left[ {0,} \right.\left. {\overline{a}} \right)\), the retailer will encroach the online market. \(\begin{gathered} { }\pi_{r}^{BE} - \pi_{r}^{BN} = \frac{1}{{\left( { - 4 + \delta } \right)^{2} \left( {3 + \delta } \right)^{2} \left( { - 4 + \delta } \right)^{2} }}\left[ { - c^{2} \left( { - 4 + \delta } \right)^{2} \left( { - 1 + \delta } \right)^{2} \left( {2 + \delta } \right)^{2} \left( {3 + \delta } \right)^{2} } \right. \hfill \\ + 2c\left( { - 4 + \delta } \right)\left( { - 1 + \delta } \right)\left( {2 + \delta } \right)\left( {3 + \delta } \right)\left( { - 4 + 26a + 22\delta - 32a\delta - 3\delta^{2} + 5a\delta^{2} - \delta^{3} + a\delta^{3} } \right) \hfill \\ - 3656 + 10424a - 7682a^{2} + 1052\delta - 3436a\delta + 2619a^{2} \delta + 708\delta^{2} - 2180a\delta^{2} \hfill \\ + 1696a^{2} \delta^{2} - 184\delta^{3} + 580a\delta^{3} - 441a^{2} \delta^{3} - 29\delta^{4} + 114a\delta^{4} - 105a^{2} \delta^{4} \hfill \\ \left. { + 10\delta^{5} - 32a\delta^{5} + 26a^{2} \delta^{5} - \delta^{6} + 2a\delta^{6} - a^{2} \delta^{6} } \right]. \hfill \\ \hfill \\ \end{gathered}\).

We simplify its numerator to a quadratic function with \(c\) as its independent variable, then we write the numerator as \({\text{f}}\left( {\text{c}} \right)\). We can obtain that \(\Delta < 0\) and the quadratic coefficient \(- \left( { - 4 + \delta } \right)^{2} \left( { - 1 + \delta } \right)^{2} \left( {2 + \delta } \right)^{2} \left( {3 + \delta } \right)^{2} < 0\). According to the discriminant of the root of quadratic equation with one variable and the opening direction of function, we can know that \(f\left( c \right)\) is always smaller than 0. But \(\pi_{r}^{BE} - \pi_{r}^{BN} = \frac{1}{{\left( { - 4 + \delta } \right)^{2} \left( {3 + \delta } \right)^{2} \left( { - 4 + \delta^{2} } \right)}}f\left( c \right)\) and \(\frac{1}{{\left( { - 4 + \delta } \right)^{2} \left( {3 + \delta } \right)^{2} \left( { - 4 + \delta^{2} } \right)}} < 0\). Therefore, \(\pi_{r}^{BE} > \pi_{r}^{BN}\).

1.4 Proof of Proposition 3

Under TCF scenario and retailer does not encroach the online market. In this case, the retailer’s profit is as \(\pi_{r} = \left( {p - w} \right)D_{r}^{{\text{N}}} + cI_{TN} \left( {D_{s}^{{\text{N}}} + D_{r}^{{\text{N}}} } \right)\). In third stage, the retailer decides on her retail price. With \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {p^{TN} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{r}}} /\partial p^{TN} = 0\), we can derive expression of the optimal retail price in relation to the supplier’s direct price and wholesale price and interest rate is \(p^{TN} = \frac{{\left[ {1 - a + w + cI_{TN} \left( { - 1 + \delta } \right) + d\delta } \right]}}{2}\). In second stage, the supplier decides on his direct price and wholesale price. With \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (d^{TN} )^{2} < 0\) and \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (w^{TN} )^{2} < 0\), \(\partial {\uppi }_{{\text{s}}} /\partial d^{TN} = 0\) and \(\partial {\uppi }_{{\text{s}}} /\partial w^{TN} = 0\), we can derive expressions of the optimal direct price and wholesale price in relation to the creditor’s interest rate are \(w^{TN} = \frac{{1 + a\left( { - 1 + \delta } \right)}}{{2\left( {1 - \delta^{2} } \right)}} - \frac{{c\left[ { - 1 + I_{TN} \left( { - 2 + \delta } \right)} \right]}}{2},d^{TN} = \frac{{a\left( { - 1 + \delta } \right) - \delta }}{{2\left( { - 1 + \delta^{2} } \right)}} + \frac{{c\left( {1 + I_{TN} } \right)}}{2}\). In first stage, the retailer as a creditor sets interest rate. With \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {I_{TN} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{r}}} /\partial I_{TN} = 0\), we solve the optimal interest rate \(I_{TN} = \frac{{\delta + a\left( {1 - \delta } \right)}}{{2c\left( {1 - \delta } \right)\left( {1 + \delta } \right)}} - \frac{1}{2}\). Then taking \(I_{TN}\) to \(w^{TN}\) and \(d^{TN}\), we can get the optimal wholesale price \(w^{TN} = \frac{{2 + \left( {2 - a} \right)\delta - \left( {1 - a} \right)\delta^{2} }}{{4\left( {1 - \delta^{2} } \right)}} + \frac{c\delta }{4}\) and direct price \(d^{TN} = \frac{{3\left[ {a\left( {1 - \delta } \right) + \delta } \right]}}{{4\left( {1 - \delta^{2} } \right)}} + \frac{c}{4}\). Next, we take \(w^{TN}\), \(d^{TN}\) and \(I_{TN}\) to \(p^{TN}\), we can get the optimal retail price \(p^{TN} = \frac{{3\left[ {1 - a\left( {1 - \delta } \right)} \right]}}{{4\left( {1 - \delta^{2} } \right)}} + \frac{c}{4}\). Finally, we derive the participates’ profits as \(\pi_{s}^{TN} = \pi_{s}^{NN} - \frac{{3c^{2} \left( {1 - \delta^{2} } \right)}}{4}I_{TN}^{2}\) and \(\pi_{r}^{TN} = \pi_{r}^{NN} + \frac{{c^{2} \left( {1 - \delta^{2} } \right)}}{2}I_{TN}^{2}\).

