Abstract

I consider a general differential R&D game with finite set of firms which may generate a multiplicity of strategically driven outcomes like prevention of entry or strategic delay. It is assumed that while interacting firms are fully aware of their potentials, the government is uncertain over the true state of the industry and thus may be unable to predict such strategic behavior. The choice function over the set of potential outcomes is defined, and robust welfare optimal and individually optimal regimes are compared. The belief of the planner over the market shapes the set of potential policy schemes. The ordering of such schemes with respect to uncertainty, costs and welfare-improving potential is established. At last, the optimal level of robustness for a given policy is found.

Similar content being viewed by others

Notes

The absence of sunk costs is crucial for the results, since if these are present, Nash equilibrium logic would prevent any strategic behavior of incumbent firms: Indeed, they can always price optimally with the threat of lowering price upon new entry, thus preventing the entry of new technology due to not negligible sunk costs.

Of course, this vector may include infinite elements if some technologies do not have a steady state, but I restrict the analysis to those cases where parameters’ space allows only for finite values of this vector.

This is not essential, but follows standard economic intuition.

For example, \(f_{j}\) are Lipschitz and bounded; then, via Picard-Lindelöf theorem for each admissible \(\vec {g}\), system (1) admits a solution.

In general, equilibrium models such an assumption would be tedious, but the framework developed here is aimed on industrial-level regulation studies and as such does not take the difference in time preferences into account following many IO papers like Dawid et al. [12]. However, this can be easily incorporated into the model.

Indeed, this is not a binding assumption, since in the case of simultaneous entry of several firms the problem may be decomposed into the sequence of problems with single entry; see discussion on the sequence of pairwise games of the leader and the follower in Bondarev and Greiner [8] and in the current paper later in Sect. 3.

Observe that any analytic function of a real argument enjoys this property, but I do not restrict attention to analytic functions only, since piecewise or absolute value functions are known to be not analytic.

I assume the value functions of all potential regimes have finitely (or countably many) complex roots, which is the case for any value function over \(\delta (0)\) satisfying Assumption 2.

Because of this characterization of outcomes through algebraic roots, I termed the approach as the algebraization, i.e., conversion to algebraic form.

In the first-best case, the government plays a Stackelberg differential game being the first mover and setting the subsidy size and duration such as to maximize social welfare.

I omit time argument in integral quantities \(W,\Pi \) and understand \(q_{-j}=q_{-j}(0), \delta =\delta (0)\) in what follows if this does not lead to confusion.

This is necessary since introduction of the subsidy changes both \(\delta (t), q_{A,B}(t)\) dynamics and thus values for the planner and firms differ from those in regime m without subsidies.

In the deterministic model, there are cases when this ordering may fail, so here I impose this ordering as an assumption.

References

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29(3):155–173

Arthur WB (1989) Competing technologies, increasing returns, and lock-in by historical events. Econ J 99(394):116–131

Athanassoglou S, Xepapadeas A (2012) Pollution control with uncertain stock dynamics: when, and how, to be precautious. J Environ Econ Manag 63(3):304–320

Babonneau F, Haurie A, Vielle M (2013) A robust meta-game for climate negotiations. Comput Manag Sci 10(4):299–329

Ben-Tal A, El Ghaoui L, Nemirovski A (2009) Robust optimization. Princeton University Press, Princeton

Ben-Youssef S, Zaccour G (2014) Absorptive capacity, R&D spillovers, emissions taxes and R&D subsidies. Strateg Behav Environ 4(1):41–58

Bondarev A (2014) Endogenous specialization of heterogeneous innovative activities of firms under the technological spillovers. J Econ Dyn Control 38:235–249

Bondarev A, Greiner A (2017) Catching-up and falling behind: Effects of learning in an R&D differential game with spillovers. J Econ Dyn Control. https://doi.org/10.1016/j.jedc.2017.10.001

