Abstract

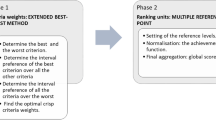

In this study an important real-world multi-criteria problem in banking sector is focused. The aim of this problem is to rank some branches of a bank in Iran subject to some economic criteria under interval type uncertainty. The problem is complex because of its multi-criteria nature and also its interval type data. A new solution procedure is proposed for this problem. In the proposed procedure first the criteria are weighted as interval values according to an effective method which combines experts’ opinions and the Shannon’s entropy approach. Then, as a novelty, the classical EDAS multi-criteria solution approach is newly modified for interval type data in order to overcome the shortcomings of the interval EDAS approaches of the literature. Finally, using the data obtained from the case study, an extensive computational study is performed by the proposed solution procedure. The sensitivity of the proposed approach also is analyzed by changing its parameters and a comparative study was done by some other approaches.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.References

Aleskerov F, Ersel H, Yolalan R (2004) Multicriterial ranking approach for evaluating bank branch performance. Int J Inf Technol Decis Mak 3(02):321–335

Beheshtinia MA, Omidi S (2017) A hybrid MCDM approach for performance evaluation in the banking industry. Kybernetes 46(8):1386–1407

Betz F, Oprică S, Peltonen TA, Sarlin P (2014) Predicting distress in European banks. J Bank Finance 45:225–241

Bičo A, Ganić M (2012) The efficiency of banking sector in Bosnia and Herzegovina in comparison to Slovenia: comparative analysis. J Econ Soc Stud 2(2):125–149

Bilbao-Terol A, Arenas-Parra M, Cañal-Fernández V, Antomil-Ibias J (2014) Using TOPSIS for assessing the sustainability of government bond funds. Omega 49:1–17

Brauers WKM, Ginevičius R, Podviezko A (2014) Development of a methodology of evaluation of financial stability of commercial banks. Panoeconomicus 61(3):349–367

Chen CT, Huang SF, Hung WZ (2018a) Linguistic VIKOR method for project evaluation of ambient intelligence product. J Ambient Intell Humaniz Comput. https://doi.org/10.1007/s12652-018-0889-x

Chen YS, Chuang HM, Sangaiah AK, Lin CK, Huang WB (2018b) A study for project risk management using an advanced MCDM-based DEMATEL-ANP approach. J Ambient Intell Humaniz Comput 10(7):2669–2681

Chitnis A, Vaidya OS (2016) Efficiency ranking method using DEA and TOPSIS (ERM-DT): case of an Indian bank. Benchmarking Int J 23(1):165–182

Cole RA, Gunther JW (1995) Separating the likelihood and timing of bank failure. J Bank Finance 19(6):1073–1089

Cole RA, Gunther JW (1998) Predicting bank failures: a comparison of on-and off-site monitoring systems. J Financ Serv Res 13(2):103–117

Doumpos M, Zopounidis C (2010) A multicriteria decision support system for bank rating. Decis Support Syst 50(1):55–63

Esmaili Dooki A, Bolhasani P, Fallah M (2017) An integrated fuzzy AHP and fuzzy TOPSIS approach for ranking and selecting the chief inspectors of bank: a case study. J Appl Res Ind Eng 4(1):8–23

Gavurova B, Belas J, Kocisova K, Kliestik T (2017) Comparison of selected methods for performance evaluation of Czech and Slovak commercial banks. J Bus Econ Manag 18(5):852–876

Ghorabaee MK, Amiri M, Zavadskas EK, Turskis Z (2017) Multi-criteria group decision-making using an extended EDAS method with interval type-2 fuzzy sets. Ekonomika a Manag, XX 1:48–68

Ginevičius R, Podviezko A (2013) The evaluation of financial stability and soundness of Lithuanian banks. Econ Res Ekonomska istraživanja 26(2):191–208

Hadi-Vencheh A (2010) An improvement to multiple criteria ABC inventory classification. Eur J Oper Res 201(3):962–965

Hadi-Vencheh A (2014) Two effective total ranking models for preference voting and aggregation. Math Sci 8(1):115

Hadi-Vencheh A, Mohamadghasemi A (2015) A new hybrid fuzzy multi-criteria decision making model for solving the material handling equipment selection problem. Int J Comput Integr Manuf 28(5):534–550

Hemmati M, Dalghandi S, Nazari H (2013) Measuring relative performance of banking industry using a DEA and TOPSIS. Manag Sci Lett 3(2):499–504

Jakšić M, Mimović P, Todorović V (2011) Analytic hierarchy process and bank ranking in Serbia. Industrija 39(1):47–66

Kahraman C, Keshavarz Ghorabaee M, Zavadskas EK, Cevik Onar S, Yazdani M, Oztaysi B (2017) Intuitionistic fuzzy EDAS method: an application to solid waste disposal site selection. J Environ Eng Landsc Manag 25:1–12