1.5 Proof of Proposition 4

Under TCF scenario and retailer encroaches the online market. In this case, the retailer’s profit is as \(\pi_{r} = \left( {p - w} \right)D_{r}^{{\text{E}}} + \left( {b - w} \right)Q_{r}^{{\text{E}}} + cI_{{{\text{TE}}}} \left( {D_{s}^{{\text{E}}} + D_{r}^{{\text{E}}} + Q_{r}^{{\text{E}}} } \right)\). In third stage, the retailer decides on her retail price and booking price. With \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {p^{TE} } \right)^{2} < 0\), \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {b^{TE} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{r}}} /\partial p^{TE} = 0\), \(\partial {\uppi }_{{\text{r}}} /\partial b^{TE} = 0\). We can derive expression of the optimal retail price \(p^{TE} = \frac{{4\left( {1 + w} \right) + a\left( { - 4 + \delta } \right) + 2d\delta + d\delta^{2} - w\delta^{2} + 2cI_{TE} \left( { - 2 + \delta + \delta^{2} } \right)}}{{2\left( {4 - \delta^{2} } \right)}}\) and booking price \(b^{TE} = \frac{{4w - 2a\left( { - 1 + \delta } \right) + 2\delta + 2d\delta + d\delta^{2} - w\delta^{2} + 2cI_{TE} \left( { - 2 + \delta + \delta^{2} } \right)}}{{2\left( {4 - \delta^{2} } \right)}}\) in relation to the supplier’s direct price, wholesale price and interest rate. In second stage, the supplier decides on his direct price and wholesale price. With \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (d^{TE} )^{2} < 0\) and \(\partial^{2} {\uppi }_{{\text{s}}} /\partial (w^{TE} )^{2} < 0\), \(\partial {\uppi }_{{\text{s}}} /\partial d^{TE} = 0\) and \(\partial {\uppi }_{{\text{s}}} /\partial w^{TE} = 0\), we can derive expressions of the optimal direct price and wholesale price in relation to the creditor’s interest rate are \(w^{TE} = \frac{{4 - 2\delta - a\left( {2 - 3\delta + \delta^{2} } \right)}}{{4\left( { - 2 + \delta } \right)\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{{cI_{TE} \left( {4 - 3\delta } \right)}}{{2\left( {2 - \delta } \right)}} + \frac{c}{2},d^{TE} = \frac{{a\left( { - 1 + \delta } \right) - \delta }}{{2\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{{c\left( {1 + I_{TE} } \right)}}{2}\). In first stage, the retailer as a creditor sets interest rate. With \(\partial^{2} {\uppi }_{{\text{r}}} /\partial \left( {I_{TE} } \right)^{2} < 0\) and \(\partial {\uppi }_{{\text{r}}} /\partial I_{TE} = 0\), we solve the optimal interest rate \(I_{TE} = \frac{{\delta + a\left( {1 - \delta } \right)}}{{2c\left( {1 - \delta } \right)\left( {2 + \delta } \right)}} - \frac{1}{2}\). Then taking \(I_{TE}\) to \(w^{TE}\) and \(d^{TE}\), we can get the optimal wholesale price \(w^{TE} = \frac{{4 + 2a\left( { - 1 + \delta } \right)^{2} + 2\left( {1 + c} \right)\delta - \left( {3 + c} \right)\delta^{2} - c\delta^{3} }}{{4\left( { - 2 + \delta } \right)\left( { - 2 + \delta + \delta^{2} } \right)}}\) and direct price \(d^{TE} = \frac{{3\left[ {a\left( { - 1 + \delta } \right) - \delta } \right]}}{{4\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{c}{4}\). Next, we take \(w^{TE}\), \(d^{TE}\) and \(I_{TE}\) to \(p^{TE}\), we get the optimal retail price \(p^{TE} = \frac{{ - 10 - 9a\left( { - 1 + \delta } \right) + 4\delta }}{{8\left( { - 2 + \delta + \delta^{2} } \right)}} + \frac{c}{4}\). Finally, we derive the participates’ profits as \(\pi_{s}^{{{\text{TE}}}} = \pi_{s}^{{{\text{NE}}}} - \frac{{3c^{2} \left( {1 - \delta } \right)\left( {2 + \delta } \right)}}{{4\left( {2 - \delta } \right)}}I_{{{\text{TE}}}}^{2}\) and \(\pi_{r}^{{{\text{TE}}}} = \pi_{r}^{{{\text{NE}}}} + \frac{{c^{2} \left( {1 - \delta } \right)\left( {2 + \delta } \right)}}{{2\left( {2 - \delta } \right)}}I_{{{\text{TE}}}}^{2}\).

