Abstract

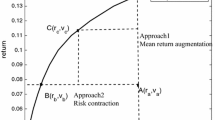

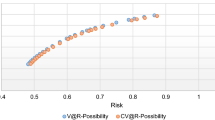

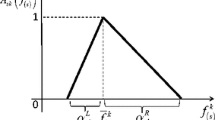

This paper proposes a data envelopment analysis (DEA)-based portfolio efficiency evaluation approach integrated with a rebalancing method to help investors acquire efficient portfolios. Two fuzzy portfolio selection models with value at risk (VaR) and conditional value at risk (CVaR) as objectives are proposed under the credibilistic framework. The models are constrained by realistic constraints of short selling/no short selling, capital budget, bounds on investment in an asset, and minimum return desired by the investor. These models are used to compute the benchmark portfolios, which constitute the portfolio efficient frontier. Furthermore, random sample portfolios are generated individually for each model in compliance with their constraints. These random sample portfolios are evaluated in terms of their relative efficiency with risk (VaR or CVaR) as an input and return as an output using DEA. Bearing in mind the volatile nature of the investment market, negative returns are also considered for portfolio efficiency evaluation using the range directional model. Moreover, an efficiency frontier improvement algorithm is used to rebalance the inefficient random portfolios to make them efficient. The proposed approach provides an alternative to the investors to acquire benchmark portfolios using the traditional portfolio selection models. A detailed numerical illustration and an out of sample analysis with the Nifty 50 index from the National Stock Exchange, India, are presented to substantiate the proposed approach.

Similar content being viewed by others

References

Banihashemi, S., Navidi, S.: Portfolio performance evaluation in mean-cvar framework: a comparison with non-parametric methods value at risk in mean-var analysis. Oper. Res. Perspect. 4, 21–28 (2017)

Banker, R.D., Charnes, A., Cooper, W.W.: Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 30(9), 1078–1092 (1984)

Branda, M.: Diversification-consistent data envelopment analysis with general deviation measures. Eur. J. Oper. Res. 226(3), 626–635 (2013)

Branda, M.: Diversification-consistent data envelopment analysis based on directional-distance measures. Omega 52, 65–76 (2015)

Charnes, A., Cooper, W.W., Rhodes, E.: Measuring the efficiency of decision making units. Eur. J. Oper. Res. 2(6), 429–444 (1978)

Chen, W., Gai, Y., Gupta, P.: Efficiency evaluation of fuzzy portfolio in different risk measures via DEA. Ann. Oper. Res. 269(1–2), 103–127 (2018)

Deng, X., Zhao, J., Li, Z.: Sensitivity analysis of the fuzzy mean-entropy portfolio model with transaction costs based on credibility theory. Int. J. Fuzzy Syst. 20(1), 209–218 (2018)

Ding, H., Zhou, Z., Xiao, H., Ma, C., Liu, W.: Performance evaluation of portfolios with margin requirements. Math. Probl. Eng. 2014, 1–8 (2014)

Emrouznejad, A., Anouze, A.L., Thanassoulis, E.: A semi-oriented radial measure for measuring the efficiency of decision making units with negative data, using DEA. Eur. J. Oper. Res. 200(1), 297–304 (2010)

Guo, X., Chan, R.H., Wong, W.-K., Zhu, L.: Mean-variance, mean-var, and mean-cvar models for portfolio selection with background risk. Risk Manag. 1–26 (2018)

Gupta, P., Mehlawat, M.K., Inuiguchi, M., Chandra, S.: Fuzzy Portfolio Optimization, vol. 316. Springer, Heidelberg (2014)

Gupta, P., Mehlawat, M.K., Saxena, A.: Asset portfolio optimization using fuzzy mathematical programming. Inf. Sci. 178(6), 1734–1755 (2008)

Hajiagha, S.H.R., Mahdiraji, H.A., Tavana, M., Hashemi, S.S.: A novel common set of weights method for multi-period efficiency measurement using mean-variance criteria. Measurement 129, 569–581 (2018)

Huang, X.: A review of credibilistic portfolio selection. Fuzzy Optim. Decis. Mak. 8(3), 263 (2009)

Huang, X., Qiao, L.: A risk index model for multi-period uncertain portfolio selection. Inf. Sci. 217, 108–116 (2012)

Joro, T., Na, P.: Portfolio performance evaluation in a mean-variance-skewness framework. Eur. J. Oper. Res. 175(1), 446–461 (2006)

Kar, M.B., Kar, S., Guo, S., Li, X., Majumder, S.: A new bi-objective fuzzy portfolio selection model and its solution through evolutionary algorithms. Soft Comput. 23, 4367–4381 (2019)

