Abstract

Recently, different greening activities in various steps of a supply chain are being used to keep a system sustainable. As a result, it creates a terrific business opportunity for a business concern. In such a direction, the present study develops a supplier-manufacturer-retailer green supply chain model under a bi-level greening performance. The first level of a greening performance is in the raw-materials delivered by a supplier, while the second level is in the production process of the manufacturer’s production house. The novelty of this model is that stocking decision has been taken on the basis of levels of these greening activities. Also, here the supplier offers a credit period to the manufacturer based on the quantity and quality of the raw-materials ordered by him/her, whereas the manufacturer forwards a credit period, which has been assumed as type-2 fuzzy in nature to tackle a non-random uncertainty, to the retailer. Under such a fuzzy uncertain environment, a new defuzzification process has been proposed to get the optimal solution of the model. Comparing different scenarios of the proposed model, our findings reveal that although bi-level greening performance is beneficial from the perspective of the whole supply chain, it is less profitable from the manufacturer’s point of view. It also reveals that bi-level greening activity positively impacts the credit policy of supply chain members. On the sustainability issue, the imperfect production has a negative impact on economic and environmental performances. Finally, several practical managerial implications have been provided to make a decision on bi-level greening performance.

Similar content being viewed by others

Notes

https://hmgroup.com/sustainability/Planet/materials/cotton.htmlLast accessed 10th March 2022.

https://www.inditex.com/documents/10279/249245/SustainabilityCommitment2021.pdf/65a6cfb3-6501-ed48-5836-18ae983428d7Last accessed 10th March 2022.

https://www.patagonia.com/denim.html Last accessed 10th March 2022.

https://www.wrangler.co.uk/uk-en/indigood-sustainable-denim/ Last accessed 8th March 2020.

Earthwards: The Unique Johnson & Johnson Program That’s Helping to Create a More Sustainable World?, Johnson & Johnson.https://www.jnj.com/innovation/earthwards-a-johnson-and-johnson-program-helping-create-a-more-sustainableworld. Last accessed 8th March 2022.

https://www.patagonia.com/our-footprint/ Last accessed 7th July 2022.

How sustainable is organic cotton, really? https://www.vogue.in/fashion/content/how-sustainable-is-organic-cotton-really Last accessed 7th July 2022.

https://bettercotton.org/Last accessed 24th March 2022.

https://apparelcoalition.org/Last accessed 24th March 2022.

Abbreviations

- B2B:

-

Business to Business

- BCI:

-

Better Cotton Initiative

- DCF:

-

Discounted Cash Flow

- EOQ:

-

Economic Order Quantity

- EPQ:

-

Economic Production Quantity

- EI:

-

Environmental impact

- FOU:

-

Footprint of Uncertainty

- SMG:

-

Secondary Membership Grade

- GMO:

-

Genetically Modified Cotton

- GSC:

-

Green Supply Chain

- GSCM:

-

Green Supply Chain Management

- LMF:

-

Lower Membership Function

- PFOA:

-

Perfluorooctanoic acid

- SC:

-

Supply Chain

- SCM:

-

Supply Chain Management

- SMEs:

-

Small and medium-sized enterprises

- SAC:

-

Sustainable Apparel Coalition

- SW :

-

Social Welfare

- TFN:

-

Triangular Fuzzy Number

- TRS:

-

Type Reduced Set

- UMF:

-

Upper Membership Function

References

Alikar N, Mousavi SM, Ghazilla RAR, Tavana M, Olugu EU (2017) A bi-objective multi-period series-parallel inventory-redundancy allocation problem with time value of money and inflation considerations. Comput Ind Eng 104:51–67

An S, Li B, Song D, Chen X (2021) Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur J Oper Res 292(1):125–142

Banu A, Mondal SK (2020) Analyzing an inventory model with two-level trade credit period including the effect of customers’ credit on the demand function using q-fuzzy number. Oper Res 20:1559–1587

Banu A, Manna AK, Mondal SK (2021) Adjustment of credit period and stock-dependent demands in a supply chain model with variable imperfectness. Rairo-Oper Res 55(3):1291–1324

Bera R, Mondal SK (2022) A multi-objective transportation problem with cost dependent credit period policy under Gaussian fuzzy environment. Oper Res. https://doi.org/10.1007/s12351-022-00691-4

Buzacott JA (1975) Economic order quantities with inflation. Oper Res Quart 26:553–558

Chen T-H (2017) Optimizing pricing, replenishment and rework decision for imperfect and deteriorating items in a manufacturer-retailer channel. Int J Prod Econ 183:539–550

