Abstract

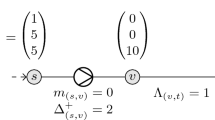

In entry-exit gas markets as they are currently implemented in Europe, network constraints do not affect market interaction beyond the technical capacities determined by the TSO that restrict the quantities individual firms can trade at the market. It is an up to now unanswered question to what extent existing network capacity remains unused in an entry-exit design and to what extent feasible adjustments of the market design could alleviate inefficiencies. In this paper, we offer a four-level modeling framework that is capable of analyzing these issues and provide some first results on the model structure. In order to decouple gas trading from network congestion management, the TSO is required to determine technical capacities and corresponding booking fees at every entry and exit node up front. Firms book those capacities, which gives them the right to charge or discharge an amount of gas at a certain node up to this capacity in every scenario. Beyond these technical capacities and the resulting bookings, gas trade is unaffected by network constraints. The technical capacities have to ensure that transportation of traded quantities is always feasible. We assume that the TSO is regulated and determines technical capacities, fees, and transportation costs under a welfare objective. As a first step we moreover assume perfect competition among gas traders and show that the booking and nomination decisions can be analyzed in a single level. We prove that this aggregated model has a unique solution. We also show that the TSO’s decisions can be subsumed in one level as well. If so, the model boils down to a mixed-integer nonlinear bilevel problem with robust aspects. In addition, we provide a first-best benchmark that allows to assess welfare losses that occur in an entry-exit system. Our approach provides a generic framework to analyze various aspects in the context of semi-liberalized gas markets. Therefore, we finally discuss and provide guidance on how to include several important aspects into the approach, such as network and production capacity investment, uncertain data, market power, and intra-day trading.

Similar content being viewed by others

References

Abada I, Gabriel S, Briat V, Massol O (2013) A generalized Nash-Cournot model for the northwestern European natural gas markets with a fuel substitution demand function: the GaMMES model. Netw Spat Econ 13(1):1–42. https://doi.org/10.1007/s11067-012-9171-5

Abada I, Massol O (2011) Security of supply and retail competition in the European gas market: some model-based insights. Energy Policy 39(7):4077–4088. https://doi.org/10.1016/j.enpol.2011.03.043 Special Section: Renewable energy policy and development

Alonso A, Olmos L, Serrano M (2010) Application of an entry-exit tariff model to the gas transport system in Spain. Energy Policy 38(5):5133–5140. https://doi.org/10.1016/j.enpol.2010.04.043

Baltensperger T, Füchslin RM, Krütli P, Lygeros J (2016) Multiplicity of equilibria in conjectural variations models of natural gas markets. Eur J Oper Res 252(2):646–656. https://doi.org/10.1016/j.ejor.2016.01.032

Boots MG, Rijkers FA, Hobbs BF (2004) Trading in the downstream European gas market: a successive oligopoly approach. Energy J 25(3):73–102. http://www.jstor.org/stable/41323043

Borraz-Sánchez C, Bent R, Backhaus S, Hijazi H, van Hentenryck P (2016) Convex relaxations for gas expansion planning. INFORMS J Comput 28(4):645–656. https://doi.org/10.1287/ijoc.2016.0697

Boucher J, Smeers Y (1985) Gas trade in the European community during the 1970s. Energy Econ 7(2):102–116. https://doi.org/10.1016/0140-9883(85)90025-8

Boucher J, Smeers Y (1987) Economic forces in the European gas market–a 1985 prospective. Energy Econ 9(1):2–16. https://doi.org/10.1016/0140-9883(87)90002-8

Brouwer J, Gasser I, Herty M (2011) Gas pipeline models revisited: model hierarchies, nonisothermal models, and simulations of networks. Multiscale Model Simul 9(2):601–623. https://doi.org/10.1137/100813580

Chyong CK, Hobbs BF (2014) Strategic Eurasian natural gas market model for energy security and policy analysis: formulation and application to south stream. Energy Econ 44:198–211. https://doi.org/10.1016/j.eneco.2014.04.006

Commission: First benchmarking report on the implementation of the internal electricity and gas market. Tech. rep., European Commission SEC (2001) 1957 (2001). https://ec.europa.eu/energy/sites/ener/files/documents/2001_report_bencmarking.pdf

European Commission: Competition. Energy and environment. Gas (2012). http://ec.europa.eu/competition/sectors/energy/gas/gas_en.html

Cremer H, Laffont JJ (2002) Competition in gas markets. Eur Econ Rev 46(4–5):928–935. https://doi.org/10.1016/S0014-2921(01)00226-4

