Abstract

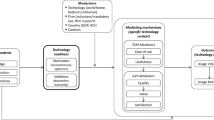

Herd behavior arises in many instances of information technology (IT) adoption. This study examines the economic and behavioral bases for herd behavior and decision conformity. We investigate the roles of payoff externalities, observational learning and managerial incentives in influencing IT adoption decision-making. Our study underscores the benefits of viewing various drivers of IT adoption herding in a unified framework focusing on equilibrium coordination under strategic complementarities. Motivated by the recent advance in behavioral economics and behavioral game theory, our study relates IT adoption herding to a range of individual-level problems, including managerial incentives, managerial behavioral biases and limited rationality. We develop a coordination game of IT adoption within the unified framework. Our analysis of the game demonstrates that, under strategic complementarities, behavioral biases or incentive problems of a small minority of decision-makers may dramatically impact aggregate outcomes.

Similar content being viewed by others

Notes

Network externalities may not necessarily lead to positive payoff externalities. In some situation where firms adopt same technology to compete with each other, the competitive losses due to congestion effects may dominate the gains from positive network feedback. Positive payoff externalities, even in markets without strong competitive pressures, are usually concave in network size.

The application of a linear payoff function, coupled with evenly-distributed idiosyncratic adoption costs, leads to a unique adoption equilibrium. When the cumulative distribution function takes a more general forms, multiple equilibria often emerge for this setting.

References

Alevy J, Haigh M, List JA (2006) Information cascades: evidence from a field experiment with financial market professionals. J Finance 62(1):151–180

Anderson L, Holt C (1997) Information cascades in the laboratory. Am Econ Rev 87(5):847–862

Angeletos GM, Pavan A (2004) Transparency of information and coordination in economies with investment complementarities. Am Econ Rev 94:91–98

Au Y, Kauffman RJ (2003) What do you know? rational expectations in IT adoption and investment. J Manag Info Sys 20(2):49–76

Au Y, Kauffman RJ (2004) Rational expectations, optimal control and information technology adoption. Info Sys E-Bus Manag 3(1):47–70

Banerjee A (1992) A simple model of herd behavior. Q J Econ 107(3):797–818

Barua A, Konana P, Whinston AB, Yin F (2004) An empirical investigation of net-enabled business value. MIS Q 28(4):585–620

Basu A, Mazumdar T, Rai S (2003) Indirect network externality effects on product attributes. Mark Sci 22(2):209–222

Bernheim B (1994) A theory of conformity. J Pol Econ 102(5):841–877

Bikhchandani S, Sharma S (2001) Herd behavior in financial markets. IMF Staff Papers 47(3):279–310

Bikhchandani S, Hirshleifer D, Welch I (1992) A theory of fads, fashion, custom, and cultural change as informational cascades. J Pol Econ 100(5):992–1026

Bikhchandani S, Hirshleifer D, Welch I (1996) Informational cascades and rational herding: an annotated bibliography and resource reference. Working paper, Paul Merage School of Business, University of California, Irvine, CA

Bikhchandani S, Hirshleifer D, Welch I (1998) Learning from the behavior of others: conformity, fads, and informational cascades. J Econ Perspect 12(3):151–170

Brandenburger A, Polak B (1996) When managers cover their posteriors: making the decisions the market wants to see. RAND J Econ 27(3):523–541

Brynjolfsson E, Kemerer CF (1996) Network externalities in microcomputer software: an econometric analysis of the spreadsheet market. Manag Sci 42(12):1627–1647

Camerer C, Fehr E (2006) When does ‘economic man’ dominate social behavior? Science 311:47–52

Celen B, Kariv S (2004a) Distinguishing informational cascades from herd behavior in the laboratory. Am Econ Rev 94(3):484–497

Celen B, Kariv S (2004b) Observational learning under imperfect information. Games Econ Behav 47(1):72–86

Cooper R, John A (1988) Coordinating coordination failures in Keynesian models. Q J Econ 103(3):441–463

Crawford V (2003) Lying for strategic advantage: rational and boundedly rational misrepresentation of intentions. Am Econ Rev 93(1):133–149

Devenow A, Welch I (1996) Rational herding in financial economics. Eur Econ Rev 40(3):603–615

Duan W, Gu B, Whinston AB (2009) Informational cascades and software adoption on the Internet: an empirical investigation. MIS Q 33(1):23–48

