Abstract

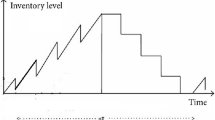

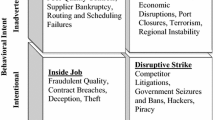

Now-a-days, the risks associated with transportation have received special attention among the global traders due to the unusual circumstances such as terrorist attack, earth quake, mishandling in transport, shipping damage, misplacing products etc. A mathematical model for an inventory system under such transport risk conditions is highly useful to run the supply chain (SC) smoothly and it paves the way to minimize the total cost incurred. In business, many suppliers offer two-part delay in payments, say \( (\alpha /M_{1} ,{\text{ net }}M_{2} ) \), in order to attract their retailers. This paper investigates retailer’s inventory system in a SC under the random effect of risk in delivery from a supplier to the retailer. Here, the supplier offers two-part trade credit to his retailer and the retailer in turn offers a full credit period to the customers. The total cost incurred at the retailer’s inventory system is minimized and the optimal replenishment policies are determined. Mathematical theorems are developed and numerical examples are presented to illustrate the sensitivity analysis of inventory key parameters.

Similar content being viewed by others

References

Aggarwal SP, Jaggi CK (1995) Ordering policies of deteriorating items under permissible delay in payment. J Oper Res Soc 46:658–662

Atasoy B, Güllü R, Tan T (2012) Optimal inventory policies with non-stationary supply disruptions and advance supply information. Decis Support Syst 53:269–281

Pal B, Sana SS, Chaudhuri K (2012) A multi-echelon supply chain model for reworkable items in multiple-markets with supply disruption. Econ Model 29:1891–1898

Pal B, Sana SS, Chaudhuri K (2014) A multi-echelon production–inventory system with supply disruption. J Manuf Syst 33:262–276

Chang CT, Teng JT, Goyal SK (2008) Inventory lot-size models under trade credits: a review. Asia Pac J Oper Res 25:89–112

Chang CT, Teng JT, Chern MS (2010) Optimal manufacturer’s optimal policies for deteriorating items in a supply chain with upstream and down stream trade credits. Int J Prod Econ 127:197–202

Chen LH, Kang FS (2010) Coordination between vendor and buyer considering trade credit and items of imperfect quality. Int J Prod Econ 123:52–61

Chen S-H, Cárdenas-Barrón LE, Teng JT (2013a) Retailer’s economic order quantity when the supplier offers conditionally permissible delay in payments link to order quantity. Int J Prod Econ. doi:10.1016/j.ijpe.2013.05.032 (in press)

Chen S-C, Chang C-T, Teng J-T (2013b) A comprehensive note on “Lot-sizing decisions for deteriorating items with two warehouses under an order-size-dependent trade credit”. Int Trans Oper Res (in press)

Chern M-S, Pan Q, Teng J-T, Chan Y-L, Chen S-C (2013) Stackelberg solution in a vendor–buyer supply chain model with permissible delay in payments. Int J Prod Econ 144(1):397–404

Chopra S, Reinhardt G, Mohan U (2007) The importance of decoupling recurrent and disruption risks in a supply chain. Naval Res Logist 54(5):544–555

Chung KJ, Cárdenas-Barrón LE (2013) The simplified solution procedure for deteriorating items under stock-dependent demand and two-level trade credit in the supply chain management. Appl Math Model 37(7):4653–4660

Chung KJ, Liao JJ (2011) The simplified solution algorithm for an integrated supplier–buyer inventory model with two-part trade credit in a supply chain system. Eur J Oper Res 213:156–165

Eisenstein DD (2005) Recovering cyclic schedules using dynamic produce-up-to policies. Oper Res 53:675–688

Feng H, Li J, Zhao D (2013) Retailer’s optimal replenishment and payment policies in the EPQ model under cash discount and two-level trade credit policy. Appl Math Model 37(5): 3322–3339

Fernquest J (2011) Floods hit auto and electronics exports. Bangkok Post, Bangkok

Gallego G (1994) When is a base stock policy optimal in recovering disrupted cyclic schedules? Naval Res Logist 41:317–333

Giunipero LC, Eltantawy RA (2004) Securing the upstream supply chain: a risk management approach. Int J Phys Distrib Logist Manage 34:698–713

Goyal SK (1985) Economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 36:335–338

Hishamuddin H, Sarker RA, Essam D (2012) A disruption recovery model for a single stage production–inventory system. Eur J Oper Res 222(3):464–473