Chen W, Wei L, Li Y (2018) Fuzzy multicycle manufacturing/remanufacturing production decisions considering inflation and time value of money. J Clean Prod 198:1494–1502

Das BC, Das B, Mondal SK (2013) Integrated supply chain model for a deteriorating item with procurement cost dependent credit period. Comput Ind Eng 64:788–796

Das BC, Das B, Mondal SK (2014) Optimal transportation and business cycles in an integrated production-inventory model with a discrete credit period. Transp Res Part E 68:1–13

Das BC, Das B, Mondal SK (2015) An integrated production inventory model under interactive fuzzy credit period for deteriorating item with several markets. Appl Soft Comput 28:453–465

Das BC, Das B, Mondal SK (2017) An integrated production-inventory model with defective item dependent stochastic credit period. Comput Ind Eng 110:255–263

Dey JK, Mondal SK, Maiti M (2008) Two storage inventory problem with dynamic demand and interval valued lead-time over finite time horizon under inflation and time value of money. Eur J Oper Res 185:170–194

Dey K, Saha S (2018) Influence of procurement decisions in two-period green supply chain. J Clean Prod 190:388–402

Dolai M, Mondal SK (2021) Work performance dependent screening process under preservation technology in an imperfect production system. J Ind Prod Eng 38(6):416–430

Diabat A, Govindan K (2011) An analysis of the drivers affecting the implementation of green supply chain management. Resour Conserv Recycl 55:659–667

Dou G, Choi T-M (2021) Does implementing trade-in and green technology together benefit the environment? Eur J Oper Res 295:517–533

Galbreth MR, Ghosh B (2013) Competition and sustainability: the impact of consumer awareness. Decis Sci 44(1):127–159

Ghosh D, Shah J (2012) A comparative analysis of greening policies across supply chain structures. Int J Prod Econ 135:568–583

Ghosh D, Shah J (2012) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Giri BC, Mondal C, Maiti T (2018) Analysing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. J Clean Prod 190:822–837

Goyal SK (1985) Economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 36:335–338

Guo S, Choi T-M, Shen B (2020) Green product development under competition: a study of the fashion apparel industry. Eur J Oper Res 280:523–538

Heydari J, Rastegar M, Glock CH (2017) A two-level delay in payments contract for supply chain coordination: the case of credit-dependent demand. Int J Prod Econ 191:26–36

Hong Z, Guo X (2019) Green product supply chain contracts considering environmental responsibilities. Omega 83:155–166

Jaber MY, Guiffrida AL (2008) Learning curves for imperfect production processes with reworks and process restoration interruptions. Eur J Oper Res 189:93–104

Jamali M-B, Rasti-Barzoki M (2018) A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J Clean Prod 170:1029–1043

Johari M, Hosseni-Mahdi S-M, Nematollahi M, Goh M, Ignatius J (2018) Bi-level credit period co-ordination for periodic review inventory system with price-credit dependent demand under time value of money. Transp Res Part E 114:270–291

Konstantaras I, Skouri K, Jaber MY (2012) Inventory models for imperfect quality items with shortages and learning in inspection. Appl Math Model 36:5334–5343

Lin T-Y, Sarker BR (2017) A pull system inventory model with carbon tax policies and imperfect quality items. Appl Math Model 50:450–462

Manna AK, Dey JK, Mondal SK (2017) Imperfect production inventory model with production rate dependent defective rate and advertisement dependent demand. Comput Ind Eng 104:9–22

Manna AK, Das B, Dey JK, Mondal SK (2017) Two layers green supply chain imperfect production inventory model under bi-level credit period. Tekhne 15:124–142

Manna AK, Das B, Tiwari S (2019) Impact of carbon emission on imperfect production inventory system with advance payment base free transportation". RAIRO-Oper Res. https://doi.org/10.1051/ro/2019015

Manna AK, Bhunia AK (2022) Investigation of green production inventory problem with selling price and green level sensitive interval-valued demand via different metaheuristic algorithms. Soft Comput. https://doi.org/10.1007/s00500-022-06856-9

Misra RB (1979) A note on optimal inventory management under inflation. Naval Res Logist 26:161–165

Pal S, Mahapatra GS (2017) A manufacturing-oriented supply chain model for imperfect quality with inspection errors, stochastic demand under rework and shortages. Comput Ind Eng 106:299–314

Panja S, Mondal SK (2019) Analyzing a four-layer green supply chain imperfect production inventory model for green products under type-2 fuzzy credit period. Comput Ind Eng 129:435–453

Panja S, Mondal SK (2020a) Exploring a two-layer green supply chain game theoretic model with credit linked demand and mark-up under revenue sharing contract. J Clean Prod 250:119491