Bondarev A, Krysiak F (2017) Temporary and permanent technology lock-ins in the quality-differentiated Bertrand competition. WWZ Working paper 2017/09

Brock W, Xepapadeas A, Yannacopoulos A (2014) Robust control and hot spots in spatiotemporal economic systems. Dyn Games Appl 4(3):257–289

D’Aspremont C, Jacquemin A (1988) Cooperative and noncooperative r & d in duopoly with spillovers. Am Econ Rev 78(5):1133–1137

Dawid H, Greiner A, Zou B (2010) Optimal foreign investment dynamics in the presence of technological spillovers. J Econ Dyn Control 34(3):296–313

Gonzalez F (2018) Pollution control with time-varying model mistrust of the stock dynamics. Comput Econ 51(3):541–569

Herrlich H (2006) Axiom of choice. Lecture Notes in Mathematics No. 1876. Springer, Berlin (2006)

Hinloopen J, Smrkolj G, Wagener F (2013) From mind to market: a global, dynamic analysis of R&D. J Econ Dyn Control 37(12):2729–2754

Krysiak F (2011) Environmental regulation, technological diversity, and the dynamics of technological change. J Econ Dyn Control 35(4):528–544

Ludkovski M, Sircar R (2016) Technology ladders and R&D in dynamic Cournot markets. J Econ Dyn Control 60(C):127–151

Mensink P, Requate T (2005) The Dixit–Pindyck and the Arrow–Fisher–Hanemann–Henry option values are not equivalent: a note on Fisher (2000). Resour Energy Econ 27(1):83–88

Robert A (2011) Nonstandard analysis. Dover books on mathematics. Dover Publications, Mineola

Todorov E (2009) Efficient computation of optimal actions. Proc Natl Acad Sci 106(28):11478–11483

Unruh G (2000) Understanding carbon lock-in. Energy Policy 28(12):817–830

Unruh G (2002) Escaping carbon lock-in. Energy Policy 30(4):317–325

Vardas G, Xepapadeas A (2010) Model uncertainty, ambiguity and the precautionary principle: implications for biodiversity management. Environ Resour Econ 45(3):379–404

Vardas G, Xepapadeas A (2015) Uncertainty aversion, robust control and asset holdings. Quant Finance 15(3):477–491

Author information

Authors and Affiliations

Corresponding author

Additional information

This research is part of the activities of SCCER CREST (Swiss Competence Center for Energy Research), which is financially supported by the Swiss Commission for Technology and Innovation (CTI) under contract KTI.2014.0114.

Appendices

A Proof of Proposition 1

Proof

The proof simply follows from the definition of value functions \(\Pi ^{m}_{j}\) and the fact that the choice function and the selector exist for any finite (and countable) collection of arbitrary sets satisfying the axiom of choice.

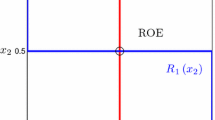

In particular, \(\Pi ^{m}_{j}\) are functions of initial state of the game \(\delta (0)\) only and thus their differences too. Each of the intervals \([\delta ^{j}_{z}(m);\delta ^{j}_{z+1}(m)]\) denotes the range of initial value \(\delta (0)\) for which the difference in values of the game for the leader j across a given outcome i and some other outcome m has constant sign (positive or negative), since \(\delta ^{j}_{z}(m);\delta ^{j}_{z+1}(m)\) denote the z-th and \(z+1\)th roots (zeros) of this difference for j as an algebraic expression. By Assumption 2, there are at most countably many such roots for each value function and hence at most countably many roots for differences of these values. Consider next only those such intervals that imply \(\Pi ^{i}_{j}(\delta (0))-\Pi ^{m}_{j}(\delta (0))\ge 0\). If \(\delta (0)\) belongs to one of such intervals, it implies that outcome i is preferred to an outcome m.

We next compare i to all other m outcomes and consider those intervals where profit difference is positive. The intersection of all such intervals would give a range of \(\delta (0)\) where outcome i is preferred to all other feasible outcomes. At last, we need to consider a union of all these intersections since there might be multiple of those.