Hishamuddin H, Sarker RA, Essam D (2013) A recovery model for a two-echelon serial supply chain with consideration of transportation disruption. Comput Ind Eng 64(2):552–561

Ho CH, Ouyang LY, Su CH (2008) Optimal pricing, shipment and payment policy for an integrated supplier–buyer inventory model with two-part trade credit. Eur J Oper Res 187:496–510

Huang YF (2003) Optimal retailer’s ordering policies in the EOQ model under trade credit financing. J Oper Res Soc 54:1011–1015

Huang YF (2007) Economic order quantity under conditionally permissible delay in payments. Eur J Oper Res 176:911–924

Huang YF, Chung KJ (2003) Optimal replenishment and payment policies in the EOQ model under cash discount and trade credit. Asia-Pac J Oper Res 20:90–177

Huang YF, Hsu KH (2008) An EOQ model under retailer partial trade credit policy in supply chain. Int J Prod Econ 112:655–664

Hwang H, Shinn SW (1997) Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payments. Comput Oper Res 24:539–547

Jaggi CK, Goyal SK, Goel SK (2008) Retailer’s optimal replenishment decisions with credit-linked demand under permissible delay in payments. Eur J Oper Res 190:130–135

Jaggi CK, Kapur PK, Goyal SK, Goel SK (2012) Optimal replenishment and credit policy in EOQ model under two-levels of trade credit policy when demand is influenced by credit period. Int J Syst Assur Eng Manag 3(4):352–359. doi:10.1007/s13198-012-0106-9

Jaggi CK, Goel SK, Mittal M (2013) Credit financing in economic ordering policies for defective items with allowable shortages. Appl Math Comput 219:5268–5282

Jamal AMM, Sarker BR, Wang S (1997) An ordering policy for deteriorating items with allowable shortage and permissible delay in payment. J Oper Res Soc 48:826–833

Li Z, Xu SH, Hayya J (2004) A periodic-review inventory system with supply interruptions. Probab Eng Inf Sci 18(1):33–53

Liao JJ (2008) An EOQ model with non-instantaneous receipt and exponentially deteriorating items under two-level trade credit. Int J Prod Econ 113:852–861

Liao JJ, Huang KN, Chung KJ (2012) Lot-sizing decisions for deteriorating items with two warehouses under an order-size-dependent trade credit. Int J Prod Econ 137:102–115

Mach Traci L, Wolken JD (2006) Financial services used by small businesses: evidence from the 2003 survey of small business finances. Fed Reserve Bull 167–195

Min J, Zhou YW, Zhao J (2010) An inventory model for deteriorating items under stock-dependent demand and two-level trade credit. Appl Math Model 34:3273–3285

Mohebbi E (2003) Supply interruptions in a lost-sales inventory system with random lead time. Comput Oper Res 30(3):411–426

Mohebbi E (2004) A replenishment model for the supply-uncertainty problem. Int J Prod Econ 87(1):25–37

Mohebbi E, Hao D (2006) When supplier’s availability affects the replenishment lead time—an extension of the supply-interruption problem. Eur J Oper Res 175(2):992–1008

Ouyang L-Y, Chang C-T (2013) Optimal production lot with imperfect production process under permissible delay in payments and complete backlogging. Int J Prod Econ 144(2):610–617

Ouyang LY, Teng JT, Chuang KW, Chuang BR (2005) Optimal inventory policy with noninstantaneous receipt under trade credit. Int J Prod Econ 98:290–300

Ouyang L-Y, Yang C-T, Chan YL, Cárdenas-Barrón LE (2013) A comprehensive extension of the optimal replenishment decisions under two levels of trade credit policy depending on the order quantity. Appl Math Comput 224(1):268–277

Özekici S, Parlar M (1999) Inventory models with unreliable suppliers in a random environment. Ann Oper Res 91:123–136

Parlar M, Berkin D (1991) Future supply uncertainty in EOQ models. Naval Res Logist 38:107–121

Parlar M, Perry D (1996) Inventory models of future supply uncertainty with single and multiple suppliers. Naval Res Logist 43:191–210

Paul S, Sarker R, Essam D (2014) Real time disruption management for a two-stage batch production–inventory system with reliability considerations. Eur J Oper Res 237:113–128

Qi X, Bard JF, Yu G (2004) Supply chain coordination with demand disruptions. Omega 32:301–312. doi:10.1016/j.omega.2003.12.002

Qi L, Shen ZJM, Snyder LV (2009) A continuous-review inventory model with disruptions at both supplier and retailer. Prod Oper Manag 18(5):516–532

