Abstract

To solve the cooperation and competition problem of online supply chain finance constructed by the high-speed development of online finance among e-commerce enterprises and commercial banks, this paper constructs a classic evolutionary game model that does not consider disturbances and a stochastic evolutionary game model considering random disturbance. A contrastive analysis of the evolutionary process and stability of strategy selection is made, and parameters for the cooperative contract are discussed. Finally, the relevant decisions are verified by a numerical simulation of contracts in Chinese online supply chain finance. The main conclusions are as follows: in the classic evolutionary game model, the probability of choosing a cooperative strategy in a high-penalty contract is more than that in a low-penalty contract, and their final strategies will stabilize at cooperation when the excess return is more than that of the competitive strategy. In the stochastic evolutionary game model, the stable conditions are stricter than those of the classic model. Moreover, the default penalty, cost of maintaining cooperation, revenue share proportion and stochastic disturbance intensity influence the dynamic evolutionary process in the stochastic evolutionary game model. The conclusions provide a reference for the cooperation of e-commerce enterprises and banks in building online supply chain finance to achieve a win‒win result.

Similar content being viewed by others

Data availability

The author confirms that all data generated or analysed during this study are included in this published article.

References

Amaral MA, Javarone MA (2020) Strategy equilibrium in dilemma games with off-diagonal payoff perturbations. Phys Rev E. https://doi.org/10.1103/PhysRevE.101.062309

Bai SZ, Xu N, Yang ZH (2013) Supply chain coordination based on inventory financing. Oper Res Manag Sci 22(3):185–193

Chen SH, He Q, Xiao H (2020) A study on cross-border e-commerce partner selection in B2B mode. Electron Commer Res. https://doi.org/10.1007/s10660-020-09403-6

Corradi V, Sarin R (2000) Continuous approximations of stochastic evolutionary game dynamics. J Econ Theory 94(2):163–191. https://doi.org/10.1006/jeth.1999.2596

Damme EV (1994) Evolutionary game theory. Eur Econ Rev 38(3–4):847–858. https://doi.org/10.1016/0014-2921(94)90121-x

Du ZP, Guo CL, Lu WH, Fu SS (2019) Cooperation analysis of cross-border e-commerce logistics alliance based on evolutionary game theory. Math Practice Theory 49(10):871–880

Emtehani F, Nahavandi N, Rafiei FM (2023) Trade credit financing for supply chain coordination under financial challenges: a multi-leader-follower game approach. Financ Innov. https://doi.org/10.1186/s40854-022-00401-1

Friedman D (1991) Evolutionary game in economics. Econometrica 59(03):637–666. https://doi.org/10.2307/2938222

Giri BC, Maiti T (2014) Trade credit competition between two retailers in a supply chain under credit-linked retail price and market demand. Optim Lett 8(7):2065–2085. https://doi.org/10.1007/s11590-013-0702-x

Heydari J, Rastegar M, Glock CH (2017) A two-level delay in payments contract for supply chain coordination: the case of credit-dependent demand. Int J Prod Econ 191:26–36. https://doi.org/10.1016/j.ijpe.2017.05.004

Hu SG, Huang CM, Wu FK (2008) Stochastic differential equations, vol 5. Science Press Ltd, Beijing

Hu H, Liu YL, Zhang HQ, Pan RX (2018) Optimal network defense strategy selection based on incomplete information evolutionary game. IEEE Access 6:29806–29821. https://doi.org/10.1109/ACCESS.2018.2841885

Huang JM, Zhang HW (2018) A method for selecting defense strategies based on stochastic evolutionary game mode. Acta Electron Sin 46(9):2222–2228. https://doi.org/10.3969/j.issn.0372-2112.2018.09.025

Huang J, Yang WS, Tu YL (2020) Financing mode decision in a supply chain with financial constraint. Int J Prod Econ. https://doi.org/10.1016/j.ijpe.2019.07.014

Jena SK, Padhi SS, Cheng TCE (2023) Optimal selection of supply chain financing programmes for a financially distressed manufacturer. Eur J Oper Res 306(1):457–477. https://doi.org/10.1016/j.ejor.2022.07.032

