Abstract

We propose a dynamic stochastic game model to assess the value of restrictive clauses in private loan contracts. Restrictive clauses are used by lenders to mitigate their credit risk, for instance, by linking the interest payments of the borrower to some observable performance measure. We show how the value of these clauses for the lender and the borrower corresponds to the solution of a feedback Stackelberg game in discrete time. We consider two instances of restrictive clauses that are commonly found in the syndicated loan market, namely safety covenants and performance pricing, and provide numerical illustrations using representative instances to compare their relative efficiency.

Similar content being viewed by others

Data Availability

No datasets were generated or analysed during the current study

Notes

Note that raising the physical default barrier above the borrower’s current asset value is equivalent to forcing bankruptcy.

Using an aggressive strategy results in an additional payoff increasing the immediate reward of the borrower.

The lender can impose immediate bankruptcy by raising the physical default barrier above the borrower’s current asset value.

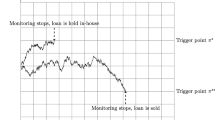

Note that the equilibrium value for the follower using the PP1 schedule is lower than under SC. This is due to the fact that, since a piecewise constant schedule is suboptimal for the leader, one has to increase the interest rate significantly to yield the same value as SC to the leader, which is detrimental to the borrower.

In scenario PP2, the borrower tends to use asset substitution when variations in spreads from one mode to the other are lower.

However this is not a reliable metric for the efficiency of these scenarios in preventing asset substitution since it does not account for the probability of the asset value reaching these areas.

Results corresponding to the performance pricing clause are qualitatively very similar.

References

Aghion P, Bolton P (1992) An incomplete contracts approach to financial contracting. Rev Econ Stud 59(3):473–494

Allen F, Morris S (2014) Game theory models in finance. In: Game theory and business applications, pp 17–41. Springer

Asquith P, Beatty A, Weber J (2005) Performance pricing in bank debt contracts. J Acc Econ 40(1–3):101–128

Beyhaghi M, Panyagometh K, Gottesman AA, Roberts GS (2017) Do tighter loan covenants signal improved future corporate results? The case of performance pricing covenants. Financ Manag 46(3):593–625

Black F, Cox JC (1976) Valuing corporate securities: some effects of bond indenture provisions. J Finance 31(2):351–367

Brennan MJ, Schwartz ES (1978) Corporate income taxes, valuation, and the problem of optimal capital structure. J Bus, pp 103–114

Breton M (2018) Dynamic games in finance. Handbook of dynamic game theory, pp 827–863

Breton M, Alj A, Haurie A (1988) Sequential stackelberg equilibria in two-person games. J Optim Theory Appl 59:71–97

Colman AM, Pulford BD, Lawrence CL (2014) Explaining strategic coordination: cognitive hierarchy theory, strong stackelberg reasoning, and team reasoning. Decision 1(1):35

Donaldson JR, Gromb D, Piacentino G, et al (2019) Conflicting priorities: a theory of covenants and collateral. 2019 Meeting Papers, vol 157

Freudenberg F, Imbierowicz B, Saunders A, Steffen S (2017) Covenant violations and dynamic loan contracting. J Corp Finance 45:540–565

Gan J, Han M, Wu J, Xu H (2023) Robust stackelberg equilibria. arXiv preprint arXiv:2304.14990

Giddy IH (2005) International financial markets: prices and policies (1st). McGraw-Hill, New York

Gustafson MT, Ivanov IT, Meisenzahl RR (2021) Bank monitoring: evidence from syndicated loans. J Financ Econ 139(2):452–477

Hu Y, Mao C (2017) Accounting quality, bank monitoring, and performance pricing loans. Rev Quant Finance Acc 49:569–597

Huang R, Wang Y (2017) Leverage, debt maturity, and the cost of debt: evidence from syndicated loans. J Corp Finance 44:203–221. https://doi.org/10.1016/j.jcorpfin.2017.03.005

Ivashina V (2009) Asymmetric information effects on loan spreads. J Financ Econ 92(2):300–319

Ivashina V, Vallee B (2020) Weak credit covenants (Tech Rep). National Bureau of Economic Research

Jensen MC, Meckling WH (2019) Theory of the firm: managerial behavior, agency costs and ownership structure. In: Corporate governance pp 77–132. Gower

Koziol C, Lawrenz J (2010) Optimal design of rating-trigger step-up bonds: agency conflicts versus asymmetric information. J Corp Finance 16(2):182–204

Leland HE (1994) Corporate debt value, bond covenants, and optimal capital structure. J Finance 49(4):1213–1252

Lim J, Do V, Vu T (2022) The effect of lenders’ dual holding on loan contract design: evidence from performance pricing provisions. J Bank Finance 137:106462

Longstaff FA, Schwartz ES (1995) A simple approach to valuing risky fixed and floating rate debt. J Finance 50(3):789–819

Manso G, Strulovici B, Tchistyi A (2010) Performance-sensitive debt. Rev Financ Stud 23(5):1819–1854

Mella-Barral P, Perraudin W (1997) Strategic debt service. J Finance 52(2):531–556

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Finance 29(2):449–470

Myklebust TA (2012) Performance sensitive debt-investment and financing incentives. NHH Dept of Finance & Management Science Discussion Paper, (2012/7)

Nini G, Smith DC, Sufi A (2012) Creditor control rights, corporate governance, and firm value. Rev Financ Stud 25(6):1713–1761

Prilmeier R (2017) Why do loans contain covenants? Evidence from lending relationships. J Financ Econ 123(3):558–579

Rajan R, Winton A (1995) Covenants and collateral as incentives to monitor. J Finance 50(4):1113–1146

Roberts MR (2015) The role of dynamic renegotiation and asymmetric information in financial contracting. J Financ Econ 116(1):61–81

Roberts MR, Sufi A (2009) Renegotiation of financial contracts: evidence from private credit agreements. J Financ Econ 93(2):159–184

Sarkar S, Zhang C (2015) Underinvestment and the design of performance-sensitive debt. Int Rev Econ Finance 37:240–253

Smith CW Jr, Warner JB (1979) On financial contracting: an analysis of bond covenants. J Financ Econ 7(2):117–161

Su X, Kjenstad EC, Zhang X (2023) Competition and loan contracting: evidence from covenants and performance pricing. Available at SSRN 2410568

Sufi A (2007) Information asymmetry and financing arrangements: evidence from syndicated loans. J Finance 62(2):629–668

Acknowledgements

This work was supported by NSERC (Canada) grant number RGPIN-2020-05053.

Author information

Authors and Affiliations

Contributions

M.B. and T.N. contributed equally to the conception of the work and to the writing and revision of the paper. T.N. created the software used in the work.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Breton, M., Nabassaga, T. Restrictive Clauses in Loan Contracts: A Sequential Stackelberg Game Interpretation. Dyn Games Appl 15, 28–47 (2025). https://doi.org/10.1007/s13235-025-00626-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-025-00626-6