The choice function \(\Theta ({\mathcal {F}})\) selects the outcomei among all feasible ones if and only if the given initial state \(\delta (0)\) belongs to the set of values where the value for j under outcome i is greater than under any other outcome, as denoted by the argmax term. At this point, we need axiom of choice which guarantees that it is always possible to select an element within a set given some criterion (the selector function), whereas the selector is given by the above procedure on intervals between zeros of value functions.

Example: Consider as an illustration the example with only three possible outcomes, a, b, c, and assume for simplicity all values are given as polynomials of 3d degree in \(\delta (0)\). In this case, for an outcome a to be optimal, it is needed that values differences \(\Pi ^{a}-\Pi ^{b}, \Pi ^{a}-\Pi ^{c}\) remain positive at the given \(\delta (0)\) level. So consider intervals between roots of those polynomials (four intervals for the case of real roots) for each of alternatives. Assume \(\delta (0)\in \{[\delta _{1}(b),\delta _{2}(b)|\Pi ^{a}-\Pi ^{b}\ge 0\}\) meaning that a is preferred to b once \(\delta (0)\) is in this range. Then, find the same interval for c alternative. If the intersection of those two ranges is non-empty and the union of such intersections contains \(\delta (0)\), outcome a is optimal in comparison with the other two, that is, the selector function gives a as an argmax of value function w.r.t. the set of outcomes (and not \(\delta (0)\) value itself). \(\square \)

B Proof of Proposition 3

Proof

-

1.

The condition \(\Theta _{\epsilon >\epsilon ^{R}_{k}(i,s)}({\mathcal {F}}_{\Sigma ^{\epsilon }_{k}})\ne \Theta _{\epsilon <\epsilon ^{R}_{k}(i,s)}({\mathcal {F}}_{\Sigma ^{\epsilon }_{k}})=s\) means that at the noise level \(\epsilon ^{R}_{k}(i,s)\) the outcome of the game believed to be realized is changing, so this is a threshold distinguishing the level under which subsidy from i to s is robust from not being robust. Thus, by definition the given policy scheme is robust up to this level of noise. If such a change in believed outcome does not exist up to the maximal noise level \(\epsilon ^{W}_{s}\) associated with the outcome s (and chosen by the planner), the given scheme will always have an effect in switching the outcome from i to s.

-

2.

The same claim follows for welfare functions: Once under a given noise level \(\epsilon ^{S}_{k}(i,s)\) the preferred outcome changes (the choice function \(\Psi \) of the planner changes its value), this defines a threshold up to which the given policy is improving the (expected) welfare. Again, if such a change in choice function is not observed for any noise level up to the maximal one, given subsidy scheme is always welfare improving.

-

3.

Combining two previous arguments, we observe that the given policy scheme will be implementable (that is, both robust and welfare improving) only for noise level being under both above-defined thresholds (if they exist).

-

4.

Now we form a set of all admissible policy schemes as defined by the previous point for a given noise level and two outcomes i, s. If this set is non-empty, then there is at least one policy scheme for a noise level up to \(\epsilon ^{W}_{s}\) which is both robust and welfare improving in switching the regime from i to s. Then, there is a problem of selecting the best of such admissible schemes (since they are all only welfare improving but not optimal). We then may define the welfare associated with each of such policy schemes and formulate choice criteria in the same way as in previous propositions of the paper: the policy scheme which yields the best worst case welfare under given noise level \(\epsilon \) is selected as the most appropriate one; see (34), which defines the selection criteria in the set of these admissible policy schemes.

-

5.