Jia FJ, Wang DD, Li LS (2022) The stochastic evolutionary game analysis of public prevention and control strategies in public health emergencies. Kybernetes. https://doi.org/10.1108/K-10-2021-0988

Jing B, Chen XF, Cai GS (2012) Equilibrium financing in a distribution channel with capital constraint. Prod Oper Manag 21(6):1090–1101. https://doi.org/10.1111/j.1937-5956.2012.01328.x

Lai ZX, Lou GX, Zhang TT, Fan TJ (2021) Financing and coordination strategies for a manufacturer with limited operating and green innovation capital: bank credit financing versus supplier green investment. Annu Oper Res. https://doi.org/10.1007/s10479-021-04098-w

Lee CH, Rhee BD (2011) Trade credit for supply chain coordination. Eur J Oper Res 214(1):136–146. https://doi.org/10.1016/j.ejor.2011.04.004

Li CF, Feng LP, Han FX, Cheng YL (2015) Dynamic evolutionary game analysis of the e-business ecosystem. Chin J Syst Sci 04(23):75–78

Liu QL, Li XC, Hassall M (2015) Evolutionary game analysis and stability control scenarios of coal mine safety inspection system in China based on system dynamics. Saf Sci 80:13–22. https://doi.org/10.1016/j.ssci.2015.07.005

Lu QH, Zeng LW, Zhou LH (2012) Research on decision-making and value of supply chain financing with accounts receivables. J Manag Sci China 15(5):10–18. https://doi.org/10.3969/j.issn.1007-9807.2012.05.002

Lun MH, Li JJ (2014) Competitive game analysis of game-agents in Internet finance. Commer Times 7:71–73. https://doi.org/10.3969/j.issn.1002-5863.2014.07.030

Maynard Smith J, Price GR (1973) The logic of animal conflict. Nature 246(5427):15–18. https://doi.org/10.1038/246015a0

Ozkan-Canbolat E, Ozkan G, Beraha A (2022) Evolutionary philosophical games in strategic management. J Model Manag. https://doi.org/10.1108/JM2-02-2022-0039

Parkhe A (1993) Strategic alliances structuring: a game theoretic and transaction cost examination of interfirm cooperation. Acad Manag J 36(4):794–829. https://doi.org/10.5465/256759

Pi ZY, Fang WG, Zhang BF (2019) Service and pricing strategies with competition and cooperation in a dual-channel supply chain with demand disruption. Comput Ind Eng. https://doi.org/10.1016/j.cie.2019.106130

Platen E, Wagner W (1982) On a Taylor formula for a class of Itô processes. Probab Math Stat 3(1):37–51

Ren DY (2016) Stochastic evolutionary game model of technological innovation in industrial clusters. Comput Digit Eng 44(9):1650–1654+1676

Sandholm WH (2009) Evolutionary game theory. In: Meyers RA (ed) Encyclopedia of complexity and systems science. Springer, Berlin, pp 3176–3205. https://doi.org/10.1007/978-0-387-30440-3_188

Scata MD, Stefano A, La Corte A, Lio P, Catania E, Guardo E, Pagano S (2016) Combining evolutionary game theory and network theory to analyze human cooperation patterns. Chaos Solitons Fractals 91:17–24. https://doi.org/10.1016/j.chaos.2016.04.018

Shi JZ, Guo JE, Yan WJ (2015) Study on the incentive contract between banks and B2B platforms based on the online supply chain finance. J Manag Sci 28(5):79–92

Shi JZ, Du Q, Lin F, Li Y, Bai LB, Fung RYK, Lai KK (2020) Coordinating the supply chain finance system with buyback contract: a capital-constrained newsvendor problem. Comput Ind Eng. https://doi.org/10.1016/j.cie.2020.106587

Shi JZ, Liu DA, Du Q, Cheng TCE (2023) The role of the procurement commitment contract in a low-carbon supply chain with a capital-constrained supplier. Int J Prod Econ. https://doi.org/10.1016/j.ijpe.2022.108681

