Abstract

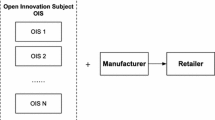

Technology research and development (R&D) plays an increasingly critical role in emerging supply chains by endowing products with desirable technical features. Due to unpredictable market acceptance, the technology concern coefficient, namely, the sensitivity of price to the technology level of technological products is uncertain in the process of R&D, and usually only its partial distribution information can be obtained by referring to similar products or resorting to experts in related fields. It reflects the subjective uncertainty of technology concern, which is different from the existing relevant literature. Motivated by this challenge, we construct a new ambiguity set of possibility distributions to characterize the distribution uncertainty of technology concern and build a novel robust fuzzy tri-level optimization model for decision-making in technology R&D supply chain (tRDsc) with government subsidy. Based on the proposed ambiguity set, we have derived the closed-form equilibrium solutions to the developed robust optimization model. At the same time, the equilibrium under manufacturer subsidy is consistent with that under consumer subsidy. Besides, manufacturer subsidy is more beneficial to the supplier, while technology supplier subsidy benefits the manufacturer more when the subsidy ratio is big enough. Finally, an application case about electric vehicles is studied to illustrate the effectiveness of our new optimization method. The case study shows that the government’s subsidy strategy may change when the uncertainty perturbation parameters change. That is, taking investment efficiency as the selection criterion, the change of perturbation set will influence subsidy policy choices.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.References

Lee, J., Krishnan, V., Shin, H.: Business models for technology-intensive supply chains. Manag. Sci. 66(5), 2120–2139 (2020). https://doi.org/10.1287/mnsc.2019.3306

Vish Krishnan, V., Lee, J., Mnyshenko, O., Shin, H.: Inclusive innovation: product innovation in technology supply chains. M &SOM-Manuf. Serv. Op. 21(2), 327–345 (2019). https://doi.org/10.1287/msom.2018.0746

Mussa, M., Rosen, S.: Monopoly and product quality. J. Econ. Theory 18(2), 301–317 (1978)

Moorthy, K.S., Png, I.P.: Market segmentation, cannibalization, and the timing of product introductions. Manag. Sci. 38(3), 345–359 (1992). https://doi.org/10.1287/mnsc.38.3.345

Majumder, P., Srinivasan, A.: Leadership and competition in network supply chains. Manag. Sci. 54(6), 1189–1204 (2008). https://doi.org/10.1287/mnsc.1070.0752

Chen, J.Y., Dimitrov, S., Pun, H.: The impact of government subsidy on supply chains’ sustainability innovation. Omega 86, 42–58 (2019). https://doi.org/10.1016/j.omega.2018.06.012

Yang, R., Tang, W., Zhang, J.: Technology improvement strategy for green products under competition: the role of government subsidy. Eur. J. Oper. Res. 289(2), 553–568 (2021). https://doi.org/10.1016/j.ejor.2020.07.030

Bao, B., Ma, J., Goh, M.: Short- and long-term repeated game behaviours of two parallel supply chains based on government subsidy in the vehicle market. Int. J. Prod. Res. 58(24), 7507–7530 (2020). https://doi.org/10.1080/00207543.2020.1711988

Zhou, X., Yang, S., Wang, G.: Impacts of knowledge spillovers and cartelization on cooperative innovation decisions with uncertain technology efficiency. Comput. Ind. Eng. 143, 106395 (2020). https://doi.org/10.1016/j.cie.2020.106395

Du, X., Zhan, H., Zhu, X., He, X.: The upstream innovation with an overconfident manufacturer in a supply chain. Omega 105, 102497 (2021). https://doi.org/10.1016/j.omega.2021.102497

Liu, N.Q., Chen, Y.J., Liu, Y.K.: Approximating credibilistic constraints by robust counterparts of uncertain linear inequality. Iran. J. Fuzzy. Syst. 18(5), 37–51 (2021). https://doi.org/10.22111/IJFS.2021.6254

Vahdani, B., Tavakkoli-Moghaddam, R., Jolai, F.: Reliable design of a logistics network under uncertainty: a fuzzy possibilistic-queuing model. Appl. Math. Model. 37(5), 3254–3268 (2013). https://doi.org/10.1016/j.apm.2012.07.021

Chen, W., Xu, W.: A hybrid multiobjective bat algorithm for fuzzy portfolio optimization with real-world constraints. Int. J. Fuzzy Syst. 21(1), 291–307 (2019). https://doi.org/10.1007/s40815-018-0533-0

