Abstract

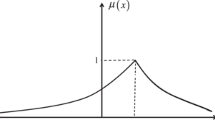

This study investigates a multi-period portfolio management problem under fuzzy settings. For the first time, the newly proposed semi-entropy in the literature is employed as an efficient downside risk measure for risk control in multi-period portfolio optimization. Fuzzy techniques for financial modeling show advantageous performance when future financial market conditions cannot be effectively detected with only historical data. We describe the assert returns by fuzzy variables. Two realistic constraints of transaction costs and bankruptcy events are taken into consideration in our model formulation of a multi-period mean-semi-entropy optimization program. The formulated program is rewritten as a crisp single-objective nonlinear programming by introducing a risk-aversion factor, and final solution to the program is obtained by using genetic algorithm. For the demonstration of computational results, we provide a numerical example with real-life stock data, which illustrates the main modelling concept and the efficiency of genetic algorithm solving method. Comparative analyses over several baseline models show the advantages of adopting fuzzy semi-entropy as an efficient downside risk measure for multi-period portfolio investment optimization.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Bajeux-Besnainou I, Portait R (1998) Dynamic asset allocation in a mean-variance framework. Manag Sci 44(11):S79–S95

Bertsimas D, Pachamanova D (2008) Robust multiperiod portfolio management in the presence of transaction costs. Comp Oper Res 35(1):3–17

Buckley JJ, Hayashi Y (1994) Fuzzy genetic algorithm and applications. Fuzzy Set Syst 61(2):129–136

Cai X, Teo KL, Yang X, Zhou XY (2000) Portfolio optimization under a minimax rule. Manag Sci 46(7):957–972

Calafiore GC (2008) Multi-period portfolio optimization with linear control policies. Automatica 44(10):2463–2473

Chen ZP (2005) Multiperiod consumption and portfolio decisions under the multivariate GARCH model with transaction costs and CVaR-based risk control. OR Spectr 27(4):603–632

Costa OLV, Araujo MV (2008) A generalized multi-period mean-variance portfolio optimization with Markov switching parameters. Automatica 44(10):2487–2497

D’Aniello G, Gaeta M, Tomasiello S, Raritá L (2016) A fuzzy consensus approach for group decision making with variable importance of experts. In: 2016 FUZZ-IEEE, pp 1693–1700

Dantzig GB, Infanger G (1993) Multi-stage stochastic linear programs for portfolio optimization. Ann Oper Res 45:59–76

Deng XT, Li ZF, Wang SY (2005) A minimax portfolio selection strategy with equilibrium. Eur J Oper Res 166(1):278–292

Elton EJ, Gruber MJ (1974) The multi-period consumption investment problem and single period analysis. Oxf Econ Papers 2:289–301

Fang SC, Rajasekera JR, Tsao HSJ (1997) Entropy optimization and mathematical programming. Kluwer Academic Publisheres, Dordrecht

Fang Y, Lai KK, Wang SY (2006) Portfolio rebalancing model with transaction costs based on fuzzy decision theory. Eur J Oper Res 175(2):879–893

Fu C, Lari-Lavassani A, Li X (2010) Dynamic mean-variance portfolio selection with borrowing constraint. Eur J Oper Res 200(1):312–319

Gülpınar N, Rustem B (2007) Worst-case robust decisions for multi-period mean-variance portfolio optimization. Eur J Oper Res 183(3):981–1000

Hakansson NH (1971) Multi-period mean-variance analysis: toward a general theory of portfolio choice. J Finance 26:857–884

Huang XX, Ying H (2013) Risk index based models for portfolio adjusting problem with returns subject to experts’ evaluations. Econ Model 30:61–66

Hibiki N (2006) Multi-period stochastic optimization models for dynamic asset allocation. J Bank Finance 30(2):365–390

Holland JH (1975) Adaptation in natural and artificial systems. University of Michigan Press, Ann Arbor

Inuiguchi M, Ramik J (2000) Possibilistic linear programming: A brief review of fuzzy mathematical programming and a comparison with stochastic programming in portfolio selection problem. Fuzzy Set Syst 111(1):3–28

Inuiguchi M, Tanino T (2000) Portfolio selection under independent possibilistic information. Fuzzy Set Syst 115(1):83–92

Jana P, Roy TK, Mazumder SK (2009) Multi-objective possibilistic model for portfolio selection with transaction cost. J Comput Appl Math 228(1):188–196

Kapur JN (1990) Maximum entropy models in science and engineering. Wiley Eastern Limited, New Delhi

Li D, Ng WL (2000) Optimal dynamic portfolio selection: multiperiod mean-variance formulation. Math Finance 10(3):387–406

Li X, Liu B (2006) A sufficient and necessary condition for credibility measures. Int J Uncertain Fuzz 14(05):527–535

Li X, Qin ZF, Kar S (2010) Mean-variance-skewness model for portfolio selection with fuzzy returns. Eur J Oper Res 202(1):239–247

Li X (2013) Credibilistic programming. Springer, New York

Li ZM, Zhang Q, Du XY, Qian XY, Lev B (2019) A hesitant fuzzy multi-criteria group decision making method for college applicants’ learning potential evaluation. J Data Inform Manag 1(1–2):65–75

Ling A, Sun J, Wang M (2019) Robust multi-period portfolio selection based on downside risk with asymmetrically distributed uncertainty set. Eur J Oper Res. https://doi.org/10.1016/j.ejor.2019.01.012