Sun HL, Wang XQ, Xue YF (2016) Stochastic evolutionary game model for unexpected incidents involving mass participation based on different scenarios. Oper Res Manag Sci 25(4):23–30

Sun JS, Yuan PP, Hua LL (2022) Pricing and financing strategies of a dual-channel supply chain with a capital-constrained manufacturer. Ann Oper Res. https://doi.org/10.1007/s10479-022-04602-w

Wallace C, Young HP (2015) Stochastic evolutionary game dynamics. In: Young HP, Zamir S (eds) Handbook of game theory with economic applications, vol 4. North Holland, Amsterdam, pp 327–380. https://doi.org/10.1016/B978-0-444-53766-9.00006-9

Wang T, Yan B (2017) Decision-making of online channel from the viewpoint of game theory. J Manag Sci China 20(6):64–77

Wang XJ, Quan J, Liu WB (2011) Study on evolutionary games and cooperation mechanism within the framework of bounded rationality. Syst Eng Theory Pract 31(S1):82–93

Wu Y, Zhang B, Zhang SH (2017) Probabilistic reward or punishment promotes cooperation in evolutionary games. Chaos Solitons Fractals 103:289–293. https://doi.org/10.1016/j.chaos.2017.06.015

Wu DD, Yang LP, Olson DL (2019) Green supply chain management under capital constraint. Int J Prod Econ 215:3–10. https://doi.org/10.1016/j.ijpe.2018.09.016

Xie XF, Shi XY, Gu J, Xu X (2023) Examining the contagion effect of credit risk in a supply chain under trade credit and bank loan offering. Omega Int J Manag Sci. https://doi.org/10.1016/j.omega.2022.102751

Xu Y, Hu B, Qian R (2011) Analysis on stability of strategic alliances based on stochastic evolutionary game including simulations. Syst Eng Theory Pract 31(5):920–926. https://doi.org/10.1007/s12182-011-0124-2

Xu K, Ding HP, Bao XZ (2017) Cooperation mechanism for supply chain financing in two-sided market and spillover value distribution. J Syst Manag 26(5):897–905

Xu XT, Wang GC, Hu JT, Lu YT (2020) Study on stochastic differential game model in network attack and defense. Secur Commun Netw. https://doi.org/10.1155/2020/3417039

Yu JR, Liu XL, Zheng XD, Tao Y (2017) Selection intensity and risk-dominant strategy: a two-strategy stochastic evolutionary game dynamics in finite population. Appl Math Comput 297:1–7. https://doi.org/10.1016/j.amc.2016.10.039

Yue JF, Austin J, Huang ZM, Chen BT (2013) Pricing and advertisement in a manufacturer-retailer supply chain. Eur J Oper Res 231(2):492–502. https://doi.org/10.1016/j.ejor.2013.06.007

Zhang Q, Yang YB, Liu B (2022) Research on operation strategy of online trading platform based on stochastic evolutionary game. Int J Innov Comput Inf Control 18(2):551–560. https://doi.org/10.24507/ijicic.18.02.551

Zhou YW, Wen ZL, Wu XL (2015) A single-period inventory and payment model with partial trade credit. Comput Ind Eng 90:132–145. https://doi.org/10.1016/j.ijpe.2022.108681

Acknowledgements

This work was supported partly by the Humanities and Social Science Fund of Ministry of Education of China (No. 16YJA790011).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that we have no financial and personal relationship with a third party whose interests could be positively or negatively influenced by the article’s content and there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

Appendix 1. Proof of Theorem 1

According to Xu et al. (2011) and Sun et al. (2016), let \({c}_{1}={c}_{2}=1, \gamma =1\;\mathrm{ and }\;p=1\). According to the above Lemma, we can get \(\left|X\left(t\right)\right|\le V\left(t,x\right)\le \left|X\left(t\right)\right|\). Because \(X\left(t\right)\ge 0\), \(V\left(t,X\left(t\right)\right)=\left|X\left(t\right)\right|=X\left(t\right)\). Thus,

