Abstract

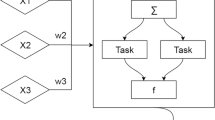

This paper aims to explore the modified multilayer perceptron (MLP) input weights’ (IW) matrices relating them with the weights of the constituent input determinants. Non-traditional MLP topologies were designed, optimized and compared with other neural networks (NN) and multidimensional linear regression methods and statistically tested. The chosen NN topology directly related the MLP IW matrices with the relative contribution of each input variable. The contribution (weights) of each input variable was estimated in a non-linear manner, which is a novel approach in the investment research domain. This approach was applied to an investigation of sectorial investment distribution in emerging investment markets. To our knowledge, there is no experiment in the field that would focus on the NN mechanisms of sectorial indices (SI) weights estimation in such an experimental setting. In summary, we found apparent correlations between multivariate linear and other NN estimates (like Garson’s, Tchaban’s and SNA methods) having some new results not revealed in the previous research.

Similar content being viewed by others

References

Haykin S (1999) Neural networks: a comprehensive foundation, 2nd edn. Prentice-Hall, New Jersey

Freedman RS, Klein A, Lederman J (1995) Artificial intelligence in the capital markets. Probus Publishing, Chicago

Hiemstra Y (1999) Linear regression versus backpropagation networks to predict quartely excess returns. The 2nd international workshop on neural networks in the capital markets, CalTech, Pasadena

Trippi RR, Lee JK (1996) Artificial intelligence in finance and investing: state-of-the-art technologies for securities selection and portfolio management. Irwin, Chicago

Songcan Chen, Qun Dai (2005) Discounted least squares-improved circular back-propagation neural networks with applications in time series prediction. Springer-Verlag London Limited 2005. Neural Computing and Applications. DOI 10.1007/s00521-004-0461-9

Philip Chen CL, Wan John Z (1999) A rapid learning and dynamic stepwise updating algorithm for flat neural networks and the application to time-series prediction. IEEE Trans Syst Man Cybern B 29(1):62–72

Kyoung-Jae Kim, Won Boo Lee (2004) Stock market prediction using artificial neural networks with optimal feature transformation. Neural computing and applications, vol. 13, Number 3. Springer, Berlin Heidelberg New York, pp 255–260

Resmini L (2000) The determinants of foreign direct investment in the CEECs: new evidence from sectoral patterns. Econ Transit 8(3):73–85

Winston WL (2004) Operations research: applications and algorithms. Thomson/Brooks/Cole, Belmont

Plikynas D, Simanauskas L, Būda S (2002) Research of neural network methods for compound stock exchange indices analysis. Informatica 13(4):465–484

Montano JJ, Palmer A (2003) Numeric sensitivity analysis applied to feedforward neural networks. Neural computing and applications issue 12, pp 119–125. DOI 10.1007/s00521-003-0377-9

Garson GD (1991) Interpreting neural-network connection weights. AI Expert 6(4):47–51

Andrews R, Geva S (2000) Rule extraction from local cluster neural nets. Neurocomputing 3:124–131

Gedeon TD (1997) Data mining of inputs: analysing magnitude and functional measures. Int J Neural Syst 8:209–218

Wang W, Jones P, Partridge D (2000) Assessing the impact of input features in a feedforward neural network. Neural Comput Appl 9:101–112

Tsaih R (1999) Sensitivity analysis, neural networks, and the finance. In: IJCNN’99, IEEE, Piscataway, pp 3830–3835

Tchaban T, Taylor MJ, Griffin A (1998) Establishing impacts of the inputs in a feedforward network. Neural Comput Appl 7:309–317

Sarle WS (2000) How to measure importance of inputs? ftp://ftp.sas.com/pub/neural/importance.html

Aykut D, Kalsi H, Ratha D (2003) Sustaining and promoting equity-related finance for developing countries. Global development finance 2003. World Bank Report, Washington

Lipsey RE (2003) Foreign direct investment, growth, and competitiveness in developing countries. In: Peter K. Cornelius (ed) The global competitiveness report 2002–2003. New York and Oxford, Oxford University Press, pp 295–305

Plikynas D, Sakalauskas L, Poliakova A (2005) Analysis of foreign investment impact on the dynamics of national capitalization structure: a computational intelligence approach. Res Int Bank Finance, RIBAF 19(2):304–332

Lithuania’s Security Commission (2003) Annual report 2003 IV q

Gianerini S, Rosa R (2004) Assessing chaos in time series: statistical aspects and perspectives. Stud Nonlin Dyn Econom 8(2)

Steiner B (2001) Key market concepts. Reuters/Pearson Education, London

Chorafas DN (1998) Chaos theory in the financial markets. Irwin, Chicago, pp 382

Baesens B, Setiono R, Mues C, Vanthienen J (2003) Using neural network rule extraction and decision tables for credit–risk evaluation. Manage Sci 49(3):312–329

Tickle A, Andrews R, Golea M, Diederich J (1998) Directions and challenges in extracting the knowledge embedded within trained artificial neural networks. IEEE Trans Neural Netw 9(6):1057–1068

Bahbah AG, Girgis AA (1999) Input feature selection for realtime transient stability assessment for artificial neural network (ANN) using ANN sensitivity analysis. In: Proceedings of PICA’99, IEEE, Piscataway, pp 295–300

Rambhia AH, Glenny R, Hwang J (1999) Critical input data channels selection for progressive work exercise test by neural network sensitivity analysis. In: Proceedings ICASSP99, IEEE, Piscataway, pp 1097–1100

Wang W, Jones P, Partridge D (2000) Assessing the impact of input features in a feedforward neural network. Neural Comput Appl 9:101–112

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Plikynas, D., Akbar, Y.H. Application of modified MLP input weights’ matrices: an analysis of sectorial investment distribution in the emerging markets. Neural Comput & Applic 15, 183–196 (2006). https://doi.org/10.1007/s00521-005-0018-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-005-0018-6