Abstract

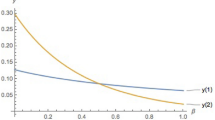

We developed a dynamic model of oligopoly in which firms’ R and D investments accumulate as R and D capital and have spillover effects. We showed that there exists a symmetric stable open-loop Nash equilibrium for each of the differential games under noncooperative R and D and cooperative R and D. We then showed that for small spillovers, each firm’s R and D investments are larger under R and D competition than under R and D cooperation. We further demonstrated that, in the limit, when the discount rate goes to zero, the stability condition for our dynamic game approaches the stability condition for the static two-stage game in d’Aspremont and Jacquemin (Am Econ Rev 78:1133–1137, 1988). However, we also showed that at the Markov perfect equilibrium, cooperative R and D investments are larger than noncooperative investments for all possible values of spillovers.

Similar content being viewed by others

Notes

See also Reinganum [25].

For the R and D investment level to be positive, \(9\delta (r+\delta )\gamma -2\alpha ^2(2-\beta )(1+\beta )\) must be positive. In our model, if \(\alpha \) is small or \(\gamma \) is large, or both, then the value of the depreciation rate that satisfies this condition can be quite large for any \(\beta \). I thank a referee for raising this point. See also footnote 5 below.

In an empirical work on the rate of depreciation for knowledge capital, Pakes and Schankerman [21] argued that one needs to distinguish between physical assets and knowledge capital, and they obtained an estimate for the rate of depreciation of 0.25.

In Henriques [16], the stability condition is given as \(\beta >\textstyle {3 \over 2}-\sqrt{\textstyle {7 \over 2}} \). The correct stability condition, however, is \(\beta >\textstyle {{3-\sqrt{7} } \over 2}\).

Depending on parameter values, there might exist boundary solutions (see Remarks 1 and 2).

References

Amir R (2000) Modelling imperfectly appropriable R&D via spillovers. Int J Ind Organ 18:1013–1032

Amir R, Evstigneev I, Wooders J (2003) Noncooperative versus cooperative R&D with endogenous spillover rates. Games Econ Behav 42:183–207

Amir R, Jin J, Troege M (2008) On additive spillovers and returns to scale in R&D. Int J Ind Organ 26:695–703

Basar T, Olsder B (1982) Dynamic noncooperative game theory. Academic Press, New York

Bernstein J, Nadiri M (1989) Research and development and intra-industry spillovers: an empirical application of dynamic duality. Rev Econ Stud 56:249–269

Cassiman B, Veugelers R (2002) R & D cooperation and spillovers: some empirical evidence from Belgium. Am Econ Rev 92:1169–1184

Cellini R, Lambertini L (1998) A dynamic model of differentiated oligopoly with capital accumulation. J Econ Theory 83:145–155

Cellini R, Lambertini L (2008) Weak and strong time consistency in a differential oligopoly game with capital accumulation. J Optim Theory Appl 138:17–26

Cellini R, Lambertini L (2009) Dynamic R&D with spillovers: competition vs cooperation. J Econ Dyn Control 33:568–582

Cohen W and Levin R (1989) Innovations and market Structure, Ch. 25 in Schmalensee R and Willig R (eds) Handbook of industrial organization, Vol. II, Elsevier, Amsterdam

d’Aspremont C, Jacquemin A (1988) Cooperative and noncooperative R and D in duopoly with spillovers. Am Econ Rev 78:1133–1137

De Bondt R, Slaets P, Cassiman B (1992) The degree of spillovers and the number of rivals for maximum effective R & D. Int J Ind Organ 10:35–54

Dockner E, Jorgensen S, Long NV, Sorger G (2000) Differential games in economics and management science. Cambridge University Press, Cambridge

Hinloopen J (2000) Strategic R&D cooperatives. Res Econ 54:153–185

Hinloopen J (2003) R&D efficiency gains due to cooperation. J Econ 80:107–125

Henriques I (1990) Cooperative and noncooperative R and D in duopoly with spillovers: comment. Am Econ Rev 80:638–640

Jaffe A (1986) Technological opportunity and spillovers of R & D: evidence from firms’ patents, profits, and market value. Am Econ Rev 76:984–1001

Kamien M, Schwartz N (1980) Market structure and innovation. Cambridge University Press, Cambridge

Kamien M, Schwartz N (1991) Dynamic optimization. Elsevier, North Holland, New York

Kamien M, Muller E, Zang I (1992) Research joint ventures and R & D cartels. Am Econ Rev 82:1293–1306

Pakes A and Schankerman M (1979) The rate of obsolescence of knowledge, research gestation lags and the private return to research resources, NBER Working Paper 346

Petit M, Tolwinski B (1999) R&D cooperation or competition. Eur Econ Rev 43:185–208

Reinganum J (1981) Dynamic games of innovation. J Econ Theory 25:11–21

Reinganum J (1982) A dynamic game for R and D: patent protection and competitive behavior. Econometrica 50:671–688

Reinganum J (1989) Timing of innovations: research, development, and diffusion, Ch. 14 in Schmalensee R and Willig R (eds) Handbook of industrial organization, vol I, Elsevier, Amsterdam