Panja S, Mondal SK (2020b) Analytics of an imperfect four-layer production inventory model under two-level credit period using branch-and-bound technique. J Oper Res Soc China. https://doi.org/10.1007/s40305-020-00300-1

Rosenblatt MJ, Lee HL (1986) Economic production cycles with imperfect production processes. IIE Trans 18:48–55

Roy A, Pal S, Maiti MK (2009) A production inventory model with stock dependent demand incorporating learning and inflationary effect in a random planning horizon: A fuzzy genetic algorithm with varying population size approach. Comput Ind Eng 57:1324–1335

Sarkis J, Zhu Q, Lai K-H (2011) An organizational theoretic review of green supply chain management literature. Int J Prod Econ 130:1–15

Song H, Gao Xu (2018) Green supply chain game model and analysis under revenue-sharing contract. J Clean Prod 170:183–192

Srivastava SK (2007) Green supply chain management: a state-of-the-art literature review. Int J Manag Rev 9:53–80

Swami S, Shah J (2013) Channel coordination in green supply chain management. J Oper Res Soc 64:336–351

Taleizadeh AA, Khanbaglo MPS, Cardenas-Barron LE (2016) An EOQ inventory model with partial backordering and reparation of imperfect products. International Journal of Production Economics 182:418–434

Taleizadeh AA, Nematollahi M (2014) An inventory control problem for deteriorating items with back-ordering and financial considerations. Appl Math Model 38:93–109

Tiwari S, Daryanto Y, Wee HM (2018) Sustainable inventory management with deteriorating and imperfect quality items considering carbon emission. J Clean Prod 192:281–292

Tseng M-L, Islam MS, Karia N, Fauzi FA, Afrin S (2019) A literature review on green supply chain management: trends and future challenges. Resour Conserv Recycl 141:145–162

Tumpa TJ, Ali SM, Rahaman MH, Paul SK, Chowdhury P, Khan SAR (2019) Barriers to green supply chain management: an emerging economy context. J Clean Prod. https://doi.org/10.1016/j.jclepro.2019.117617

Vandana Kaur A (2019) Two-level trade credit with default risk in the supply chain under stochastic demand. Omega 88:4–23

Wu J, Ouyang L-Y, Cárdenas-Barrón LE, Goyal SK (2014) Optimal credit period and lot size for deteriorating items with expiration dates under two-level trade credit financing. Eur J Oper Res 237:898–908

Wu DD, Yang L, Olson D (2019) Green supply chain management under capital constraint. Int J Prod Econ 215:3–10

Xu S, Fang L (2020) Partial credit guarantee and trade credit in an emission-dependent supply chain with capital constraint. Transp Res Part E 135:101859

Xu S, Fang L, Govindan K (2022) Energy performance contracting in a supply chain with financially asymmetric manufacturers under carbon tax regulation for climate change mitigation. Omega 106:102535

Yang D, Xiao T (2017) Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J Clean Prod 149:1174–1187

Acknowledgements

This research work was supported by Council of Scientific and Industrial Research, Human Resource Development Group, India [25(0276)/17/EMR-II].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported is this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Manufacturer’s holding cost for the raw-materials:

As discussed in Section 4.2.1, here we have derived the total raw-materials holding cost by considering two different cycle structures: Raw-materials holding cost for the first \(k_1\) cycles and raw-materials holding cost for remaining \((k-k_1)\) cycles. We have considered the scenarios because of the variation in inventory patterns. As we can observe from Fig. 2, during the first \(k_1\) cycles, at the start of every cycle, the manufacturer has raw-materials stock carried out from the previous cycle along with the ordered amount from the supplier. On the other side, in the remaining \((k-k_1)\) cycles, there is no replenishment from the supplier; only the unused raw-materials of the first \(k_1\) cycles are used for production. Now, we will formulate the holding costs for these two cycle structures and then finally, taking the sum of the obtained holding costs, we get the manufacturer’s total holding cost for raw-materials.