Pakhira, N., Maiti, M.K., Maiti, M.: Fuzzy optimization for multi-item supply chain with trade credit and two-level price discount under promotional cost sharing. Int. J. Fuzzy Syst. 20(5), 1644–1655 (2018). https://doi.org/10.1007/s40815-017-0434-7

Liu, B., Liu, Y.K.: Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans. Fuzzy Syst. 10(4), 445–450 (2002). https://doi.org/10.1109/TFUZZ.2002.800692

Mirzaei, N., Mahmoodirad, A., Niroomand, S.: An uncertain multi-objective assembly line balancing problem: a credibility-based fuzzy modeling approach. Int. J. Fuzzy Syst. 21(8), 2392–2404 (2019). https://doi.org/10.1007/s40815-019-00734-7

Ben-Tal, A., Nemirovski, A.: Robust convex optimization. Math. Oper. Res. 23(4), 769–805 (1998). https://doi.org/10.1287/moor.23.4.769

El Ghaoui, L., Oustry, F., Lebret, H.: Robust solutions to uncertain semidefinite programs. SIAM J. Optim. 9, 33–52 (1998). https://doi.org/10.1137/S1052623496305717

Pishvaee, M.S., Razmi, J., Torabi, S.A.: Robust possibilistic programming for socially responsible supply chain network design: a new approach. Fuzzy. Set. Syst. 206, 1–20 (2012). https://doi.org/10.1016/j.fss.2012.04.010

Liu, Y., Liu, Y.K.: Distributionally robust fuzzy project portfolio optimization problem with interactive returns. Appl. Soft Comput. 56(5), 655–668 (2017). https://doi.org/10.1016/j.asoc.2016.09.022

Guo, Z., Liu, Y.: Modelling single-period inventory problem by distributionally robust fuzzy optimization method. J. Intell. Fuzzy Syst. 35(1), 1007–1019 (2018). https://doi.org/10.3233/JIFS-172128

Bai, X., Li, X., Jia, R., Liu, Y.: A distributionally robust credibilistic optimization method for the economic-environmental-energy-social sustainability problem. Inf. Sci. 501, 1–18 (2019). https://doi.org/10.1016/j.ins.2019.05.031

Liu, Y., Ma, L., Liu, Y.: A novel robust fuzzy mean-UPM model for green closed-loop supply chain network design under distribution ambiguity. Appl. Math. Model. 92, 99–135 (2021). https://doi.org/10.1016/j.apm.2020.10.042

Dempe, S., Zemkoho, A.: Bilevel optimization: advances and next chanllenges. In: Springer Optimization and Its Applications, Vol. 161. Springer, Cham (2020)

Prajogo, D.I., Sohal, A.S.: The integration of TQM and technology/R &D management in determining quality and innovation performance. Omega 34(3), 296–312 (2006). https://doi.org/10.1016/j.omega.2004.11.004

Reyniers, D.J., Tapiero, C.S.: The delivery and control of quality in supplier-producer contracts. Manag. Sci. 41(10), 1581–1589 (1995). https://doi.org/10.1287/mnsc.41.10.1581

Chakraborty, T., Chauhan, S.S., Ouhimmou, M.: Cost-sharing mechanism for product quality improvement in a supply chain under competition. Int. J. Prod. Econ. 208, 566–587 (2019). https://doi.org/10.1016/j.ijpe.2018.12.015

El Ouardighi, F.: Supply quality management with optimal wholesale price and revenue sharing contracts: a two-stage game approach. Int. J. Prod. Econ. 156, 260–268 (2014). https://doi.org/10.1016/j.ijpe.2014.06.006

Li, G., Wu, H., Zheng, H.: Technology investment strategy for a competitive manufacturer in the presence of technology spillover. IEEE Trans. Eng. Manag. 22(September), 1–12 (2021). https://doi.org/10.1109/TEM.2021.3105014

Guellec, D., Van Pottelsberghe De La Potterie, B.: The impact of public R &D expenditure on business R &D, Econ. Innov. New Techn. 12(3), 225–243 (2003). https://doi.org/10.1080/10438590290004555

Ma, W., Zhang, R., Chai, S.: What drives green innovation? A game theoretic analysis of government subsidy and cooperation contract. Sustain. Basel 11(20), 5584 (2019). https://doi.org/10.3390/su11205584

Shao, L., Yang, J., Zhang, M.: Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Oper. Res. 262(3), 1181–1195 (2017). https://doi.org/10.1016/j.ejor.2017.04.030

