Abstract

We characterize a relatively simple Markov Perfect equilibrium in a continuous-time dynamic model of competition with switching costs. When firms cannot price-discriminate between old and new consumers, the effect of switching costs on prices critically depends on the degree of market share asymmetries: If firms’ market shares are sufficiently asymmetric, an increase in switching costs leads to higher prices. However, as market shares become sufficiently symmetric, price competition turns fiercer, and in the long-run, switching costs have a pro-competitive effect. If firms can price-discriminate, an increase in switching costs make all consumers better off regardless of market structure.

Similar content being viewed by others

Notes

Our model could be extended to multiple competing firms assuming a “circular city” model of product differentiation with evenly spaced product varieties as in Salop’s model. In that model, demand for a product variety is a function of the two adjacent product varieties. So in a dynamic model with switching, demand for a product will be a function of prices and market shares of the two adjacent product varieties. A dynamic model would therefore require a multi-dimensional state space, which is out of the scope of the current paper.

In the context of a discrete choice model with product differentiation, the relaxation of the full market coverage assumption would imply that not all consumers are served continuously: Some consumers may at times drop out of the market and then sign back up for service at a future time (without experiencing a switching cost). Thus, relaxing the full market assumption would add an element of competitive pressure on firms equilibrium pricing strategies.

In Sect. 4.1, we analyze the effects of price discrimination.

The analysis is robust to arrival rates different from one. However, this would add an additional parameter in the model, with only a scaling effect.

The main conclusions of the analysis are preserved if we allowed for more sophisticated consumers. See “Appendix 1”.

Note that this assumption is consistent with Hotelling’s model of product differentiation with product varieties at the extremes of a linear city uniformly distributed in \([0,\frac{1}{2}]\). Results are robust to allowing for more general distributions.

Note that \(q_{ii}\ge q_{ji}\) reflects the fact that, for given prices, firm i is more likely to retain a randomly chosen current customer than to “steal” one from firm j.

We believe that there would be little difference between the affine MPE presented in the paper and an equilibrium (should it exist) in nonlinear strategies. In the linear MPE, the dominant firm exploits its market share, while the firm with smaller market share offers a price discount that decreases over time. The rate at which the dominant firm loses market share is constant. Suppose firms follow nonlinear pricing strategies and the firm with lower market share offers a price discount. In this case, nonlinearity changes the speed at which the dominant firm loses market share. There may be a nonlinear equilibrium in which market dominance decreases more slowly initially (with high prices by both firms) and then speeds up (with relatively larger price discounts) as market shares equilibrate. However, there would be no qualitative difference between this equilibrium (should it exist) and the one presented in the paper. With relatively high discount rates, there can not be a nonlinear equilibrium in which the dominant firm maintains (or increases) dominance because this entails a price discount by the dominant firm which would make it worse off.

Note that \(a\rightarrow 0^{+}\) as \(s\rightarrow 0^{+}\), the equilibrium pricing corresponds to the “static” case (i.e., without switching costs) with \(p_{1}=p_{2}=\) \(\frac{1}{2}\cdot \)

[4] also considers the case when the seller is able to discriminate between locked-in and not locked-in consumers.

Note that in the no-discrimination case, \(p_{ii}=p_{ji}\) and \(p_{jj}=p_{ij}.\) Hence, the price terms in parenthesis canceled out in that case.

Similarly to the no price discrimination case (Proposition 1), as \( s\rightarrow 0\), we retrieve the prices of the static game for both types of consumers, \(\lim _{s\rightarrow 0}p_{11}^{*}=\lim _{s\rightarrow 0}p_{21}^{*}=\frac{1}{2}\).

Indeed, the price discount offered to new consumers is constant at s / 3.

Mathematically, this arises since the co-state variable \(\lambda _{1}=\frac{ \partial V_{1}}{\partial x_{1}}\) is constant.

Available from the authors upon request.

