Abstract

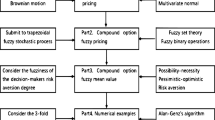

Bond game options are complex financial instruments that include the aspects of the risk (stochastic uncertainty) of a term structure of interest rates, option (flexibility) and interactivity (game). Forecasting uncertainty also comprises the vagueness (fuzzy uncertainty), often neglected. The fuzzy-stochastic models encompass both features. The paper objective is to develop and apply the fuzzy-stochastic soft bond game option model in discrete time. This model is based on normal fuzzy sets of the T-number type, the decomposition principle and \(\varepsilon{\text{-}}cuts\). The forward induction arbitrage-free method for the Ho–Lee calibration of interest rates, the binomial model and the two-person zero-sum games are used. An application example of the fuzzy-stochastic soft bond game option model from the buyer perspective based on the power triangle numbers for three variants of fuzziness is developed and computed. Inclusion of vagueness allows reflecting better valuation conditions and getting a more complex valuation picture. The developed model can adequately reflect valuation conditions and considers all aspects of the complex valuation problem of the bond game options, besides risk, flexibility, interactivity and vagueness.

Graphical Abstract

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Data Availability

Not applicable.

Code Availability

Not applicable.

References

Kifer, Y.: Game options. Financ. Stoch. 4, 443–463 (2000). https://doi.org/10.1007/PL00013527

Ben-Ameur, H., Breton, M., Karoui, L., L’Ecuyer, P.: A dynamic programming approach for pricing options embedded in bonds. J. Econ. Dyn. Control 31, 2212–2233 (2007). https://doi.org/10.1016/j.jedc.2006.06.007

Dolinsky, Y.: Hedging of game options under model uncertainty in discrete time. Electron. Commun. Probab. (2014). https://doi.org/10.1214/ECP.v19-2714

Dolinsky, Y., Iron, Y., Kifer, Y.: Perfect and partial hedging for swing game options in discrete time. Math. Financ. 21, 447–474 (2011). https://doi.org/10.1111/j.1467-9965.2010.00440.x

Dolinsky, Y., Kifer, Y.: Hedging with risk for game options in discrete time. Stochastics 79, 169–195 (2007). https://doi.org/10.1080/17442500601097784

Kallsen, J., Kuhn, C.: Pricing derivatives of American and game type in incomplete markets. Financ. Stoch. 8, 261–284 (2004). https://doi.org/10.1007/s00780-003-0110-7

Ohtsubo, Y.: Optimal stopping in sequential games with or without a constraint of always terminating. Math. Oper Res. 11, 591–607 (1986). https://doi.org/10.1287/moor.11.4.591

Sebehela, T.: Game options. Ann. Financ. Econ. 12(3), 18 (2017). https://doi.org/10.1142/S2010495217500154

Beveridge, C., Joshi, M.: Monte Carlo bounds for game options including convertible bonds. Manag. Sci. 57(5), 960–974 (2011). https://doi.org/10.2139/ssrn.1577593

Chen, N., Dai, M., Wan, X.: A non-zero-sum game approach to convertible bonds: tax benefits, bankruptcy costs and early/late calls. Math. Financ. 23(1), 57–93 (2013). https://doi.org/10.1111/j.1467-9965.2011.00488.x

Kwok, Y.K.: Game option models of convertible bonds: determinants of call policies. J. Financ. Eng. 1(4), 19 (2014). https://doi.org/10.1142/S2345768614500299

Ochiai, N., Ohnishi, M.: Valuation of game option bonds under the generalised Ho-Lee model: a stochastic game approach. J. Math. Financ. 5, 412–422 (2015). https://doi.org/10.4236/jmf.2015.54035

Sirbu, M., Shreve, S.E.: A two-person game for pricing convertible bonds. SIAM J. Control Optim. 45(4), 1508–1539 (2006). https://doi.org/10.1137/050630222

Carlsson, C., Fuller, R.: A fuzzy approach to real option valuation. Fuzzy Sets Syst. 139, 297–312 (2003). https://doi.org/10.1016/s0165-0114(02)00591-2

Chrysafis, K.A., Papadopoulos, B.K.: On theoretical pricing of options with fuzzy estimators. J. Comput. Appl. Math. 223(2), 552–566 (2009). https://doi.org/10.1016/j.cam.2007.12.006

Driouchi, T., Trigeorgis, L., Gao, Y.: Choquet-based European option pricing with stochastic (and fixed) strikes. OR Spectrum 37(3), 787–802 (2015). https://doi.org/10.1007/s00291-014-0378-3

Guerra, M. L., Sorini, L., Stefanini, L.: Parametrised fuzzy numbers for option pricing. In: IEEE International Conference on Fuzzy Systems, London, vol. 1–4, pp. 727–732 (2007) https://doi.org/10.1109/fuzzy.2007.4295456

