Abstract

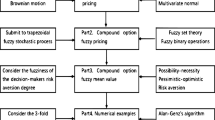

Interest rate is an important part of option pricing model, which attracts many scholars’ attention. In this paper, the fuzzy interest rate model is established under the framework of credibility theory, and the fuzzy term structure equations of zero coupon bonds and coupon bonds are derived. In order to solve the fuzzy term structure equations, the conditions of bond price possessing affine term structure in fuzzy environment is verified. As an illustration, based on a special fuzzy interest rate model, the pricing formula of zero coupon bond is obtained by using the fuzzy term structure equation and affine term structure.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.References

Merton, R.: Theory of rational option pricing. Bell J. Econ. Manag. Sci. 4, 141–183 (1973)

Vasicek, O.: An equilibrium characterization of the term of the structure. J. Financ. Econ. 5(2), 177–188 (1977)

Cox, J., Ingersll, J., Ross, S.: A theory of the term structure of interest rates. Econometrica 53(2), 385–407 (1985)

Hull, J., White, A.: Pricing interest-rate-derivative securities. Rev. Financ. Stud. 3(4), 573–592 (1990)

Zadeh, L.: Fuzzy sets. Inf. Control 8(3), 338–353 (1965)

Zadeh, L.: Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst. 1, 3–28 (1978)

Liu, B., Liu, Y.: Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans. Fuzzy Syst. 10(4), 445–450 (2002)

Liu, B.: Uncertainty Theory, 2nd edn. Springer-Verlag, Berlin (2007)

Liu, B.: Fuzzy process, hybrid process and uncertain process. J. Uncertain Syst. 2(1), 3–16 (2008)

You, C., Wang, W., Huo, H.: Existence and uniqueness theorems for fuzzy differential equations. J. Uncertain Syst. 7(4), 303–315 (2013)

Chen, X., Qin, Z.: A new existence and uniqueness theorem for fuzzy differential equation. Int. J. Fuzzy Syst. 13(2), 148–151 (2011)

Qin, Z., Li, X.: Option pricing formula for fuzzy financial market. J. Uncertain Syst. 2(1), 17–21 (2008)

Gao, X., Chen, X.: Option pricing formula for generalized stock models (2008). http://orsc.edu.cn/process/080317.pdf

Gao, J., Gao, X.: A new stock model for credibilistic option pricing. J. Uncertain Syst. 2(4), 243–247 (2008)

Peng, J.: A general stock model for fuzzy markets. J. Uncertain Syst. 2(4), 248–254 (2008)

You, C., Bo, L.: Option pricing formula for generalized fuzzy stock model. J. Ind. Manag. Optim. 16(1), 387–396 (2020)

Deng, X., Liu, Y.: A high-moment trapezoidal fuzzy random portfolio model with background risk. J. Syst. Sci. Inf. 6(1), 1–28 (2018)

Liu, J., Jin, X., Yuan, Y.: Empirical study of random fuzzy portfolio model with different investor risk attitudes. Oper. Res. Manag. Sci. 25(1), 166–174 (2016)

Sun, W., Zhang, W., Zhang, Q., Gao, L.: Fuzzy random portfolio model with investment limited. Math. Pract. Theory 45(24), 51–60 (2015)

Björk, T.: Arbitrage Theory in Continuous Time, 2nd edn. Oxford University Press, Oxford (2004)

Acknowledgements

This work was supported by Natural Science Foundation of China, Grant No. 61773150.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bo, L., You, C. Fuzzy Interest Rate Term Structure Equation. Int. J. Fuzzy Syst. 22, 999–1006 (2020). https://doi.org/10.1007/s40815-020-00810-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-020-00810-3