Crew MA, Fernando CS, Kleindorfer PR (1995) The theory of peak-load pricing: a survey. J Regul Econ 8(3):215–248. https://doi.org/10.1007/BF01070807

Dempe S (2002) Foundations of bilevel programming. Springer, Berlin

Domschke P, Geißler B, Kolb O, Lang J, Martin A, Morsi A (2011) Combination of nonlinear and linear optimization of transient gas networks. INFORMS J Comput 23(4):605–617. https://doi.org/10.1287/ijoc.1100.0429

Egging R (2013) Benders decomposition for multi-stage stochastic mixed complementarity problems–applied to a global natural gas market model. Eur J Oper Res 226(2):341–353. https://doi.org/10.1016/j.ejor.2012.11.024

Egging R, Gabriel SA, Holz F, Zhuang J (2008) A complementarity model for the European natural gas market. Energy Policy 36(7):2385–2414. https://doi.org/10.1016/j.enpol.2008.01.044

Egging R, Holz F, Gabriel SA (2010) The world gas model: a multi-period mixed complementarity model for the global natural gas market. Energy 35(10):4016–4029. https://doi.org/10.1016/j.energy.2010.03.053

European Parliament and Council of the European Union (1998) Directive 98/30/EC of the European Parliament and of the Council of 22 June 1998 concerning common rules for the internal market in natural gas

European Parliament and Council of the European Union (2003) Directive 2003/55/EC of the European Parliament and of the Council of 26 June 2003 concerning common rules for the internal market in natural gas and repealing Directive 98/30/EC

European Parliament and Council of the European Union (2009) Directive 2009/73/EC of the European Parliament and of the Council concerning common rules for the internal market in natural gas and repealing Directive 2003/55/EC

European Parliament and Council of the European Union (2009) Regulation No 715/2009 of the European Parliament and of the Council on conditions for access to the natural gas transmission networks and repealing Regulation No 1775/2005

Facchinei F, Fischer A, Piccialli V (2007) On generalized nash games and variational inequalities. Oper Res Lett 35(2):159–164. https://doi.org/10.1016/j.orl.2006.03.004

Facchinei F, Kanzow C (2007) Generalized nash equilibrium problems. 4OR 5(3):173–210. https://doi.org/10.1007/s10288-007-0054-4

Fiacco AV, Kyparisis J (1986) Convexity and concavity properties of the optimal value function in parametric nonlinear programming. J Optim Theory Appl 48(1):95–126. https://doi.org/10.1007/BF00938592

Fodstad M, Midthun KT, Tomasgard A (2015) Adding flexibility in a natural gas transportation network using interruptible transportation services. Eur J Oper Res 243(2):647–657. https://doi.org/10.1016/j.ejor.2014.12.010

Fügenschuh A, Geißler B, Gollmer R, Morsi A, Pfetsch ME, Rövekamp J, Schmidt M, Spreckelsen K, Steinbach MC (2015) Physical and technical fundamentals of gas networks. In: Koch T, Hiller B, Pfetsch ME, Schewe L (eds) Evaluating gas network capacities. SIAM-MOS series on optimization, chap. 2. SIAM, Philadelphia, pp 17–43. https://doi.org/10.1137/1.9781611973693.ch2

Gabriel SA, Conejo AJ, Fuller JD, Hobbs BF, Ruiz C (2012) Complementarity modeling in energy markets, vol 180. Springer, Berlin

Gabriel SA, Kiet S, Zhuang J (2005) A mixed complementarity-based equilibrium model of natural gas markets. Oper Res 53(5):799–818. https://doi.org/10.1287/opre.1040.0199

Gabriel SA, Zhuang J, Egging R (2009) Solving stochastic complementarity problems in energy market modeling using scenario reduction. Eur J Oper Res 197(3):1028–1040. https://doi.org/10.1016/j.ejor.2007.12.046

Geißler B, Morsi A, Schewe L (2013) A new algorithm for MINLP applied to gas transport energy cost minimization. In: Jünger M, Reinelt G (eds) Facets of combinatorial optimization. Springer, Heidelberg, pp 321–353. https://doi.org/10.1007/978-3-642-38189-8_14

Geißler B, Morsi A, Schewe L, Schmidt M (2015) Solving power-constrained gas transportation problems using an MIP-based alternating direction method. Comput Chem Eng 82:303–317. https://doi.org/10.1016/j.compchemeng.2015.07.005

Geißler B, Morsi A, Schewe L, Schmidt M (2017) Solving highly detailed gas transport MINLPs: block separability and penalty alternating direction methods. INFORMS J Comput. https://doi.org/10.1287/ijoc.2017.0780