Krzemienowski, A., Szymczyk, S.: Portfolio optimization with a copula-based extension of conditional value-at-risk. Ann. Oper. Res. 237(1–2), 219–236 (2016)

Liu, B.: Theory and Practice of Uncertain Programming, vol. 239. Springer, Heidelberg (2009)

Liu, B., Liu, Y.-K.: Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans. Fuzzy Syst. 10(4), 445–450 (2002)

Liu, N., Chen, Y., Liu, Y.: Optimizing portfolio selection problems under credibilistic cvar criterion. J. Intell. Fuzzy Syst. 34(1), 335–347 (2018)

Liu, W., Zhou, Z., Liu, D., Xiao, H.: Estimation of portfolio efficiency via dea. Omega 52, 107–118 (2015)

Markowitz, H.M.: Portfolio selection. J. Financ. 7(1), 77–91 (1952)

Mehlawat, M.K.: Credibilistic mean-entropy models for multi-period portfolio selection with multi-choice aspiration levels. Inf. Sci. 345, 9–26 (2016)

Mehlawat, M.K., Kumar, A., Yadav, S., Chen, W.: Data envelopment analysis based fuzzy multi-objective portfolio selection model involving higher moments. Inf. Sci. 460–461, 128–150 (2018)

Morey, M.R., Morey, R.C.: Mutual fund performance appraisals: a multihorizon perspective with endogenous benchmarking. Omega 27(2), 241–258 (1999)

Murthi, B., Choi, Y.K., Desai, P.: Efficiency of mutual funds and portfolio performance measurement: a non-parametric approach. Eur. J. Oper. Res. 98(2), 408–418 (1997)

Portela, M.S., Thanassoulis, E., Simpson, G.: Negative data in dea: a directional distance approach applied to bank branches. J. Oper. Res. Soc. 55(10), 1111–1121 (2004)

Rockafellar, R.T., Uryasev, S.: Optimization of conditional value-at-risk. J. Risk 2, 21–42 (2000)

Scheel, H.: Undesirable outputs in efficiency valuations. E. J. Oper. Res. 132(2), 400–410 (2001)

Sharp, J.A., Meng, W., Liu, W.: A modified slacks-based measure model for data envelopment analysis with ‘natural’ negative outputs and inputs. E. J. Oper. Res. Soc. 58(12), 1672–1677 (2007)

Sharpe, W.F.: Mutual fund performance. J. Bus. 39(1), 119–138 (1966)

Vercher, E., Bermúdez, J.D.: Portfolio optimization using a credibility meanabsolute semi-deviation model. Expert Syst. Appl. 42(20), 7121–7131 (2015)

Wang, B., Wang, S., Watada, J.: Fuzzy-portfolio-selection models with value-at-risk. IEEE Trans. Fuzzy Syst. 19(4), 758–769 (2011)

Wang, M., Xu, C., Xu, F., Xue, H.: A mixed 0–1 lp for index tracking problem with cvar risk constraints. Ann. Oper. Res. 196(1), 591–609 (2012)

Xu, Q., Zhou, Y., Jiang, C., Yu, K., Niu, X.: A large cvar-based portfolio selection model with weight constraints. Econ. Model. 59, 436–447 (2016)

Zadeh, L.A.: Fuzzy sets. Inf. Control 8(3), 338–353 (1965)

Zhang, W.-G., Zhang, X., Chen, Y.: Portfolio adjusting optimization with added assets and transaction costs based on credibility measures. Insur. Math. Econ. 49(3), 353–360 (2011)

Zhou, Z., Xiao, H., Jin, Q., Liu, W.: DEA frontier improvement and portfolio rebalancing: an application of china mutual funds on considering sustainability information disclosure. Eur. J. Oper. Res. 269(1), 111–131 (2018)

Acknowledgements

We thank the Editor-in-Chief, the Associate Editor, and all the esteemed reviewers for helping us improve the presentation of the paper. “The third author, Arun Kumar, is supported by the Rajiv Gandhi National Fellowship for SC Candidates granted by University Grants Commission (UGC), New Delhi, India vide letter no. F1-17.1/2015-16/RGNF-2015-17-SC-DEL-8966/(SA-III/Website)”. “The fourth author, Sanjay Yadav, is supported by the National Fellowship for Other Backward Classes (OBC) granted by University Grants Commission (UGC), New Delhi, India vide letter no. F./2016-17/NFO-2015-17-OBC-DEL-34358/(SA-III/Website)”.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gupta, P., Mehlawat, M.K., Kumar, A. et al. A Credibilistic Fuzzy DEA Approach for Portfolio Efficiency Evaluation and Rebalancing Toward Benchmark Portfolios Using Positive and Negative Returns. Int. J. Fuzzy Syst. 22, 824–843 (2020). https://doi.org/10.1007/s40815-020-00801-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-020-00801-4