Abstract

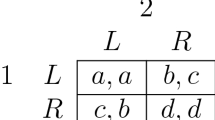

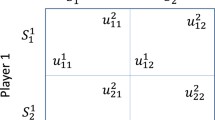

We study a two-strategy model with negative externalities proposed by Schelling, in a dynamical setting where a society consists of two interacting populations with different behaviors derived from experiments with human participants. The resulting dynamics is a three-dimensional piecewise smooth map with one discontinuity, which inherits some of the characteristics of each homogeneous population dynamics, while others are lost and new ones emerge. We propose a technique to represent the dynamics on a bidimensional space and prove that the heterogeneous society dynamics can be obtained as a linear combination of the dynamics of the two homogeneous populations. As expected, complexity arises with respect to some aspects. Firstly, the number of equilibria expands to infinity and we were able to determine possible focal equilibria in the sense of Schelling. Secondly, when heterogeneity is introduced, the period adding structure of cycles is replaced by a period incrementing structure. Thirdly, the phenomenon of overreaction and cyclic oscillations can be mitigated even if it never completely disappears. We also derive the orbits of cycles of period two and provide numerical evidences of coexistence of cycles with different periods. It is worth noticing that with the heterogeneous society, the dynamics does not depend on the society aggregate choices only, rather on each population choice; neglecting it will make impossible to determine the future evolution of the system. The implications are important as heterogeneity makes the system path-dependent and a policy maker, considering aggregate society choice only, would be unable to make the proper decisions, unless further information is considered.

Similar content being viewed by others

Notes

Thomas C. Schelling–Facts”. Nobelprize.org. Nobel Media AB 2014. Web. 10 Nov 2016. http://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2005/schelling-facts.html.

In this paper we use the same terminology as in the Population Games literature, see [37, p. 3].

For the sake of brevity in the following proposition we omit subscript t.

The small difference in terms of notation has to be attributed to the fact that in [8] the dynamics is studied by considering agents choosing L instead of R.

References

Agiza H, Elsadan A (2003) Nonlinear dynamics in the Cournot duopoly game with heterogeneous players. Phys A 320:512–524

Alós-Ferrer C (1999) Dynamical systems with a continuum of randomly matched agents. J Econ Theory 86(2):245–267. https://doi.org/10.1006/jeth.1999.2522

Arthur WB (2013) Complexity economics: A different framework for economic thought

Avrutin V, Granados A, Schanz M (2011) Sufficient conditions for a period incrementing big bang bifurcation in one-dimensional maps. Nonlinearity 24(9):2575. http://stacks.iop.org/0951-7715/24/i=9/a=012. Accessed 25 June 2018

Avrutin V, Dibak C, Dal Forno A, Merlone U (2015) Dynamics of a \(2\)d piecewise linear Braess paradox model: effect of the third partition. Int J Bifurc Chaos 25(11):1530031

Bischi GI, Merlone U (2009) Global dynamics in binary choice models with social influence. J Math Sociol 33(4):277–302

Bischi GI, Merlone U (2017) Evolutionary minority games with memory. J Evolut Econ 27(5):859–875

Bischi GI, Gardini L, Merlone U (2009) Impulsivity in binary choices and the emergence of periodicity. Discrete Dyn Nat Soc 2009: Article ID 407,913, 22 pages. https://doi.org/10.1155/2009/407913

Bischi GI, Gardini L, Merlone U (2009b) Periodic cycles and bifurcation curves for one-dimensional maps with two discontinuities. J Dyn Syst Geom Theor 7(2):101–123

Carting AH (1987) The Schelling diagram: on binary choice with externalities. Behav Sci 32(1):4–18

Caulkins JP, Feichtinger G, Grass D, Hartl RF, Kort PM, Novak AJ, Seidl A, Wirl F (2014) A dynamic analysis of Schelling’s binary corruption model: a competitive equilibrium approach. J Optim Theory Appl 161(2):608–625

Cavalli F, Naimzada A, Pireddu M (2016) A family of models for Schelling binary choices. Physica A 444:276–296

Ciccone A, Costain J (2004) On payoff heterogeneity in games with strategic complementarities. Oxford Econ Pap 56(4):701–713

Colman AM, Thomas C (2006) Schelling’s psychological decision theory: introduction to a special issue. J Econ Psychol 27:603–608

Costa VD, Tran VL, Turchi J, Averbeck BB (2014) Equity theory and time: a reformulation. Behav Neurosci 128(5):556–566

Dal Forno A, Merlone U (2013) Border-collision bifurcations in a model of Braess paradox. Math Comput Simul 87:1–18

Dal Forno A, Merlone U (2013b) Replicating human interaction in Braess paradox. In: Pasupathy R, Kim SH, A Tolk RH, Kuhl ME (eds) Proceedings of the 2013 Winter Simulation Conference, Institute of Electrical and Electronics Engineers, Inc., Piscataway, New Jersey