Chemama, J., Cohen, M.C., Lobel, R., Perakis, G.: Consumer subsidies with a strategic supplier: commitment vs. flexibility. Manag. Sci. 65(2), 681–713 (2019). https://doi.org/10.1287/mnsc.2017.2962

Ma, W.M., Zhao, Z., Ke, H.: Dual-channel closed-loop supply chain with government consumption-subsidy. Eur. J. Oper. Res. 226(2), 221–227 (2013). https://doi.org/10.1016/j.ejor.2012.10.033

Yu, J.J., Tang, C.S., Shen, Z.J.M.: Improving consumer welfare and manufacturer profit via government subsidy programs: subsidizing consumers or manufacturers. M &SOM-Manuf. Serv. Oper. 20(4), 752–766 (2018). https://doi.org/10.1287/msom.2017.0684

Bian, J., Zhang, G., Zhou, G.: Manufacturer vs. consumer subsidy with green technology investment and environmental concern. Eur. J. Oper. Res. 287(3), 832–843 (2020). https://doi.org/10.1016/j.ejor.2020.05.014

Mu, Z., Li, Q., Dai, G., Li, K., Zhang, G., Zhang, F.: Government subsidy policy and online selling strategy in a platform supply chain with green R &D and DDM activities. Sustain. Basel 14(15), 9658 (2022). https://doi.org/10.3390/su14159658

Yang, D., Xiao, T.: Pricing and green level decisions of a green supply chain with governmental interventions under fuzzy uncertainties. J. Clean. Prod. 149, 1174–1187 (2017). https://doi.org/10.1016/j.jclepro.2017.02.138

Spence, M.: Product differentiation and welfare. Am. Econ. Rev. 66(2), 407–414 (1976)

Hansen, L.P., Sargent, T.J.: Robustness. Princeton University Press, Princeton (2008)

Acknowledgements

We would like to thank the editors and the anonymous reviewers for their insight comments for improving the quality of this paper. This work is supported by the National Natural Science Foundation of China (Grant No. 61773150).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

The Proofs of Main Results

The Proof of Theorem 1

According to Definition 1, the possibility distribution \(\mu _{\xi }(x;\lambda _l,\lambda _r)\) of trapezoidal fuzzy variable \(\xi\) is as follows:

Based on the expression of \(\mu _{\xi }(x;\lambda _l,\lambda _r)\), one has the credibility of the fuzzy event \(\{\xi \le x\}\) as follows:

By the definition of the expected value of \(\xi\), we get

The Proof of Theorem 2

Based on the ambiguity set \({\mathcal {F}}_{\mu }\) in Equation (4) and the expected value of \(\mu _{\xi }\) in Theorem 1, the computationally tractable formulation of the robust fuzzy bi-level tRDsc model (2) is as follows:

where \(\displaystyle L(d)=(\alpha +\gamma \theta -\beta d-w-c)d\), \(\displaystyle \pi _{s}(w,\theta )=wd-\frac{1}{2}\phi \theta ^2\), and \(\gamma =\frac{r_1+r_2+r_3+r_4}{4}+\frac{\delta _{l}(r_1-r_2)+\delta _{r}(r_3-r_4)}{8}\).

For the function L(d) in the lower level, we have its second derivative \(\frac{\partial ^2 L}{\partial d^2}=-\beta <0\), then L(d) is concave which ensures the maximum point of L exists. Given w and \(\theta\), from the first-order conditions, the reaction function of d is obtained as follows:

Based on the manufacturer’s reaction, the supplier determines optimal w and \(\theta\) to maximize his profit function. The Hessian matrix associated with \(\pi _s\) is as following:

By calculation, \(\vert H\vert =\frac{4\beta \phi -\gamma ^2}{4\beta ^2}\). Suppose that \(4\beta \phi -\gamma ^2>0\), we have H is negative definite. So \(\pi _s\) is jointly concave in w and \(\theta\). From the first-order conditions

we have \(\theta =\frac{(\alpha -c)\gamma }{4\beta \phi -\gamma ^2}\) and \(w=\frac{2\beta \phi (\alpha -c)}{4\beta \phi -\gamma ^2}\). Substituting the values of w and \(\theta\) into the reaction function d and Equation (1), we get \(d=\frac{\phi (\alpha -c)}{4\beta \phi -\gamma ^2}\) and \(p=\frac{\beta \phi (3\alpha +c)-c \gamma ^2}{4\beta \phi -\gamma ^2}.\)

