Abstract

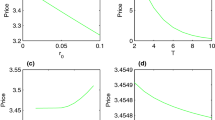

Lookback options are among the most popular path-dependent options in financial market. In this paper, the option pricing problem of lookback options is investigated under the assumption that the underlying stock price follows an uncertain differential equation driven by Liu process instead of stochastic differential equation, and the lookback options pricing formulae are derived under this assumption. Several numerical examples are also discussed to illustrate the pricing formula.

Similar content being viewed by others

References

Black F, Scholes M (1973) The pricing of option and corporate liabilities. J Polit Econ 81:637–654

Chen XW (2011) American option pricing formula for uncertain financial market. Int J Oper Res 8(2):32–37

Chen XW, Gao J (2013) Uncertain term structure model of interest rate. Soft Comput 17(4):597–604

Chen XW, Liu YH, Ralescu DA (2013) Uncertain stock model with periodic dividends. Fuzzy Optim Decis Mak 12(1):111–123

Conze A, Viswanathan R (1991) Path dependent options: the case of lookback options. J Finance 46:1893–1907

Dai M, Wong HY, Kwok YK (2004) Quanto lookback options. Math Finance 14:445–467

Goldman MB, Sosin HB, Gatto MA (1979) Path dependent options: buy at the low, sell at the high. J Finance 34:1111–1127

Heynen RC, Kat HM (1995) Lookback options with discrete and partial monitoring of the underlying price. Appl Math Finance 2:273–284

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2009) Some research problems in uncertainty theory. J Uncertain Syst 3(1):3–10

Liu B (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu YH, Ha MH (2010) Expected value of function of uncertain variables. J Uncertain Syst 4(3):181–186

Liu YH, Chen XW, Ralescu DA (2015) Uncertain currency model and currency option pricing. Int J Intell Syst 30:40–51

Longstaff FA (1995) How much can marketability affect security values? J Finance 50:1767–1774

Peng J, Yao K (2011) A new option pricing model for stocks in uncertainty markets. Int J Oper Res 8(2):18–26

Wong HY, Kwok YK (2003) Sub-replication and replenishing premium: efficient pricing of multi-state lookbacks. Rev Deriv Res 6:83–106

Yao K (2012) No-arbitrage determinant theorems on mean-reverting stock model in uncertain market. Knowl Based Syst 35:259–263

Yao K (2013) Extreme values and integral of solution of uncertain differential equation. J Uncertain Anal Appl 1:2

Yao K, Chen XW (2013) A numerical method for solving uncertain differential equations. J Intell Fuzzy Syst 25(3):825–832

Zhang ZQ, Liu WQ (2014) Geometric average Asian option pricing for uncertain financial market. J Uncertain Syst 8(4):317–320

Zhang ZQ, Ralescu DA, Liu WQ (2016) Valuation of interest rate ceiling and floor in uncertain financial market. Fuzzy Optim Decis 15(2):139–154

Zhang ZQ, Liu WQ, Ding JH (2017a) Valuation of stock loan under uncertain environment. Soft Comput. https://doi.org/10.1007/s00500-017-2591-x

Zhang ZQ, Liu WQ, Zhang XD (2017b) Valuation of convertible bond under uncertain mean-reverting stock model. J Amb Intel Hum Comput 8(5):641–650

Acknowledgements

This work was supported by National Natural Science Foundation of China (Grant Nos. 71371113, 71371141, 71001080) and Doctoral Fund of Shanxi Datong University (No. 2016-B-03).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, Z., Ke, H. & Liu, W. Lookback options pricing for uncertain financial market. Soft Comput 23, 5537–5546 (2019). https://doi.org/10.1007/s00500-018-3211-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-018-3211-0