Abstract

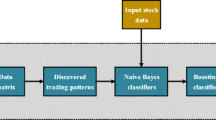

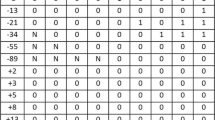

Due to the effects of many deterministic and stochastic factors, it has always been a challenging goal to gain good profits from the stock market. Many methods based on different theories have been proposed in the past decades. However, there has been little research about determining the temporal investment style (i.e., short term, middle term, or long term) for the stock. In this paper, we propose a method to find suitable stock investment styles in terms of investment time. Firstly, biclustering is applied to a matrix that is composed of technical indicators of each trading day to discover trading patterns (regarded as trading rules). Subsequently a k-nearest neighbor (KNN) algorithm is employed to transform the trading rules to the trading actions (i.e., the buy, sell, or no-action signals). Finally, a min-max and quantization strategy is designed for determination of the temporal investment style of the stock. The proposed method was tested on 30 stocks from US bear, bull, and flat markets. The experimental results validate its usefulness.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.References

Wang F, Zhang Y, Rao Q, Li K, Zhang H. Exploring mutual information-based sentimental analysis with kernel-based extreme learning machine for stock prediction. Soft Comput. 2017;21(12):3193–205.

Chavarnakul T, Enke D. Intelligent technical analysis based equivolume charting for stock trading using neural networks. Expert Syst Appl. 2008;34(2):1004–17.

Chang PC, Fan CY, Liu CH. Integrating a piecewise linear representation method and a neural network model for stock trading points prediction. IEEE Trans Syst Man Cybern Part C Appl Rev. 2009;39(1):80–92.

Li Y, Liu W, Li X, Huang Q, Li X. GA-SIFT: a new scale invariant feature transform for multispectral image using geometric algebra. Inf Sci. 2014;281:559–72.

Li Y, Liu W, Huang Q. Traffic anomaly detection based on image descriptor in videos. Multimed Tools Appl. 2016;75(5):2487–505.

Wang YH. Using neural network to forecast stock index option price: a new hybrid GARCH approach. Qual Quant. 2009;43(5):833–43.

Tilakaratne CD, Morris SA, Mammadov MA, Hurst C P. Predicting stock market index trading signals using neural networks. In: Proceedings of the 14th annual global finance conference (GFC’07); 2007. pp. 171-179.

White H. Economic prediction using neural networks: the case of IBM daily stock returns. In: IEEE International Conference on Neural Networks; 1988. vol. 2, pp451–458.

Wu Y, Zhu X, Li L, et al. Mining dual networks: models, algorithms, and applications. ACM Trans Knowl Discov Data. 2016;10(4):40.

Zhang D, Jiang Q, and Li X (2004) Application of neural networks in financial data mining. In: International Conference on Computational Intelligence, pp. 392-395.

Zhang S, Li X, Zong M, et al. Learning k for knn classification. ACM Trans Intell Syst Technol. 2017;8(3):43.

Potvin JY, Soriano P, Vallée M. Generating trading rules on the stock markets with genetic programming. Comput Oper Res. 2004;31(7):1033–1047.4.

Hilliard JE, Hilliard, J. Rebalancing versus buy and hold: theory, simulation and empirical analysis. Rev Quant Finan Acc. 2018;50(1):1–32.

Chang PC, Liu CH. A TSK type fuzzy rule based system for stock price prediction. Expert Syst Appl. 2008;34(1):135–44.

Briza AC, Naval PC Jr. Stock trading system based on the multi-objective particle swarm optimization of technical indicators on end-of-day market data. Appl Soft Comput. 2011;11(1):1191–201.

Leigh W, Modani N, Purvis R, Roberts T. Stock market trading rule discovery using technical charting heuristics. Expert Syst Appl. 2002;23(2):155–9.

Huang W, Nakamori Y, Wang SY. Forecasting stock market movement direction with support vector machine. Comput Oper Res. 2005;32(10):2513–22.

Yang F, Huang Q, Jin L, Wee-Chung Liew A. Segmentation and recognition of multi-model photo event. Neurocomputing. 2016;172:159–67.

Zarandi MHF, Rezaee B, Turksen IB, et al. A type-2 fuzzy rule-based expert system model for stock price analysis. Expert Syst Appl. 2009;36(1):139–54.