The Proof of Theorem 3

From the ambiguity set \({\mathcal {F}}_{\mu }\) in Equation (4) and the expected value of \(\mu _{\xi }\) in Theorem 1, we have the computationally tractable formulation of the robust fuzzy tRDsc model (5) as follows:

where \(L_1^{sp}(\kappa )=(\alpha -c)d+\gamma \theta d-\frac{1}{2}\phi \theta ^2-\frac{1}{2}\beta d^2\), \(L_2^{sp}(w,\theta )=wd-\frac{1}{2}\phi \theta ^2 (1-\kappa )\), and \(L_3^{sp}(d)=(\alpha +\gamma \theta -\beta d -w-c)d\),

\(\gamma =\frac{r_1+r_2+r_3+r_4}{4}+\frac{\delta _{l}(r_1-r_2)+\delta _{r}(r_3-r_4)}{8}\).

By calculation, the second derivative associated with the function in the lower level is \(\frac{\partial ^2 L_3^{sp}}{\partial d^2}=-\beta <0\), then \(L_3^{sp}(d)\) is concave which ensures \(L_3^{sp}(d)\) has the maximum point. Given \(\kappa\), w, and \(\theta\), based on the first-order conditions, the reaction function of d is given by

According to the manufacturer’s reaction, the supplier maximize his profit function by determining optimal w and \(\theta\). The Hessian matrix associated with \(L_2^{sp}(w,\theta )\) is as follows:

It can be seen that \(\vert H\vert =\frac{4\beta \phi (1-\kappa )-\gamma ^2}{4\beta ^2}>0\). Suppose that \(4\beta \phi (1-\kappa )-\gamma ^2>0\), we have H is negative definite. So \(L_2^{sp}(w,\theta )\) is jointly concave in w and \(\theta\). From the first-order conditions

we have \(\theta ^{sp}=\frac{(\alpha -c)\gamma }{4\beta \phi (1-\kappa )-\gamma ^2}\) and \(w^{sp}=\frac{2\beta \phi (\alpha -c)(1-\kappa )}{4\beta \phi (1-\kappa )-\gamma ^2}\). Substituting the values of \(w^{sp}\) and \(\theta ^{sp}\) into the reaction function \(d^{sp}\) and Equation (1), we get \(d^{sp}=\frac{\phi (\alpha -c)(1-\kappa )}{4\beta \phi (1-\kappa )-\gamma ^2}\) and \(p^{sp}=\frac{(3\alpha +c)\beta \phi (1-\kappa )-c \gamma ^2}{4\beta \phi (1-\kappa )-\gamma ^2}\).

The Proof of Proposition 5

(1) From practical problem, we can see that the price cap \(\alpha\) is greater than unit production cost c. Differentiating the wholesale price in Theorem 3 with respect to the technology cost coefficient \(\phi\), we get \(\frac{\partial w^{sp}}{\partial \phi }=-\frac{2 \beta (\kappa -1) (c-\alpha ) \gamma ^{2}}{(4 \beta \kappa \phi +\gamma ^{2}-4 \beta \phi )^{2}}<0\);

(2) Differentiating the technology quality level in Theorem 3 with respect to technology cost coefficient \(\phi\), one gets \(\frac{\partial \theta ^{sp}}{\partial \phi }=-\frac{\gamma (c-\alpha ) (4 \beta \kappa -4 \beta )}{(4 \beta \kappa \phi +\gamma ^{2}-4 \beta \phi )^{2}}<0\);

(3) Differentiating the production quantity in Theorem 3 with respect to technology cost coefficient \(\phi\), we have \(\frac{\partial d^{sp}}{\partial \phi }=-\frac{(\kappa -1) (c-\alpha ) \gamma ^{2}}{16 [\beta \phi (\kappa -1)+\frac{\gamma ^{2}}{4}]^{2}}<0\); and

(4) Differentiating the selling price in Theorem 3 with respect to technology cost coefficient \(\phi\), we get \(\frac{\partial p^{sp}}{\partial \phi }=-\frac{3 \beta (\kappa -1) (c-\alpha ) \gamma ^{2}}{16 [\beta \phi (\kappa -1)+\frac{\gamma ^{2}}{4}]^{2}}<0\).