Glachant JM, Hallack M, Vazquez M (2013) Building competitive gas markets in the EU. Edward Elgar Publishing, Cheltenham

Grimm V, Grübel J, Schewe L, Schmidt M, Zöttl G (2017) Nonconvex equilibrium models for gas market analysis: failure of standard techniques and alternative modeling approaches. Tech. rep. http://www.optimization-online.org/DB_HTML/2017/11/6332.html

Grimm V, Kleinert T, Liers F, Schmidt M, Zöttl G (2017) Optimal price zones of electricity markets: a mixed-integer multilevel model and global solution approaches. Optim Methods Softw. https://doi.org/10.1080/10556788.2017.1401069

Grimm V, Martin A, Schmidt M, Weibelzahl M, Zöttl G (2016a) Transmission and generation investment in electricity markets: the effects of market splitting and network fee regimes. Eur J Oper Res 254(2):493–509. https://doi.org/10.1016/j.ejor.2016.03.044

Grimm V, Martin A, Weibelzahl M, Zöttl G (2016b) On the long run effects of market splitting: why more price zones might decrease welfare. Energy Policy 94:453–467. https://doi.org/10.1016/j.enpol.2015.11.010

Grimm V, Schewe L, Schmidt M, Zöttl G (2017) Uniqueness of market equilibrium on a network: a peak-load pricing approach. Eur J Oper Res 261(3):971–983. https://doi.org/10.1016/j.ejor.2017.03.036

Grimm V, Zöttl G (2013) Investment incentives and electricity spot market competition. J Econ Manag Strategy 22(4):832–851. https://doi.org/10.1111/jems.12029

Gugat M, Leugering G, Martin A, Schmidt M, Sirvent M, Wintergerst D (2018) Towards simulation based mixed-integer optimization with differential equations. Networks 72(1):60–83. https://doi.org/10.1002/net.21812

Hallack M, Vazquez M (2013) European union regulation of gas transmission services: challenges in the allocation of network resources through entry/exit schemes. Util Policy 25 25(5):23–32. https://doi.org/10.1016/j.jup.2013.01.003

Harker PT (1991) Generalized nash games and quasi-variational inequalities. Eur J Oper Res 54(1):81–94. https://doi.org/10.1016/0377-2217(91)90325-P

Hirschhausen C (2006) Reform der Erdgaswirtschaft in der EU und in Deutschland: Wieviel Regulierung braucht der Wettbewerb? Perspektiven der Wirtschaftspolitik 7(1):89–103. https://doi.org/10.1111/j.1465-6493.2006.00200.x

Hobbs BF, Helman U (2004) Complementarity-based equilibrium modeling for electric power markets. In: Bunn D (ed) Modeling prices in competitive electricity markets. Wiley, New York

Holz F, von Hirschhausen C, Kemfert C (2008) A strategic model of European gas supply (GASMOD). Energy Econ 30(3):766–788. https://doi.org/10.1016/j.eneco.2007.01.018

Hubert F, Ikonnikova S (2011) Investment options and bargaining power: the Eurasian supply chain for natural gas. J Ind Econ 59(1):85–116. https://doi.org/10.1111/j.1467-6451.2011.00447.x

Hunt P (2008) Entry–exit transmission pricing with national hubs. Can it deliver a Pan-European wholesale market in gas? Tech. rep., Oxford Institute of Energy Studies

Huppmann D (2013) Endogenous production capacity investment in natural gas market equilibrium models. Eur J Oper Res 231(2):503–506. https://doi.org/10.1016/j.ejor.2013.05.048

Ikonnikova S, Zwart GT (2014) Trade quotas and buyer power, with an application to the E.U. natural gas market. J Eur Econ Assoc 12(1):177–199. https://doi.org/10.1111/jeea.12064

Jansen T, van Lier A, van Witteloostuijn A, von Ochssée TB (2012) A modified Cournot model of the natural gas market in the European union: mixed-motives delegation in a politicized environment. Energy Policy 41:280–285. https://doi.org/10.1016/j.enpol.2011.10.047 Modeling Transport (Energy) Demand and Policies

Joskow P, Tirole J (2007) Reliability and competitive electricity markets. RAND J Econ 38(1):60–84. https://doi.org/10.1111/j.1756-2171.2007.tb00044.x

Kema for European Commission (2013) Country factsheets. entry–exit regimes in gas, a project for the european commission—dg ener under the framework service contract for technical assistance tren/r1/350-2008 lot 3. Tech. rep., European Commission. https://ec.europa.eu/energy/sites/ener/files/documents/2001_report_bencmarking.pdf