Raw-materials holding cost for first \(k_1\) cycles:

Let us denote \(I_r(t)\) as the manufacturer’s raw-materials inventory level at any instant t \((0 \le t \le kT)\). For the first \(k_1\) cycles, the governing differential equation for \(I_r (t)\) is given by

The solution of the differential equation (A.1) is (using \(Q_p = fPT\))

Therefore the present value of holding cost for the i-th cycle (\(i = 1, 2,...., k_1\)) is

Raw-materials holding cost for remaining \(k - k_1\) cycles:

The governing differential equation that delineate the structure of manufacturer’s remaining in-stock raw-materials is expressed as the following

Similarly, using the solution of differential equation (A.3) we get the present value of holding cost for the i-th cycle (\(i = k_1, k_1 + 1, ....., k-1\)) as

Using (A.2) and (A.4), we get the present value of total holding cost for raw-materials as

Manufacturer’s paid interest to the supplier:

Present value of the total paid interest to the supplier is given by

Appendix B

Manufacturer’s holding cost for the good finished products:

Here we have formulated the total holding cost for perfect quality items by considering two different cycle structures: Holding cost of good finished products for the first k cycles and holding cost of good finished products for the remaining \((n-k)\) cycles. During the first k cycles, production continues in the manufacturing system and at the end of the \(i-\)th cycle (\(i=1,2,......,k\)), the retailer replenishes \(Q_r\) amount of perfect quality items from the manufacturer. After fulfilling the retailer’s requirement, the manufacturer stocks the remaining items carried out into the next cycle. This process continues until the time kT, i.e., the end of the k-th cycle. On the other side, there is no production for the remaining \((n-k)\) cycles. Only the items kept in stock during the last k cycles are used to fulfil the retailer’s requirement.

Holding cost of good finished products for first k cycles:

Let \({(I_f)}_{i} (t)\) be the good green products’ inventory level at time \(t \in [(i-1)T, iT]\), where \(i = 1,2,3,...,k\). Then the differential equation for \({(I_f)}_{i} (t)\) can be expressed as

with the initial condition \({(I_f)}_{1} (0) = 0\) and \({(I_f)}_{i} (iT) = {(I_f)}_{i} ((i-1)T) - Q_r, i = 2,3,...,k\)

Therefore the manufacturer’s good green products’ inventory level at time \(t \in [(i-1)T, iT]\) is given by

So, using (A.8), we get the present value of the holding cost for good green products for the i-th cycle (\(i = 1,2,...., k\)) as

Holding cost of good finished products for remaining \((n -k)\) cycles:

The present value of the holding cost for good green products for the remaining i-th cycle (\(i = k, k + 1, ....., n-1\)) is given by

Using (A.9) and (A.10), we get the present value of total holding cost for good finished items as

Appendix C

Derivation of \(RNP_n\) and RIEB:

First, we derive the net profit in total n cycles (\(RNP_n\)). To do that, the net profit in each of the ith-cycle (\(RNP_i, i=1,2,...,n\))has to be calculated. Then by adding all these profits, we can get the net profit in n-cycles.

Let \({(J_r)}_{i}(t)\) be the inventory level of the retailer at time \(t\in [iT, (i+1)T], i = 1,2,...,n\). Then from the inventory pattern of the retailer (see Level 4) for the i-th cycle we can derive the differential equation of \({(J_r)}_{i}(t)\) as:

Then the solution of the differential equation (A.12) is \(J_r (t) = (i+1)DT -Dt, iT \le t \le (i+1) T\) and \(i = 1,2,......,n\).

Using the solution, we get the present value of the retailer’s holding cost for the i-th cycle is \(RHC_i = \frac{C_{rh} D}{R^2} {\big (e^{-(i+1)RT} + (RT-1) e^{-iRT}\big )}\), where \(i = 1, 2, ...., n\).

Similar to the case of the manufacturer, here also for each cycle, the retailer’s purchasing price will be evaluated at time iT, \(i=1,2,....,n\). Therefore the present value of the retailer’s purchasing cost for the i-th order (\(i = 1, 2, ...., n\)) is \(RPC_{i} = S_m Q_r e^{-iRT}\).

The retailer’s pricing strategy is also the same as in Panja and Mondal (2019, 2020a), i.e., he/she retails each product at a price \(S_r = m_2 S_m\), where \(m_2 (>1)\) is a mark-up on the manufacturer’s wholesale price. Here, the retailer instantly collects revenue from the market customers by selling each product. So, the present value of the sales revenue of the retailer for the i-th cycle is \(RSR_i = \frac{S_r D}{R} {(e^{-iRT} - e^{-(i+1)RT})}, i = 1,2,....,n\).

Since the retailer earns his/her revenue by selling a single green product during the interval \([iT, (i+1)T]\) and pays the payment at time \((i+1)T\) for the i-th cycle, he/she can earn interest from this selling amount up to time \((i+1)T\). Thus, we get the present value of the interest earned by the retailer in each of the i-th cycle as \(RIE_{i}= \frac{I_e S_rD}{R^2} \big \{e^{-(i+1)RT} + (RT-1) e^{-iRT}\big \}\), (\(i = 1, 2, ...., n\)).