The Proof of Proposition 6

(1) Differentiating the technology supplier’s equilibrium profit in Theorem 4 with respect to technology cost coefficient \(\phi\), we get

\(\frac{\partial \pi _{s}^{sp}}{\partial \phi }=\frac{(\kappa -1) (c-\alpha )^{2} \gamma ^{2}}{32 [\beta \phi (\kappa -1)+\frac{\gamma ^{2}}{4}]^{2}}<0\),

(2) To ensure the results are meaningful, we assume that \(\kappa <1-\frac{\gamma ^2}{4\beta \phi }\) in Theorem 3. Differentiating the manufacturer’s equilibrium profit in Theorem 4 with respect to the technology cost coefficient \(\phi\), we have \(\frac{\partial \pi _{m}^{sp}}{\partial \phi }=\frac{\beta \phi (\kappa -1)^{2} (c-\alpha )^{2} \gamma ^{2}}{32 [\beta \phi (\kappa -1)+\frac{\gamma ^{2}}{4}]^{3}}<0\),

(3) Differentiating the equilibrium social welfare in Theorem 4 with respect to the technology cost coefficient \(\phi\) and set it equal to 0, then we have

\(\frac{\partial SW^{sp}}{\partial \phi }=\frac{7 (c-\alpha )^{2} [\beta (\kappa -\frac{5}{7}) (-1+\kappa ) \phi -\frac{\gamma ^{2}}{14}] \gamma ^{2}}{64 [\beta (-1+\kappa ) \phi +\frac{\gamma ^{2}}{4}]^{3}}=0.\)

The solution is \(\kappa = \frac{6}{7}-\sqrt{\frac{1}{49}+\frac{\gamma ^2}{14\beta \phi }}\). Therefore,

when \(0<\kappa< \frac{6}{7}-\sqrt{\frac{1}{49}+\frac{\gamma ^2}{14\beta \phi }}, \frac{\partial SW^{sp}}{\partial \phi }<0\) and

when \(\frac{6}{7}-\sqrt{\frac{1}{49}+\frac{\gamma ^2}{14\beta \phi }}<\kappa <1-\frac{\gamma ^2}{4\beta \phi }, \frac{\partial SW^{sp}}{\partial \phi }>0\).

(4) Differentiating the government spending in Theorem 4 with respect to technology cost coefficient \(\phi\), we have \(\frac{\partial GS^{sp}}{\partial \phi }=\frac{(c-\alpha )^{2} \kappa [\beta (1-\kappa ) \phi +\frac{\gamma ^{2}}{4}] \gamma ^{2}}{32 [\beta (-1+\kappa ) \phi +\frac{\gamma ^{2}}{4}]^{3}}<0\).

The Proof of Theorem 7

According to the ambiguity set \({\mathcal {F}}_{\mu }\) in Equation (4) and the expected value of \(\mu _{\xi }\) in Theorem 1, the robust fuzzy tRDsc model (6) is equivalent to

where \(L_1^{mp}(\rho )=(\alpha -c)d+\gamma \theta d-\frac{1}{2}\phi \theta ^2-\frac{1}{2}\beta d^2\), \(L_2^{mp}(w,\theta )=wd-\frac{1}{2}\phi \theta ^2\), \(L_3^{mp}(d)=(\alpha +\gamma \theta -\beta d -w-c+\rho )d\), and

\(\gamma =\frac{r_1+r_2+r_3+r_4}{4}+\frac{\delta _{l}(r_1-r_2)+\delta _{r}(r_3-r_4)}{8}\).

By calculating the second derivative of the lower function, we have \(\frac{\partial ^2 L_3^{mp}}{\partial d^2}=-\beta <0\), then \(L_3^{mp}(d)\) is concave which indicates the maximum point of \(L_3^{mp}(d)\) exists. Given \(\rho\), w, and \(\theta\), based on the first-order conditions, the reaction function of d is given by

According to the manufacturer’s reaction, the supplier maximizes his profit function by determining optimal w and \(\theta\). The Hessian matrix associated with \(L_2^{mp}(w,\theta )\) is as follows:

Therefore, \(\vert H\vert =\frac{4\beta \phi -\gamma ^2}{4\beta ^2}>0\). From the assumption that \(\beta \phi -\gamma ^2>0\), we have H is negative definite. So \(L_2^{mp}(w,\theta )\) is jointly concave in w and \(\theta\). From the first-order conditions

we have \(\theta ^{mp}=\frac{(\alpha -c+\rho )\gamma }{4\beta \phi -\gamma ^2}\) and \(w^{mp}=\frac{2\beta \phi (\alpha -c+\rho )}{4\beta \phi -\gamma ^2}\). Substituting the values of \(w^{mp}\) and \(\theta ^{mp}\) into the reaction function \(d^{mp}\), we get \(d^{mp}=\frac{\phi (\alpha -c+\rho )}{4\beta \phi -\gamma ^2}\). Getting the decisions of the technology supplier and the manufacturer, the government reduces his objective function to this form that is