Dal Forno A, Gardini L, Merlone U (2012) Ternary choices in repeated games and border collision bifurcations. Chaos, Solitons Fractals 45(3):294–305. https://doi.org/10.1016/j.chaos.2011.12.003

Dal Forno A, Merlone U, Avrutin V (2014) Dynamics in Braess paradox with non-impulsive commuters. Discrete Dyn Nat Soc 2014: Article ID 345, 795

Devaney R (1989) An introduction to Chaotic Dynamical Systems, 2nd edn. Perseus Books, Reading

Feudel U (2008) Complex dynamics in multistable systems. Int J Bifurc Chaos 18(06):1607–1626

Feudel U, Grebogi C (1997) Multistability and the control of complexity. Chaos: an Interdisciplinary. J Nonlinear Sci 7(4):597–604

Gigerenzer G (2008) Why heuristics work. Perspect Psychol Sci 3(1):20–29. https://doi.org/10.1111/j.1745-6916.2008.00058.x

Golman R (2011) Why learning doesn’t add up: equilibrium selection with a composition of learning rules. Int J Game Theory 40(4):719–733

Grissom RJ, Kim J (2012) Effect sizes for research. Routledge, New York

Harrison JM, Kreps DM (1978) Speculative investor behavior in a stock market with heterogeneous expectations. Q J Econ 92(2):323–336

Hertwig R, Hoffrage U (1965) Simple heuristics: the foundations of adaptive social behaviour. In: Hertwig R, Hoffrage U, ABC Research Group (eds) Simple heuristics in a social world, Oxford University Press, Oxford, pp 3–36

Hinson JM, Jameson TL, Whitney P (2003) Impulsive decision making and working memory. J Exp Psychol Learn Mem Cogn 29(2):289–306

Hommes C (2006) Heterogeneous agent models in economics and finance. In: Tesfatsion L, Judd KL (eds) Handbook of computational economics, vol 2. Agent-based computational economics. Elsevier Science, Amsterdam, NL, pp 1109–1186

Kirman A (2006) Heterogeneity in economics. J Econ Interac Coord 1(1):89–117

Kline P (2010) Place based policies, heterogeneity, and agglomeration. Am Econ Rev 100(2):383–387

Nerlove M (2014) Individual heterogeneity and state dependence: from George Biddell Airy to James Joseph Heckman. Œconomia 4:281–320

Parchomovsky G, Siegelman P (2012) Cities, property, and positive externalities. William Mary Law Rev 54(1):211–260

Pennings JME, Garcia P (2004) Hedging behavior in small and medium-sized enterprises: the role of unobserved heterogeneity. J Bank Finance 28(5):951–978

Phan D (2007) Heterogeneous agents with local social influence networks: Path dependence and plurality of equilibria in the ace noiseless case. In: Consiglio A (ed) Artificial markets modeling: methods and applications. Springer, Berlin, pp 181–194

Platteau JP, Strzalecki T (2004) Collective action, heterogeneous loyalties and path dependence: micro-evidence from senegal. J Afr Econ 13(3):417–445

Sandholm WH (2010) Population games and evolutionary dynamics. The MIT Press, Cambridge

Santos FC, Pacheco JM, Lenaerts T (2006) Evolutionary dynamics of social dilemmas in structured heterogeneous populations. Proc Natl Acad Sci USA 103:3490–3494

Schelling TC (1960) The strategy of conflict. Harvard University Press, Cambridge

Schelling TC (1973) Hockey helmets, concealed weapons, and daylight saving. J Conflict Resolut 17:381–428

Schelling TC (1978) Micromotives and macrobehavior. W. W, Norton, New York

Schmid AA (2008) Conflict and cooperation: institutional and behavioral economics. Blackwell Publishing, Oxford

Siegel S, Goldstein DA (1959) Decision making behavior in a two-choice uncertain outcome situation. J Exp Psychol 57:37–42

Weibull J (1997) Evolutionary Game Theory. MIT Press, Cambridge

Acknowledgements

The authors are grateful to Gian-Italo Bischi, Laura Gardini, Amnon Rapoport, the participants to the June, 8th, 2011 seminar at Centro de Modelamiento Matemático, Universidad de Chile and the participants to the 46th Annual Meeting of the Society of Mathematical Psychology in Potsdam, for helpful suggestions and constructive discussions. Usual caveats apply. This work has been performed within the activity of the PRIN project “Local interactions and global dynamics in economics and finance: models and tools”, MIUR, Italy, and under the auspices of COST Action IS1104 “The EU in the new complex geography of economic systems: models, tools and policy evaluation”.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dal Forno, A., Merlone, U. Heterogeneous Society in Binary Choices with Externalities. Dyn Games Appl 9, 433–457 (2019). https://doi.org/10.1007/s13235-018-0270-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-018-0270-x