(1) According to the above Lemma, in order to make the moment exponent of the zero solution stable, \(X\left(t\right)\in \left[\mathrm{0,1}\right]\) and \(Y\left(t\right)\in \left[\mathrm{0,1}\right]\) should satisfy the following in equation:

That is, \((1-X\left(t\right))\left[\left(1-Y\left(t\right)\right)\left(W-C-g\Delta \pi \right)+Y\left(t\right)\left({N}_{e}-C\right)\right]\le -1\). We can obtain that

Because \(Y\left(t\right)\in \left[\mathrm{0,1}\right]\), we can get

Sorting the above inequalities, we can obtain:

Therefore, when \(C-W+g\Delta \pi -\frac{1}{1-X\left(t\right)}\ge 0\) and \(C-{N}_{e}-\frac{1}{1-X\left(t\right)}\ge 0\), the moment exponent of the zero solution is stable, that is, the cooperative strategy that the e-commerce enterprises choose is systematically stable. Through merging the inequalities in (7), we can get \(\mathrm{min}\left\{C-W+g\Delta \pi , C-{N}_{e}\right\}-\frac{1}{1-X\left(t\right)}\ge 0\). Thus, there are \(X\left(t\right)\le 1-\frac{1}{\mathrm{min}\{C-W+g\Delta \pi ,C-{N}_{e}\}}\) and \(\mathrm{min}\left\{C-W+g\Delta \pi ,C-{N}_{e}\right\}>0\).

(2) If the moment exponent of the zero solution in stochastic differential Eq. (4) is unstable, then \(X\left(t\right)\in \left[\mathrm{0,1}\right]\) and \(Y\left(t\right)\in \left[\mathrm{0,1}\right]\) should meet the condition that

Sorting the above inequality, we can obtain:

Due to \(Y\left(t\right)\in \left[\mathrm{0,1}\right]\), there is

Sorting the above inequalities, we can get the formula below:

Therefore, when \(C-W+g\Delta \pi +\frac{1}{1-X\left(t\right)}\le 0\) and \(C-{N}_{e}+\frac{1}{1-X\left(t\right)}\le 0\), the moment exponent of the zero solution is unstable, which means that the competitive strategy which the e-commerce enterprises choose is systematically stable. Merging the in equations in (8), we can get that \(\mathrm{max}\{C-W+g\Delta \pi ,C-{N}_{e}\}+\frac{1}{1-X\left(t\right)}\le 0\), that is, \(X\left(t\right)\le 1+\frac{1}{\mathrm{max}\{C-W+g\Delta \pi ,C-{N}_{e}\}}\) and \(\mathrm{max}\left\{C-W+g\Delta \pi ,C-{N}_{e}\right\}<0\).

Appendix 2. Proof of Theorem 2

Proof is the same with Theorem 1.

Appendix 3. Proof of Inference

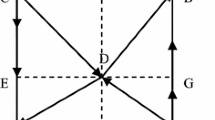

If the variables of payoff functions and the initial proportions of e-commerce enterprises and commercial banks who accept the competitive strategy satisfy the stability conditions of Theorems 1 and 2, there exists the only ESS point E1 (0, 0), i.e., both e-commerce enterprises and banks will stably choose the EOBO strategy combination {\({A}_{0},{B}_{0}\)}. Thus Inference (1) is proved. If the instability conditions of Theorems 1 and 2 are satisfied at the same time, there exists the only ESS point E4 (1, 1), in which both e-commerce enterprises and banks will choose to compete, i.e., ECBC strategy combination {\({A}_{1},{B}_{1}\)}. Thus Inference (4) is proved. Inference (2) and (3) can be proved in the same way.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Du, J., Li, J., Li, J. et al. Competition–cooperation mechanism of online supply chain finance based on a stochastic evolutionary game. Oper Res Int J 23, 55 (2023). https://doi.org/10.1007/s12351-023-00792-8

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12351-023-00792-8