Schmitt AJ, Snyder LV (2012) Infinite-horizon models for inventory control under yield uncertainty and disruptions. Comput Oper Res 39:850–862

Schmitt AJ, Snyder LV, Shen ZJM (2010) Inventory systems with stochastic demand and supply: properties and approximations. Eur J Oper Res 206(2):313–328

Shah NH (1993) Probabilistic time-scheduling model for an exponentially decaying inventory when delay in payment is permissible. Int J Prod Econ 32:77–82

Taleizadeh AA, Mohammadi B, Cárdenas-Barrón LE, Samimi H (2013) An EOQ model for perishable product with special sale and shortage. Int J Prod Econ 145(1):318–338

Teng JT (2002) On the economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 53:915–918

Teng JT (2006) Discount cash-flow analysis on inventory control under various supplier’s trade credits. Int J Oper Res 3:23–29

Teng JT (2009) Optimal ordering policies for a retailer who offers distinct trade credits to its good and bad credit customers. Int J Prod Econ 119:415–423

Teng JT, Chang CT (2009) Optimal manufacturer’s replenishment policies in the EPQ model under two levels of trade credit policy. Eur J Oper Res 195:358–363

Teng JT, Goyal SK (2007) Optimal ordering policies for a retailer in a supply chain with up-stream and down-stream trade credits. J Oper Res Soc 58:1252–1255

Teng JT, Yang HL, Chern MS (2013) An inventory model for increasing demand under two levels of trade credit linked to order quantity. Appl Math Model 37:7624–7632

Thangam A (2012) Optimal price discounting and lot-sizing policies for perishable items in a supply chain under advance payment scheme and two-echelon trade credits. Int J Prod Econ 139:459–472

Thangam A, Uthayakumar R (2009) Two-echelon trade credit financing for perishable items in a supply chain when demand depends on both credit period and selling price. Comput Ind Eng 57:773–786

Tomlin B (2006) On the value of mitigation and contingency strategies for managing supply chain disruption risks. Manage Sci 52(5):639–657

Tsao YC (2009) Retailers optimal ordering and discounting policies advance sales discount and trade credits. Comput Ind Eng 56:208–215

Tsao YC (2011) Replenishment policies considering trade credit and logistics risk. Sci Iranica 18:753–758

Tsao YC, Sheen GJ (2012) A multi-item supply chain with credit periods and weight freight cost discounts. Int J Prod Econ 135:106–115

Wilson MC (2007) The impact of transportation disruptions on supply chain performance. Transp Res E 43:295–320. doi:10.1016/j.tre.2005.09.008

Xia Y, Yang M-H, Golany B, Gilbert SM, Yu G (2004) Real-time disruption management in a two-stage production and inventory system. IIE Trans 36:111–125

Zeynep Sargut F, Qi L (2012) Analysis of a two-party supply chain with random disruptions. Oper Res Lett 40:114–122

Zhong YG, Zhou YW (2012) The model and algorithm for determining optimal ordering/trade-credit policy of supply chains. Appl Math Comput 219:3809–3825

Zhong YG, Zhou YW, Wahab MIM (2013) How to make the replenishment and payment strategy under flexible two-part trade credit. Comput Oper Res 40:1328–1338

Author information

Authors and Affiliations

Corresponding author

Appendix 1

Appendix 1

1.1 Proof of Theorem 1

Before going to the proof for the statements in Theorem 1, we need the following as a preliminary.

We could observe that \( \frac{{d^{2} TC_{Ai} (T)}}{{dT^{2} }} > 0 \) for i = 1, 2, 3, 4 under various conditions. So,

-

(i)

\( \frac{{dTC_{A1} (T)}}{dT} \) is an increasing function on \( [PM_{1} /\lambda ,\infty ) \).

-

(ii)

\( \frac{{dTC_{A2} (T)}}{dT} \) is an increasing function on \( \left[ {M_{1} ,\frac{{PM_{1} }}{\lambda }} \right] \).

-

(iii)

\( \frac{{dTC_{A3} (T)}}{dT} \) is an increasing function on \( \left[ {M_{1} - N,M_{1} } \right] \).