By calculating, we get \(\frac{\partial ^2 L_1^{mp}}{\partial \rho ^2}=-\frac{\phi (\beta \phi -\gamma ^2)}{(4\beta \phi -\gamma ^2)^2}\). Based on the assumption that \(\beta \phi -\gamma ^2>0\), then \(\frac{\partial ^2 L_1^{mp}}{\partial \rho ^2}<0\) which indicates that \(L_1^{mp}(\rho )\) has the maximum points. According to the first-order conditions, we have

Further, it can be obtained that all robust equilibrium solutions which are shown in Theorem 7.

The Proof of Proposition 9

(1) Note that the price cap \(\alpha\) is greater than unit production cost c. Differentiating the wholesale price in Theorem 7 with respect to the technology cost coefficient \(\phi\), we get \(\frac{\partial w^{mp}}{\partial \phi }=-\frac{2 \beta \gamma ^{2} (\alpha -c)}{(\beta \phi -\gamma ^{2})^{2}}<0\);

(2) Differentiating the technology quality level in Theorem 7 with respect to the technology cost coefficient \(\phi\), one gets \(\frac{\partial \theta ^{mp}}{\partial \phi }=-\frac{\gamma \beta (\alpha -c)}{(\beta \phi -\gamma ^{2})^{2}}<0\);

(3) Differentiating the production quantity in Theorem 7 with respect to the technology cost coefficient \(\phi\), we have \(\frac{\partial d^{mp}}{\partial \phi }=-\frac{(\alpha -c) \gamma ^{2}}{(\beta \phi -\gamma ^{2})^{2}}<0\); and

(4) Differentiating the selling price in Theorem 7 with respect to the technology cost coefficient \(\phi\), we get \(\frac{\partial p^{mp}}{\partial \phi }=0\).

The Proof of Proposition 10

(1) Differentiating the technology supplier’s equilibrium profit in Theorem 8 with respect to technology cost coefficient \(\phi\), we get \(\frac{\partial \pi _{s}^{mp}}{\partial \phi }=-\frac{\gamma ^{2}(\alpha -c)^{2}(7\beta \phi -\gamma ^{2})}{2(\beta \phi -\gamma ^{2})^{3}}<0\);

(2) Differentiating the manufacturer’s equilibrium profit in Theorem 8 with respect to the technology cost coefficient \(\phi\), we have \(\frac{\partial \pi _{m}^{mp}}{\partial \phi }=-\frac{2 \beta \phi \gamma ^2 (\alpha -c)^{2}}{(\beta \phi - \gamma ^{2})^{3}}<0\);

(3) To make sense of the result, we assume that \(\beta \phi -\gamma ^2 > 0\) in Theorem 8. Differentiating the equilibrium social welfare in Theorem 8 with respect to the technology cost coefficient \(\phi\), we have

\(\frac{\partial SW^{mp}}{\partial \phi }=-\frac{\gamma ^{2}(\alpha -c)^{2}}{2(\beta \phi - \gamma ^{2})^{2}}<0\); and

(4) Differentiating the government spending in Theorem 8 with respect to technology cost coefficient \(\phi\), we have \(\frac{\partial GS^{mp}}{\partial \phi }=-\frac{6\beta \phi \gamma ^2 (\alpha -c)^{2}}{(\beta \phi - \gamma ^{2})^{3}}<0\).

The Proof of Theorem 11

Based on the ambiguity set \({\mathcal {F}}_{\mu }\) in Equation (4) and the expected value of \(\mu _{\xi }\) in Theorem 1, the robust fuzzy tRDsc model (7) is equivalently written as follows:

where \(L_1^{cp}(\epsilon )=(\alpha -c)d+\gamma \theta d-\frac{1}{2}\phi \theta ^2-\frac{1}{2}\beta d^2\),

\(L_2^{cp}(w,\theta )=wd-\frac{1}{2}\phi \theta ^2\), \(L_3^{cp}(d)=(\alpha +\gamma \theta -\beta d -w-c+\epsilon )d\), and

\(\gamma =\frac{r_1+r_2+r_3+r_4}{4}+\frac{\delta _{l}(r_1-r_2)+\delta _{r}(r_3-r_4)}{8}\).