Liu BD, Iwamura K (1998) Chance constrained programming with fuzzy parameters. Fuzzy Set Syst 94(2):227–237

Liu BD (2000) Dependent-chance programming in fuzzy environments. Fuzzy Set Syst 109(1):97–106

Liu BD, Liu Y-K (2002) Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans Fuzzy Syst 10(4):445–450

Liu Y-K, Liu B (2003) Expected value operator of random fuzzy variable and random fuzzy expected value models. Int J Uncertain Fuzz 11(2):195–215

Liu BD (2003) Inequalities and convergence concepts of fuzzy and rough variables. Fuzzy Optim Decis Making 2(2):87–100

Liu BD (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty, 3rd edn. Springer, Berlin

Liu YJ, Zhang WG, Xu WJ (2012) Fuzzy multi-period portfolio selection optimization models using multiple criteria. Automatica 48(12):3042–3053

Liu F, Yu Q, Huang MJ, Ralescu DA (2020) An inconsistency index of interval additive reciprocal matrices with application to group decision making. J Data Inform Manag. https://doi.org/10.1007/s42488-019-00019-6

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–91

Markowitz H (1987) Mean-variance analysis in portfolio choice and capital markets. Blackwell, Oxford

Markowitz H, Todd P, Xu G, Yamane Y (1993) Computation of mean-semivariance efficient sets by the critical line algorithm. Ann Oper Res 45(1):307–317

Mossin J (1968) Optimal multiperiod portfolio polices. J Bus 41:215–229

Patel NR, Subrahmanyam MG (1982) A simple algorithm for optimal portfolio selection with fixed transaction costs. Manag Sci 28(3):303–314

Qin JD (2019) A survey of type-2 fuzzy aggregation and application for multiple criteria decision making. J Data Inform Manag 1(1–2):17–32

Sadjadi SJ, Seyedhosseini SM, Hassanlou KH (2011) Fuzzy multiperiod portfolio selection with different rates for borrowing and lending. Appl Soft Comput 11(4):3821–3826

Shen RJ, Zhang SZ (2008) Robust portfolio selection based on a multi-stage scenario tree. Eur J Oper Res 191(3):864–887

Takano Y, Gotoh JY (2014) Multi-period portfolio selection using kernel-based control policy with dimensionality reduction. Expert Syst Appl 41(8):3901–3914

Vercher E, Bermúdez JD, Segura JV (2007) Fuzzy portfolio optimization under downside risk measures. Fuzzy Set Syst 158(7):769–782

Wang SY, Zhu SS (2002) On fuzzy portfolio selection problem. Fuzzy Opt Decis Making 1(4):361–377

Xia YS, Liu BD, Wang SY, Lai KK (2000) A model for portfolio selection with order of expected returns. Comput Oper Res 27(5):409–422

Yan W, Miao R, Li SR (2007) Multi-period semi-variance portfolio selection: model and numerical solution. Appl Math Comput 194(1):128–134

Yan W, Li SR (2009) A class of multi-period semi-variance portfolio selection with a four-factor futures price model. J Appl Math Comput 29(1–2):19–34

Yin G, Zhou XY (2004) Markowitz’s mean-variance portfolio selection with regime witching: from discrete-time models to their continuous-time limits. IEEE Trans Autom Control 49(3):349–360

Yu M, Takahashi S, Inoue H, Wang SY (2010) Dynamic portfolio optimization with risk control for absolute deviation model. Eur J Oper Res 201(2):349–364

Zadeh LA (1965) Fuzzy sets. Inform Control 8:338–353

Zadeh LA (1978) Fuzzy sets as a basis for a theory of possibility. Fuzzy Set Syst 1:3–28

Zadeh LA (1979) A theory of approximate reasoning. In: Hayes et al (eds) Mathematical Frontiers of the Social and Policy Sciences. Westview Press, Boulder, pp 69–129

Zhang WG, Zhang XL, Chen YX (2011) Portfolio adjusting optimization with added assets and transaction costs based on credibility measures. Insur Math Econ 49:353–360

Zhang WG, Liu YJ, Xu WJ (2012) A possibilistic mean-semivariance-entropy model for multi-period portfolio selection with transaction costs. Eur J Oper Res 222:341–349

Zhang GQ, Zhang QQ (2019) Multiportfolio optimization with CVaR risk measure. J Data Inform Manag 1(3–4):91–106

Zhou JD, Li X, Pedrycz W (2016) Mean-semi-entropy models of fuzzy portfolio selection. IEEE Trans Fuzzy Syst 24(6):1627–1636

Zhou JD, Li X, Kar S, Zhang GQ, Yu HT (2017) Time consistent fuzzy multi-period rolling portfolio optimization with adaptive risk aversion factor. J Ambient Intell Human Comput 8(5):651–666

Zhu SS, Li D, Wang SY (2004) Risk control over bankruptcy in dynamic portfolio selection: a generalized mean-variance. IEEE Trans Autom Control 49(3):447–457

Funding

This work was supported by the National Natural Science Foundation of China (Nos. 71722007, 71931001), and the Funds for First-class Discipline Construction in China (No. XK1802-5).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors. This article does not contain any studies with animals performed by any of the authors. This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

There is no individual participant included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhou, J., Li, X. Multi-period mean-semi-entropy portfolio management with transaction costs and bankruptcy control. J Ambient Intell Human Comput 12, 705–715 (2021). https://doi.org/10.1007/s12652-020-02053-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12652-020-02053-4