Fix the noise level for which a given policy scheme is optimal. Once we allow this value to vary, it is straightforward that the choice function (34) will change its value (i.e., will select a different scheme) at some level of noise. This level is the next threshold, where the scheme \(\Sigma ^{\epsilon }_{x}\) ceases either being robust or welfare improving and the set of admissible schemes shrinks. The fact that the set will shrink under increasing \(\epsilon \) is implied by the min operator over \(\epsilon \) in (34) formulation. Thus, there is an increasing sequence of \(\epsilon ^{*}\) such that the previously admissible scheme stops to be such and the \(\Lambda \) selector will yield a different result.

-

6.

By selecting at each such a threshold a new policy scheme the sequence \(\Sigma ^{*}\) is formed. Since we have countably many schemes, the increasing sequence can be constructed out of it. It follows that each next element is better then previous ones under given noise level, since otherwise those previously selected elements will remain optimal.\(\square \)

C Proof of Corollary 4

Proof

-

1.

Once the belief of the social planner is such that only delay may realize, this outcome may be switched to the simultaneous one in a variety of ways. The set \(\Sigma _{\epsilon }(d,*)\) defined as in Proposition 3 excludes schemes \(\Sigma _{+}, \Sigma _{o}\) since even in the extreme case of no information except the expected realization the scheme \(\Sigma _{-}\) is robust and by (52) it is less costly than the other two constant schemes. Hence, \(\Sigma _{\epsilon }(d,*)=\{\{\Sigma ^{\epsilon }_{\mathrm{min}},\Sigma ^{\epsilon }_{-},\Sigma ^{\epsilon }_\mathrm{suff},\Sigma ^{\epsilon }_{\mathrm{max}}\}\}\). Then, we start with robustness level \(\epsilon <\min \{\epsilon ^{R}_{\mathrm{min}},\epsilon ^{S}_{\mathrm{min}}\}\), for which, by Proposition 3 all the set is admissible. Then, the most welfare-improving scheme is selected which is by (52) scheme \(\Sigma ^{\epsilon }_{\mathrm{min}}\), giving case a. Once we increase the confidence interval to the level \(\min \{\epsilon ^{R}_\mathrm{suff},\epsilon ^{S}_\mathrm{suff}\}\), this scheme stops being robust and the set \(\Sigma _{\epsilon }(d,*)\) looses one element. Thus, the next scheme is selected, which is \(\Sigma ^{\epsilon }_\mathrm{suff}\). The process continues until the maximal level of noise is reached, under which only the constant subsidy remains robust.

-

2.

Once the belief is different and permits multiple other outcomes except the delay, minimal subsidy cannot be robust since it does not prevent firm A from strategic pricing and the same is true for its constant counterpart. At the same time, since (52) the scheme \(\Sigma _{+}\) is clearly dominated by the \(\Sigma _{o}\) and thus is also excluded from the admissible set. We get \(\Sigma _{\epsilon }(m,*)=\{\Sigma ^{\epsilon }_\mathrm{suff},\Sigma ^{\epsilon }_{o},\Sigma ^{\epsilon }_{\mathrm{max}}\}\). We next again apply Proposition 3 increasing the uncertainty tolerance level \(\epsilon \) and selecting at each of the threshold the next optimal scheme after the shrinkage of the admissible set.

-

3.

At last, if there is not enough information for the planner to believe in any particular outcome of the game, only the constant maximal scheme is robust and can prevent strategic pricing. This would be the case if the robustness level is above the one enabling to select the belief in any particular outcome, \(\max \{\epsilon ^{O}_{m\in {\mathcal {F}}}\}\) but still under the threshold where the planner believes in the social optimality of simultaneous development, \(\epsilon ^{W}_{*}\). The policy scheme is welfare improving (and thus optimal since the set of admissible subsidies is a singleton) if additionally it is robust; i.e., the noise level does not exceed its robustness level.\(\square \)

Rights and permissions

About this article

Cite this article

Bondarev, A. Robust Policy Schemes for Differential R&D Games with Asymmetric Information. Dyn Games Appl 9, 391–415 (2019). https://doi.org/10.1007/s13235-018-0286-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-018-0286-2