Abstract

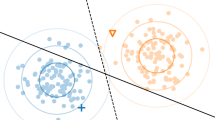

Credit scoring represents a two-classification problem. Moreover, the data imbalance of the credit data sets, where one class contains a small number of data samples and the other contains a large number of data samples, is an often problem. Therefore, if only a traditional classifier is used to classify the data, the final classification effect will be affected. To improve the classification of the credit data sets, a Gaussian mixture model based combined resampling algorithm is proposed. This resampling approach first determines the number of samples of the majority class and the minority class using a sampling factor. Then, the Gaussian mixture clustering is used for undersampling of the majority of samples, and the synthetic minority oversampling technique is used for the rest of the samples, so an eventual imbalance problem is eliminated. Here we compare several resampling methods commonly used in the analysis of imbalanced credit data sets. The obtained experimental results demonstrate that the proposed method consistently improves classification performances such as F-measure, AUC, G-mean, and so on. In addition, the method has strong robustness for credit data sets.

Similar content being viewed by others

References

Albisua I, Arbelaitz O, Gurrutxaga I, Lasarguren A, Muguerza J, Pérez JM (2013) The quest for the optimal class distribution: an approach for enhancing the effectiveness of learning via resampling methods for imbalanced data sets. Prog Artif Intell 2(1):45–63

Altman EI, Marco G, Varetto F (2004) Corporate distress diagnosis: comparisons using linear discriminant analysis and neural networks (the Italian experience). J Bank Financ 18(3):505–529

Arminger G, Enache D, Bonne T (1997) Analyzing credit risk data: a comparison of logistic discrimination, classification tree analysis, and feedforward networks. Comput Stat 12(2):293–310

Baesens B, Gestel TV, Viaene S, Stepanova M, Suykens J, Vanthienen J (2003) Benchmarking state-of-the-art classification algorithms for credit scoring. J Oper Res Soc 54(6):627–635

Baesens B, Mues C, Martens D, Vanthienen J (2009) 50 years of data mining and OR: upcoming trends and challenges. J Oper Res Soc 60(1):S16–S23

Beyan C, Fisher R (2015) Classifying imbalanced data sets using similarity based hierarchical decomposition. Pattern Recognit 48(5):1653–1672

Błaszczyński J, Stefanowski J (2015) Neighbourhood sampling in bagging for imbalanced data. Neurocomputing 150:529–542

Brown I, Mues C (2012) An experimental comparison of classification algorithms for imbalanced credit scoring data sets. Expert Syst Appl 39(3):3446–3453

Chawla NV (2009) Data mining for imbalanced datasets: an overview. In: Data mining and knowledge discovery handbook. Springer, Boston, MA, pp 875–886

Chawla NV, Bowyer KW, Hall LO, Kegelmeyer WP (2002) SMOTE: synthetic minority over-sampling technique. J Artif Intell Res 16(1):321–357

Chawla NV, Cieslak DA, Hall LO, Joshi A (2008) Automatically countering imbalance and its empirical relationship to cost. Data Min Knowl Discov 17(2):225–252

Chawla NV, Japkowicz N, Kotcz A (2004) Editorial: Special issue on learning from imbalanced data sets. ACM Sigkdd Explor Newsl 6(1):1–6

Chawla NV, Lazarevic A, Hall LO, Bowyer KW (2003) SMOTEBoost: improving prediction of the minority class in boosting. Lect Notes Comput Sci 2838:107–119

Cieslak DA, Chawla NV, Striegel A (2006) Combating imbalance in network intrusion datasets. In: IEEE international conference on granular computing, IEEE. Atlanta, USA

Cohen WW (1995) Fast effective rule induction. In: Twelfth international conference on machine learning. Morgan Kaufmann Publishers Inc. Tahoe City, California, pp 115–123

Dempster AP, Laird NM, Rubin DB (1977) Maximum likelihood from incomplete data via the EM algorithm. J R Stat Soc Ser B Methodol 39(1):1–22

Desai VS, Crook JN, Jr GO (1996) A comparison of neural networks and linear scoring models in the credit union environment. Eur J Oper Res 95(1):24–37

Domingos P (1999) Metacost: a general method for making classifiers cost-sensitive. In: KDD’99 proceedings of the ifth ACM SIGKDD international conference on knowledge discovery and data mining. San Diego, USA, vol 99, pp 155–164

Fawcett T (2006) An introduction to ROC analysis. Pattern Recognit Lett 27(8):861–874