In each cycle, the retailer has to pay interest to the manufacturer. Since the payable interest is calculated based on the purchasing price, the present value of payable interest for the i-th cycle (\(i = 1, 2, ...., n\)) is \(RIP_{i} = I_p S_m e^{-iRT}D \frac{(T-N)^2}{2}\).

Present value of the retailer’s ordering cost for the i-th cycle (\(i = 1, 2, ...., n\)) is \(ROC_{i} = A_r e^{-iRT}\)

So, the net profit of the retailer in each of the i-th cycles under present value consideration is

Therefore the present value of the retailer’s net profit for the total n cycles is

Next, we obtain the total interest earned from the bank (RIEB). In that policy, the retailer deposits the net profit of each cycle in the bank and earns interest on the deposited amount during the remaining time of the year. Thus, \(RNP_1\), the net profit of the first cycle, is deposited in the bank for the duration of \((n-1)T\). Similarly, the net profit in the second cycle \((RNP_2)\) is deposited in the bank for the duration \((n-2)T\). Proceeding in this way, we can get the total interest earned by the retailer from the bank during his/her total business period as

Appendix D

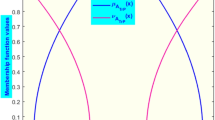

Evaluation of TRS of \(\widetilde{\widetilde{N}}\):

The explicit expression of \(\mu _{\widetilde{N}} (x)\) has been derived in the form of following cases depending on the position of x:

Case 1. when \(N_0 - \Delta _1 \le x \le N_0\):

Here, \(\mu _1 (x) = 0\) and \(\mu _2 (x) = \frac{\{x-(N_0-\Delta _1)\} w_2}{\Delta _1}\). So, in this domain, the membership function of TRS is given by

Case 2. when \(N_0 \le x \le N_0 + \Delta _2\):

Here, \(\mu _1 (x) = \frac{(x-N_0) w_1}{\Delta _2}\) and \(\mu _2 (x) = w_2\). So, in this domain, the membership function of TRS is given by

Case 3. when \(N_0 + \Delta _2 \le x \le N_1 - \Delta _1\):

Here, \(\mu _1 (x) = w_1\) and \(\mu _2 (x) = w_2\). Therefore, in this domain, the membership function of TRS is given by

Case 4. when \(N_1 - \Delta _1 \le x \le N_1\):

Here, \(\mu _1 (x) = \frac{(N_1-x) w_1}{\Delta _1}\) and \(\mu _2 (x) = w_2\). So, in this domain, the membership function of TRS is given by

Case 5. when \(N_1 \le x \le N_1 + \Delta _2\):

Here, \(\mu _1 (x) = 0\) and \(\mu _2 (x) = \frac{\{(N_1 +\Delta _2) -x\} w_2}{\Delta _2}\). Thus, in this domain, the membership function of TRS is given by

The explicit expression of \(\mu _{\widetilde{N}} (x)\) for every \(x\in [N_0-\Delta _1, N_1+\Delta _2]\) is obtained using (A.15)-(A.19) as

where \(w' = \frac{w_2 (\eta _1 + 2 \eta _2)}{w_1 (\eta _2 + 2\eta _1)}\). Here, \(\mu _{\widetilde{N}}(x)\) is a generalized hexagonal fuzzy number.

Evaluation of the centroid of \(\widetilde{N}\):

Here, we get the TRS, \(\widetilde{N}\) as a generalized hexagonal fuzzy number whose membership function has been presented in equation (A.20). The centroid of the mentioned fuzzy number can be obtained through following theorem.

Theorem 1

The centroid of the hexagonal fuzzy number \(\widetilde{N}\) is given by

Proof

We have from equation (A.20)

Theorem 2

The crisp form of the joint type-2 fuzzy profit \(JTP_{(n, k_1, \eta , \theta )}(\widetilde{\widetilde{N}})\) is given by

where \(t_0 = {JTP}_{(n,k_1,\eta ,\theta )} (N_0-\Delta _1), t_1 = {JTP}_{(n,k_1,\eta ,\theta )} (N_0), t_2 = {JTP}_{(n,k_1,\eta ,\theta )} (N_0 + \Delta _2), t_3 = {JTP}_{(n,k_1,\eta ,\theta )} (N_1 - \Delta _1), t_4 = {JTP}_{(n,k_1,\eta ,\theta )} (N_1), t_5 = {JTP}_{(n,k_1,\eta ,\theta )} (N_1 + \Delta _2)\).

Proof

The proof follows from Theorem 1.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Panja, S., Mondal, S.K. Sustainable production inventory management through bi-level greening performance in a three-echelon supply chain. Oper Res Int J 23, 16 (2023). https://doi.org/10.1007/s12351-023-00763-z

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12351-023-00763-z