Liyan, H., Wenli, C.: The generalisation of λ-fuzzy measures with application to the fuzzy option. In: Wang, L. et al. (eds.) Proceedings: Fuzzy Systems and Knowledge Discovery, LNAI, vol. 4223, pp. 762–765. Springer, Berlin (2006). https://doi.org/10.1007/11881599_93

Simonelli, M.R.: Fuzziness in valuing financial instruments by certainty equivalents. Eur. J. Oper. Res. 135(2), 296–302 (2001). https://doi.org/10.1016/s0377-2217(01)00041-8

Thiagarajaha, K., Appadoob, S.S., Thavaneswaranc, A.: Option valuation model with adaptive fuzzy numbers. Comput. Math. Appl. 53, 831–841 (2007). https://doi.org/10.1016/j.camwa.2007.01.011

Wu, H.C.: European option pricing under fuzzy environments. Int. J. Intell. Syst. 20, 89–102 (2005). https://doi.org/10.1002/int.20055

Wu, H.C.: Using fuzzy sets theory and Black-Scholes formula to generate pricing boundaries of European options. Appl. Math. Comput. 185(1), 136–146 (2007). https://doi.org/10.1016/j.amc.2006.07.015

Yoshida, Y.: The valuation of European options in uncertain environment. Eur. J. Oper. Res. 145, 221–229 (2003). https://doi.org/10.1016/s0377-2217(02)00209-6

Zhang, J., Du, H., Tang, W.: Pricing R&D option with combining randomness and fuzziness. In: Computational intelligence, PT 2, Proceedings Book Series: Lecture Notes in Artificial Intelligence, vol. 4114, pp. 798–808 (2006). https://doi.org/10.1007/978-3-540-37275-2_100

Zmeškal, Z.: Application of the fuzzy-stochastic methodology to appraising the firm value as a European calls option. Eur. J. Oper. Res. 135(2), 303–310 (2001). https://doi.org/10.1016/s0377-2217(01)00042-x

Cheng, F.-L., Tzeng, G.-H., Wang, S.-Y.: A fuzzy set approach for generalised CRR model: an empirical analysis of S&P 500 Index options. Rev. Quant. Financ. Acc. 25, 255–275 (2005). https://doi.org/10.1007/s11156-005-4767-1

Muzzioli, S., De Baets, B.: Fuzzy approaches to option price modeling. IEEE Trans. Fuzzy Syst. 25(2), 392–401 (2017). https://doi.org/10.1109/tfuzz.2016.2574906

Muzzioli, S., Reynaerts, H.: The solution of fuzzy linear systems by non-linear programming: a financial application. Eur. J. Oper. Res. 177, 1218–1231 (2007). https://doi.org/10.1016/j.ejor.2005.10.055

Muzzioli, S., Reynaerts, H.: American option pricing with imprecise risk-neutral probabilities. Int. J. Approx. Reason. 49(1), 140–147 (2008). https://doi.org/10.1016/j.ijar.2007.06.011

Nowak, P., Romaniuk, M.: Fuzzy approach to option pricing in a Levy process setting. Int. J. Appl. Math. Comput. Sci. 23(3), 613–622 (2013). https://doi.org/10.2478/amcs-2013-0046

Yoshida, Y.: A discrete-time model of American put option in an uncertain environment. Eur. J. Oper. Res. 151, 153–166 (2002). https://doi.org/10.1016/s0377-2217(02)00591-x

Yoshida, Y., Yasuda, M., Nakagami, J., Kurano, M.: A discrete-time American put option model with fuzziness of stock prices. Fuzzy Optim. Decis. Mak. 4(3), 191–207 (2005). https://doi.org/10.1007/s10700-005-1889-9

Zhang, W.G., Li, Z., Liu, Y.J., et al.: Pricing European option under fuzzy mixed fractional Brownian motion model with jumps. Comput. Econ. 58, 483–515 (2021). https://doi.org/10.1007/s10614-020-10043-z

Zmeškal, Z.: Generalised soft binomial American real option pricing model (fuzzy–stochastic approach). Eur. J. Oper. Res. 207(2), 1096–1103 (2010). https://doi.org/10.1016/j.ejor.2010.05.045

Zmeškal, Z., Dluhošová, D., Gurný, P., Kresta, A.: Generalised soft multi-mode real options model (fuzzy - stochastic approach). Expert Syst. Appl. (2022). https://doi.org/10.1016/j.eswa.2021.116388

Yoshida, Y.: A zero-sum stopping game in a continuous-time dynamic fuzzy system. Math. Comput. Model. 34(5–6), 603–614 (2001). https://doi.org/10.1016/S0895-7177(01)00086-3

Ho Thomas, S.Y., Lee, S.-B.: Term structure movement and pricing interest rate contingent claims. J. Financ. 41(5), 1011–1029 (1986). https://doi.org/10.1007/978-1-4614-5360-4_25