References

Allaz B, Vila J-L (1993) Cournot competition, forwards markets and efficiency. J Econ Theory 59:1–16

Arie G, Grieco P (2013) Who pays for switching costs?. Working Paper SSRN 1802675

Cabral L (2011) Dynamic price competition with network effects. Rev Econ Stud 78:83–111

Cabral L (2012) Switching costs and equilibrium prices. New York University, Mimeo

Dockner E, Jorgensen S, Van Long N, Sorger G (2000) Differential games in economics and management science. Cambridge University Press, Cambridge

Doganoglu T (2010) Switching costs, experience goods and dynamic price competition. Quant Mark Econ 8(2):167–205

Dubé J-P, Hitsch G, Rossi P (2009) Do switching costs make markets less competitive? J Mark Res 46(4):435–445

Farrell J, Klemperer P (2007) Coordination and lock-in: competition with switching costs and network effects. In: Armstrong M, Porter R (eds) Handbook of industrial organization, vol 3. North-Holland

Farrell J, Shapiro C (1988) Dynamic competition with switching costs. RAND J Econ 19(1):123–137

Klemperer P (1987a) Markets with consumer switching costs. Q J Econ 102(2):375–394

Klemperer P (1987b) The competitiveness of markets with switching costs. RAND J Econ 18(1):138–150

Klemperer P (1995) Competition when consumers have switching cost. Rev Econ Stud 62(4):515–539

Padilla AJ (1995) Revisiting dynamic duopoly with consumer switching costs. J Econ Theory 67(2):520–530

Rhodes A (2013) Re-examining the effects of switching costs. Oxford University, Mimeo

Shi M, Chiang J, Rhee B (2006) Price competition with reduced consumer switching costs: the case of wireless number portability in the cellular phone industry. Manag Sci 52(1):27–38

To T (1995) Multiperiod competition with switching costs: an overlapping generations formulation. J Ind Econ 44(1):81–87

Viard B (2007) Do switching costs make markets more or less competitive? The case of 800-number portability. RAND J Econ 38(1):146–163

Villas-Boas JM (2006) Dynamic competition with experience goods. J Econ Manag strategy 15:37–66

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Juan Pablo Rincón (Universidad Carlos III) for many helpful suggestions. Natalia Fabra acknowledges financial support awarded by the Spanish Ministry of Science and Innovation, Project ECO2012-32280. She is grateful to CEMFI for their hospitality while working on this paper.

Appendices

Appendix 1: Forward-Looking Consumers

In this appendix, we show that the pro-competitive effect of switching costs on steady-state prices found in the basic model of Sect. 2 is robust to allowing for more forward-looking consumers who aim to maximize their total discounted consumption surplus over the infinite horizon. Hence, they may abstain from switching when they correctly anticipate price increases in the future. In our extended model of switching, we assume that consumers are able to correctly anticipate infinite price trajectories when deciding whether or not to switch. However, we only consider the open-loop solution to the stochastic optimization problem in which a consumer has to decide whether or not to switch taking into account future opportunities to switch (at random times) subject to (random) switching costs. For simplicity, we only focus on the case of (exogenously given) symmetric switching costs.

Let us denote by \(p_{i}^{e}(\tau )\) consumers’ anticipation of firm i’s price at time \(\tau >t\). Given current prices, \(p_{i}(t)\), consumers assume

where \(\alpha ,\beta ,\gamma >0\). Note that consumers anticipate that price differences will gradually decrease over time. We assume all consumers use a normalized discount rate.

When an opportunity to switch arises at time \(t>0\) , a consumer currently served by firm j would opt for firm i provided that

Thus, the probability \(\bar{q}_{ji}(t)\) that a customer served by firm j switches to firm i at time \(t>0\) is given by

With some algebra,

assuming that \(p_{i}(t)-p_{j}(t)\in \left[ -\frac{1+\gamma }{\alpha }(1-s), \frac{1+\gamma }{\alpha }(1+s)\right] \). Conversely, the probability that a customer already served by firm i maintains this relationship at time \(t>0\) is given by

Note that when \(\frac{\alpha }{1+\gamma }<1,\) forward-looking consumers are less sensitive to current price differences than myopic consumers.