Zhang H, Su J. Naive bayesian classifiers for ranking. In: European conference on machine learning. Berlin: Springer; 2004. p. 501–12.

Upadhyay A, Bandyopadhyay G, Dutta A. Forecasting stock performance in Indian market using multinomial logistic regression. J Bus Stud Q. 2012;3(3):16.

Asghar MZ, Khan A, Bibi A, Kundi FM, Ahmad H. Sentence-level emotion detection framework using rule-based classification. Cogn Comput. 2017;9(6):868–94.

Sun X, Peng X, Ding S. Emotional human-machine conversation generation based on long short-term memory. Cogn Comput. 2018;10(3):389–97.

Ding S, Zhang J, Jia H, Qian J. An adaptive density data stream clustering algorithm. Cogn Comput. 2016;8(1):30–8.

Huang Q, Wang T, Tao D, Li X. Biclustering learning of trading rules. IEEE Trans Cybern. 2015;45(10):2287–98.

Hussain A, Cambria E. Semi-supervised learning for big social data analysis. Neurocomputing. 2018;275:1662–73.

Mahmud M, Kaiser MS, Rahman MM, Rahman MA, Shabut AM, Mamun SA, et al. A brain-inspired trust management model to assure security in a cloud based iot framework for neuroscience applications. Cogn Comput. 2018;9:1–10.

Malik ZK, Hussain A, Wu QMJ. Extracting online information from dual and multiple data streams. Neural Comput & Applic. 2018;30(1):87–98.

Gong C, Tao D, Maybank SJ, Liu W, Kang G, Yang J. Multi-modal curriculum learning for semi-supervised image classification. IEEE Trans Image Process. 2016;25(7):3249–60.

Gong C, Liu T, Tao D, Fu K, Tu E, Yang J. Deformed graph Laplacian for semisupervised learning. IEEE Trans Neural Netw Learn Syst. 2015;26(10):2261–74.

Gong C, Liu T, Tang Y, Yang J, Yang J, Tao D. A regularization approach for instance-based superset label learning. IEEE Trans Cybern. 2018;48(3):967–78.

Wang M, Shang X, Li X, Liu W, Li Z. Efficient mining differential co-expression biclusters in microarray datasets. Gene. 2013;518(1):59–69.

Huang Q. A biclustering technique for mining trading rules in stock markets. Appl Inform Commun. 2011;224:16–24.

Huang Q, Huang X, Kong Z, Li X, Tao D. Bi-phase evolutionary searching for biclusters in gene expression data. IEEE Trans Evol Comput. 2018. https://doi.org/10.1109/TEVC.2018.2884521.

Huang Q, Chen Y, Liu L, Tao D, Li X. On combining biclustering mining and AdaBoost for breast tumor classification. IEEE Trans Evol Comput. 2019. https://doi.org/10.1109/TKDE.2019.2891622.

Huang Q, Kong Z, Li Y, Yang J, Li X. Discovery of trading points based on Bayesian modeling of trading rules. World Wide Web. 2018;21(6):1473–90.

Ratner M, Leal RPC. Tests of technical trading strategies in the emerging equity markets of Latin America and Asia. J Bank Financ. 1999;23(12):1887–905.

Xu C, Tao D, Xu C. A survey on multi-view learning. Comput Sci. 2013.

Zhang L, Zhang Q, Zhang L, Tao D, Huang X, Du B. Ensemble manifold regularized sparse low-rank approximation for multiview feature embedding. Pattern Recogn. 2015;48(10):3102–12.

Funding

This work was financially supported in part by the National Natural Science Foundation of China under Grant 61571193; in part by the Natural Science Foundation of Guangdong Province, China under Grant 2017A030312006 and Grant 2017A030330247; in part by the Fundamental Research Funds for the Central Universities under Grant 2017MS064; in part by the Science and Technology Program of Guangzhou under Grant 201704020134; and in part by the Project of Science and Technology Department of Guangdong province (Nos. 2016A010101021, 2016A010101022, and 2016A010101023).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Ethical Approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Sun, J., Huang, Q. & Li, X. Determination of Temporal Stock Investment Styles via Biclustering Trading Patterns. Cogn Comput 11, 799–808 (2019). https://doi.org/10.1007/s12559-019-9626-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12559-019-9626-9