By calculating the second derivative of the lower function \(L_3^{cp}(d)\), we have \(\frac{\partial ^2 L_3^{cp}}{\partial d^2}=-\beta <0\), then \(L_3^{cp}(d)\) is concave which indicates the maximum point of \(L_3^{cp}(d)\) exists. Given \(\epsilon\), w, and \(\theta\), based on the first-order conditions, the reaction function of d is given by

Getting the manufacturer’s reaction, the supplier maximizes his profit function by determining optimal w and \(\theta\). The Hessian matrix associated with \(L_2^{cp}(w,\theta )\) is as follows:

Then, we get \(\vert H\vert =\frac{4\beta \phi -\gamma ^2}{4\beta ^2}\). It is known that \(\beta \phi -\gamma ^2>0\), then \(4\beta \phi -\gamma ^2>0\) and H is negative definite. So \(L_2^{cp}(w,\theta )\) is jointly concave in w and \(\theta\). From the first-order conditions

we have \(\theta ^{cp}=\frac{(\alpha -c+\epsilon )\gamma }{4\beta \phi -\gamma ^2}\) and \(w^{cp}=\frac{2\beta \phi (\alpha -c+\epsilon )}{4\beta \phi -\gamma ^2}\). Substituting the values of \(w^{cp}\) and \(\theta ^{cp}\) into the reaction function \(d^{cp}\), we get \(d^{cp}=\frac{\phi (\alpha -c+\epsilon )}{4\beta \phi -\gamma ^2}\). Getting the decisions of the technology supplier and the manufacturer, the government reduces its objective function to this form, that is,

The second derivative \(\frac{\partial ^2 L_1^{cp}}{\partial \epsilon ^2}=-\frac{\phi (\beta \phi -\gamma ^2)}{(4\beta \phi -\gamma ^2)^2}\). Based on the assumption that \(\beta \phi -\gamma ^2>0\), then \(\frac{\partial ^2 L_1^{cp}}{\partial \epsilon ^2}<0\) which indicates that \(L_1^{cp}(\epsilon )\) has the maximum points. Based on the first-order conditions, we have

Further, it can be obtained that all robust equilibrium solutions which are shown in Theorem 11.

The Proof of Proposition 12

The equilibrium solutions under technology supplier subsidy and those under manufacturer subsidy can be seen in Theorem 3 and 7, respectively.

(1) Technology quality: \(\theta ^{sp}-\theta ^{mp}=\frac{\gamma (\alpha -c)}{4\beta \phi (1-\kappa )-\gamma ^2}-\frac{\gamma (\alpha -c)}{\beta \phi -\gamma ^2}=0\), the solution is \(\kappa =\frac{3}{4}\), then we have

if \(0\le \kappa <\frac{3}{4}\) and then \(\theta ^{sp}<\theta ^{mp}\);

if \(\frac{3}{4} \le \kappa <1-\frac{\gamma ^2}{4\beta \phi }\), then \(\theta ^{sp}\ge \theta ^{mp}\).

(2) Wholesale price: \(w^{sp}-w^{mp}=\frac{2\beta \phi (\alpha -c)(1-\kappa )}{4\beta \phi (1-\kappa )-\gamma ^2}-\frac{2 \beta \phi (\alpha -c)}{\beta \phi -\gamma ^2}=0\), the solution is \(\kappa =\frac{3\beta \phi }{\gamma ^{2}+3\beta \phi }\), then we have

if \(0\le \kappa <\frac{3\beta \phi }{\gamma ^{2}+3\beta \phi }\), then \(w^{sp} < w^{mp}\); and

if \(\frac{3\beta \phi }{\gamma ^{2}+3\beta \phi } \le \kappa <1-\frac{\gamma ^2}{4\beta \phi }\), then \(w^{sp} \ge w^{mp}\).

(3) Production quantity: \(d^{sp} - d^{mp}=\frac{\phi (\alpha -c)(1-\kappa )}{4\beta \phi (1-\kappa )-\gamma ^2}-\frac{\phi (\alpha -c)}{ \beta \phi -\gamma ^2}=0\), the solution is \(\kappa =\frac{3\beta \phi }{\gamma ^{2}+3\beta \phi }\), then we have

if \(0\le \kappa <\frac{3\beta \phi }{\gamma ^{2}+3\beta \phi }\), then \(d^{sp} < d^{mp}\); and

if \(\frac{3\beta \phi }{\gamma ^{2}+3\beta \phi } \le \kappa <1-\frac{\gamma ^2}{4\beta \phi }\), then \(d^{sp} \ge d^{mp}\).

