Abstract

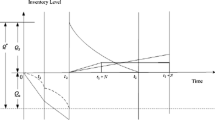

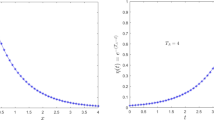

The surge in e-commerce has reshaped consumer shopping habits, necessitating advance order booking and adaptable return policies in the online retail business. This paper introduces an integrated inventory model that addresses inventory order quantity, return policy, and pricing decisions, with advance order booking and cancellations catering to the evolving e-commerce environment. Customers get the option to cancel their advance orders, as well as return the product within the designated return window, against the full refund policy. All returned products are screened, and defective products found are sold to third-party vendor at a discounted price. Order cancellations are assumed to decrease in waiting time, i.e., more cancellations are expected at the beginning of the advance booking period than towards the end. The study assumes that consumer demand varies with price, return window duration, and the proportion of defective products. A profit maximization model is developed to determine the optimal selling price, order cycle length and return window. A solution approach is suggested and illustrated through numerical analysis, providing practical insights for online retailers seeking to refine their inventory strategies.

Similar content being viewed by others

References

Chen J, Bell PC (2009) The impact of customer returns on pricing and order decisions. Eur J Oper Res 195(1):280–295

Cheng MC, Hsieh TP, Lee HM, Ouyang LY (2020) Optimal ordering policies for deteriorating items with a return period and price-dependent demand under two-phase advance sales. Oper Res Int Journal 20:585–604

Dye CY, Hsieh TP (2013) Joint pricing and ordering policy for an advance booking system with partial order cancellations. Appl Math Model 37(6):3645–3659

Emmons H, Gilbert SM (1998) Note. The role of returns policies in pricing and inventory decisions for catalogue goods. Manag Sci 44(2):276–283

He J, Chin KS, Yang JB, Zhu DL (2006) Return policy model of supply chain management for single-period products. J Optim Theory Appl 129:293–308

Heiman A, McWilliams B, Zhao J, Zilberman D (2002) Valuation and management of money-back guarantee options. J Retail 78(3):193–205

Hu W, Li Y, Govindan K (2014) The impact of consumer returns policies on consignment contracts with inventory control. Eur J Oper Res 233(2):398–407

Hu W, Li J (2012) How to implement return policies in a two-echelon supply chain? Discrete Dyn Nat Soc. https://doi.org/10.1155/2012/453193

Janakiraman N, Syrdal HA, Freling R (2016) The effect of return policy leniency on consumer purchase and return decisions: a meta-analytic review. J Retail 92(2):226–235

Jeng SP (2017) Increasing customer purchase intention through product return policies: the pivotal impacts of retailer brand familiarity and product categories. J Retail Consum Serv 39:182–189

Ketzenberg ME, Zuidwijk RA (2009) Optimal pricing, ordering, and return policies for consumer goods. Prod Oper Manag 18(3):344–360

Koide T, Ishii H (2005) The hotel yield management with two types of room prices, overbooking and cancellations. Int J Prod Econ 93:417–428

Kumar S (2021) Joint pricing and ordering policy for an advance sales system of perishable items with partial order cancellations and price varying linearly decreasing demand. Turk J Comput Math Educ 12(5):2009–2018

Kumari M, De PK (2022) An EOQ model for deteriorating items analyzing retailer’s optimal strategy under trade credit and return policy with nonlinear demand and resalable returns. Int J Optim Control Theories Appl 12(1):47–55

Li Y, Xu L, Li D (2013) Examining relationships between the return policy, product quality, and pricing strategy in online direct selling. Int J Prod Econ 144(2):451–460

Li D, Chen J, Liao Y (2021) Optimal decisions on prices, order quantities, and returns policies in a supply chain with two-period selling. Eur J Oper Res 290(3):1063–1082

Liu J, Mantin B, Wang H (2014) Supply chain coordination with customer returns and refund-dependent demand. Int J Prod Econ 148:81–89

Mitra S (2009) Analysis of a two-echelon inventory system with returns. Omega 37(1):106–115

Mostard J, Teunter R (2006) The newsboy problem with resalable returns: a single period model and case study. Eur J Oper Res 169(1):81–96

Pasternack BA (1985) Optimal pricing and return policies for perishable commodities. Mark Sci 4(2):166–176

Shah N, Shah P, Patel M (2022) Pricing decisions with effect of advertisement and greening efforts for a greengocer. Sustainability 14(21):13807

Tsao YC (2009) Retailer’s optimal ordering and discounting policies under advance sales discount and trade credits. Comput Ind Eng 56(1):208–215

Uthayakumar R, Priyadharshini AR (2024) Optimal strategy on inventory model under permissible delay in payments and return policy for deteriorating items with shortages. Malaya J Matematik 12(01):71–84

Webster S, Weng ZK (2000) A risk-free perishable item returns policy. Manuf Serv Oper Manag 2(1):100–106

Yang H, Chen J, Chen X, Chen B (2017) The impact of customer returns in a supply chain with a common retailer. Eur J Oper Res 256(1):139–150

Yao Z, Leung SC, Lai KK (2008) Analysis of the impact of price-sensitivity factors on the returns policy in coordinating supply chain. Eur J Oper Res 187(1):275–282

You PS (2006) Ordering and pricing of service products in an advance sales system with price-dependent demand. Eur J Oper Res 170(1):57–71

You PS, Wu MT (2007) Optimal ordering and pricing policy for an inventory system with order cancellations. OR Spectr 29(4):661

Yue X, Raghunathan S (2007) The impacts of the full returns policy on a supply chain with information asymmetry. Eur J Oper Res 180(2):630–647

Zhang J, Niu B, Li J (2014) Optimal pricing and inventory policy with order cancelations under the cash-on-delivery payment scheme. J Syst Sci Complex 27:970–992

Funding

This study received no funding from public, commercial, or non-profit organizations.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors do not have any conflict of interest.

Software usage

The MATLAB software is utilized solely for numerical analysis in the context of the discussed model, and its use is strictly limited to academic purposes. The authors of this paper do not maintain any direct financial affiliation with MATLAB.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Hessian matrix

For this matrix, calculate the principal minors:

The concavity of the profit function requires the conditions to be met: \(D_{1} \left\langle {0, D_{2} } \right\rangle 0, D_{3} < 0.\)

Due to the complexity of the calculations, MATLAB software was used to obtain the values of the minors. By substituting the values of the decision variables and solving the minors, we obtain:

From the above values of principal minors, it can be concluded that the profit function given in Eq. (41) is concave in nature for the obtained values of the decision variables.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Aggarwal, K.K., Ahmed, S. Optimizing ordering, pricing and return strategies in an advanced sales inventory system with product screening. Int J Syst Assur Eng Manag 15, 5548–5573 (2024). https://doi.org/10.1007/s13198-024-02524-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-024-02524-3