\( 2A \ge \delta_{1} \) is implied from \( T_{A1}^{*} \ge \frac{{PM_{1} }}{\lambda } \). Since \( \frac{{dTC_{A1} (T)}}{dT} \) is an increasing function, we have \( \frac{{dTC_{A1} (T_{A1}^{*} )}}{dT} \ge \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \). This implies that \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \le 0 \). Hence, \( 2A \ge \delta_{1} \) implies that \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \le 0 \) and so \( 2A \le \delta_{1} \) implies that \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \ge 0. \) Similarly, \( 2A \ge \delta_{2} \) implies that \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \le 0 \) and so \( 2A \le \delta_{2} \) implies that \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \ge 0. \)

\( 2A \le \delta_{1} \) implies that \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \ge 0 \) and so \( 2A \ge \delta_{1} \) implies that \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \le 0. \)

\( 2A \le \delta_{2} \) implies that \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \ge 0 \) and so \( 2A \ge \delta_{2} \) implies that \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \le 0. \)

\( 2A \ge \delta_{3} \) implies that \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \le 0 \) and so \( 2A \le \delta_{3} \) implies that \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \ge 0. \)

\( 2A < \delta_{3} \) implies that \( \frac{{dTC_{A4} (M_{1} - N)}}{dT} \, \ge 0 \) and so \( 2A > \delta_{3} \) implies that \( \frac{{dTC_{A4} (M_{1} - N)}}{dT} \, \le 0. \)

-

(a)

If \( 2A \ge \delta_{1}, \) then \( TC_{A1} (T) \) is a convex function on \( [PM_{1} /\lambda ,\infty ) \) and \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \le 0; \) This shows that \( TC_{A1} (T) \) is decreasing on \( [PM_{1} /\lambda ,T_{A1}^{*} ] \) and increasing on \( [T_{A1}^{*} ,\infty ). \) Since \( \delta_{1} \ge \delta_{2} \ge \delta_{3} \, , \) we have \( 2A \ge \delta_{2} \) and \( 2A \ge \delta_{3}. \) These imply that \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \le 0 \) and \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \le 0, \) \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \le 0 \) and \( \frac{{dTC_{A4} (M_{1} - N)}}{dT} \, \le 0. \) \( 2A \ge \delta_{1} \) implies that \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \le 0. \) Hence, we have (i) \( TC_{A2} (T) \) is a decreasing function on \( \left[ {M_{1} ,\frac{{PM_{1} }}{\lambda }} \right], \) (ii) \( TC_{A3} (T) \) is a decreasing function on \( \left[ {M_{1} - N,M_{1} } \right], \) (iii) \( TC_{A4} (T) \) is a decreasing function on \( \left[ {0,M_{1} - N} \right] \) since \( \mathop { \lim }\limits_{{{\text{T}} \to 0}} TC_{A4}^{\prime } (T) = - \infty. \) Hence, \( TC_{A} (T) \) is decreasing on [0, \( T_{A1}^{*} \)] and increasing on [\( T_{A1}^{*} \),∞). Hence, \( T^{*} = T_{A1}^{*} \) and \( TC_{A}^{*} (T) = TC_{A1}^{*} (T_{A1}^{*} ). \)

-

(b)

Let \( \delta_{1} \ge 2A \ge \delta_{2} \). \( \delta_{1} \ge 2A \) implies that \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \ge 0. \) \( \delta_{2} \le 2A \) implies that \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \le 0 \) and \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \le 0. \) \( \delta_{3} \le \delta_{2} \le 2A \) implies that \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \le 0 \) and \( \frac{{dTC_{A4} (M_{1} - N)}}{dT} \, \le 0. \) Since \( TC_{A1}^{\prime } (T) \) is increasing on \( [PM_{1} /\lambda ,\infty ) \) and \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \ge 0 \) implies that \( TC_{A1} (T) \) is increasing on \( [PM_{1} /\lambda ,\infty ). \) Since \( \delta_{1} \ge 2A \ge \delta_{2} \) implies that \( TC_{A2} (T) \)is a convex function on \( [M_{1} ,PM_{1} /\lambda ] \) and \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \le 0. \) Therefore, \( TC_{A2} (T) \) is decreasing on \( [M_{1} ,T_{A2}^{*} ] \) and increasing on \( [T_{A2}^{*} ,PM_{1} /\lambda ]. \) Since \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \le 0 \) and \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \le 0, \) \( TC_{A3} (T) \) is decreasing on \( \left[ {M_{1} - N,M_{1} } \right]. \) Since \( - \infty = \mathop { \lim }\limits_{{{\text{T}} \to 0}} TC_{A4}^{\prime } (T) < TC_{A4}^{\prime } (M_{1} - N) \le 0, \) \( TC_{A4} (T) \) is decreasing on \( \left[ {0,M_{1} - N} \right]. \) Hence, \( TC_{A} (T) \) is decreasing on [0, \( T_{A2}^{*} \)] and increasing on [\( T_{A2}^{*} \), ∞). Hence, \( T^{*} = T_{A2}^{*} \) and \( TC_{A}^{*} (T) = TC_{A2}^{*} (T_{A2}^{*} ). \)