Reynolds S (1987) Capacity investment, preemption, commitment in an infinite horizon model. Int Econ Rev 28:69–88

Starr AW, Ho YC (1969) Nonzero-sum differential games. J Optim Theory Appl 3:184–206

Suzumura K (1992) Cooperative and noncooperative R&D in an oligopoly with spillovers. Am Econ Rev 82:1307–1320

Acknowledgments

I would like to thank the editor Luca Lambertini and two anonymous referees for insightful comments and helpful suggestions. I am grateful to Jim Y. Jin for his helpful comments and conversations. I would also like to thank Mihkel Tombak for valuable comments on an earlier version of the paper. The usual disclaimer applies. I gratefully acknowledge financial support from Nihon University.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Proposition 5

Proof

Let \(V^i(y_i ,y_j )\) be the value function for firm \(i\). Feedback Nash equilibrium strategies must satisfy a system of Hamilton-Jacobi-Bellman equations, \(\forall i\),

Assuming symmetric strategies of the firms, we can set \(V^i(y_i ,y_j)=V(y_i ,y_j )\).

We may now suppose the value function takes the following form:

Solving the maximization of the right-hand side of Eq. (16) yields

Imposing symmetry, \(K_1 =K_2 =K,\;L_1 =L_2 =L\) and \(y_1 =y_2 =y\), we have

Thus, we obtain

Substituting Eqs. (17) and (18) into Eq. (16) results in

This equation must hold for any \(y\), and it follows that we have

and

From these equations, we have

and

To ensure that \(x^*\ge 0\) for any \(y\), we must have \(K^*\ge 0\). Thus, we take a root

Next, we seek a stability condition for the Markov perfect equilibrium. Substituting Eq. (18) into Eq. (2) yields

The complete solution to Eq. (19) is

For this state trajectory to be asymptotically stable, we must have \(\delta >\frac{(1+\beta )^2G^*}{\gamma }.\) \(\square \)

Appendix 2: Proof of Proposition 8

The current-value Hamiltonian in this case is given by

The necessary conditions for an open-loop Nash equilibrium are

and

At the steady state, we have \(\dot{\lambda }_i =0, \quad \dot{\mu }_i =0,\) \(\dot{y}_i =0,\) and \(\dot{y}_j =0.\)

Thus, we have

and

It follows that we get

where \(E_i \equiv 2-\beta _i\, \mathrm{and}\, F_i \equiv 2-\beta _i ,\,\;i,\,j=1,\,2,\,\;i\ne j.\)

Suppose that firm \(i\) has a smaller R and D spillover rate than firm \(j\), that is, \(\beta _i >\beta _j.\)

Since \(E_i -E_j <0\) and \(F_j -F_i <0\), we have \(9\delta (r+\delta )(E_i -E_j )+2E_i E_j ( {(E_i -E_j )+(F_j -F_i )})<0.\)

Thus, \(x_i <x_j \). \(\square \)

1.1 The Case of R and D Cooperation with Asymmetric Spillovers

The current-value Hamiltonian in this case is given by \(H_i^C =\pi _i (c_i ,\,c_j )+\pi _j (c_i ,\,c_j )-\frac{1}{2}x_i^2 -\frac{1}{2}x_j^2 +\lambda _i (x_i +\beta _j x_j -\delta y_i )+\mu _i (x_j +\beta _i x_i -\delta y_j ),\;\,i,\,j=1,\,2,\,\;i\ne j.\) Then, following the procedure in the proof of Proposition 2, we have the desired results.

Appendix 3: Proof of Proposition 9

1.1 The Case of R and D Competition

The current-value Hamiltonian in this case is given by

The necessary conditions for an open-loop Nash equilibrium are

where

and

At the steady state, we have \(\dot{\lambda }_i^i =0, \quad \dot{\lambda }_i^j =0\) for every \(j\), and \(\dot{y}_i =0\).

For a symmetric equilibrium, we get

and

It follows that we have the following equilibrium values:

and

\(\square \)

1.2 The Case of R and D Cooperation

The current-value Hamiltonian in this case is

The rest of the analysis is similar to the proof of Proposition 3.

Thus, we can show \(x^{C*}=\frac{2\delta ( {1+(n-1)\beta })(a-\bar{c})}{(n+1)^2\delta (r+\delta )-2\,( {1+(n-1)\beta })^2}\).

Appendix 4: Proof of Proposition 12

At the open-loop Nash equilibrium, the R and D level \(x_\theta ^C \) under R and D cooperation is given by

Thus,

Hence,

Therefore, if \(\frac{1}{2}<\beta \le \theta \), then \(1-(\beta +\theta )<0\). Thus, \(x^N<x_\theta ^C \).

If \(\beta \le \theta <\frac{1}{2}\), then \(1-(\beta +\theta )>0\). Thus,

\(\square \)

Rights and permissions

About this article

Cite this article

Kobayashi, S. On a Dynamic Model of Cooperative and Noncooperative R and D in Oligopoly with Spillovers. Dyn Games Appl 5, 599–619 (2015). https://doi.org/10.1007/s13235-014-0117-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-014-0117-z