(4) Retail price: \(p^{sp}-p^{mp}=\frac{(3\alpha +c)\beta \phi (1-\kappa )-c \gamma ^2}{4\beta \phi (1-\kappa )-\gamma ^2}-c \ge 0\), thus \(p^{sp}\ge p^{mp}\).

The Proof of Proposition 13

The equilibrium objectives under technology supplier subsidy and those under manufacturer subsidy can be seen in Theorems 4 and 8, respectively.

(1) The technology supplier’s profit:

\(\pi _s^{sp} - \pi _s^{mp}=\frac{\phi (\alpha -c)^2 (1-\kappa )}{2[4\beta \phi (1-\kappa )-\gamma ^2]}-\frac{\phi (4\beta \phi -\gamma ^2)(\alpha -c)^2}{2(\beta \phi -\gamma ^2)^2}=0\), the solution is \(\kappa = \frac{3\beta \phi (2 \gamma ^{2}-5\beta \phi )}{\gamma ^{4}+2 \gamma ^{2}\beta \phi -15\beta ^{2}\phi ^{2}}\), then we have

if \(0\le \kappa <\frac{3\beta \phi (2 \gamma ^{2}-5\beta \phi )}{\gamma ^{4}+2 \gamma ^{2}\beta \phi -15\beta ^{2}\phi ^{2}}\), then \(\pi _s^{sp} < \pi _s^{mp}\); and

if \(\frac{3\beta \phi (2 \gamma ^{2}-5\beta \phi )}{\gamma ^{4}+2 \gamma ^{2}\beta \phi -15\beta ^{2}\phi ^{2}} \le \kappa <1-\frac{\gamma ^2}{4\beta \phi }\), then \(\pi _s^{sp} \ge \pi _s^{mp}\).

(2) The manufacturer’s profit:

\(\pi _m^{sp} - \pi _m^{mp}=\frac{\beta \phi ^2(\alpha -c)^2 (1-\kappa )^2}{[4\beta \phi (1-\kappa )-\gamma ^2]^2}-\frac{\beta \phi ^2(\alpha -c)^2}{(\beta \phi -\gamma ^2)^2}=0\), the solution is \(\kappa =\kappa _2\), then we have, if \(0\le \kappa <\kappa _2\), then \(\pi _m^{sp} < \pi _m^{mp}\); and if \(\kappa _2 \le \kappa <1-\frac{\gamma ^2}{4\beta \phi }\), then \(\pi _m^{sp} \ge \pi _m^{mp}\),

where \(\kappa _2=-\frac{\sqrt{\gamma ^{8}+12 \gamma ^{6}\beta \phi -26 \gamma ^{4}\beta ^{2}\phi ^{2}+12 \gamma ^{2}\beta ^{3}\phi ^{3}+\beta ^{4}\phi ^{4}}}{32\beta ^{2}\phi ^{2}}+\frac{-\gamma ^{4}-6 \gamma ^{2}\beta \phi +31 \beta ^{2}\phi ^{2}}{32\beta ^{2}\phi ^{2}}.\)

(3) Social welfare: \(SW^{sp}-SW^{mp}=\frac{\phi (\alpha -c)^2 [7\beta \phi (1-\kappa )^2-\gamma ^2]}{2[4 \beta \phi (1-\kappa )-\gamma ^2]^2}-\frac{\phi (\alpha -c)^2}{2( \beta \phi -\gamma ^2)}<0\); and

(4) Investment efficiency: Based on the results of social welfare and government spending, the investment efficiency under technology supplier subsidy and manufacturer subsidy are obtained as follows, respectively, \(IE^{sp}= \frac{7\beta \phi (1-\kappa )^2-\gamma ^2}{\kappa \gamma ^2}, IE^{mp}=\frac{\beta \phi -\gamma ^2}{6\beta \phi }\), then

Therefore, \(0\le \kappa \le 1-\sqrt{\frac{\gamma ^2}{6\beta \phi }}\).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chen, A., Liu, Y. Optimizing Technology R&D Supply Chain Problem Under Technology Concern Uncertainty. Int. J. Fuzzy Syst. 25, 916–939 (2023). https://doi.org/10.1007/s40815-022-01418-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-022-01418-5