Jamshidian, F.: An exact bond option formula. J. Financ. 44, 205–209 (1989). https://doi.org/10.1111/j.1540-6261.1989.tb02413.x

Jamshidian, F.: Forward induction and construction of yield curve diffusion models. J. Fixed Income 1, 62–74 (1991). https://doi.org/10.3905/jfi.1991.692348

Jamshidian, F.: Bond futures and option evaluation in the quadratic interest rate model. Appl. Math. Financ. 3, 93–115 (1996). https://doi.org/10.1080/13504869600000005

Clewlow, L., Strickland, Ch.: Implementing Derivatives Models. Wiley, New York (1998)

Dubois, D., Prade, H.: Fuzzy Sets and Systems. Academic Press, New York (1980)

Inuiguchi, M., Ramík, J.: Possibilistic linear programming: a brief review of fuzzy mathematical programming and comparison with stochastic programming in portfolio selection problem. Fuzzy Sets Syst. 111, 3–28 (2000). https://doi.org/10.1016/s0165-0114(98)00449-7

Kacprzyk, J., Fedrizzi, M.: Combining Fuzzy Imprecision with Probabilistic Uncertainty in Decision-Making. Springer, Heidelberg (1988). https://doi.org/10.1007/978-3-642-46644-1

Kruse, R., Meyer, D.: Descriptive Statistics with Vague Data. Series B: Mathematical and Statistical Methods. Reidel, Dodrecht (1987). https://doi.org/10.1007/978-94-009-3943-1_8

Luhandjula, M.K.: Fuzzy stochastic linear programming: survey and future research directions. Eur. J. Oper. Res. 174(3), 1353–1367 (2006). https://doi.org/10.1016/j.ejor.2005.07.019

Luhandjula, M.K.: Fuzziness and randomness in an optimisation framework. Fuzzy Sets Syst. 77, 291–297 (1996). https://doi.org/10.1016/0165-0114(95)00043-7

Sakawa, M., Kato, K., Nishizaki, I.: An interactive fuzzy satisfying method for multiobjective stochastic linear programming problems through an expectation model. Eur. J. Oper. Res. 145(3), 665–672 (2003). https://doi.org/10.1016/s0377-2217(02)00150-9

Van Hop, N.: Fuzzy stochastic goal programming problems. Eur. J. Oper. Res. 176(1), 77–86 (2007). https://doi.org/10.1016/j.ejor.2005.09.023

Viertl, R.: Statistical Methods for Non-Precise Data. CRC Press, Boca Raton (1996). https://doi.org/10.1007/978-3-642-04898-2_546

Wang, G.Y., Qiao, Z.: Linear programming with fuzzy-random variable coefficients. Fuzzy Sets Syst. 57, 295–311 (1993). https://doi.org/10.1016/0165-0114(93)90025-d

Zadeh, L.A.: Fuzzy sets. Inf. Control 8(3), 338–353 (1965). https://doi.org/10.1016/S0019-9958(65)90241-X

Ramík, J., Rommelfanger, H.: Fuzzy mathematical programming based on some new inequality relations. Fuzzy Sets Syst. 81, 77–87 (1996). https://doi.org/10.1016/0165-0114(95)00241-3

Zadeh, L.A.: Concept of a linguistic variable and its application to approximate reasoning. Inf. Sci. 9(1), 43–80 (1975). https://doi.org/10.1016/0020-0255(75)90017-1

Zadeh, L.A.: Similarity relation and fuzzy ordering. Inf. Sci. (1971). https://doi.org/10.1016/S0020-0255(71)80005-1

Puri, M.L., Ralescu, D.A.: Fuzzy random variables. J. Math. Anal. Appl. 114, 409–422 (1986). https://doi.org/10.1515/9783110917833.452

Acknowledgements

The paper is supported by the Grant Agency of the VSB-Technical University Ostrava SP2022/58, SP2021/57. This support is gratefully acknowledged.

Funding

The research was funded by the VSB-Technical University Ostrava.

Author information

Authors and Affiliations

Contributions

All authors contributed to the paper conception, methodology and formal analysis and investigation. The first draft of the manuscript was written by ZZ, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript. Conceptualisation: ZZ, DD, PG and HG; Methodology: ZZ, DD, PG and HG; Software: ZZ; Writing—Original Draft: ZZ; Writing—Review & Editing: DD, PG, HG; Funding acquisition: DD; Formal analysis and investigation: ZZ, DD, PG, HG.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Rights and permissions

About this article

Cite this article

Zmeškal, Z., Dluhošová, D., Gurný, P. et al. Soft Bond Game Options Valuation in Discrete Time Using a Fuzzy-Stochastic Approach. Int. J. Fuzzy Syst. 24, 2215–2228 (2022). https://doi.org/10.1007/s40815-022-01258-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-022-01258-3