Keyaerts N, D’haeseleer W, (2014) Forum shopping for ex-post gas-balancing servies. Energy Policy 67:209–221. https://doi.org/10.1016/j.enpol.2013.11.062

Keyaerts N, Hallack M, Glachant JM, D’haeseleer W, (2011) Gas market distorting effects of imbalanced gas balancing rules: inefficient regulation of pipeline flexibility. Energy Policy 39(2):865–876. https://doi.org/10.1016/j.enpol.2010.11.006

Kleinert T, Schmidt M (2018) Global optimization of multilevel electricity market models including network design and graph partitioning. Tech. rep., FAU Erlangen-Nürnberg. http://www.optimization-online.org/DB_HTML/2018/02/6460.html

Koch T, Hiller B, Pfetsch ME, Schewe L (eds.) Evaluating gas network capacities. SIAM-MOS series on optimization. SIAM (2015). https://doi.org/10.1137/1.9781611973693

Krebs V, Schmidt M (2018) Uniqueness of market equilibria on networks with transport costs. Oper Res Perspect 5:169–173. https://doi.org/10.1016/j.orp.2018.05.002

Krebs V, Schewe L, Schmidt M (2018) Uniqueness and multiplicity of market equilibria on DC power flow networks. Eur J Oper Res 271(1):165–178. https://doi.org/10.1016/j.ejor.2018.05.016

Le Veque RJ (1992) Numerical methods for conservation laws. Birkhäuser, Basel

Le Veque RJ (2002) Finite volume methods for hyperbolic problems. Cambridge University Press, Cambridge

Mahlke D, Martin A, Moritz S (2010) A mixed integer approach for time-dependent gas network optimization. Optim Methods Softw 25(4):625–644

Mangasarian OL (1988) A simple characterization of solution sets of convex programs. Oper Res Lett 7(1):21–26. https://doi.org/10.1016/0167-6377(88)90047-8

Mehrmann V, Schmidt M, Stolwijk JJ (2018) Model and discretization error adaptivity within stationary gas transport optimization. Vietnam J Math. http://www.optimization-online.org/DB_HTML/2017/12/6365.html

Meran G, von Hirschhausen C, Neumann A (2010) Access pricing and network expansion in natural gas markets. Zeitschrift für Energiewirtschaft 34(3):179–183. https://doi.org/10.1007/s12398-010-0028-7

Midthun KT, Bjorndal M, Tomasgard A (2009) Modeling optimal economic dispatch and system effects in natural gas networks. Energy J 30(4):155–180. https://ideas.repec.org/a/aen/journl/2009v30-04-a06.html

Midthun KT, Fodstad M, Hellemo L (2015) Optimization model to analyse optimal development of natural gas fields and infrastructure. Energy Procedia 64:111–119. https://doi.org/10.1016/j.egypro.2015.01.014

Moritz S (2007) A mixed integer approach for the transient case of gas network optimization. Ph.D. thesis, Technische Universität Darmstadt

Murphy FH, Smeers Y (2005) Generation capacity expansion in imperfectly competitive restructured electricity markets. Oper Res 53(4):646–661. https://doi.org/10.1287/opre.1050.0211

Nagayama D, Horita M (2014) A network game analysis of strategic interactions in the international trade of Russian natural gas through Ukraine and Belarus. Energy Econ 43:89–101. https://doi.org/10.1016/j.eneco.2014.02.010

Oliver ME, Mason CF, Finnoff D (2014) Pipeline congestion and basis differentials. J Regul Econ 46(3):261–291. https://doi.org/10.1007/s11149-014-9256-9

Pfetsch ME, Fügenschuh A, Geißler B, Geißler N, Gollmer R, Hiller B, Humpola J, Koch T, Lehmann T, Martin A, Morsi A, Rövekamp J, Schewe L, Schmidt M, Schultz R, Schwarz R, Schweiger J, Stangl C, Steinbach MC, Vigerske S, Willert BM (2015) Validation of nominations in gas network optimization: models, methods, and solutions. Optim Methods Softw 30(1):15–53. https://doi.org/10.1080/10556788.2014.888426

Rømo F, Tomasgard A, Hellemo L, Fodstad M, Eidesen BH, Pedersen B (2009) Optimizing the norwegian natural gas production and transport. Interfaces 39(1):46–56. https://doi.org/10.1287/inte.1080.0414

Ríos-Mercado RZ, Borraz-Sánchez C (2015) Optimization problems in natural gas transportation systems: a state-of-the-art review. Appl Energy 147(1):536–555. https://doi.org/10.1016/j.apenergy.2015.03.017