Economides N (1996) The economics of networks. Intl J Ind Org 16(4):673–699

Edlin A, Stiglitz J (1995) Discouraging rivals: managerial rent-seeking and economic inefficiencies. Am Econ Rev 85(5):1301–1312

Fehr E, Tyran J (2005) Individual irrationality and aggregate outcomes. J Econ Perspect 19(4):43–66

Gallaugher J, Wang Y (2002) Understanding network effects in software markets: evidence from web server pricing. MIS Q 26(4):303–327

Graham J (1999) Herding among investment newsletters: theory and evidence. J Fin 54(1):237–269

Graham J, Harvey C, Puri M (2013) Managerial attitudes and corporate actions. J Fin Econ 109(1):103–121

Holmström B (1999) Managerial incentive problems: a dynamic perspective. Rev Econ Stud 66(1):169–182

Hong H, Kubik J, Solomon A (2000) Security analysts’ career concerns and herding of earnings forecasts. RAND J Econ 31(1):121–144

Hung A, Plott C (2001) Information cascades: replication and an extension to majority rule and conformity-rewarding institutions. Am Econ Rev 91(5):1508–1520

Katz M, Shapiro C (1994) System competition and network effects. J Econ Perspect 8(2):93–115

Kauffman R, Li X (2005) Technology competition and optimal investment timing: a real options perspective. IEEE Trans Eng Manag 52(1):15–29

Kauffman R, McAndrews JJ, Wang Y (2000) Opening the black box of network externalities in network adoption. Info Sys Res 11(1):1, 61-82

Kennedy R (2002) Strategy fads and competitive convergence: an empirical test for herd behavior in primetime TV programming. J Ind Econ 50(1):57–84

Laffont J, Martimort D (2002) The theory of incentives: the principal-agent model. Princeton University Press, Princeton

Lee J, Lee J, Lee H (2003) Exploration and exploitation in the presence of network externalities. Manag Sci 49(4):553–570

Levinthal D, March J (1993) The myopia of learning. Strateg Manag J 14:95–112

Li X (2004) Informational cascades in IT adoption. Commun ACM 47(4):93–97

Li X (2005) Cheap talk and bogus network externalities in the emerging technology market. Mark Sci 24(4):531–543

Li X (2009a) Managerial entrenchment with strategic information technology: a dynamic perspective. J Manag Info Sys 25(4):183–204

Li X (2009b) Preemptive learning, competency traps and information technology adoption: a real options analysis. IEEE Trans Eng Manag 56(4):650–662

Liebowitz S (2002) Rethinking the network economy: the true forces that drive the digital economy. Amacom Publishing, Saranac Lake

Malmendier U, Tate G (2005) CEO overconfidence and corporate investment. J Fin 60(6):2661–2700

Milgrom P, Roberts J (1990) Rationalizability, learning, and equilibrium in games with strategic complementarities. Econometrica 58(6):1255–1277

Morris S, Shin HS (2002) The social value of public information. Am Econ Rev 92:1521–1534

Ottaviani M, Sorensen P (2000) Herd behavior and investment: comment. Am Econ Rev 90(3):695–704

Ottaviani M, Sørensen P (2006) Reputational cheap talk. J Econ 37(1):155–175

Porter ME (2001) Strategy and the internet. Harv Bus Rev 79(3):62–79

Rogers E (1995) Diffusion of innovations, 4th edn. Free Press, New York

Scharfstein D, Stein J (1990) Herd behavior and investment. Am Econ Rev 80(3):465–479

Schiller R (1995) Rhetoric and economic behavior: conversation, information and herd behavior. Am Econ Rev 85(2):181–185

Tingling P, Parent M (2002) Mimetic isomorphism and technology evaluation: does imitation transcend judgment? J Assoc Info Sys 3:113–143

Vives X (2005) Complementarities and games: new developments. J Econ Lit 43(2):437–479

Wade M, Hulland J (2004) The resource-based view and information systems research: review, extension, and suggestions for future research. MIS Q 28(1):107–142

Walden E, Browne G (2002) Information cascades in the adoption of new technology. In L Applegate, J DeGross, R Galliers (eds.), Proc 23rd Intl Conf on Info Sys, Barcelona, Spain, 435-443

Weber D, Kauffman RJ (2011) What drives global ICT adoption? analysis and research directions. Electron Commer Res Appl 10(6):683–701

Welch I (2000) Herding among security analysts. J Fin Econ 58(3):369–396

Zhang J (1997) Strategic delay and the onset of investment cascades. RAND J Econ 28(1):188–205

Zwiebel J (1995) Corporate conservatism and relative compensation. J Pol Econ 103(1):1–25

Author information

Authors and Affiliations

Corresponding author

Appendix: propositions and proofs

Appendix: propositions and proofs

Proposition 1 (Two IT Adoption Scenarios)

When α > 1, every decision-maker in the IT adoption game adopts the technology in the payoff-dominant equilibrium, and when α < 1, no one adopts the technology in the unique equilibrium. This equilibrium is socially-inefficient when 0.5 < α < 1.

