Abstract

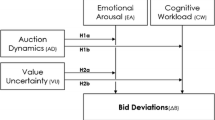

Auction fever is a multifaceted phenomenon that is frequently observed in both traditional and Internet auctions. In order to gain a better understanding of its causes, we develop a conceptual framework to analyze emotions in auctions, which is based on an exhaustive literature review. The framework integrates rational calculus with emotional aspects and suggests that emotional processing is triggered at three different stages of an auction: First, the economic environment can affect a bidder’s level of perceived competition and thus influence the bidding strategy prior to the auction. Second, auction events may have ramifications on the bidder’s emotional state during the auction due to previous investments or perceived ownership. Third, past auction outcomes may impact future bidding behavior through emotions such as the joy of winning or loser regret. Auction fever, eventually, is a phenomenon that results from the interplay of these emotional processes and causes a bidder to deviate from an initially chosen bidding strategy.

Similar content being viewed by others

Notes

We thank an anonymous referee for pointing this out.

To the best of our knowledge there are no studies to date that have systematically investigated the hypothesized direct relationship between auction events and immediate emotions (P3). In the conclusion, we argue that this should be subject to future neuro- or physioeconomic studies.

References

Abele, S., Ehrhart, K.-M., & Ott, M. (2006). An experiment on auction fever. In S. Seifert & C. Weinhardt (Eds.), Proceedings of the 7th Group Decision and Negotiation Conference (pp. 86–88). Germany: Karlsruhe.

Adam, M. T. P., Gamer, M., Hey, S., Ketter, W., & Weinhardt, C. (2009). Measuring the impact of emotions on decision-making in electronic markets: A physio-economic approach. In D. M. Kilgour & Q. Wang (Eds.), Proceedings of the 10th Group Decision and Negotiation Conference (pp. 193–196). Canada: Toronto.

Andreoni, J., Che, Y.-K., & Kim, J. (2007). Asymmetric information about rivals’ types: An experiment. Games and Economic Behavior, 59, 240–259.

Ariely, D., & Simonson, I. (2003). Buying, bidding, playing, or competing? value assessment and decision dynamics in online auctions. Journal of Consumer Psychology, 13, 113–123.

Arkes, H. R., & Blumer, C. (1985). The psychology of sunk costs. Organizational Behavior and Human Decision Processes, 35(1), 124–140.

Bapna, R., Goes, P., & Gupta, A. (2001). Insights and analyses of online auctions. Communications of the ACM, 44(11), 42–50.

Bault, N., Coricelle, G., & Rustichini, A. (2008). Interdependent utilities: How social ranking affects choice behavior. PloS One, 3(10), 1–10.

Bechara, A., & Damasio, A. R. (2005). The somatic marker hypothesis: A neural theory of economic decision. Games and Economic Behavior, 52(2), 336–372.

Bosman, R., & Riedl, A. (2003). Emotions and economic shocks in a first-price auction: An experimental study. SSRN working papers, from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=417660, 1–29

Bosman, R., & van Winden, F. (2002). Emotional hazard in a power-to-take- experiment. The Economic Journal, 112(476), 147–169.

Boucsein, W. (1992). Electrodermal activity. Berlin: Springer.

Carare, O., & Rothkopf, M. (2005). Slow Dutch auctions. Management Science, 51(3), 365–373.

Connolly, T., & Butler, D. (2006). Regret in economic and psychological theories of choice. Journal of Behavioral Decision Making, 19, 139–154.

Cooper, D., & Fang, H. (2008). Understanding overbidding in second price auctions: An experimental study. The Economic Journal, 118, 1572–1595.

Dawson, M. E., Schell, A. M., & Filion, D. L. (2007). The electrodermal system. In J. T. Cacioppo, L. G. Tassinary, & G. G. Berntson (Eds.), Handbook of psychophysiology (3rd ed., pp. 159–181). Cambridge: Cambridge Univ. Press.

Delgado, M. R., Schotter, A., Ozbay, E. Y., & Phelphs, E. A. (2008). Understanding overbidding: Using the neural circuitry of reward to design economic auctions. Science, 321(5897), 1849–1852.

Ding, M., Eliashberg, J., Huber, J., & Saini, R. (2005). Emotional bidders: An analytical and experimental examination of consumers’ behavior in a priceline-like reverse auction. Management Science, 51(3), 352–364.

Ehrhart, K.-M., Ott, M., Abele, S. (2008). Auction fever: Theory and experimental evidence. SFB 504 discussion paper series, no. 08–27, from http://www.sfb504.uni-mannheim.de/publications/dp08-27.pdf.

Engelbrecht-Wiggans, R. (1989). The effect of regret on optimal bidding in auctions. Management Science, 35(6), 685–692.

Engelbrecht-Wiggans, R., & Katok, E. (2007). Regret in auctions: Theory and evidence. Economic Theory, 33(1), 81–101.