Freitas A (2011) Building cost-sensitive decision trees for medical applications. AI Commun 24(3):285–287

Galar M, Barrenechea E, Herrera F (2013) EUSBoost: enhancing ensembles for highly imbalanced data-sets by evolutionary undersampling. Pattern Recognit 46(12):3460–3471

Galar M, Fernandez A, Barrenechea E, Bustince H, Herrera F (2012) A review on ensembles for the class imbalance problem: bagging-, boosting-, and hybrid-based approaches. IEEE Trans Syst Man Cybern Part C Appl Rev 42(4):463–484

García V, Marqués AI, Sánchez JS (2012) On the use of data filtering techniques for credit risk prediction with instance-based models. Expert Syst Appl 39(18):13267–13276

Ghazikhani A, Monsefi R, Yazdi HS (2013) Ensemble of online neural networks for non-stationary and imbalanced data streams. Neurocomputing 122:535–544

Guo H, Li Y, Shang J, Gu M, Huang Y, Gong B (2016) Learning from class-imbalanced data: review of methods and applications. Expert Syst Appl 73:220–239

Han H, Wang WY, Mao BH (2005) Borderline-SMOTE: a new over-sampling method in imbalanced data sets learning. In: International conference on intelligent computing. Springer, Berlin, Heidelberg. Ulsan, Korea, pp 878–887

Hand DJ, Henley WE (1997) Statistical classification methods in consumer credit scoring: a review. J R Stat Soc 160(3):523–541

Hartigan JA, Wong MA (1979) Algorithm AS 136: a k-means clustering algorithm. J R Stat Soc 28(1):100–108

Hu S, Liang Y, Ma L, He Y (2009) MSMOTE: improving classification performance when training data is imbalanced. In: 2009 second international workshop on computer science and engineering, IEEE. Qingdao, China, vol 2, pp 13–17

Huang Z, Chen H, Hsu CJ, Chen WH, Wu S (2004) Credit rating analysis with support vector machines and neural networks: a market comparative study. Decis Support Syst 37(4):543–558

Jackowski K, Krawczyk B, Woźniak M (2012) Cost-sensitive splitting and selection method for medical decision support system. In: Intelligent data engineering and automated learning—IDEAL 2012. Springer, Berlin

Li DC, Liu CW, Hu SC (2010) A learning method for the class imbalance problem with medical data sets. Comput Biol Med 40(5):509–518

Japkowicz N, Stephen S (2002) The class imbalance problem: a systematic study. Intell Data Anal 6(5):429–449

Kasabov N (2002) Evolving connectionist systems for adaptive learning and knowledge discovery: methods, tools, applications. In: Proceedings first international IEEE symposium intelligent systems, IEEE. Varna, Bulgaria, vol 1, pp 24–28

Kasabov N, Feigin V, Hou ZG, Chen Y, Liang L, Krishnamurthi R, Parmar P (2014) Evolving spiking neural networks for personalised modelling, classification and prediction of spatio-temporal patterns with a case study on stroke. Neurocomputing 134(4):269–279

Kasabov NK, Doborjeh MG, Doborjeh ZG (2016) Mapping, learning, visualization, classification, and understanding of fMRI data in the NeuCube evolving spatiotemporal data machine of spiking neural networks. IEEE Trans Neural Netw Learn Syst PP(99):887–899

Kohavi R (1995) A study of cross-validation and bootstrap for accuracy estimation and model selection. In: The international joint conference on artiicial intelligence, Morgan Kaufmann. Los Angeles, CA, vol 14, no 2, pp 1137–1145

Kotsiantis S, Kanellopoulos D, Pintelas P (2006) Handling imbalanced datasets: a review. GESTS Int Trans Comput Sci Eng 30(1):25–36

Krawczyk B, Woniak M, Schaefer G (2014) Cost-sensitive decision tree ensembles for effective imbalanced classification. Appl Soft Comput 14(1):554–562

Kubat M, Matwin S (1997) Addressing the curse of imbalanced training sets: one-sided selection. In: the 14th international conference on machine learning. Nashville, TN, USA, vol 97, pp 179–186

Lenca P, Lallich S (2008) A comparison of different off-centered entropies to deal with class imbalance for decision trees. Lect Notes Comput Sci 5012:634–643

Li Y, Sun G, Zhu Y (2010) Data imbalance problem in text classification. In: 2010 third international symposium on information processing, IEEE. Qingdao, China, pp 301–305