1.6 Proof of Lemma 2

When \(\pi_{r}^{TE} - \pi_{r}^{TN} > 0\), the retailer will encroach the online market, otherwise, she doesn’t encroach. \(\pi_{r}^{TE} - \pi_{r}^{TN} = \frac{1}{{64\left[ {\left( {2 -\delta } \right)\left( {1 - \delta } \right)\left( {1 + \delta }\right)\left( {2 + \delta } \right)} \right]}}\left\{ {24 - 72a -12\delta - } \right\}\)\(4a\delta - 44\delta^{2} + 128a\delta^{2} + 20\delta^{3} - 44a\delta^{3} + 4\delta^{4} - 8a\delta^{4} + 4c^{2} \left( { - 1 + \delta } \right)^{2} \left( {4 + 4\delta + \delta^{2} + 2\delta^{3} + \delta^{4} } \right) + a^{2} \left( {34 + 21\delta - 86\delta^{2} + 27\delta^{3} + 4\delta^{4} } \right)\)\(+ c\left[ { - 8a\left( { - 1 + \delta } \right)^{3}\left( {2 + 3\delta + \delta^{2} } \right) + 8\left( { - 1 + \delta } \right)^{2} \delta \left( {2 + 3\delta + \delta^{2} } \right)}\right].\) As evidenced by Lemma 1, the equilibrium strategy is as summarized in the text.

1.7 Proof of Lemma 3

According to the retailer behavior equilibrium, we discuss how the supplier considers different credit financing strategies. Through the similar steps as before, we divide the range of \(\delta ,c\) and \(a\) into the following intervals

-

1.

consider the substitution degree \(\delta \in \left[ {0,} \right.\left. {0.319} \right)\), (i) if the production cost \(c \in \left[ 0 \right.,\left. {c_{3} } \right)\) and potential online market \(a \in \left[ 0 \right.,\left. {\overline{a}} \right)\) or production cost \(c \in \left[ {c_{3} ,} \right.c_{1} )\) and potential online market \(a \in \left[ {a_{1} } \right.,\left. {\overline{a}} \right)\) or \(a \in \left[ {a_{2} } \right.,\left. {\overline{a}} \right)\) or \(c \in \left[ {c_{1} ,} \right.\overline{c})\) and \(a \in \left[ {a_{2} } \right.,\left. {\overline{a}} \right)\), the supplier will choose trade credit financing strategy; (ii) if the production cost \(c \in \left[ {c_{3} ,} \right.\left. {c_{1} } \right)\) and potential online market \(a \in {\text{min}}\left\{ {a_{1} ,a_{2} } \right\}\) or \(c \in \left[ {c_{1} ,} \right.\overline{c})\) and \(a \in {\text{min}}\left\{ {\overline{a},a_{2} } \right\}\) the supplier will choose bank credit financing strategy.

-

2.

consider the substitution degree \(\delta \in [\left. {0.319,0.505} \right)\), (i) if the production cost \(c \in \left[ 0 \right.,\left. {c_{3} } \right)\) and potential online market \(a \in \left[ 0 \right.,\left. {\overline{a}} \right)\), the supplier will choose trade credit financing strategy; (ii) if \(c \in \left[ {c_{3} ,} \right.\overline{c})\) and potential online market \(a \in {\text{min}}\left\{ {a_{1} ,a_{2} } \right\}\), the supplier will choose bank credit financing strategy, otherwise, he will choose trade credit financing strategy.

-

3.

consider the substitution degree \(\delta \in [\left. {0.505,1} \right)\), if \(c \in \left[ {0,} \right.\overline{c})\) and \(a \in \left[ 0 \right.,\left. {\overline{a}} \right)\), the supplier will choose trade credit financing.

Rights and permissions

About this article

Cite this article

Xu, L., Luo, Y., Shi, J. et al. Credit financing and channel encroachment: analysis of distribution choice in a dual-channel supply chain. Oper Res Int J 22, 3925–3944 (2022). https://doi.org/10.1007/s12351-022-00699-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-022-00699-w