Keshavarz Ghorabaee M, Zavadskas EK, Olfat L, Turskis Z (2015) Multi-criteria inventory classification using a new method of evaluation based on distance from average solution (edas). Informatica 26:435–451

Kosmidou K, Zopounidis C (2008) Measurement of bank performance in Greece. SouthEast Eur J Econ 1(1):79–95

Krylovas A, Zavadskas EK, Kosareva N, Dadelo S (2014) New KEMIRA method for determining criteria priority and weights in solving MCDM problem. Int J Inf Technol Decis Mak 13(6):1119–1133

Kumbirai M, Webb R (2010) A financial ratio analysis of commercial bank performance in South Africa. Afr Rev Econ Finance 2(1):30–53

Levandowsky M, Winter D (1971) Distance between sets. Nature 234:34–35

Lotfi FH, Fallahnejad R (2010) Imprecise Shannon’s entropy and multi attribute decision making. Entropy 12(1):53–62

Maghyereh AI, Awartani B (2014) Bank distress prediction: empirical evidence from the Gulf Cooperation Council countries. Res Int Bus Finance 30:126–147

Mandic K, Delibasic B, Knezevic S, Benkovic S (2014) Analysis of the financial parameters of Serbian banks through the application of the fuzzy AHP and TOPSIS methods. Econ Model 43:30–37

Minh NK, Van Khanh P, Tuan PA (2012) A new approach for ranking efficient units in data envelopment analysis and application to a sample of Vietnamese agricultural bank branches. Am J Oper Res 2(1):17839

Niroomand S, Bazyar A, Alborzi M, Miami H, Mahmoodirad A (2018) A hybrid approach for multi-criteria emergency center location problem considering existing emergency centers with interval type data: a case study. J Ambient Intell Humaniz Comput 9(6):1999–2008

Niroomand S, Mirzaei N, Hadi-Vencheh A (2019a) A simple mathematical programming model for countries' credit ranking problem. Int J Finance Econ 24(1):449–460

Niroomand S, Mosallaeipour S, Mahmoodirad A (2019b) A hybrid simple additive weighting approach for constrained multicriteria facilities location problem of glass production industries under uncertainty. IEEE Trans Eng Manag. https://doi.org/10.1109/TEM.2019.2891702

Qian H, Wu X, Xu Y (2011) Intelligent surveillance systems. Springer, Dordrecht

Qiao D, Shen KW, Wang JQ, Wang TL (2019) Multi-criteria PROMETHEE method based on possibility degree with Z-numbers under uncertain linguistic environment. J Ambient Intell Humaniz Comput. https://doi.org/10.1007/s12652-019-01251-z

Ren J, Toniolo S (2018) Life cycle sustainability decision-support framework for ranking of hydrogen production pathways under uncertainties: an interval multi-criteria decision making approach. J Clean Prod 175:222–236

Said RM, Tumin MH (2011) Performance and financial ratios of commercial banks in Malaysia and China. Int Rev Bus Res Pap 7(2):157–169

Seçme NY, Bayrakdaroğlu A, Kahraman C (2009) Fuzzy performance evaluation in Turkish banking sector using analytic hierarchy process and TOPSIS. Expert Syst Appl 36(9):11699–11709

Shaverdi M, Akbari M, Fallah Tafti S (2011) Combining fuzzy MCDM with BSC approach in performance evaluation of Iranian private banking sector. Adv Fuzzy Syst. https://doi.org/10.1155/2011/148712

Shui XZ, Li DQ (2003) A possibility based method for priorities of interval judgment matrix. Chin J Manag Sci 11(1):63–65

Wang WK, Lu WM, Lin YL (2012) Does corporate governance play an important role in BHC performance? Evidence from the US. Econ Model 29(3):751–760

Wang WK, Lu WM, Wang YH (2013) The relationship between bank performance and intellectual capital in East Asia. Qual Quant 47(2):1041–1062

Wanke P, Azad MAK, Barros CP (2016) Efficiency factors in OECD banks: a ten-year analysis. Expert Syst Appl 64:208–227

Wu HY, Tzeng GH, Chen YH (2009) A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard. Expert Syst Appl 36(6):10135–10147

Zhang C, Wang C, Zhang Z, Tian D (2018) A novel technique for multiple attribute group decision making in interval-valued hesitant fuzzy environments with incomplete weight information. J Ambient Intell Humaniz Comput 10(6):2417–2433

Zhao H, Sinha AP, Ge W (2009) Effects of feature construction on classification performance: an empirical study in bank failure prediction. Expert Syst Appl 36(2):2633–2644

Acknowledgements

The authors would like to thank the editors and anonymous reviewers of the journal for their helpful and constructive comments that improved the quality of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

No, R.K.G., Niroomand, S., Didehkhani, H. et al. Modified interval EDAS approach for the multi-criteria ranking problem in banking sector of Iran. J Ambient Intell Human Comput 12, 8129–8148 (2021). https://doi.org/10.1007/s12652-020-02550-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12652-020-02550-6