Abstract

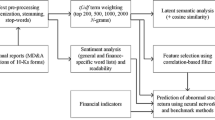

This study utilizes the textual financial information—letters to shareholders to propose a scheme for corporate financial crisis prediction instead of traditional numerical financial ratios. In the scheme, the letters to shareholders were first parsed and analyzed to establish a library of financial crisis feature terms. Based on the financial crisis feature term library, queen genetic algorithm and support vector machine were then used to classify letters to shareholders (i.e., financial crisis and non-financial crises). This scheme can effectively enhance the accuracy of corporate financial crisis detection and reduce the resulting capital damage to enterprises and investors. To achieve the above objective, the following tasks were performed: (1) a process for predicting corporate financial crises by using letters to shareholders was designed, (2) techniques involved in the process of financial crisis prediction were developed, and (3) the use of the proposed approach was demonstrated and evaluated.

Similar content being viewed by others

References

Bae JK (2012) Predicting financial distress of the South Korean manufacturing industries. Expert Syst Appl 39(10):9159–9165

Campbell JY, Hilscher J, Szilagyi J (2011) Predicting financial distress and the performance of distressed stocks. J Invest Manag 9(2):14–34

Cecchini M, Aytug H, Koehler GJ, Pathak P (2010) Making terms work: using financial text as a predictor of financial events. Decis Support Syst 50(1):164–175

Chen J-H (2012) Developing SFNN models to predict financial distress of construction companies. Expert Syst Appl 39(1):823–827

Chen L-H, Hsiao H-D (2008) Feature selection to diagnose a business crisis by using a real GA-based support vector machine: an empirical study. Expert Syst Appl 35(3):1145–1155

Chen Y-J, Wu C-Y (2020) Predicting a corporate financial crisis using letters to shareholders. Soft Comput. https://doi.org/10.1007/s00500-020-05391-9

Depczynski U, Frost VJ, Molt K (2000) Genetic algorithms applied to the selection of factors in principal component regression. Anal Chim Acta 420(2):217–227

Glancy FH, Yadav SB (2011) A computational model for financial reporting fraud detection. Decis Support Syst 50(3):595–601

Güraksın GE, Haklıb H, Uğuz H (2014) Support vector machines classification based on particle swarm optimization for bone age determination. Appl Soft Comput 24:597–602

https://ckipsvr.iis.sinica.edu.tw/. Chinese knowledge information processing group.

https://mops.twse.com.tw/mops/web/index. Market observation post system.

https://www.tej.com.tw/twsite/. Taiwan Economic Journal.

Huang C-C (2012) Mining of corporate annual report and its information content in predicting financial distress. In: Accounting theory and practice conference

Liang D, Chia-Chi Lu, Tsai C-F, Shih G-A (2016) Financial ratios and corporate governance indicators in bankruptcy prediction: a comprehensive study. Eur J Oper Res 252:561–572

Ma W-Y, Chen K-J (2003) Introduction to CKIP Chinese word segmentation system for the first international Chinese word segmentation bakeoff. In: Proceedings of ACL, second SIGHAN workshop on Chinese language processing, vol 17, pp 168–171

Peng X, Dong Xu (2013) A twin-hypersphere support vector machine classifier and the fast learning algorithm. Inf Sci 221:12–27

Sterm H, Chassidim Y, Zofi M (2006) Multiagent visual area coverage using a new genetic algorithm selection scheme. Eur J Oper Res 175(3):1890–1907

Sun J, Li H (2008) Listed companies’ financial distress prediction based on weighted majority voting combination of multiple classifiers. Expert Syst Appl 35(3):818–827

Tian S, Yan Yu (2017) Financial ratios and bankruptcy predictions: an international evidence. Int Rev Econ Finance 51:510–526

Tinoco MH, Wilson N (2013) Financial distress and bankruptcy prediction among listed companies using accounting, market and macroeconomic variables. Int Rev Financ Anal 30:394–419

Tsai C-F (2014) Combining cluster analysis with classifier ensembles to predict financial distress. Inf Fusion 16:46–58

Uthayakumar J, Metawa N, Shankar K, Lakshmanaprabu SK (2020) Financial crisis prediction model using ant colony optimization. Int J Inf Manag 50:538–556

Yu L, Wang S, Lai KK, Wen F (2010) A multiscale neural network learning paradigm for financial crises forecasting. Neurocomputing 73(4–6):716–725

Zhang W, Yoshida T, Tang X (2011) A comparative study of TF * IDF, LSI and multi-terms for text classification. Expert Syst Appl 38(3):2758–2765

Acknowledgements

The authors would like to thank the Ministry of Science and Technology R.O.C, Taiwan, for financially supporting this research under Contract Nos. MOST105-2410-H-327-014 and MOST106-2410-H-327-005-MY3. Additionally, we deeply appreciate the editor and reviewers for their constructive comments and suggestions on the work.

Funding

This study was funded by Grant Numbers MOST105-2410-H-327-014 and MOST106-2410-H-327-005-MY3.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Communicated by V. Loia.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chen, YJ., Wu, CY. Predicting a corporate financial crisis using letters to shareholders. Soft Comput 25, 3623–3636 (2021). https://doi.org/10.1007/s00500-020-05391-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-020-05391-9