Engelbrecht-Wiggans, R., & Katok, E. (2008). Regret and feedback information in first-price sealed-bid auctions. Management Science, 54(4), 808–819.

Festinger, L. (1957). A theory of cognitive dissonance. Evanston: Row, Peterson.

Filiz-Ozbay, E., & Ozbay, E. Y. (2007). Auctions with anticipated regret: Theory and experiment. The American Economic Review, 97(4), 1407–1418.

Friedman, D., Pommerenke, K., Lukose, R., Milam, G., & Huberman, B. A. (2007). Searching for the sunk cost fallacy. Experimental Economics, 10, 79–104.

Frijda, N. H. (1986). The emotions. Cambridge: Cambridge University Press.

Fudenberg, D., & Tirole, J. (1998). Game theory (6th printing). Cambridge: MIT Press.

Gilovich, T., Medvec, V. H., & Savitsky, K. (2000). The spotlight effect in social judgment: An egocentric bias in estimates of the salience of one’s own actions and appearance. Journal of Personality and Psychology, 78(2), 211–222.

Glänzer, S., & Schäfers, B. (2001). Dynamic trading network und virtuelle Auktionen im internet: Das Beispiel ricardo.de. In A. Hermanns & M. Sauter (Eds.), Management-Handbuch electronic commerce. Grundlagen, Strategien, Praxisbeispiele (pp. 609–616). München: Vahlen.

Goeree, J. K., & Offerman, T. (2003). Winner’s curse without overbidding. European Economic Review, 47, 625–644.

Haruvy, E., & Popkowski Leszczyc, P. T. (2010). The impact of online auction duration. Decision Analysis, 7(1), 99–106.

Häubl, G., & Popkowski Leszczyc, P. T. (2004). The psychology of auctions: Enriching models of bidder and seller behavior. Advances in Consumer Research, 31(1), 91–92.

Heyman, J. E., Orhun, Y., & Ariely, D. (2004). Auction fever: The effect of opponents and quasi-endowment on product valuations. Journal of Interactive Marketing, 18(4), 7–21.

Humphrey, S. J. (2004). Feedback-conditional regret theory and testing regret-aversion in risky choice. Journal of Economic Psychology, 25, 839–857.

Ivanova-Stenzel, R., & Salmon, T. C. (2004). Entry fees and endogenous entry in electronic auctions. Electronic Markets, 14(3), 170–177.

Jennings, B., & Dorina, M. (2003). Excitation-transfer theory and three-factor theory of emotion. In B. Jennings, D. Roskos-Ewoldsen, & J. Cantor (Eds.), Communication and emotion essays in honor of Dolf Zillmann (pp. 31–59). Mahwah: Lawrence Erlbaum Associates Publishers.

Johns, C. L., & Zaichkowsky, J. L. (2003). Bidding behavior at the auction. Psychology and Marketing, 20(4), 303–322.

Kahneman, D., Knetsch, J., & Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase theorem. The Journal of Political Economy, 98(6), 1325–1348.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–292.

Katok, E., & Kwasnica, A. M. (2008). Time is money: The effect of clock speed on seller’s revenue in Dutch auctions. Experimental Economics, 11(4), 344–357.

Klemperer, P. (1999). Auction theory: A guide to the literature. Journal of Economic Surveys, 13(3), 227–286.

Kogan, S., & Morgan, J. (2009). Securities auctions under moral hazard: An experimental study. Review of Finance, 13(2), 1–44.

Köszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics, 121(4), 1133–1165.

Krishna, V. (2002). Auction theory. San Diego: Acad. Press.

Ku, G. (2000). Auctions and auction fever: Explanations from competitive arousal and framing. Kellogg Journal of Organization Behavior, 1–32.

Ku, G., Galinsky, A. D., Murnighan, J. K. (2008). Arousal, interest, and auction bidders, SSRN working papers, from http://ssrn.com/abstract=1298572.

Ku, G., Malhotra, D., & Murnighan, J. K. (2005). Towards a competitive arousal model of decision-making: A study of auction fever in live and Internet auctions. Organizational Behavior and Human Decision Processes, 96, 89–103.

Lee, M.-Y., Kim, Y.-K., & Fairhurst, A. (2009). Shopping value in online auctions: Their antecedents and outcomes. Journal of Retailing and Consumer Services, 16, 75–82.

Lee, Y. H., & Malmendier, U. (2007). The bidder’s curse. NBER working paper no. W1369, forthcoming in American Economic Review, from http://ssrn.com/abstract=1080202.

Loewenstein, G. (2000). Emotions in economic theory and economic behavior. The American Economic Review, 90(2), 426–432.

Loewenstein, G., Weber, E. U., Hsee, C. K., & Welch, N. (2001). Risk as feelings. Psychological Bulletin, 127(2), 267–286.