Proof

If a decision-maker with the adopt cost \(\hat{\beta }\) adopts the technology in any equilibrium of this coordination game, all other decision-makers with adoption cost below \(\hat{\beta }\) will adopt the technology in the equilibrium. Otherwise some decision-makers will play the game in an irrational manner. However, when α < 1, we cannot construct any equilibrium with an adoption threshold of \(0 < \hat{\beta } < 1\). In this scenario, every decision-maker in the IT adoption game will adopt the technology in the payoff-dominant equilibrium. Similarly, we cannot construct any equilibrium with an adoption threshold of \(0 < \hat{\beta } < 1\) in situations where α < 1. It is also easy to verify that adoption by all decision-makers is not a viable equilibrium. So the unique equilibrium entails no adoption by any decision-maker under this scenario. If all decision-makers adopt the technology, the average payoff of all decision-makers is α − 1/2. So this unique non-adoption equilibrium is not socially-efficient when 0.5 < α < 1. □

Proposition 2 (Fully-Rational Decision-Makers’ IT Adoption)

When 0.5 < α < 1 and a small portion of decision-makers, 0 < η < 1, adopt the technology because of their limited rationality, a portion, 0 < λ < 1, of the fully-rational decision-makers will also adopt the technology in equilibrium, when λ satisfies α [η +(1 − η)λ] = λ. Compared to the benchmark scenario where no rational decision-makers adopt the technology, rational adopters’ average payoff will be higher by λ/2, and the average payoff of adopters with limited rationality will increase by αλ(1 − η).

Proof

As illustrated in Proposition 1, any fully-rational decision-maker’s equilibrium strategy entails the characterization of an adoption threshold. Under this scenario, we can construct an equilibrium with an adoption threshold λ that satisfies α[η + (1 − η)λ] = λ. This equilibrium condition guarantees that any rational decision-maker with adoption cost less than λ will be better off by adopting the technology, and that those with adoption cost above this threshold will have no incentive to adopt the technology. Moreover, it is easy to verify that 0 < λ < 1 when 0.5 < α < 1. Consequently a portion, 0 < λ < 1, of the rational decision-makers will adopt the technology in the equilibrium. On average, these rational adopters will be better off by λ − λ/2 = λ/2, and those adopters with limited rationality are better off by the strictly positive value, α [η + (1 − η)λ] − 1/2 − (αη − 1/2) = αλ(1 − η). □

Proposition 3 (Conditions for Excess Inertia)

While the payoff-dominant equilibrium entails adoption by every decision-maker whenever α > 1, excess inertia—when everyone stays with the old technology—may occur when it is known that a small portion, 0 < δ < 1, of decision-makers will stay with the old technology because of their incentive problems. This inefficient situation arises when either α is sufficiently close to 1 or δ is sufficiently large, that is, whenever α (1 − δ) < 1.

Proof

As illustrated in Proposition 1, any equilibrium strategy entails the characterization of an adoption threshold. Suppose that we can construct an equilibrium with an adoption threshold \(\hat{\beta }\) in this scenario. To guarantee that any rational decision-maker with adoption cost less than \(\hat{\beta }\) is better off by adopting the technology, we must have α (1 − δ) \(\hat{\beta }\) >\(\hat{\beta }\). We can verify that this threshold is not obtainable whenever α (1 − δ) < 1. The payoff-dominant equilibrium entails adoption by every decision-maker when this condition is satisfied. This situation involving excessive inertia is caused by some decision-makers’ incentive problems. This leads to overall inefficiency because the average payoff for all decision-makers decreases by α − 1/2. □

Rights and permissions

About this article

Cite this article

Li, X., Kauffman, R.J., Yu, F. et al. Externalities, incentives and strategic complementarities: understanding herd behavior in IT adoption. Inf Syst E-Bus Manage 12, 443–464 (2014). https://doi.org/10.1007/s10257-013-0231-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10257-013-0231-2