-

(c)

Let \( \delta_{2} \ge 2A \ge \delta_{3}. \) \( \delta_{2} \ge 2A \) implies that \( \delta_{1} \ge 2A. \) \( \delta_{1} \ge 2A \) implies that \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \ge 0. \) \( \delta_{2} \ge 2A \) implies that \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \ge 0. \) \( 2A \ge \delta_{3} \) implies that \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \le 0 \) and \( \frac{{dTC_{A4} (M_{1} - N)}}{dT} \, \le 0. \) From the discussions in (b), \( TC_{A1} (T) \) is increasing on \( [PM_{1} /\lambda ,\infty ). \) Since \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \ge 0, \) \( TC_{A2} (T) \)is increasing on \( [M_{1} ,PM_{1} /\lambda ]. \) Since \( \delta_{2} \ge 2A \ge \delta_{3}, \) \( TC_{A3} (T) \) is convex on \( \left[ {M_{1} - N,M_{1} } \right] \) and \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \le 0, \) \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \ge 0, \) \( TC_{A3} (T) \) is decreasing on \( [M_{1} - N,T_{A3}^{*} ] \) and increasing on \( [T_{A3}^{*} ,M_{1} ]. \) Since \( - \infty = \mathop { \lim }\limits_{{{\text{T}} \to 0}} TC_{A4}^{\prime } (T) < TC_{A4}^{\prime } (M_{1} - N) \le 0, \) \( TC_{A4} (T) \) is decreasing on \( \left[ {0,M_{1} - N} \right]. \) Hence, \( TC_{A} (T) \) is decreasing on [0, \( T_{A3}^{*} \)] and increasing on [\( T_{A3}^{*} \), ∞). Hence, \( T^{*} = T_{A3}^{*} \) and \( TC_{A}^{*} (T) = TC_{A3}^{*} (T_{A3}^{*} ) \)

-

(d)

Let \( \delta_{3} \ge 2A. \) Since \( \delta_{1} \ge \delta_{2} \ge \delta_{3}, \) we have the following

(i) \( \delta_{1} \ge 2A \) implies that \( \frac{{dTC_{A1} (PM_{1} /\lambda )}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A2} (PM_{1} /\lambda )}}{dT} \, \ge 0. \)

(ii) \( \delta_{2} \ge 2A \) implies that \( \frac{{dTC_{A2} (M_{1} )}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A3} (M_{1} )}}{dT} \, \ge 0. \)

(iii) \( \delta_{3} \ge 2A \) implies that \( \frac{{dTC_{A3} (M_{1} - N)}}{dT} \, \ge 0 \) and \( \frac{{dTC_{A4} (M_{1} - N)}}{dT} \, \ge 0. \)

(iv) \( TC_{A4} (T) \) is a convex function on \( \left[ {0,M_{1} - N} \right]. \)

Therefore,

-

(i)

\( TC_{A1} (T) \) is increasing on \( [PM_{1} /\lambda ,\infty ). \)

-

(ii)

\( TC_{A2} (T) \) is increasing on \( [M_{1} ,PM_{1} /\lambda ]. \)

-

(iii)

\( TC_{A3} (T) \) is increasing on \( [M_{1} - N,M_{1} ]. \)

-

(iv)

\( TC_{A4} (T) \) is decreasing on \( [0,T_{A4}^{*} ] \) and decreasing on \( [T_{A4}^{*} ,M_{1} - N]. \)

Hence \( TC_{A} (T) \) is decreasing on [0, \( T_{A4}^{*} \)] and increasing on [\( T_{A4}^{*} \), ∞). Hence, \( T^{*} = T_{A4}^{*} \) and \( TC_{A}^{*} (T) = TC_{A4}^{*} (T_{A4}^{*} ) \).

Rights and permissions

About this article

Cite this article

Thangam, A. Retailer’s optimal replenishment policy in a two-echelon supply chain under two-part delay in payments and disruption in delivery. Int J Syst Assur Eng Manag 8 (Suppl 1), 26–46 (2017). https://doi.org/10.1007/s13198-014-0285-7

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-014-0285-7