Lucking-Reiley, D. (1999). Using field experiments to test equivalence between auction formats: Magic on the Internet. The American Economic Review, 89(5), 1063–1080.

Malhotra, D., Ku, G., & Murnighan, J. K. (2008). When winning is everything. Harvard Business Review, 86(5), 78–86.

Malmendier, U., & Szeidl, A. (2008). Fishing for fools. Working paper, UC Berkeley, from http://www.econ.berkeley.edu/~szeidl/papers/fishing_for_fools.pdf, 1–49.

Maule, A. J., Hockey, G. R. J., & Bdzola, L. (2000). Effects of time-pressure on decision-making under uncertainty: Changes in affective state and information processing. Acta Psychologica, 104, 283–301.

McAfee, R. P., & McMillan, J. (1987). Auctions and bidding. Journal of Economic Literature, 25(2), 699–738.

Meyer, D. J. (1993). First price auctions with entry: An experimental investigation. The Quarterly Review of Economics and Finance, 33(2), 107–122.

Möllenberg, A. (2004). Internet auctions in marketing: The consumer perspective. Electronic Markets, 14(4), 360–371.

Morgan, J., Steiglitz, K., & Reis, G. (2003). The spite motive and equilibrium behavior in auctions. Contributions to Economic Analysis & Policy, 2(1), 1102–1127.

Murnighan, J. K. (2002). A very extreme case of the dollar auction. Journal of Management Education, 26, 56–69.

Myers, D. G. (2004). Psychology (7th ed.). New York: Worth Publishers.

Ockenfels, A., Reiley, D., & Sadrieh, A. (2006). Online auctions. In T. J. Hendershott (Ed.), Handbooks in information systems: Vol. 1. Economics and information systems (pp. 571–628). Amsterdam, The Netherlands: Elsevier.

Osborne, M. J., & Rubinstein, A. (1998). A course in game theory (5th printing). Cambridge, MA: MIT Press.

Park, S. C., Kim, J., & Bock, G. W. (2008). Understanding a bidder’s escalation of commitment in the online C2C auction. In Z. Irani, S. Sahraoui, A. Ghoneim, J. Sharp, S. Ozkan, M. Ali, et al. (Eds.), European Mediterranean Conference on Information Systems (EMCIS). Dubai, UAE: Late Breaking Papers.

Rasmusen, E. (2007). Games and information: An introduction to game theory (4th ed.). Malden, Mass: Blackwell.

Rick, S., & Loewenstein, G. (2008). The role of emotion in economic behavior. In M. Lewis, J. M. Haviland-Jones, & L. F. Barrett (Eds.), Handbook of emotions (3rd ed., pp. 138–156). New York: The Guilford Press.

Romer, P. M. (1990). Endogenous technological change. The Journal of Political Economy, 98(2), 71–102.

Roth, A. E., & Ockenfels, A. (2002). Last-minute bidding and the rules for ending second-price auctions: Evidence from eBay and Amazon auctions on the Internet. The American Economic Review, 92(4), 1093–1103.

Rottenberg, J., Ray, R. D., & Gross, J. J. (2007). Emotion elicitation using films. In J. A. Coan & J. J. B. Allen (Eds.), Handbook of emotion elicitation and assessment (pp. 9–28). New York: The Guilford Press.

Russell, J. A., & Mehrabian, A. (1977). Evidence for a three factor theory of emotions. Journal of Research in Personality, 11, 273–294.

Staw, B. M. (1976). Knee-deep in the big muddy: A study of escalating commitment to a chosen course of action. Organizational Behavior and Human Decision Processes, 16, 27–44.

Staw, B. M., & Ross, J. (1989). Understanding behavior in escalation situations. Science, 246, 216–220.

Stern, B., Royne, M. B., Stafford, T. F., & Bienstock, C. C. (2008). Consumer acceptance of online auctions: An extension and revision of the TAM. Psychology and Marketing, 25(7), 619–636.

Sun, Y., & Wu, S. (2008). The effect of emotional state on waiting in decision making. Social Behavior and Personality, 36, 591–602.

Thaler, R. H. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior & Organization, 1(1), 39–60.

Vickrey, W. (1961). Counterspeculation, auctions, and competitive sealed tenders. The Journal of Finance, 16(1), 8–37.

Zajonc, R. B. (1965). Social facilitation. Science, 149, 269–274.

Zajonc, R. B. (1984). On the primacy of affect. American Psychologist, 39(2), 117–123.

Zeelenberg, M. (1999). Anticipated regret, expected feedback and behavioral decision-making. Journal of Behavioral Decision Making, 12, 93–106.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Hans-Dieter Zimmermann

Rights and permissions

About this article

Cite this article

Adam, M.T.P., Krämer, J., Jähnig, C. et al. Understanding auction fever: a framework for emotional bidding. Electron Markets 21, 197–207 (2011). https://doi.org/10.1007/s12525-011-0068-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12525-011-0068-9