By comparing switching probabilities with myopic and with forward-looking consumers, it can be seen that equilibrium prices \(\bar{p}_{i}(x_{1})\) in the latter case can be obtained by a simple rescaling of the equilibrium prices in the former, i.e., \(\bar{p}_{i}(x_{1})=\frac{1+\gamma }{\alpha } p_{i}(x_{1})\cdot \) Therefore, the price dynamics with forward-looking consumers remained unaltered as compared to the myopic consumers case. In other words, the pro-competitive effect of switching costs on steady- state prices survives the presence of more sophisticated consumers. Still, the pro-competitive effect is slightly attenuated because forward-looking consumers are less sensitive to current price differences.

For completeness, let us stress that consumers’ anticipation of price differences over time is correct provided that

or equivalently, using expressions (9), (10) and Proposition 1,

For this to be the case, \(\alpha \) and must take the following values,

Appendix 2: Proofs of Lemmas and Propositions

Basic Model

1.1 Proof of Proposition 1

The Hamiltonians are

for \(i=1,2\). The Hamiltonians are strictly concave so that first order conditions for MPE are also sufficient (see [5]),

for \(i=1,2\). These, respectively, lead to:

Equations (11) and (13) are firms’ best reply functions. Using them we can obtain equilibrium prices,

Thus,

Substituting into (12) and (14) we obtain

We solve this system of differential equations by the method of undetermined coefficients. Assume \(\lambda _{i}=a_{i}(x_{1}-\frac{1}{2})+b_{i}\) for \( i=1,2 \). Substitution into the last equation yields

This results in the following two equations:

In a similar fashion,

We obtain two additional equations:

Thus, substracting (15) from (17) we get:

Hence, \(a_{1}-a_{2}=0\). Let \(a_{1}=a_{2}=a,\) we solve the quadratic equation implicit in (15):

Then (16) and (18) imply \(b_{1}+b_{2}=0\) and

So the equilibrium strategies can be rewritten as

Or equivalently,

Finally, we note that given the assumption \(s<\frac{3}{5}\) the pricing policies satisfy:

so that \(q_{0},q_{1}\in (0,1)\).

1.2 Proof of Lemma 3

We first note that implicit differentiation in (3) yields:

-

(i)

Using this result, it is straightforward to see that \(\frac{\partial p_{2}}{\partial s}<0.\) Taking derivatives,

$$\begin{aligned} \frac{\partial p_{2}}{\partial s}= & {} -\frac{1}{3}\left( \left( 1-\frac{ \partial a}{\partial s}\right) \left( x_{1}-\frac{1}{2}\right) +\frac{ \partial a}{\partial s}\right) \\&-\,\frac{1}{3}\frac{1}{1+\rho }\left( \frac{2}{3}\left( \frac{s}{3}+\frac{a}{ 2}\right) +\left( 1-\frac{s}{3}\right) \left( \frac{1}{3}+\frac{1}{2}\frac{ \partial a}{\partial s}\right) \right) \end{aligned}$$ -

(ii)

Taking derivatives,

$$\begin{aligned} \frac{\partial p_{1}}{\partial s}= & {} \frac{1}{3}\left( \left( 1-\frac{ \partial a}{\partial s}\right) x_{1}-\frac{1}{2}\left( 1+\frac{\partial a}{ \partial s}\right) \right) \\&-\frac{1}{3}\frac{1}{1+\rho }\left( \frac{2}{3}\left( \frac{s}{3}+\frac{a}{ 2}\right) +\left( 1-\frac{s}{3}\right) \left( \frac{1}{3}+\frac{1}{2}\frac{ \partial a}{\partial s}\right) \right) \end{aligned}$$The second term is negative, while the sign of the first term cannot be determined in general. Solving for \(x_{1}\), expression above is positive if and only if