Lin Y, Huang X, Xu K (2013) Research on extreme risk warning for financial market based on RU-SMOTE-SVM. Forecasting 32(4)

Liu TY (2012) Feature selection based on mutual information for gear imbalanced problem faulty diagnosis. In: IET conference publications, 2012, pp 54–54. https://doi.org/10.1049/cp.2012.0506

Liu W, Chawla S (2011) Class confidence weighted kNN algorithms for imbalanced data sets. In: Computer science. https://doi.org/10.1007/978-3-642-20847-8, pp 345–356 (chapter 29)

Liu W, Chawla S, Cieslak DA, Chawla NV (2010) A robust decision tree algorithm for imbalanced data sets. In: Paper presented at the SIAM international conference on data mining, SDM 2010, April 29–May 1, 2010, Columbus, Ohio, USA

Lomax S, Vadera S (2013) A survey of cost-sensitive decision tree induction algorithms. ACM Comput Surv 45(2):1–35

Maalouf M, Trafalis TB (2011) Robust weighted kernel logistic regression in imbalanced and rare events data. Comput Stat Data Anal 55(1):168–183

Marqués AI, García V, Sánchez JS (2013) On the suitability of resampling techniques for the class imbalance problem in credit scoring. J Oper Res Soc 64(7):1060–1070

Mena L, Gonzalez JA (2006) Machine learning for imbalanced datasets: application in medical diagnostic. In: Paper presented at the nineteenth international Florida artificial intelligence research society conference, Melbourne Beach, Florida, USA, May

Min F, Zhu W (2012) A competition strategy to cost-sensitive decision trees. Springer, Berlin

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23(4):589–609

Perols J (2013) Financial statement fraud detection: an analysis of statistical and machine learning algorithms. Soc Sci Electron Publ 30(2):19–50

Pluto K, Tasche D (2005) Estimating probabilities of default for low default portfolios. Dirk Tasche 6(3):79–103

Rodda S, Mogalla S (2011) A normalized measure for estimating classification rules for multi-class imbalanced datasets. Int J Eng Sci Technol 3(4):3216–3220

Rousseeuw P (1987) Silhouettes: a graphical aid to the interpretation and validation of cluster analysis. J Comput Appl Math 20(20):53–65

Steenackers A, Goovaerts MJ (1989) A credit scoring model for personal loans. Insur Math Econ 8(1):31–34

Sun Y, Kamel MS, Wong AKC, Wang Y (2007) Cost-sensitive boosting for classification of imbalanced data. Pattern Recognit 40(12):3358–3378

Thomas C (2013) Improving intrusion detection for imbalanced network traffic. Secur Commun Netw 6(3):309–324

Thomas LC, Crook J, Edelman D (2002) Credit scoring and its applications. SIAM, Philadelphia

Tomek I (1976) Two modifications of CNN. IEEE Trans Syst Man Cybern SMC 6(11):769–772

Wang G, Hao J, Ma J, Jiang H (2011) A comparative assessment of ensemble learning for credit scoring. Expert Syst Appl 38(1):223–230

Wang S, Yao X (2009) Diversity analysis on imbalanced data sets by using ensemble models. In: 2009 IEEE symposium on computational intelligence and data mining, IEEE. Nashville, TN, USA, pp 324–331

West D (2000) Neural network credit scoring models. Comput Oper Res 27(11):1131–1152

Wiginton JC (1980) A note on the comparison of logit and discriminant models of consumer credit behavior. J Financ Quant Anal 15(3):757–770

Yang Y (2007) Adaptive credit scoring with kernel learning methods. Eur J Oper Res 183(3):1521–1536

Yobas MB, Crook JN, Ross P (2000) Credit scoring using neural and evolutionary techniques. IMA J Manag Math 11(2):111–125

Zheng Z, Wu X, Srihari R (2004) Feature selection for text categorization on imbalanced data. Sigkdd Explor 6(1):80–89

Acknowledgements

The authors are grateful to the support of the National Natural Science Foundation of China (71671123, 71571132). Meanwhile, the author is grateful for the help of relevant enterprises and professors in the process.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Han, X., Cui, R., Lan, Y. et al. A Gaussian mixture model based combined resampling algorithm for classification of imbalanced credit data sets. Int. J. Mach. Learn. & Cyber. 10, 3687–3699 (2019). https://doi.org/10.1007/s13042-019-00953-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13042-019-00953-2