Rose D, Schmidt M, Steinbach MC, Willert BM (2016) Computational optimization of gas compressor stations: MINLP models versus continuous reformulations. Math Methods Oper Res. https://doi.org/10.1007/s00186-016-0533-5

Rövekamp J (2015) Background on gas market regulation. In: Koch T, Hiller B, Pfetsch ME, Schewe L (eds) Evaluating gas network capacities. SIAM-MOS series on optimization. SIAM, Philadelphia, pp 325–330. https://doi.org/10.1137/1.9781611973693.appa

Schmidt M (2013) A generic interior-point framework for nonsmooth and complementarity constrained nonlinear optimization. Ph.D. thesis, Gottfried Wilhelm Leibniz Universität Hannover

Schmidt M, Sirvent M, Wollner W (2018) A decomposition method for MINLPs with Lipschitz continuous nonlinearities. Math Program. https://doi.org/10.1007/s10107-018-1309-x

Schmidt M, Steinbach MC, Willert BM (2015) High detail stationary optimization models for gas networks. Optim Eng 16(1):131–164. https://doi.org/10.1007/s11081-014-9246-x

Schmidt M, Steinbach MC, Willert BM (2016) High detail stationary optimization models for gas networks: validation and results. Optim Eng 17(2):437–472. https://doi.org/10.1007/s11081-015-9300-3

Shaw D (1994) Pipeline system optimization: A tutorial. Tech. Rep. PSIG 9405, Pipeline Simulation Interest Group

Siddiqui S, Gabriel SA (2017) Modeling market power in the U.S. shale gas market. Optim Eng 18(1):203–213. https://doi.org/10.1007/s11081-016-9310-9

Smeers Y (2008) Gas models and three difficult objectives. Tech. rep., Core Discussion Paper. http://www.uclouvain.be/cps/ucl/doc/core/documents/coreDP2008_9.pdf

Vazquez M, Hallack M, Glachant JM (2012) Designing the European gas market: More liquid and less natural? Econ Energy Environ Policy. https://doi.org/10.5547/2160-5890.1.3.3

Weymouth TR (1912) Problems in natural gas engineering. Trans Am Soc Mech Eng 34(1349):185–231

Wogrin S, Hobbs BF, Ralph D, Centeno E, Barquín J (2013) Open versus closed loop capacity equilibria in electricity markets under perfect and oligopolistic competition. Math Program 140(2):295–322. https://doi.org/10.1007/s10107-013-0696-2

Yang Z, Zhang R, Zhang Z (2016) An exploration of a strategic competition model for the European Union natural gas market. Energy Econ 57:236–242. https://doi.org/10.1016/j.eneco.2016.05.008

Zheng Q, Rebennack S, Iliadis N, Pardalos P (2010) Optimization models in the natural gas industry. In: Pardalos PM, Iliadis NA, Pereira MV, Rebennack S (eds) Handbook of power systems I. Springer, Berlin, pp 121–148

Zhuang J, Gabriel SA (2008) A complementarity model for solving stochastic natural gas market equilibria. Energy Econ 30(1):113–147. https://doi.org/10.1016/j.eneco.2006.09.004

Zöttl G (2010) A framework of peak load pricing with strategic firms. Oper Res 58(4):1637–1649. https://doi.org/10.1287/opre.1100.0836

Zöttl G (2011) On optimal scarcity prices. Int J Ind Organ 29(5):589–605. https://doi.org/10.1016/j.ijindorg.2011.01.002

Zwart G, Mulder M (2006) NATGAS: a model of the European natural gas market. Tech. Rep. 144, CPB Netherlands Bureau for Economic Policy Analysis. https://ideas.repec.org/p/cpb/memodm/144.html

Acknowledgements

This research has been performed as part of the Energie Campus Nürnberg and is supported by funding of the Bavarian State Government and by the Emerging Field Initiative (EFI) of the Friedrich-Alexander-Universität Erlangen-Nürnberg through the project “Sustainable Business Models in Energy Markets”. The authors acknowledge funding through the DFG Transregio 154, subprojects A05, B07, and B08. We also thank Alexander Martin, Julia Grübel, and Jonas Egerer for many fruitful discussions on the topic of this paper. Finally, we are very grateful to two anonymous reviewers, whose comments on the manuscript greatly helped to improve the quality of the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Grimm, V., Schewe, L., Schmidt, M. et al. A multilevel model of the European entry-exit gas market. Math Meth Oper Res 89, 223–255 (2019). https://doi.org/10.1007/s00186-018-0647-z

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-018-0647-z