$$\begin{aligned} x_{1}>\widehat{x}_{1}\!=\!\frac{1}{\left( 1\!-\!\frac{\partial a}{\partial s}\right) }\left( \frac{1}{1\!+\!\rho }\left( \frac{2}{3}\left( \frac{s}{3}\!+\!\frac{a}{2} \right) +\left( 1-\frac{s}{3}\right) \left( \frac{1}{3}+\frac{1}{2}\frac{ \partial a}{\partial s}\right) \right) +\frac{1}{2} \left( 1+\frac{\partial a }{\partial s}\right) \right) \end{aligned}$$The fact that \(\widehat{x}_{1}>\frac{1}{2}\) follows since \(\frac{\partial p_{1}}{\partial s}\) is weakly increasing in \(x_{1}\ \)and \(\frac{\partial p_{1}}{\partial s}<0\) for \(x_{1}=\frac{1}{2},\) as the first term becomes \(- \frac{\partial a}{\partial s}<0.\)

-

(iii)

It follows from the fact that the price differential \(p_{1}-p_{2}\) is directly proportional to \(s-a\) and, as shown above, \(\frac{\partial a}{ \partial s}<1.\)

-

(iv)

The proof is provided in the main text.

1.3 Proof of Lemma 4

(i) It follows from the fact that \(\dot{p}(t)\) is inversely proportional to \( s-a\) and, as shown above, \(\frac{\partial a}{\partial s}<1.\) (ii) The transition to the steady state occurs at a rate which is inversely proportional to \(\frac{s+2a}{3},\) and as shown above, \(\frac{\partial a}{ \partial s}>0.\)

1.4 Proof of Lemma 5

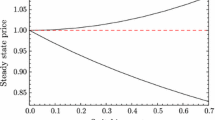

Steady-state prices are

Taking derivatives w.r.t. s,

where the inequality follows from \(\frac{\partial a}{\partial s}\in (0,1)\) and \(a<\frac{s}{2}\).

Price Discrimination

1.1 Proof of Proposition 2

The Hamiltonians are:

for \(i=1,2.\) A necessary condition for optimality is:

These conditions imply:

Note that these “instantaneous” best reply functions do not depend on \(x_{1}\). Hence,

The remaining conditions are:

Since \(\frac{\partial p_{ii}}{\partial x_{1}}=\frac{\partial p_{ij}}{ \partial x_{1}}=0\) we have

and

We posit a solution of the form \(\lambda _{i}=b_{i},\) \(i=1,2.\) Solving the equations above, we respectively get:

Adding these equations we obtain:

Thus, \(b_{1}=-b_{2}\). Plugging this into the FOCs above,

Thus, prices are

Note that the price discount to new consumers is:

Condition \(s<1\) guarantees that \(p_{ii}-p_{ij}\in \left[ -\frac{1}{2}(1-s), \frac{1}{2}(1+s)\right] \) and \(p_{ji}-p_{jj}\in \left[ -\frac{1}{2}(1+s), \frac{1}{2}(1-s)\right] \), as we had previously assumed.

1.2 Proof of Lemma 6

The comparative statics of prices with respect to s is,

under the assumption \(\rho <1.\)

Asymmetric Switching Costs

1.1 Proof of Proposition 3

As in the proof of Proposition 1, the Hamiltonians are

for \(i=1,2\). First order conditions (which in this case due to concavity are also sufficient) are:

The first order conditions lead to:

Here, (19) and (21) imply that equilibrium prices are of the form:

Hence \(\frac{\partial p_{1}}{\partial x_{1}}=-\frac{\partial p_{2}}{\partial x_{1}}=\frac{s}{6}\). Substituting into (20) and (22) we obtain

We solve using method of undetermined coefficients. Assume \(\lambda _{i}=a_{i}x_{1}+b_{i}\) for \(i=1,2\). Substitution into the last equation yields

This results in the following two equations:

In a similar fashion, we obtain two additional equations:

The symmetry of Eqs. (23) and (25) imply \(a_{1}=a_{2}=a\) which is a solution to the quadratic equation:

By adding and substracting (24) and (26) we obtain

It follows that

The equilibrium pricing strategies can be written as:

which concludes the proof.

Rights and permissions

About this article

Cite this article

Fabra, N., García, A. Dynamic Price Competition with Switching Costs. Dyn Games Appl 5, 540–567 (2015). https://doi.org/10.1007/s13235-015-0157-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-015-0157-z